- GRIT

- Posts

- 👉 Jerome Powell Speaks in Jackson Hole

👉 Jerome Powell Speaks in Jackson Hole

Estee Lauder, Walmart, Disney

Welcome to your new week.

As a reminder, the Rate of Return by GRIT newsletter is broken up into two pieces. Every Monday morning we publish this edition of the newsletter — The Investing Week Ahead. This edition is entirely focused on ensuring you know exactly what’s taking place throughout the week — earnings reports, economic data, global affairs. You name it!

The Investing Week Ahead is completely free, so forward it to your friends.

On Sundays we publish the Week in Review. This edition of our newsletter is a detailed walkthrough of what actually happened in the markets between Monday and Sunday — and what I’m doing with my investment portfolio as I digest the news.

Together, The Investing Week Ahead and the Week in Review are the internet’s best summary of what took place in the markets and how to position your portfolio going forward.

Let’s jump in!

Key Earnings Announcements:

There are still some big earnings report ahead: Baidu, Estee Lauder, Home Depot, Palo Alto, Target, and Walmart.

Monday (8/18/): Agora, BHP, Bitdeer, Blink, Fabrinet, Freightos, Palo Alto, Riskified, XPeng

Tuesday (8/19): Amer Sports, Carlyle, Home Depot, Jack Henry, Keysight Technologies, La-Z-Boy, Medtronic, SQM, Toll Brothers, ZTO Express

Wednesday (8/20): Analog Devices, Baidu, Coty, Estee Lauder, FUTU, Target, TJX, ZIM Integrated

Thursday (8/21): Bilibili, Canadian Solar, Intuit, Ross Stores, Walmart, Workday, Zoom

Friday (8/22): BJ’s Wholesale, Gold Fields

What We’re Watching:

Estée Lauder (EL)

Estée Lauder reports Q4 earnings Wednesday after the bell, with shares under pressure amid challenges in China and travel retail. The company recently slashed its dividend by ~47%, bringing the annual yield to approximately 1.6%. Meanwhile, buybacks have fallen from a cumulative $10 billion returned to shareholders over 2013–2022, to just $140,000 last quarter.

Investors will be watching how the new “Beauty Reimagined” turnaround strategy is taking shape. With 5,800–7,000 job cuts (~10% of the workforce), streamlining in supply chains, and renewed marketing and innovation initiatives, the focus will be on whether management can halt declines and rebuild momentum.

Key to the recovery story is travel retail, which at its peak contributed 27% of Estée Lauder’s revenue in FY22 before collapsing to roughly half that level by 2025. A healthier China, coupled with a rebound in tourism like post-COVID international travel demand, would mark a critical inflection point for EL’s top line.

“We delivered our organic sales outlook and exceeded profitability expectations… moving decisively and building momentum as we bring our 'Beauty Reimagined' strategic vision to life.”

The Estee Lauder Companies Inc. (EL) Stock Performance, 5-Year Chart, Seeking Alpha

Walmart (WMT)

Walmart reports Q2 earnings Thursday before the bell. All eyes on how America’s largest retailer is balancing inflation, tariffs, and a digital transformation amid a shifting retail landscape.

This cycle, the spotlight will be on two fronts:

Tariff impact: Executives are under pressure to absorb rising costs — Walmart has already indicated that while it’s doing what it can to keep prices low, narrow margins mean some increases are inevitable.

AI strategy: Walmart is rolling out a suite of AI-powered “super agents” —including Sparky for shoppers, Marty for suppliers and advertisers, and internal tools for employees and developers as part of its push to have 50% of sales online within five years.

I’ll be watching for how smoothly Walmart navigates tariff pass-throughs and whether early signs of efficiency gains from AI innovations like improved delivery or streamlined operations show up in commentary or guidance.

The most important thing to remember is this company’s operating income margin is only 4%. If Walmart is able to materially increase that (even by a percentage point or two) over the coming half-decade because of their AI + online shopping efforts, that could mean 10s of billions of dollars more sitting on their bottom line.

"We will do our best to keep prices as low as possible... even at the reduced levels, the higher tariffs will result in higher prices."

Walmart Inc. (WMT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Disney and ESPN roll out new offerings, Foot Locker and Dick’s vote on merger, Trump and Zelensky set to meet today,

Disney and ESPN DTC Service

Source: Vlad Dimitrov Seeking Alpha

Disney’s ESPN will roll out its long-awaited direct-to-consumer streaming service (priced at $29.99/month) offering access to ESPN’s linear networks — ESPN+, SEC Network+, and ACCNX. The platform will feature 47,000+ live events annually, along with on-demand replays, studio shows, and original content.

This launch marks Disney’s most aggressive push yet into sports streaming and comes as cord-cutting accelerates. I’ll be watching closely to see how uptake compares to rival bundles and whether ESPN can capture incremental subscribers without cannibalizing its traditional pay-TV base. Guess I’ll have to tack this one onto the ever-growing “football season budget.”

It’s the same deal with Disney — these low-profit businesses are looking to do anything digital in efforts to boost their operating income margin. Disney’s operating income margin has shrunk from 25% to 13% over the last 10 years. Yikes!

Crypto Treasury Companies Gain Momentum*

Bitmine Immersion Technologies (BMNR) announced plans to issue up to $20 billion in new stock to significantly increase its Ethereum (ETH) holdings. The company, led by Fundstrat’s Tom Lee, currently owns about 1.15 million ETH tokens worth $4.96 billion — roughly 1% of all ETH in circulation — but aims to acquire 5% of the global supply.

Bitmine is part of a growing group of “crypto treasury companies” that raise capital by selling stock and using the proceeds to buy and hold cryptocurrencies on their balance sheets, a strategy popularized by Michael Saylor’s MicroStrategy (MSTR).

But it’s not only about BTC and ETH — CEA Industries (BNC) has now become the largest corporate holder of the Binance coin (BNB). CEA Industries’ treasury arm, BNB Network Company, has purchased 200,000 BNB tokens for $160 million, making it the largest corporate holder of the cryptocurrency.

The acquisition follows a $500 million private placement led by 10X Capital and YZi Labs, with plans to focus the company’s treasury strategy exclusively on BNB. Leadership changes accompanied the move, with Galaxy Digital co-founder David Namdar becoming CEO.

CEA Industries (BNC) intends to keep buying BNB until all treasury funds are deployed, positioning the company as a major long-term player in the token’s market. If warrants tied to the recent fundraising are exercised, the company could have as much as $1.25 billion available for further BNB acquisitions.

Let’s think about this for a second — Trump just signed an executive order allowing Americans to invest into cryptocurrency via their 401(k) / retirement accounts, crypto treasury companies are pouring 10s of billions into the asset class, and the Fed is likely going to begin their rate-cutting cycle in September.

Buckle up!

Foot Locker votes on Dick’s Merger

Source: SGB Media

Foot Locker will hold an extraordinary shareholders meeting this week to vote on the proposed $2.4B acquisition by Dick’s Sporting Goods. The deal comes as both companies seek scale and operational synergies to compete against Nike’s DTC push and the rise of e-commerce rivals. Under the deal, Foot Locker investors can choose either $24 per share in cash or 0.1168 shares of Dick’s stock, with the merger valued at approximately $2.4B in equity and $2.5B enterprise value.

Investors will be watching closely to see if the merger garners enough support to move forward, given the potential for cost savings, expanded distribution, and pricing leverage across footwear and apparel.

As you all might remember, Dick’s Sporting Goods’ entire business model the last few years have been these “interactive” locations via their “House of Sports” campaign. Their locations would include golf simulators, batting cages, tennis courts, and more.

Assuming they’re able to somehow sell through Foot Locker’s inventory as a complement to the activity taking place at these “interactive” locations, the merger could make a lot of sense.

On the flip side, Foot Locker is known for basketball shoes — whereas Dick’s Sporting Goods is trying to cater to all sports. Only time will tell.

Trump and Zelensky to Meet

President Trump will host Ukrainian President Volodymyr Zelensky at the White House on Monday, joined by leaders of France, Germany, Italy, Britain, Finland, the EU, and NATO in a show of transatlantic unity. The talks follow Trump’s high-profile meeting with Russian President Vladimir Putin in Alaska, where Putin floated peace terms requiring Ukraine to withdraw from Donbas in exchange for freezing fighting in southern regions.

At stake are potential U.S. security guarantees for Kyiv — modeled on NATO’s Article V but offered bilaterally — as well as Europe’s insistence that Ukraine’s territorial sovereignty remain the foundation of any settlement. Zelensky faces the delicate task of pushing back on Russian demands while addressing Trump’s desire for a quick end to the war, all under the constraint of Ukraine’s constitutional ban on ceding territory.

Markets and geopolitics will be watching closely: a credible U.S.—EU framework for Ukraine’s defense could stabilize the region, while a breakdown in talks risks renewed tensions between Washington and Kyiv.

Bringing peace to the region would be a step in the right direction, period.

Major Economic Events:

Existing home sales and Fed Chair Powell’s speech at the annual Jackson Hole Economic Symposium take center stage this week.

Monday (8/18/): Home builder confidence index

Tuesday (8/19): Building permits, Housing starts

Wednesday (8/20): Minutes of Federal Reserve’s July FOMC meeting

Thursday (8/21): Existing home sales, Initial jobless claims, Philadelphia Fed manufacturing survey, S&P flash U.S. manufacturing PMI, S&P flash U.S. services PMI, U.S. leading economic indicators

Friday (8/22): Fed Chair Powell Speech from Jackson Hole

What We’re Watching:

Existing Home Sales

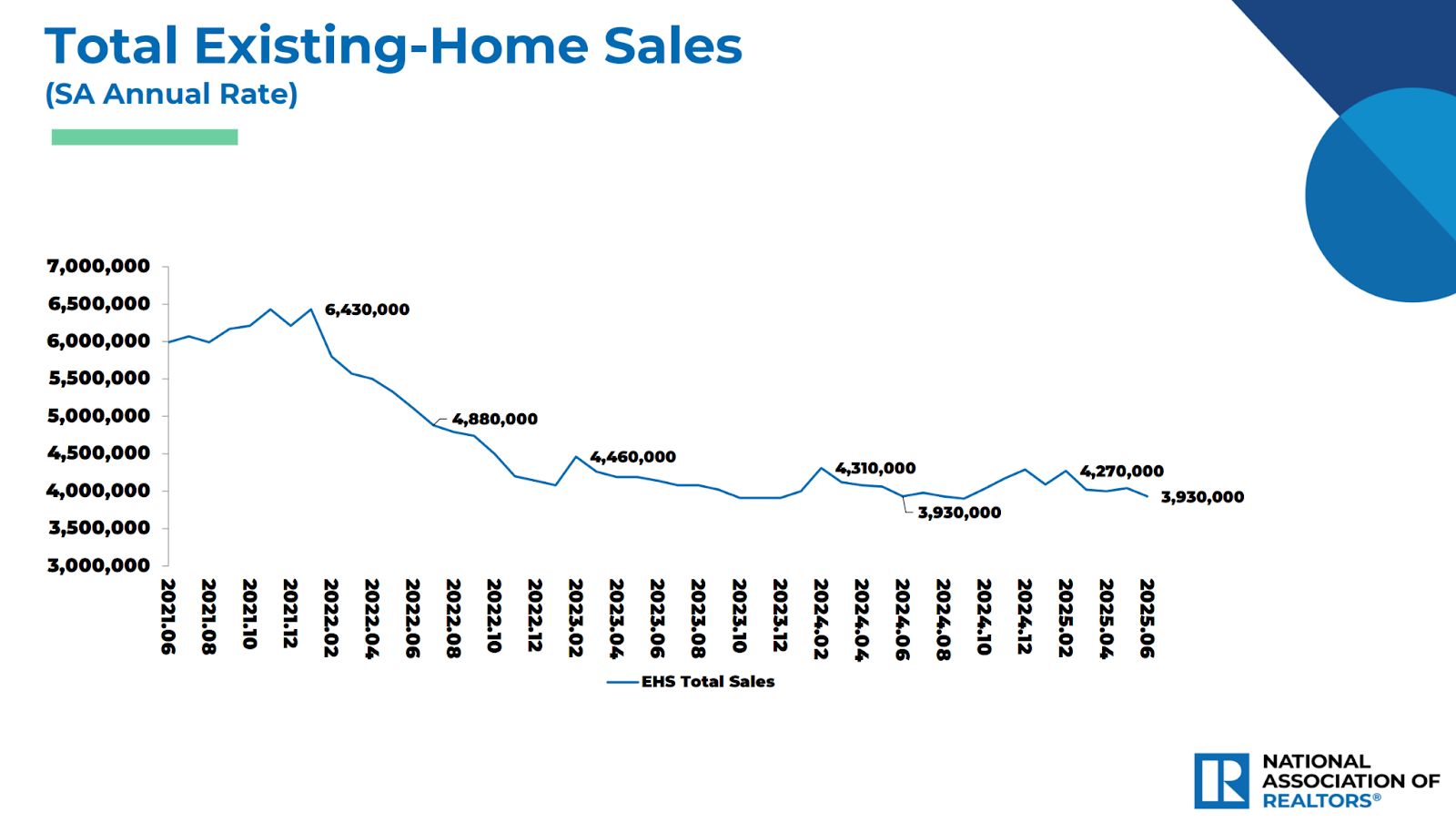

US existing-home sales fell 2.7% MoM in June to an annualized rate of 3.93M units (est. 4.01M), down from 4.04M in May — the slowest pace since Sept. 2024. The median sales price rose to $435,300, a record high for June and the 24th consecutive YoY increase.

Single-family sales dropped -3% to 3.57M units, while condo/co-op sales held flat at 360K. By region: Northeast (-8%), Midwest (-4%), South (-2.2%), West (+1.4%).

Economists expect the following this week:

Existing Home Sales (July): 3.39M, Down ~13%

Isn’t it so weird that while volumes are at historic lows prices continue to make all-time highs? I’m optimistic mortgage rates will begin to tick lower soon.

Fed Chair Powell Speech from Jackson Hole

Fed Chair Jerome Powell will deliver his keynote at the annual Jackson Hole Economic Symposium on Friday, a pivotal moment for markets with ~90% odds priced in for a September rate cut. Investors will be parsing his language for clues on the speed and depth of the easing cycle.

The Fed has held rates steady at 4.25%–4.50% for five straight meetings, with two governors dissenting in favor of cuts — the first dual dissent since 1993. Policymakers cited moderating growth in H1, a still-low unemployment rate, and sticky but easing inflation pressures.

Clarity from Powell on the balance of risks — inflation persistence vs. labor market weakness — will set the tone for the fall. With trade tensions and policy uncertainty elevated, markets are bracing for sharp moves depending on whether Powell signals gradual cuts or a faster pivot.

Can’t wait to recap this one for you all!

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: Creative Direct Marketing Group (CDMG) Inc. paid to have news shared about CEA Industries becoming the largest corporate holder of BNB. This is not financial advice and provides no guarantee of future returns.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]