- GRIT

- Posts

- 👉 Long, Hot... Tariff-Filled Summer?

👉 Long, Hot... Tariff-Filled Summer?

Broadcom, CrowdStrike, Lululemon

Welcome to your new week.

The summer months have officially arrived and it looks like this vacation season will be a hectic one in the markets.

Bitcoin is range-bound beneath all-time highs, the stock market is anxious about tariffs, the bond market is painting an ugly picture, and the Russia / Ukraine war hasn’t slowed down.

Throughout the summer — I’ll be sharing weekly portfolio updates, breaking down all of the most important earnings reports, and much more. We’d love to have you as a premium subscriber to receive all the analysis + portfolio access!

Key Earnings Announcements:

Broadcom, Campbell’s, Crowdstrike, DocuSign, MongoDB, and NIO highlight this week’s earnings reports.

Monday (6/2): Campbell’s, SAIC

Tuesday (6/3): Asana, CrowdStrike, Dollar General, Ferguson, Guidewire, Hewlett Packard Enterprise, NIO, Signet Jewelers

Wednesday (6/4): Five Below, MongoDB, PVH, Planet Labs, TechTarget, Thor Industries, Verint

Thursday (6/5): Broadcom, Cracker Barrel, DocuSign, Lands’ End, Lululemon, Rubrik, Samsara, ServiceTitan, Toro, Victoria’s Secret

Friday (6/6): ABM, FuelCell Energy, G-III Apparel

What We’re Watching:

Crowdstrike (CRWD)

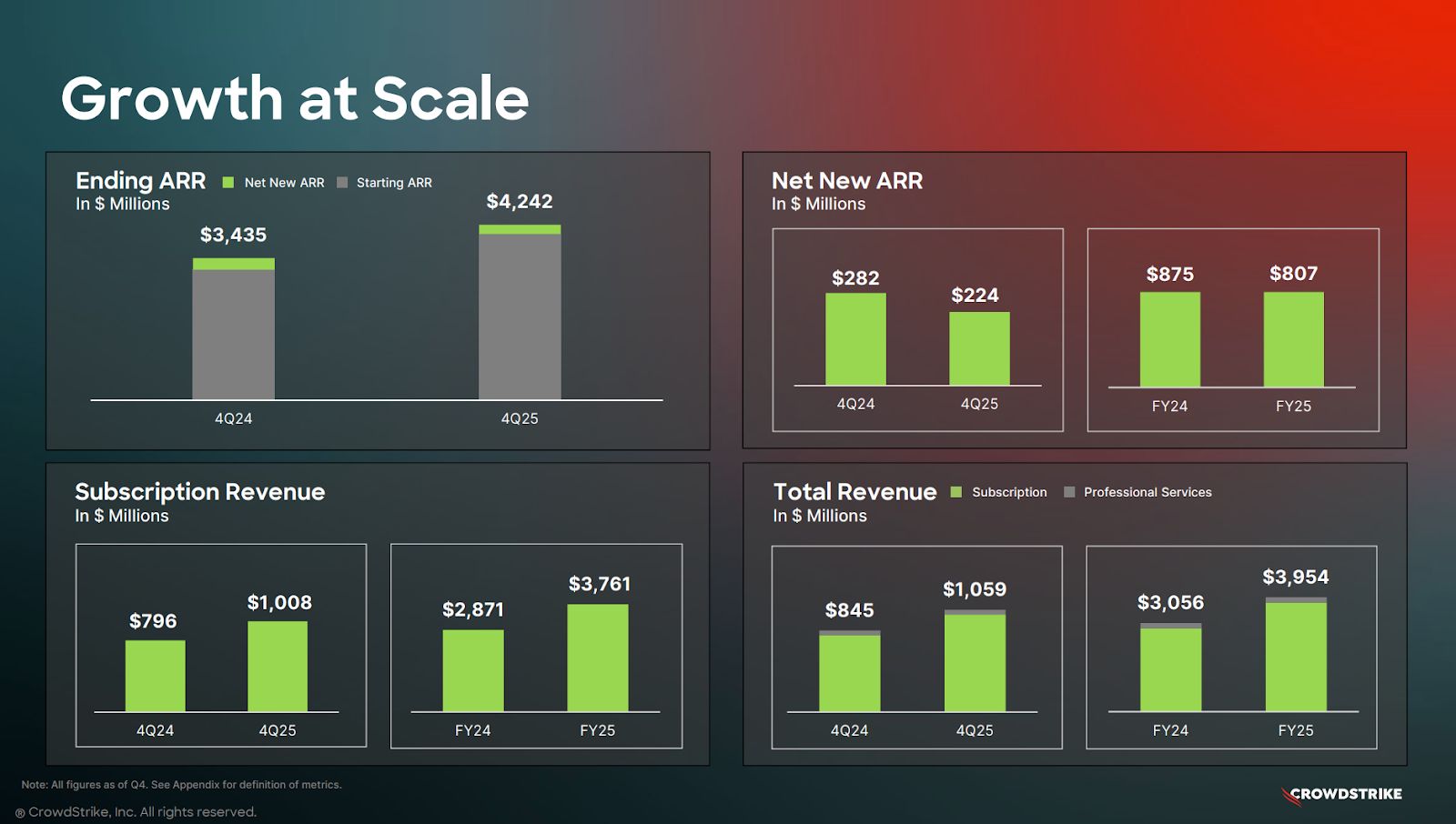

Source: CrowdStrike Earnings Deck

CrowdStrike reports earnings Tuesday after the bell. Shares are up +37.8% YTD as investors continue to reward its consistent execution and leadership in endpoint security. Last quarter, subscription revenue rose +33% YoY and net new ARR added came in strong, but operating margins narrowed slightly due to heavier AI R&D investment.

EPS expectations have been revised modestly upward, but attention will center on sustained ARR growth, federal contract momentum, and traction from its Falcon Cloud Security and LogScale platforms. Management has emphasized growing its platform strategy beyond endpoint protection, and investors will want to see that diversification reflected in results. I’ll also be watching commentary on enterprise cybersecurity budgets and pipeline visibility into 2H 2025.

I’m still a happy holder of CRWD — up +121% on my position.

“We are building the cybersecurity AI-native platform of the future – unifying threat detection, response, and data at scale.”

Crowdstrike Holdings, Inc. (CRWD) Stock Performance, 5-Year Chart, Seeking Alpha

Lululemon (LULU)

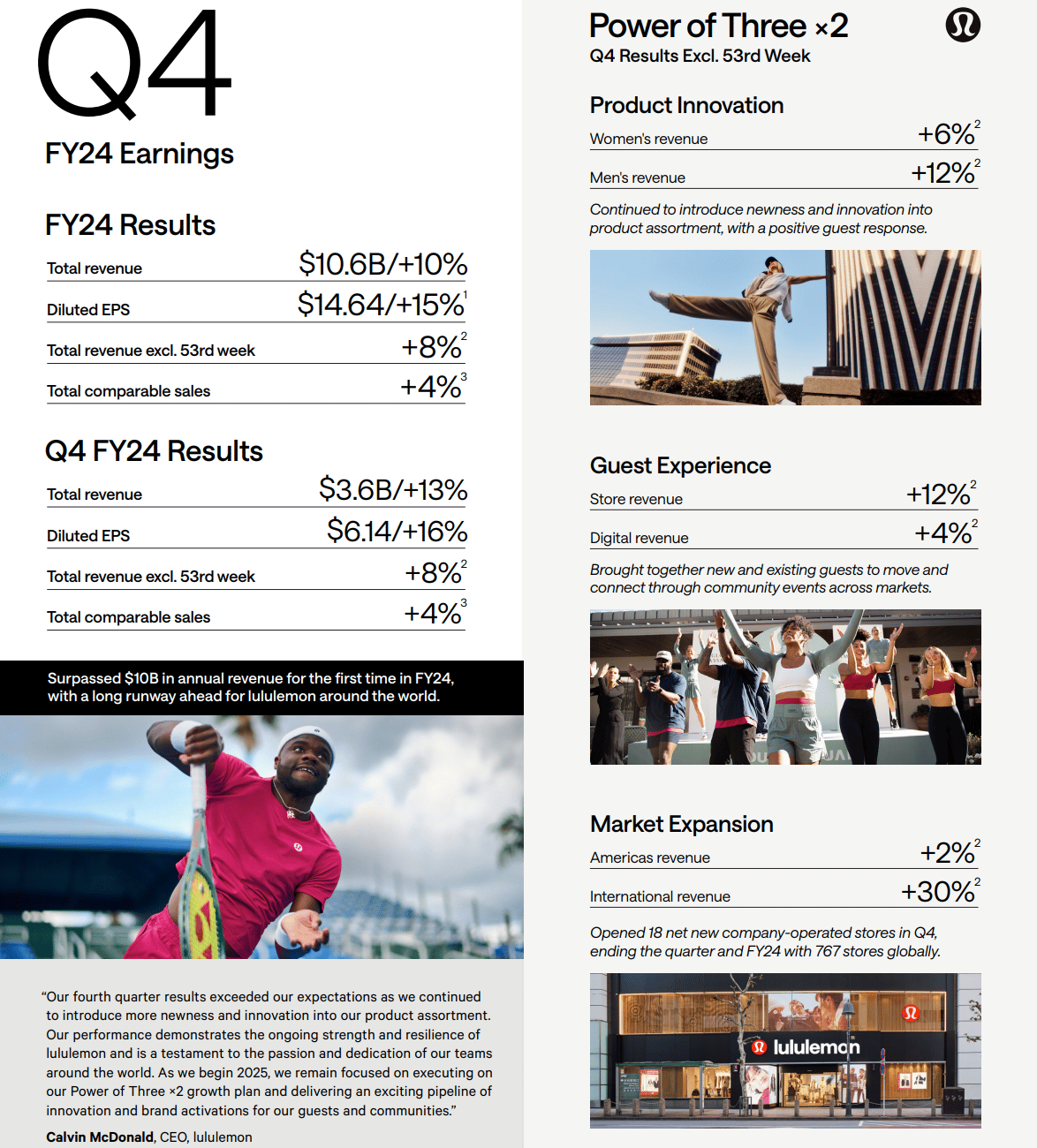

Source: Lululemon Earnings Infographic

Lululemon reports earnings Tuesday after the bell. Shares have fallen -17% YTD as the company grapples with macroeconomic headwinds, including new U.S. tariffs on Asian imports that impact nearly 86% of its product line. Analysts estimate these tariffs could reduce gross margins by up to 720 basis points, with a blended tariff rate around 39%.

While Lululemon has historically avoided broad price hikes, the current environment may test that strategy. Investors will be closely watching for updates on margin pressures, consumer demand trends, and any strategic adjustments to mitigate the impact of tariffs.

“Consumers are spending less due to increased concerns about inflation and the economy. This is manifesting itself into slower traffic across the industry in the U.S. in quarter one, which we are experiencing in our business as well.”

Lululemon Athletica Inc. (LULU) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Circle eyes $6B valuation, Snowflake hosts its annual 4-day summit, and more Trump tariff updates.

Circle Eyes $6B Valuation

Jeremy Allaire, Co-Founder, Chairman and CEO of Circle. Source: Getty Images

Stablecoin issuer Circle (who manages USDC) is set to price its IPO this week, aiming to raise $624M at a ~$6B valuation on the NYSE. With early backing from BlackRock and ARK Invest, the deal will be closely watched as a major test of investor appetite for crypto infrastructure amid broader market volatility.

All of this comes as the stablecoin market surpassed the $250B milestone for the very first time. According to The Block — Tether's USDT is dominating with a market cap exceeding $153 billion, ahead of runner-up Circle’s USDC with a market cap of $60.9 billion.

“The Trump Administration is going big on digital assets. Why? Because the previous administration nearly destroyed the industry with its anti-innovation agenda and regulation-by-enforcement approach. No more. Digital asset companies deserve regulatory clarity—and that’s exactly what we are working toward. Passing the stablecoin bill is just the start.”

Snowflake (SNOW) Summit 2025

Snowflake’s flagship Summit kicks off this week in San Francisco, bringing together the global data, AI, and application development community. Over four days, the company will showcase new product innovations like Cortex and Snowpipe Streaming — with more than 500 sessions and nearly 200 partners in attendance.

The most anticipated moment? A high-profile fireside chat between Snowflake CEO Sridhar Ramaswamy and OpenAI’s Sam Altman on Tuesday at 2PM — a spotlight on the future of enterprise AI.

Snowflake Inc. (SNOW) Stock Performance, All-Time Chart, Seeking Alpha

"Enterprises are at a turning point on their AI journeys, shifting from experimentation to full-scale deployment that drives real business impact. But AI is only as powerful as the data behind it. Snowflake Summit 2025 will demonstrate how we are making AI and data come alive with Snowflake’s trusted data platform, serving as the engine helping global enterprises unlock AI’s value.”

Trump Tariff Updates

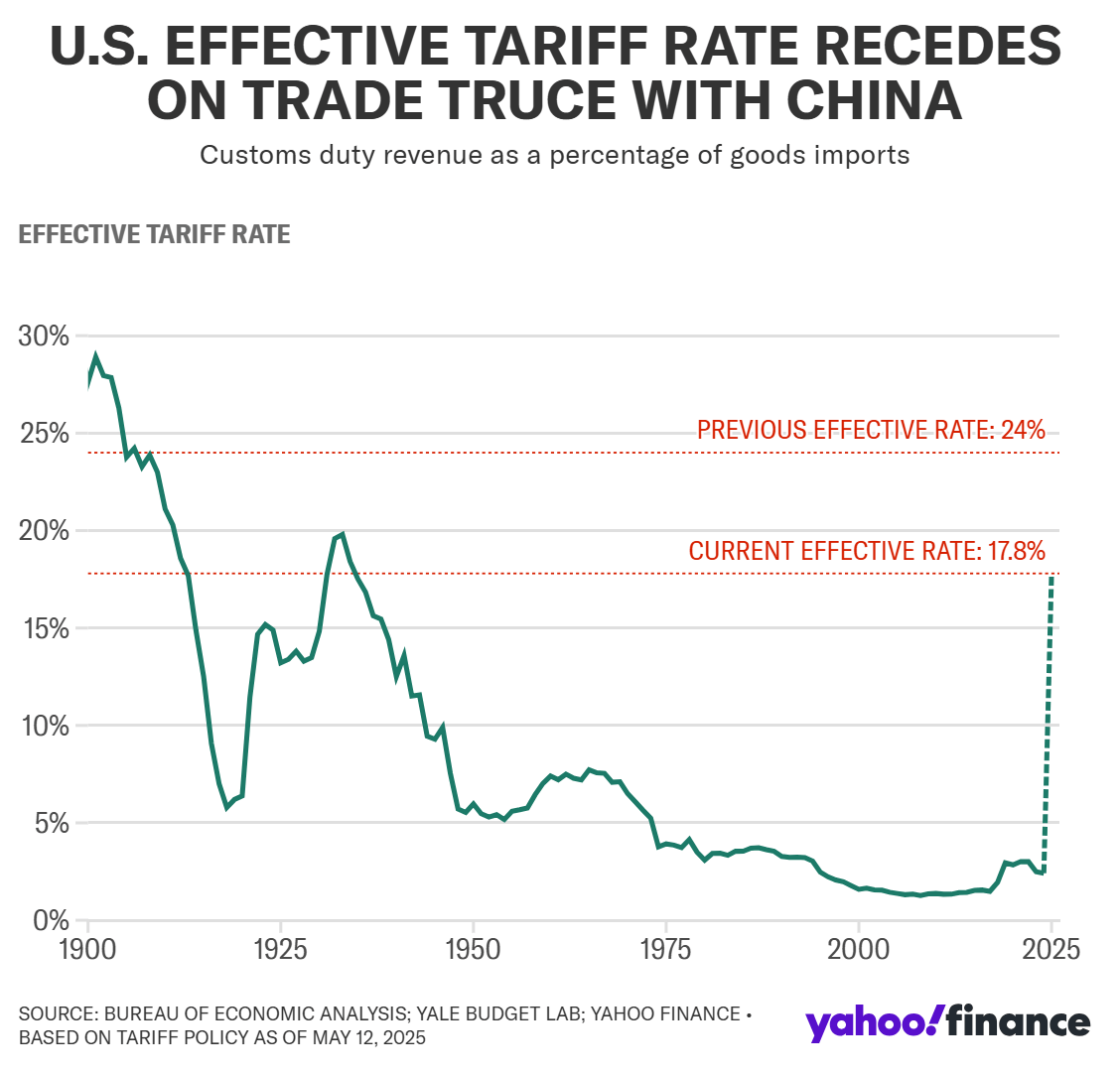

President Trump has intensified his trade policy by doubling tariffs on steel and aluminum imports to 50%, effective June 4, aiming to bolster domestic production. This move has drawn criticism from international trade partners and economists, who warn of potential inflationary pressures and retaliatory measures.

The European Union, facing a similar 50% tariff threat, has been granted a reprieve until July 9 to negotiate a trade deal, highlighting the administration's strategic use of tariffs in diplomatic discussions. Meanwhile, a U.S. trade court ruling challenging the legality of these tariffs has been temporarily halted, allowing the measures to remain in effect during ongoing legal proceedings.

Like all investors — we’re eager to see if there will be more tariff updates this week. The clock is ticking here…

“Just when we thought the noise around tariffs was quietening down, recent events have shown that investors should take nothing for granted until it is signed and sealed.”

Major Economic Events:

Investors will learn a lot about the labor market this week.

Monday (6/2): Auto Sales, Chicago Fed President Austan Goolsbee Speech, Construction Spending, Dallas Fed President Lorie Logan Speech, Federal Reserve Chair Jerome Powell Opening Remarks, ISM Manufacturing, S&P Final U.S. Manufacturing PMI

Tuesday (6/3): Chicago Fed President Austan Goolsbee Speech, Dallas Fed President Lorie Logan Opening Remarks, Factory Orders, Federal Reserve Governor Lisa Cook Speech, Job Openings

Wednesday (6/4): ADP Employment, Atlanta Fed President Raphael Bostic and Federal Reserve Governor Lisa Cook at Fed Listens Event, Fed Beige Book, ISM Services, S&P Final U.S. Services PMI

Thursday (6/5): Federal Reserve Governor Adriana Kugler Speech, Initial Jobless Claims, Philadelphia Fed President Patrick Harker Speech, U.S. Productivity, U.S. Trade Deficit

Friday (6/6): Consumer Credit, Hourly Wages Year Over Year, U.S. Employment Report, U.S. Hourly Wages, U.S. Unemployment Rate

What We’re Watching:

Non-Farm Payrolls

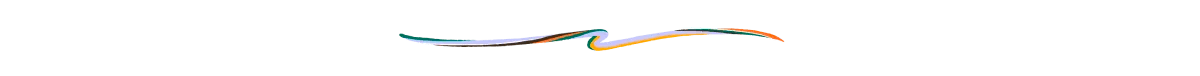

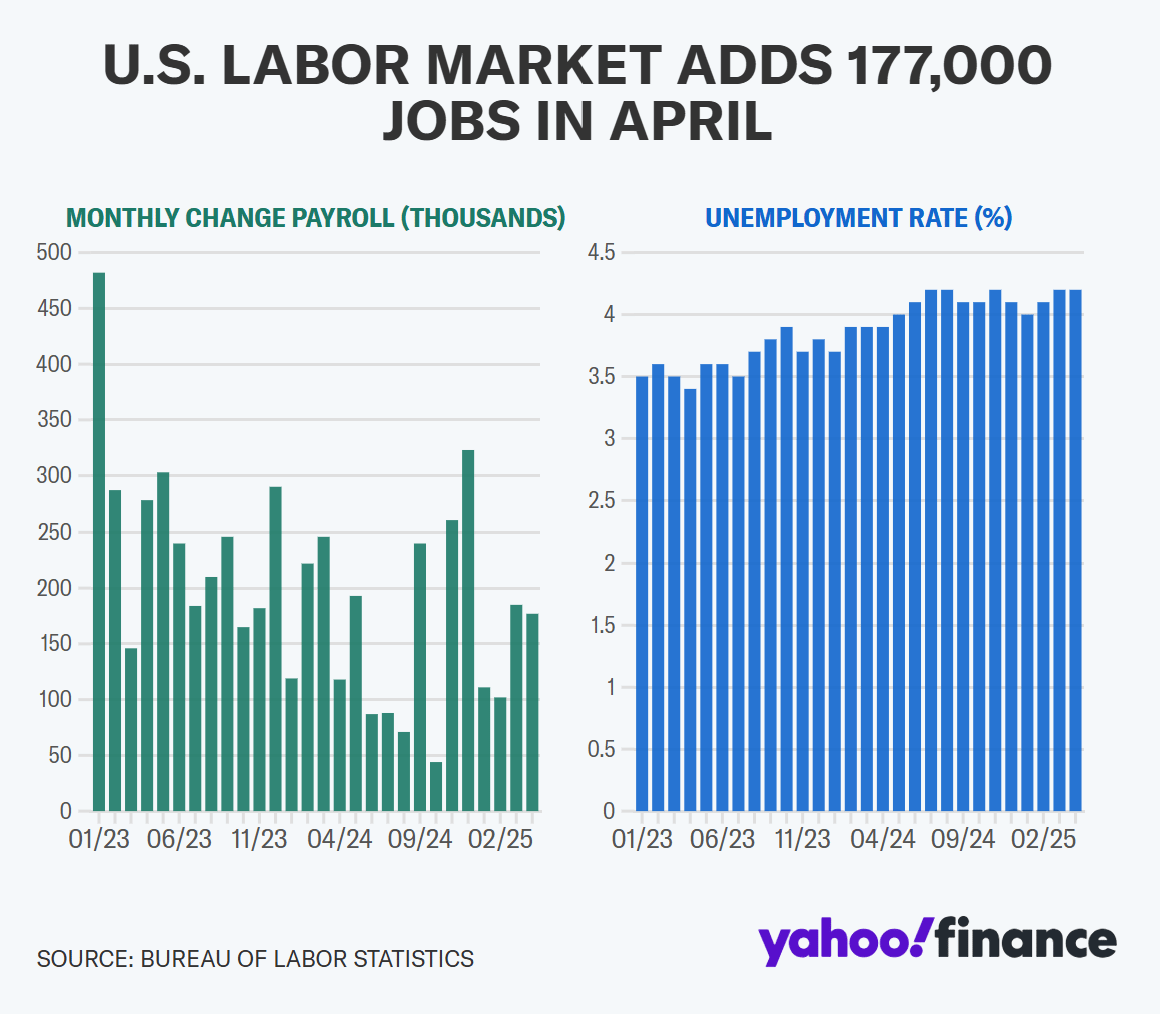

The U.S. economy added +177K jobs in April — well above the +130K consensus and roughly in line with the 12-month average. Hiring was led by health care, transportation, and financial services, while federal government jobs declined. Despite slowing from March, the report shows labor market resilience in the face of rising uncertainty from Trump’s tariff policies. I’ll be watching the report Friday to see if May continued the major jobs growth.

The median forecast for this week’s May report is +125K jobs, very much below April’s results.

"May's employment report will offer the first real look at how the labor market is faring under a rapidly changing trade environment. We suspect it will show the cloudier outlook starting to weigh on hiring, with payroll growth moderating to +125K in May."

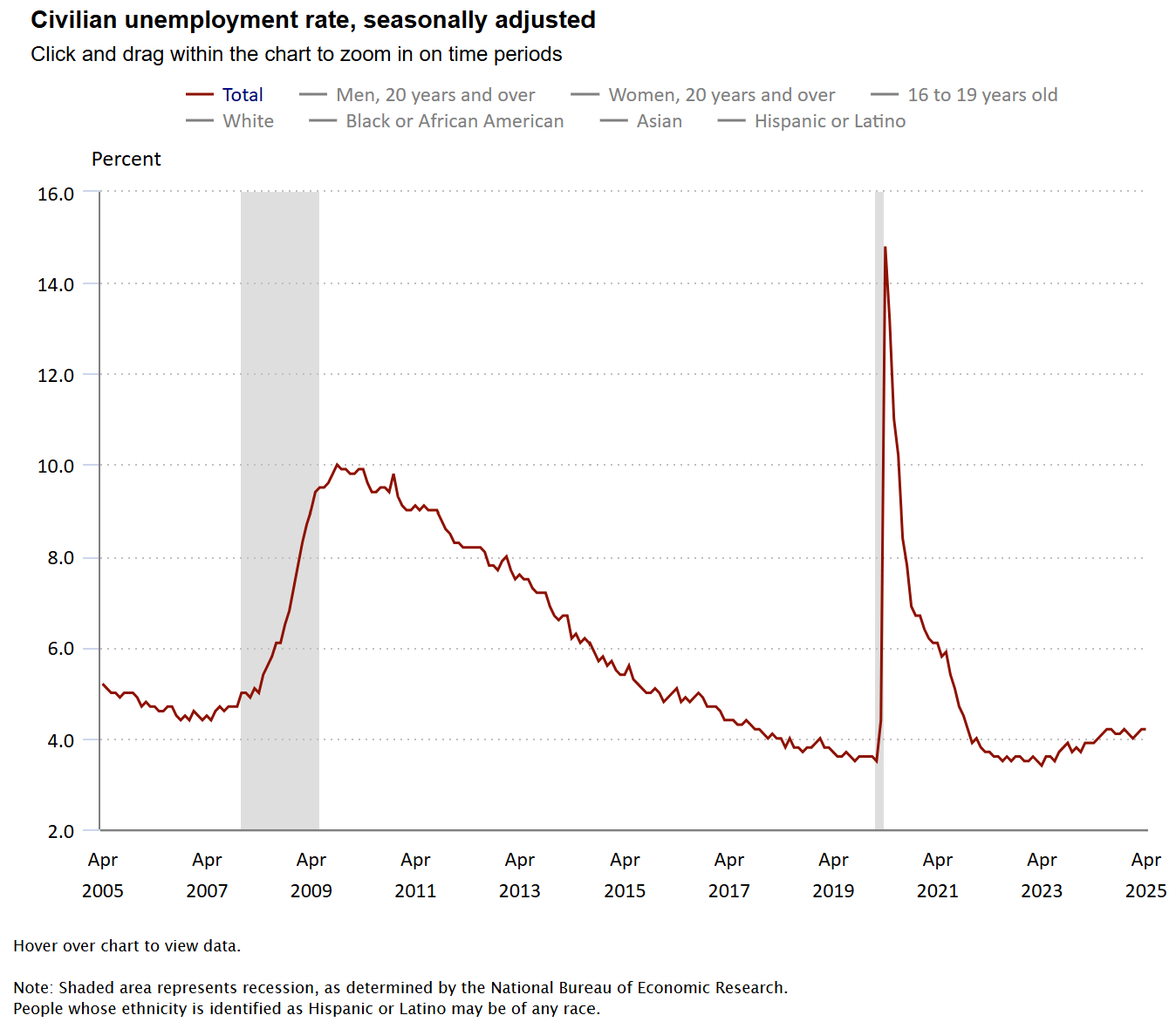

Unemployment Rate

The U.S. unemployment rate held steady at 4.2% in April, matching expectations. While joblessness ticked slightly higher, employment rose by +436K and labor force participation nudged up to 62.6%.

Encouragingly, the broader U-6 unemployment rate dipped to 7.8% — hinting at ongoing labor market resilience despite economic headwinds. The May Jobs report will come out this Friday with analysts expecting the unemployment rate to hold steady again at 4.2%.

“We can push recession concerns to another month. Job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy in play before the tariff shock. The economy will weaken in the coming months but, with this underlying momentum, the U.S. has a decent chance of averting recession if it can step back from the tariff brink in time.”

The Father-Son Duo Revolutionizing Homebuilding

Paolo and Galiano Tiramani founded BOXABL with a disruptive idea: bring factory efficiency to homebuilding. Today, new homes can roll off their assembly lines in ~4 hours – already building 700+. Now, they’re prepping for Phase 2, combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can share in their growth.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Reuters / Brendan McDermid / File Photo

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]