- GRIT

- Posts

- 👉 Last Full Market Week of 2024

👉 Last Full Market Week of 2024

Micron, Nike, Palo Alto Networks

Welcome to your new week.

Maybe we should rephrase that….

Welcome to the last full work week of the year!

To all of my fellow Bitcoin holders — cheers!

As a quick note for our scheduling — we plan on doing one more Week in Review and Investing Week Ahead post this year. They may be a bit more abbreviated than our typical newsletters, but you can expect those on Sunday the 22nd and Monday the 23rd.

Let’s dive into everything you need to know this week.

🎥 Finance + Thrills = 🎁 Free Movie Night!

Calling all Canadian GRIT Subscribers! The first 20 to reply with their favorite finance movie will snag 2 free tickets to BABYGIRL courtesy of Elevation Pictures — a steamy thriller starring Nicole Kidman as a high-powered CEO in a forbidden affair.

You can click here to watch the trailer on YouTube.

📅 It hits theaters across Canada on December 25th.

Don't wait — reply now and claim your free tickets! 🍿✨

Key Earnings Announcements:

Accenture, CarMax, Carnival, Cintas, Darden Restaurants, FedEx, Micron, Nike, and more.

Monday (12/16): Red Cat Holdings

Tuesday (12/17): Heico

Wednesday (12/18): ABM, Birkenstock, General Mills, Jabil, Micron, Toro

Thursday (12/19): Accenture, Blackberry, Carmax, Cintas, Darden Restaurants, FedEx, Nike

Friday (12/20): Carnival Cruises, Winnebago

What We’re Watching:

Micron Technologies (MU)

Source: Micron Investor Relations

Micron Technology (+24% YTD) reports earnings on Wednesday, expected to post EPS of $1.56 on $8.71B of revenue. Analysts will focus on its HBM3E ramp and record data center contributions, which now account for 35% of revenue — up from 25% last year.

Wells Fargo projects Micron capturing over 20% of the $25B high-bandwidth memory (HBM) market by 2025, with supply already sold out for the year. Momentum in AI-driven server demand and DDR5 adoption are also expected to fuel growth.

“Servers continuously need more memory, especially considering the enormous demand due to AI. Micron's revenues surged by a staggering 93% last quarter due to enormous AI server demand… should materialize into robust earnings this quarter.”

Micron Technology, Inc. (MU) Stock Performance, 5-Year Chart, Seeking Alpha

Nike (NKE)

Source: Nike Investor Relations

Nike (-29% YTD) will release its fiscal Q2 earnings on Thursday. Investors are closely watching new CEO Elliott Hill's initial moves since his return in October, as his leadership is seen as critical to turning the company around.

While the worst of Nike's margin pressures may be behind it, analysts caution that a full recovery could take years, with revised EPS estimates for 2025-2027 reflecting a slower rebound. Barclays recently lowered its price target to $79, citing the need for sustained transformation efforts.

Nike has now declined more than -50% since its peak in 2021, it will be interesting to see if the company will be able to make a turnaround.

Nike, Inc. (NKE) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Palo Alto’s stock split, the next “Triple Witching Day,” and the U.S. government faces yet another funding deadline.

Palo Alto Networks (PANW) 2-for-1 Stock Split

Sources: David Paul Morris / Bloomberg / Getty Images / Fast Company

Palo Alto Networks (+33% YTD) will begin trading at its split-adjusted price after completing a 2-for-1 stock split — its first since 2022. This comes alongside strong Q1 FY2025 earnings and improved operating margins; however, billings saw an unexpected decline, management emphasized that this metric no longer reflects the company’s performance and reaffirmed their free cash flow and long-term growth outlook.

Palo Alto Networks (PANW) Stock Performance, 5-Year Chart, Seeking Alpha

Palo Alto Networks did not give an explicit reason why it was splitting its shares. Assumptions are that they’re following the norm of companies that want to make their shares more “accessible” to the masses and potentially appealing with a lower price.

They are joining Chipotle (CMG), Nvidia (NVDA), Walmart (WMT), and others giants that have had a stock split this year.

If you’re a holder of PANW — don’t freak out! Your shares did not get cut in half overnight.

Triple Witching Day

Sources: Michael Nagle | Bloomberg | Getty Images

The stock market may experience increased volatility this Friday — but don’t worry.

“Triple Witching Days” occur on the third Friday of March, June, September, and December, when three types of derivatives — stock options, index futures, and index options — all expire simultaneously. This event often triggers heightened market volatility as traders rush to settle or roll their positions, especially during the final trading hour, known as the “witching hour.”

Historically associated with sharp price swings, triple witching has become less dramatic in recent years due to staggered derivative expirations. While these days may lead to short-term stock market weakness, the long-term impact is minimal for buy-and-hold investors. However, active traders may find opportunities in the volatility. For all market participants, staying mindful of these dates can help navigate potential risks and opportunities.

Source: Barchart

We’ll see if potentially increased volatility can do anything to slow down the insane inflow into U.S. ETFs and mutual funds. It’s been $186 Billion over the last 9 weeks, the largest inflow in history!

“In recent years, triple witching days have tended to be less dramatic in terms of volatility. That partly reflects a vastly larger pool of option contracts and other derivatives that have staggered expirations or expire on a weekly or even a daily basis. Expiration dates are now scattered across the calendar, rather than happening on just a handful of days every year.”

