- GRIT

- Posts

- 👉 "Liberation Day" Has Arrived...

👉 "Liberation Day" Has Arrived...

Conagra Brands, RH, Tesla Deliveries

Together with Betterment

Welcome to your new week.

I just have one quick note below and then let’s jump right in!

We are officially sold out for the GRIT Money Summit! Even after expanding the capacity twice for the event — you guys made it happen. We look forward to seeing you this week in Toronto!

1) If your plans have changed and you’re no longer able to attend, please reply to this email and let us know.

2) If you are still planning to attend and have multiple tickets, please reply to confirm if all tickets are going to be used.

3) If you’re not going to be there in person, you can still tune in virtually! Sign up for free here.

Get an investment portfolio that puts your money to work with low-cost ETFs. It’s managed, optimized, and tax-smart so you can spend less time stressing and more time living.

Learn more here!

Key Earnings Announcements:

A much quieter week of earnings reports than we’ve seen in awhile… adding to the focus on “Liberation Day.”

Monday (3/31): PVH, Progress Software, Red Cat

Tuesday (4/1): Sportsman’s Warehouse

Wednesday (4/2): BlackBerry, Cognyte, RH

Thursday (4/3): Conagra Brands, Guess, MSC Industrial

Friday (4/4): N/A

What We’re Watching:

RH (RH)

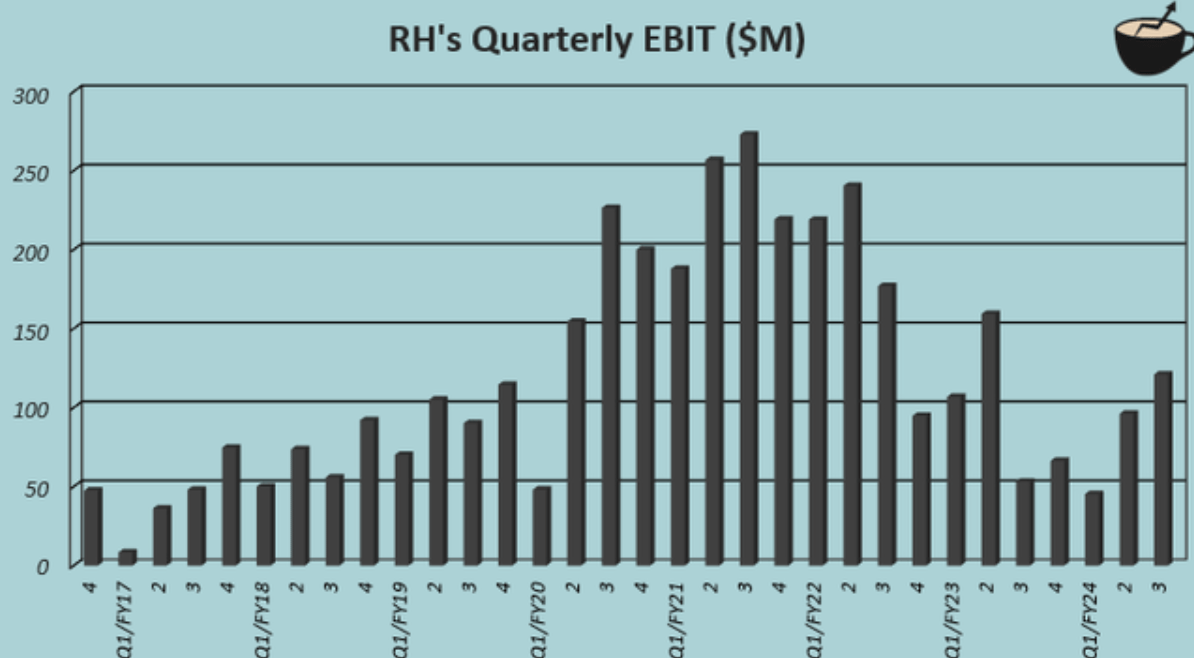

Source: Caffital Research, Seeking Alpha

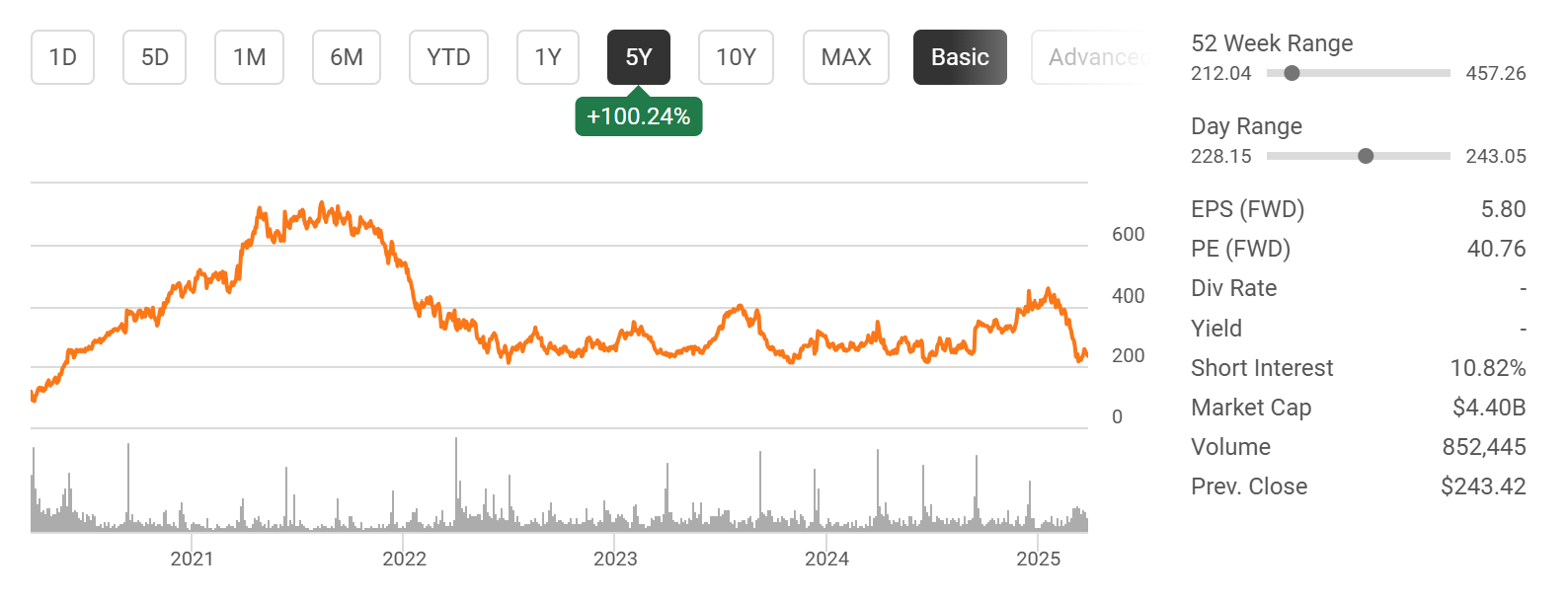

RH, the luxury home furnishings gallery, reports Q4 fiscal 2024 earnings Wednesday. Shares have crashed -50% from $450 in January to $225, slashing its market cap to $4B, after a post-election high faded away. CEO Gary Friedman’s December guidance included projected Q4 sales growth at +18-20%, relying on holiday momentum.

Q3’s +8% sales pop ($812M) and 12.3% margins teased a rebound, but 2024’s flatline at $3.2B and 11.6% margins — mirroring 2023’s slump — are disappointing investors. Net debt for RH most recently came in at $2.5B, with $230M in annual interest — eating into half of their $513M in EBITDA. High interest rates and a shaky luxury housing market have been hitting the market for wealthy buyers.

During the company’s last earnings report, CEO Gary Friedman said the following about tariffs. Investors will be eager for any updates.

“We do not expect a negative impact to margins as a result of the most recent communications regarding the potential for increased tariffs in 2025. We have been proactively moving sourcing away from China over the past several years with the expectation of fully exiting the country by the end of the second quarter. We are also transitioning products manufactured in Mexico and believe we can successfully reposition our sourcing with no disruption to the supply chain.”

RH (RH) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Trumps “Liberation Day” is upon us, Wall Street optimism is faltering, and Tesla will report its Q1 auto deliveries this week.

April 2nd is “Liberation Day” in the United States

Source: Yahoo Finance

Trump’s big tariff reveal is coming this Wednesday, April 2. Dubbed “Liberation Day,” the current expectation is for widespread reciprocal tariffs to be implemented that will target the $1.2T U.S. trade deficit. As of Monday morning, it’s believed that the tariffs will target 10-15 countries that have the worst trade imbalances with the United States — but a list has not yet been provided.

Goldman Sachs’ Alec Phillips warns of a downside surprise: “Markets expect a 9-point rate, but we see it doubling — officials want high stakes to negotiate.” Barclays’ Ajay Rajadhyaksha adds, “It’s a bigger deal than the market thinks.”

Last week’s 25% auto tariff teaser alone sank S&P 500 by -2%. Barclays recently slashed its 2025 S&P target to 5,900 from 6,600 — expecting widespread pain for stocks (at least in the short-term).

“This is the beginning of Liberation Day in America… We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years. They’ve taken so much out of our country, friend and foe. And, frankly, friend has been oftentimes much worse than foe.”

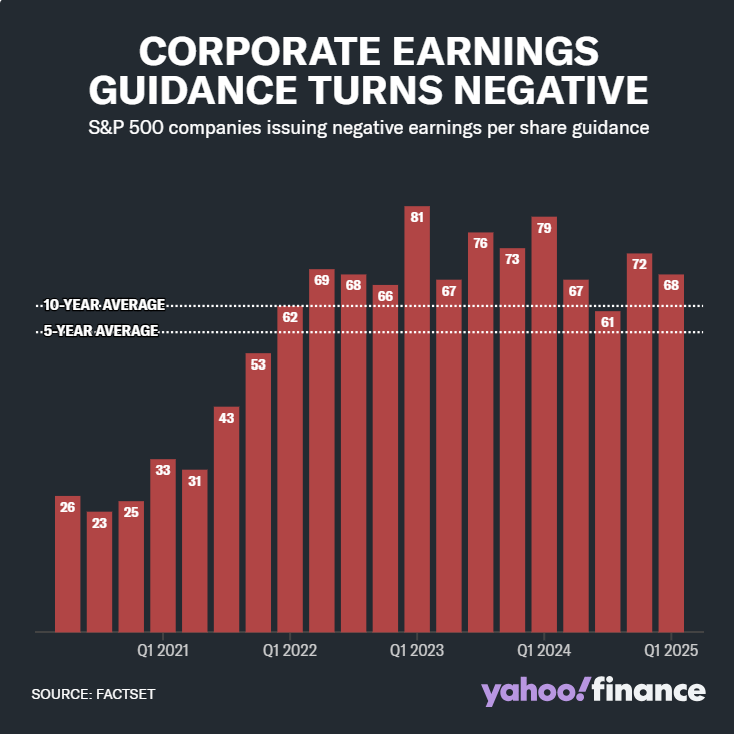

Negative Earnings Guidance for the S&P 500

S&P 500 firms are flashing warning signs. According to FactSet, 68 of 107 issuing Q1 2025 guidance went negative — topping the 5-year average (57) and 10-year average (62). Negative guidance — when a company’s EPS outlook dips below the previous consensus — signals tariff jitters are hitting hard, with 63% of guiders bearish versus 57% historically.

Wall Street’s 2025 optimism (S&P EPS growth pegged at 13% by FactSet) looks shaky as Q1 earnings season nears, starting April 11. Nike and FedEx have already cited tariff profit squeezes, and more companies could soon follow. Analysts are slashing estimates — with Goldman Sachs flagging a 2-3% S&P EPS hit if tariffs stick.

"A lot of people are worried about things like tariffs… it’s a broad economic slowdown that would be very difficult for companies to contend with."

Tesla (TSLA) Auto Deliveries

Tesla reports Q1 2025 auto deliveries Tuesday, with whispers of a plunge below 300,000 units — down from 386,810 in Q1 2024 and far under the 377,000 consensus, per Seeking Alpha. Weak European (-42% Jan-Feb) and Chinese (-49% Feb) sales, plus Model Y changeover hiccups, have been signaling trouble. Shares are down -30.5% YTD.

Analysts believe a sub-300K print could tank TSLA -10-15%, as brand issues tied to Musk’s political activity and tariff fears both continue to linger. Analysts at JPMorgan (355K), Morgan Stanley (351K), and William Blair (350K) slashed forecasts. Fundstrat’s Tom Lee believes that Tesla could soon lead a recovery for Big Tech after Trump’s “Liberation Day” passes.

"The winner in our view from this tariff is no one... as even Tesla still is hit from these tariffs and will be forced to raise prices.”

Major Economic Events:

ISM Manufacturing PMI, Jobs Report, and Unemployment Data.

Monday (3/31): Chicago Business Barometer

Tuesday (4/1): Auto Sales, Construction Spending, ISM Manufacturing, Job Openings, Richmond Fed President Thomas Barkin Speaks, S&P Final U.S. Manufacturing PMI

Wednesday (4/2): ADP Employment, Factory Orders, Fed Governor Adriana Kugler Speaks

Thursday (4/3): Fed Governor Lisa Cook Speaks, Fed Vice Chairman Phillip Jefferson Speaks, Initial Jobless Claims, ISM Services, S&P Final U.S. Services PMI, U.S. Trade Deficit

Friday (4/4): Fed Chairman Jerome Powell Speaks, Fed Governor Christopher Waller Speaks, Fed Governor Michael Barr Speaks, U.S. Employment Report, U.S. Hourly Wages, U.S. Unemployment Rate

What We’re Watching:

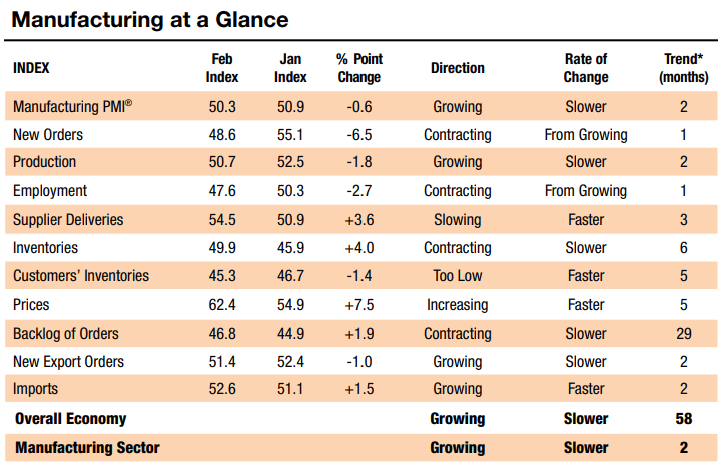

ISM Manufacturing PMI

February’s ISM Manufacturing PMI dipped to 50.3 from 50.9, missing the 50.5 forecast — barely above expansion. New orders tanked to 48.6 (lowest since March 2022), employment hit 47.6, and production slowed to 50.7. Prices soared to 62.4 — their highest level since June 2022 — while supplier delays rose (54.5).

Economists expect the ISM Manufacturing PMI to drop back into contraction territory in March — with median expectations of a 49.5 reading. You can read last month’s full report here.

"Demand eased, production stabilized, and destaffing continued as companies experience the first operational shock of the new administration’s tariff policy. Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages and manufacturing inventory impacts.”

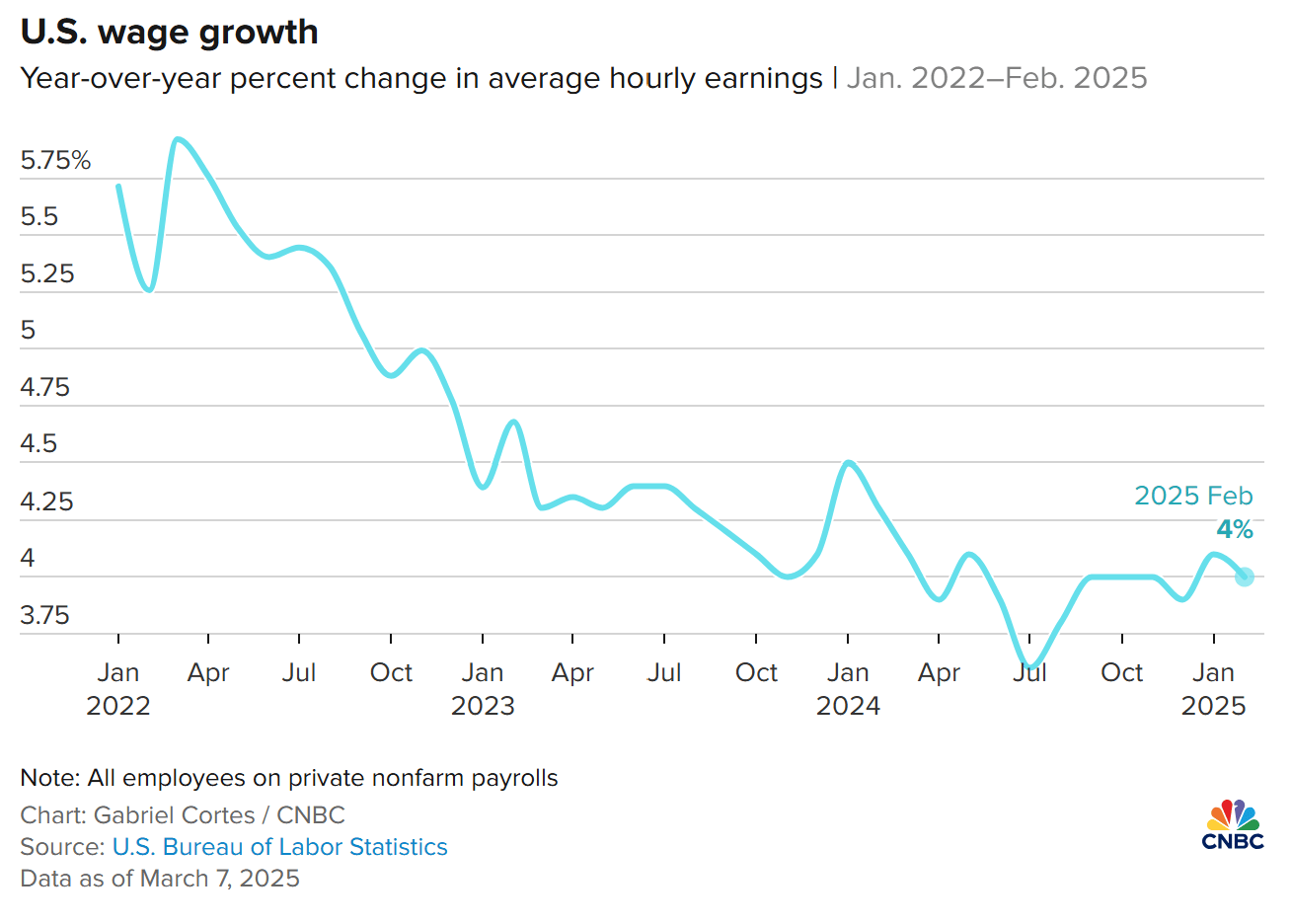

Jobs Report / Unemployment Data

The U.S. added +151K jobs in February 2025, beating January’s revised +125K result — but missing the +160K forecast. Health care (+52K), financials (+21K), and transport (+18K) led the gains. Federal jobs dropped -10K amid resignations and government downsizing. Retail shed -6K jobs, likely from early tariff effects / the anticipation of more tariffs.

The +4.1% unemployment rate continues to hold, but Goldman sees tariffs and spending cuts cutting -50K-100K jobs monthly by mid-2025. Many analysts expect this to cause a surge in the unemployment rate.

“The near-term path of policy is cloudy, and so the economy’s path is cloudy, too… If the government stays the course on big tariff hikes and spending cuts, those policies would continue to weigh on job creation in the next few months, likely pushing the unemployment rate higher still.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Illustration by John DiJulio, University of Virginia Communications

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]