- GRIT

- Posts

- 👉 Major Earnings Reports Return This Week

👉 Major Earnings Reports Return This Week

Chipotle, Google, Tesla

Together with Roi

Welcome to your new week.

I encourage all of you to join me and Katie Stockton on Thursday (4/24) at 12:30p ET for an hour long deep dive into three stock picks!

I will share three of my favorite stocks right now (fundamentally speaking) and Katie will provide thoughts on where their prices could be heading (technically speaking). All GRIT subscribers are welcome to join us for this livestream!

Most finance apps suck for serious investors — they’re built for budgeting, not building wealth. That’s why we use Roi (pronounced “Roy”) — the best way to track and grow your net worth in one place.

Tired of apps that miss accounts or disconnect? Roi tracks everything — stocks, cash, crypto, bonds, even company equity — in real-time.

For those of you interested in using AI to help them invest, Roi can now enable AI features on top of your existing brokerage accounts. This AI actually understands your portfolio. It analyzes your investments, finds opportunities, and can answer financial questions you have.

Users last year found an extra $1,463 in opportunities on average using Roi AI.

If you’re serious about building wealth, click here to download Roi now!

Key Earnings Announcements:

Around 20% of the S&P 500 report earnings this week.

Monday (4/21): Comerica, HBT Financial, Medpace

Tuesday (4/22): Capital One, GE Aerospace, Halliburton, Lockheed Martin, Raytheon, SAP, Tesla, Verizon, Quest Diagnostics

Wednesday (4/23): AT&T, Boeing, Chipotle, IBM, Nextera Energy, Phillip Morris, ServiceNow, Vertiv

Thursday (4/24): Alphabet, American Airlines, Intel, PepsiCo, Southwest, T-Mobile

Friday (4/25): Abbvie, Centene, Charter, Phillips66

What We’re Watching:

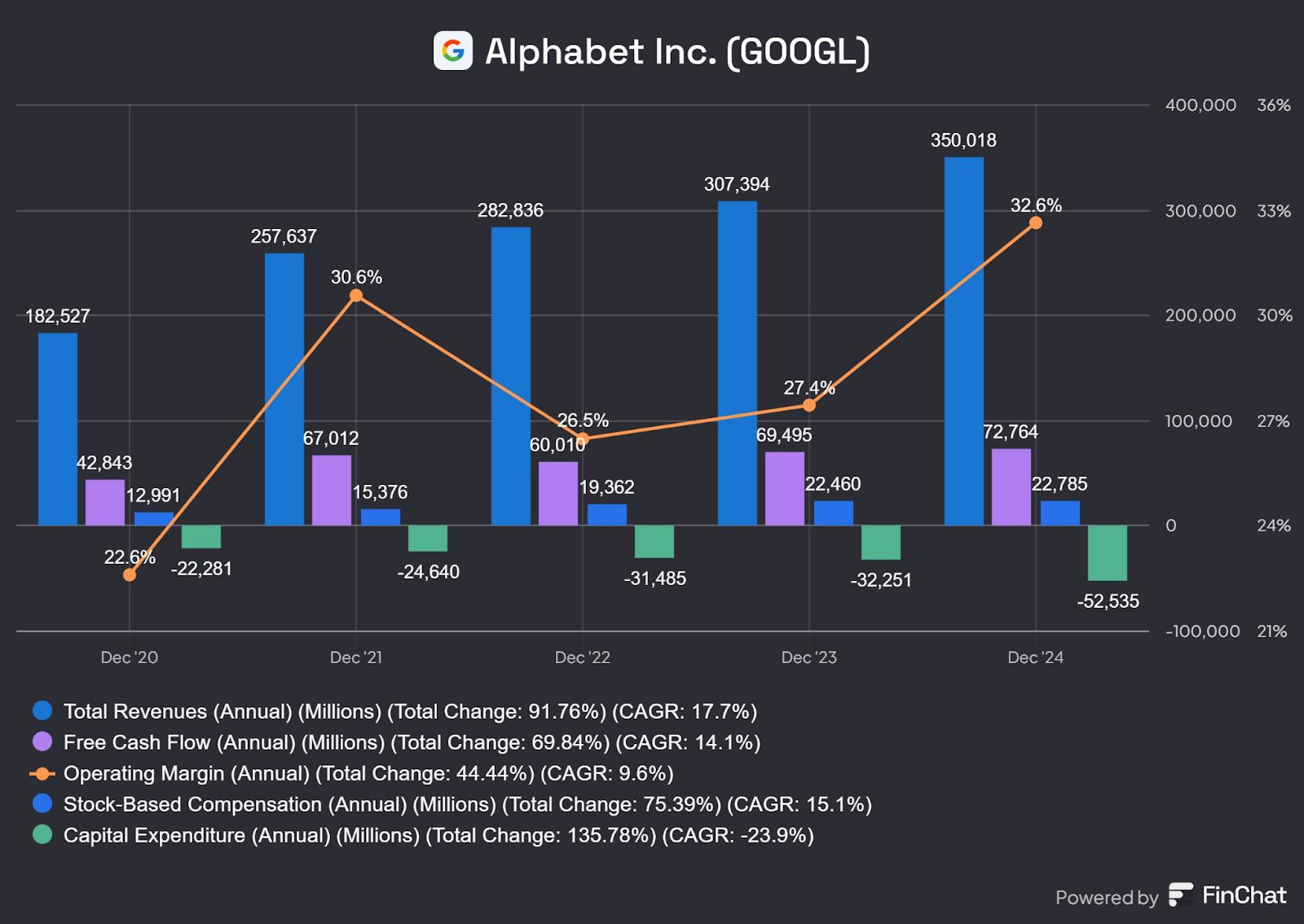

Alphabet (GOOG)

Alphabet reports earnings on Thursday after the bell. Shares are down -20% YTD despite Google Cloud’s $10B Q4 2024 revenue milestone — up +30% YoY. A $75B AI CapEx plan for 2025, including the Gemini 2.5 rollout, has investors on edge as ad sales face significant legal scrutiny. Q4 2024 ad sales hit $72.5B, up +13% YoY.

A federal ad tech monopoly ruling and a £7B UK lawsuit over search ad overcharges threaten ad revenue — which was $307B in 2024 (~80% of sales). Judge Leonie Brinkema ruled Google “willfully” monopolized ad tech, illegally tying its “publisher ad servers and the market for ad exchanges which sit between buyers and sellers.”

The DOJ may force a breakup of Google Ad Manager, risking a -12% revenue hit. The UK suit claims Google abused search dominance to overcharge advertisers, potentially costing $6.6B in damages.

“Google has been leveraging its dominance in the general search and search advertising market to overcharge advertisers. This class action is about holding Google accountable for its unlawful practices and seeking compensation on behalf of UK advertisers who have been overcharged.”

Alphabet Inc. (GOOGL) Stock Performance, 5-Year Chart Seeking Alpha

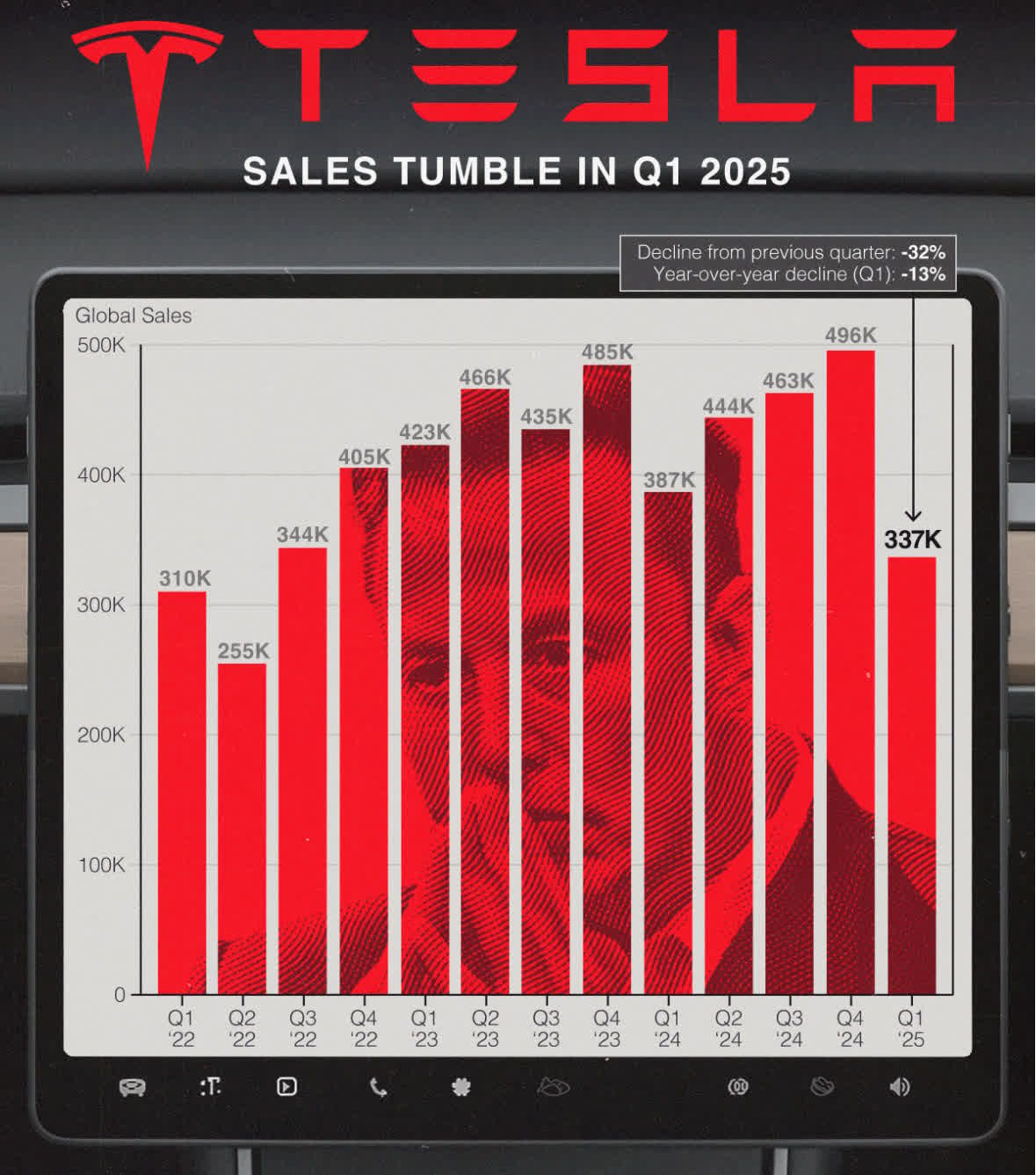

Tesla (TSLA)

Source: Visual Capitalist

Tesla reports earnings tomorrow after a difficult Q1. Deliveries were down -13% YoY to 336,681 vehicles (missing the 377,000 consensus estimate), hit by Model Y retooling and anti-Musk sentiment. Q4 2024 featured an EPS beat ($0.77 vs. $0.73 expected), but shares are down -40% YTD. Looking past all of the negative press around the company, the impact of tariffs should hit Tesla less than other automakers. Musk claims that Tesla is the “most American-made car” with 75% American / Canadian parts (according to NHTSA data), a potential edge as Trump’s 25% auto tariffs squeeze rivals.

Energy storage shined in Tesla’s most recent earnings report — with 10.4 GWh deployed, up +156% YoY, boosting segment revenue +90% to $3.1B. Tesla bulls will want to hear more about energy during this earnings call because loyal investors consider Tesla to be much more than just a car company.

Musk expects to launch unsupervised FSD by June, but the combination of bad Tesla press, tariff chaos, and recession fears has been suppressing the excitement around FSD. Banks like BNP Paribas have been slashing 2026 EPS estimates (-38% by them). Elon really needs to show that he is focused on Tesla, FSD will be rolled out smoothly, energy storage is growing sustainably, and their Optimus humanoid robot is making strides.

“Tesla is in the middle of a crisis tornado.”

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Waiting on a Russia / Ukraine peace deal, there will be major speakers at the Semafor World Economic Conference, and rising tensions in the U.S. / China trade war.

Time is Ticking for Russia & Ukraine Peace Deal

Source: Ludovic Marin/Press Pool/WSJ

The Trump administration has proposed a peace plan for Ukraine that includes U.S. recognition of Russia’s 2014 annexation of Crimea and blocking Ukraine from ever joining NATO. The proposal, presented to Ukrainian and European officials in Paris, is now awaiting Kyiv’s response at a follow-up meeting in London this week. Secretary of State Marco Rubio warned that if progress isn’t made soon, the U.S. may pause its diplomatic efforts.

The plan would also designate the area around the Zaporizhzhia nuclear power plant as neutral territory potentially under American control, and Trump has floated the idea of the U.S. acquiring Ukrainian power plants. While the proposals stop short of recognizing Russia’s claims to four eastern Ukrainian regions, they also don’t demand the withdrawal of Russian forces from those areas.

The U.S. is not proposing to cap Ukraine’s military or halt Western military support, but has yet to clarify what security guarantees Ukraine might receive. Some American officials are skeptical of Putin’s intentions — despite Special Envoy Steve Witkoff’s reported progress in talks with the Kremlin. Ukraine has signaled openness to a 30-day cease-fire if Russia reciprocates, though Kyiv accuses Moscow of violating a recent Easter truce.

Expect more news on this by the end of the week.

“The Ukrainians have to go back home, they have to run it by their president, they have to take into account their views on all of this. But we need to figure out here now, within a matter of days, whether this is doable in the short term. Because if it’s not, then I think we’re just going to move on.”

Semafor World Economy Summit

The three-day Semafor World Economy Summit kicks off Wednesday, April 23, in Washington, D.C. — uniting over 200 CEOs to address trade, tech, and energy shifts amid tariff tensions. We’ll be watching for any takes on navigating a 60% recession risk (JPMorgan estimates) and any supply chain updates as each company approaches their unique tariff situation differently.

We’ll loop back if any market-moving news comes out of the conference. Notable speakers include:

- Citadel CEO Ken Griffin

- Former Microsoft (MSFT) CEO Steve Ballmer

- General Motors (GM) CEO Mary Barra

- PayPal (PYPL) CEO Alex Chriss.

- Pfizer (PFE) CEO Albert Bourla

- Philip Morris (PM) CEO Jacek Olczak

- Uber Technologies (UBER) CEO Dara Khosrowshahi

and many more linked here.

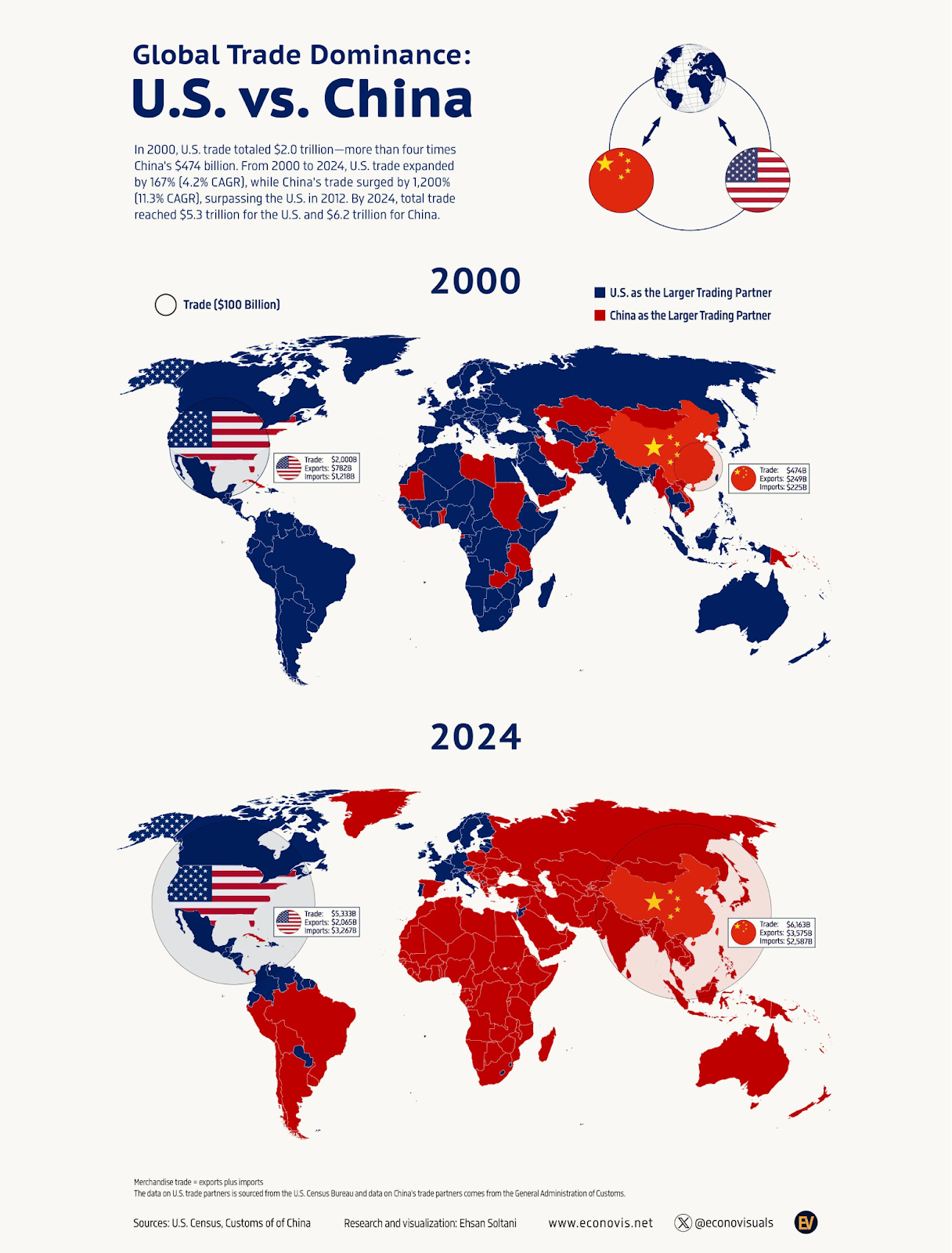

U.S and China Trade War

The U.S. / China trade war deepens as President Xi Jinping tours Southeast Asia this week. He will be meeting with leaders in Vietnam, Malaysia, and Cambodia — with the goal of rallying trade partners against Trump’s tariffs. Chinese Ambassador Xie Feng urged “peaceful coexistence” Saturday but warned of retaliation, while Trump’s team expects a call from Xi that doesn’t seem to have come yet. Beijing also recently suspended rare earth exports, which will impact U.S. automakers and chipmakers.

One of the highlights of the week should be President Xi’s speech in Hanoi, Vietnam on Wednesday. He’s expected to discuss potential trade pacts — potentially redirecting China’s $1T+ goods surplus to other parts of Asia. China’s new trade negotiator, Li Qiang, may move forward with World Trade Organization (WTO) complaints this week — adding an interesting legal aspect to this trade war.

The market is begging for a productive call between President Trump and President Xi Jinping. If that doesn’t come this week — then more negative sentiment is all-the-more likely.

“Seeking temporary self-interest at the expense of others — in exchange for so-called exemptions — is like asking a tiger for its skin. In the end, it will achieve nothing and harm both others and oneself… China firmly opposes any party reaching a deal at the expense of China’s interests. If such a situation arises, China will not accept it and will resolutely take reciprocal countermeasures.”

Major Economic Events:

Watching the impact of tariffs on durable-goods orders and existing home sales.

Monday (4/21): U.S. Leading Economic Indicators

Tuesday (4/22): Minneapolis Fed President Neel Kahskari Speaks, Philadelphia Fed President Patrick Harker Speaks, Richmond Fed President Tom Barkin Speaks

Wednesday (4/23): Atlanta Fed President Bostic Speaks, Chicago Fed President Austan Goolsbee Opening Remarks, Cleveland Fed President Beth Hammack Speaks, Fed Beige Book, New Home Sales, St. Louis Fed President Alberton Musalem and Fed Governor Christopher Waller Speak, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

Thursday (4/24): Durable-Goods Orders, Existing Home Sales, Initial Jobless Claims, Minneapolis Fed President Neel Kashkari Speaks

Friday (4/25): Consumer Sentiment

What We’re Watching:

Durable-Goods Orders

Durable goods orders in the U.S. rose +0.9% in February to $289.3 billion, marking the second straight monthly gain and defying expectations for a decline. The increase was driven by strong transportation orders — including a +4% jump in motor vehicles and a +9.3% surge in defense aircrafts.

Other categories also posted gains — including electrical equipment (+2%), computers (+1.1%), and fabricated metals (+0.9%). However, business investment showed signs of cooling, with core capital goods orders (non-defense excluding aircraft) slipping -0.3% (the first drop in four months) as tariff uncertainty weighs on corporate spending plans.

A substantial +1.4% jump is expected this week. We’ll see if durable goods orders can continue to trend in the right direction despite all of the economic tension.

“There is tremendous uncertainty coming from Washington, but companies are not just holding their breath waiting for the other tariff shoe to drop, they are actively ordering up more equipment to beat the price increases once the trade war sanctions jack up the cost of the goods and materials they need to even higher levels.”

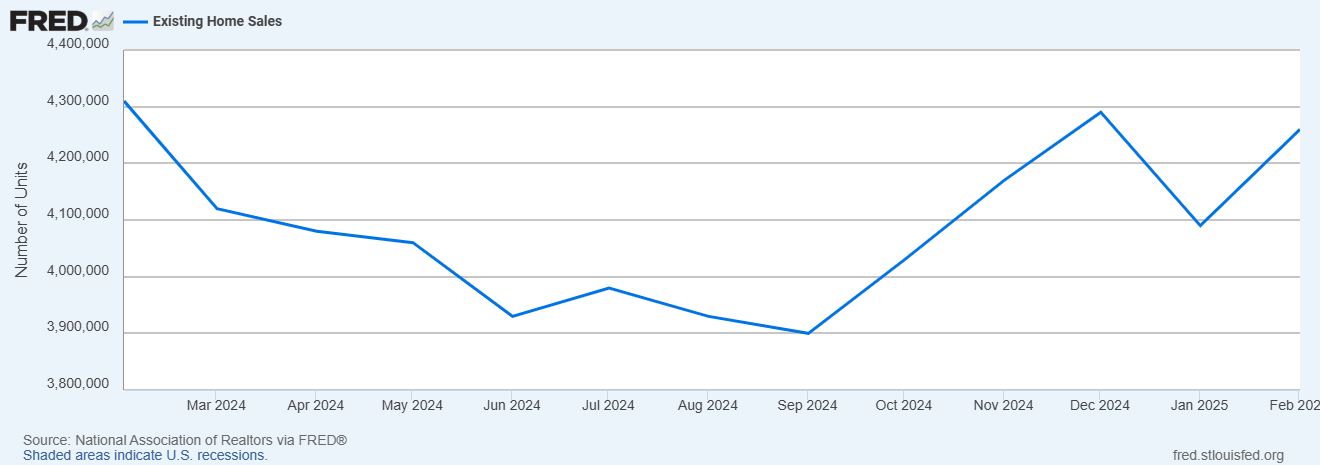

Existing Home Sales

Existing home sales in the U.S. rose +4.2% in February to a seasonally adjusted annualized rate of 4.26 million — a solid rebound from January’s -4.7% decline and well above expectations for a drop to 3.95 million. The median sales price climbed +3.8% YoY to $398,400, while inventory increased +5.1% from the prior month to 1.24 million homes — representing 3.5 months of supply at the current pace.

While mortgage rates have remained relatively steady, more inventory and improved buyer choice are beginning to unlock demand. Economists expect things to cool off slightly month-over-month, with a seasonally adjusted annualized rate of 4.10 million expected in this week’s report.

"Home buyers are slowly entering the market. Mortgage rates have not changed much, but more inventory and choices are releasing pent-up housing demand."

“There’s a growing disconnect between what sellers think they can get for their homes and the direction the market is actually moving. Tariff fears and widespread economic uncertainty are making homebuyers nervous, so if sellers don’t lower their price expectations, home sales may slow in the coming months.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: ChinaFotoPress/Getty Images

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]