U.S. Government Funding Deadline

Source: Michael Dell

The U.S. government faces a funding deadline on Friday, December 20 — with Congress likely to pass a continuing resolution to extend funding into early 2025.

This would avoid a government shutdown and give the new administration and Congress control over fiscal decisions. Meanwhile, the debt ceiling looms on January 1 — requiring action to prevent a default which would have large economic consequences.

“There are a lot of things I would prefer. But realistically, we’re not going to put together a budget between now and Christmas. It’s not going to happen. I expect us to have a continuing resolution (CR) probably through the middle of March. I expect that CR to be pretty thin."

Major Economic Events:

The Fed’s final rate decision of 2024 seems to be locked in, and we’ll receive retail sales updates.

Monday (12/16): Empire State Manufacturing Survey, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

Tuesday (12/17): Capacity Utilization, Home Builder Confidence Survey, Industrial Production, Retail Sales Minus Autos, U.S. Retail Sales

Wednesday (12/18): Building Permits, Fed Chair Powell Press Conference, FOMC Interest Rate Decision, Housing Starts

Thursday (12/19): Existing Home Sales, GDP (second revision), Initial Jobless Claims, Philly Fed Manufacturing Survey, U.S. Leading Economic Indicators

Friday (12/20): Consumer Sentiment, Core PCE, PCE, Personal Income, Personal Spending

What We’re Watching:

Fed Interest Rate Decision

Source: CME FedWatch Tool

The Federal Reserve is expected to cut interest rates to 4.25%-4.5% on December 18th. Fixed income markets and recent Fed speeches have led to a +95% chance of a cut according to CME FedWatch Tool and Kalshi Prediction Markets.

Upcoming jobs and inflation data could influence the decision, but cooling inflation and a softening job market make a cut likely.

"We think that the economic forecasts will show better growth and firmer inflation this year and that the median interest rate forecast dots will be revised to show three cuts next year instead of four, as in the September dots.”

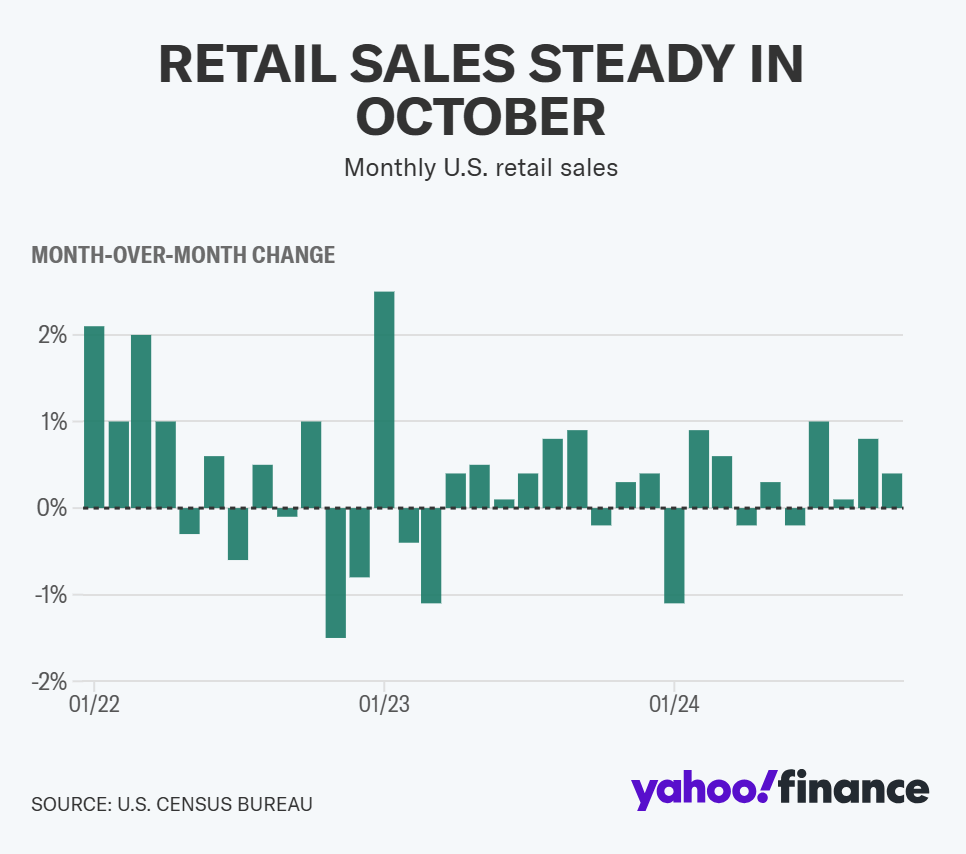

U.S. Retail Sales

Retail sales in the US increased +0.4% M/M in October 2024 — following an upwardly revised +0.8% gain in September, and above market forecasts of +0.3%.

Economists expect a gain of +0.6% for November — with Black Friday shopping baked into the equation.

"Online retail spending was particularly strong around the Thanksgiving period. In fact, holiday spending is running ahead of cumulative 2023 levels despite a delayed Thanksgiving. Hence, we expect a robust retail sales report for Nov, with retail sales ex-autos and the core control category coming in at +0.5% M/M."

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply