- GRIT

- Posts

- 👉 $20B+ To Be Spent This Black Friday

👉 $20B+ To Be Spent This Black Friday

CrowdStrike, Dell, Zoom Video

Welcome to your new week.

As an advance notice — we’ll not be having a Week in Review post this upcoming Sunday (12/1). We encourage you to enjoy time with family, friends, pets, and turkeys.

Our next post will be The Investing Week Ahead on next Monday (12/2).

Happy Thanksgiving to all of our readers in the U.S. — and let’s dive into the short week!

Key Earnings Announcements:

Tuesday is the biggest day of earnings this week with a mix of retail & tech.

Monday (11/25): Agilent Technologies, Bath & Body Works, Zoom

Tuesday (11/26): Abercrombie & Fitch, Analog Devices, Autodesk, BestBuy, Burlington, Crowdstrike, Dell, Dick’s Sporting Goods, HP, Macy’s, Nordstrom, Urban Outfitters, Workday

Wednesday (11/27): N/A

Thursday (11/28): HAPPY THANKSGIVING

Friday (11/29): Market Closes at 1PM

What We’re Watching:

CrowdStrike (CRWD)

Source: CrowdStrike Investor Relations

CrowdStrike is set to report earnings after the bell on Tuesday, with analysts focused on signs of “outage recovery” and future growth. The stock, up over +70% in 2024, holds a consensus Buy rating from Wall Street — despite Seeking Alpha’s Quant Rating assigning it a Hold.

Recent updates suggest optimism: Oppenheimer raised its price target to $375, citing diminishing impacts from a past software disruption and increased adoption of its Customer Commitment Packages. Cantor Fitzgerald echoed this, lifting its target to $370 on expectations of improved annual recurring revenue (ARR) and low churn rates.

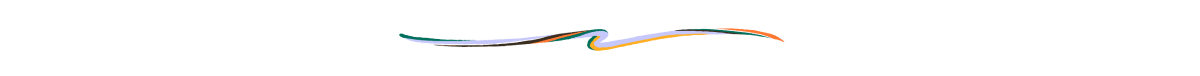

The company’s Falcon platform — a cornerstone of its cybersecurity services — continues to deliver strong results, with ARR from LogScale SIEM, identity protection, and cloud security surpassing $1 billion (up +85% YoY).

While the July 19 outage initially casted doubts — proactive crisis management and enhanced platform security measures have helped restore customer confidence. With forecasts lowered following Q2, CrowdStrike could deliver a beat in Q3 and provide strong Q4 guidance, setting up a potential bullish catalyst for the stock.

Crowdstrike Holdings, Inc. (CRWD) Stock Performance, 5-Year Chart, Seeking Alpha

Dell Technologies (DELL)

Source: Dell Investor Relations

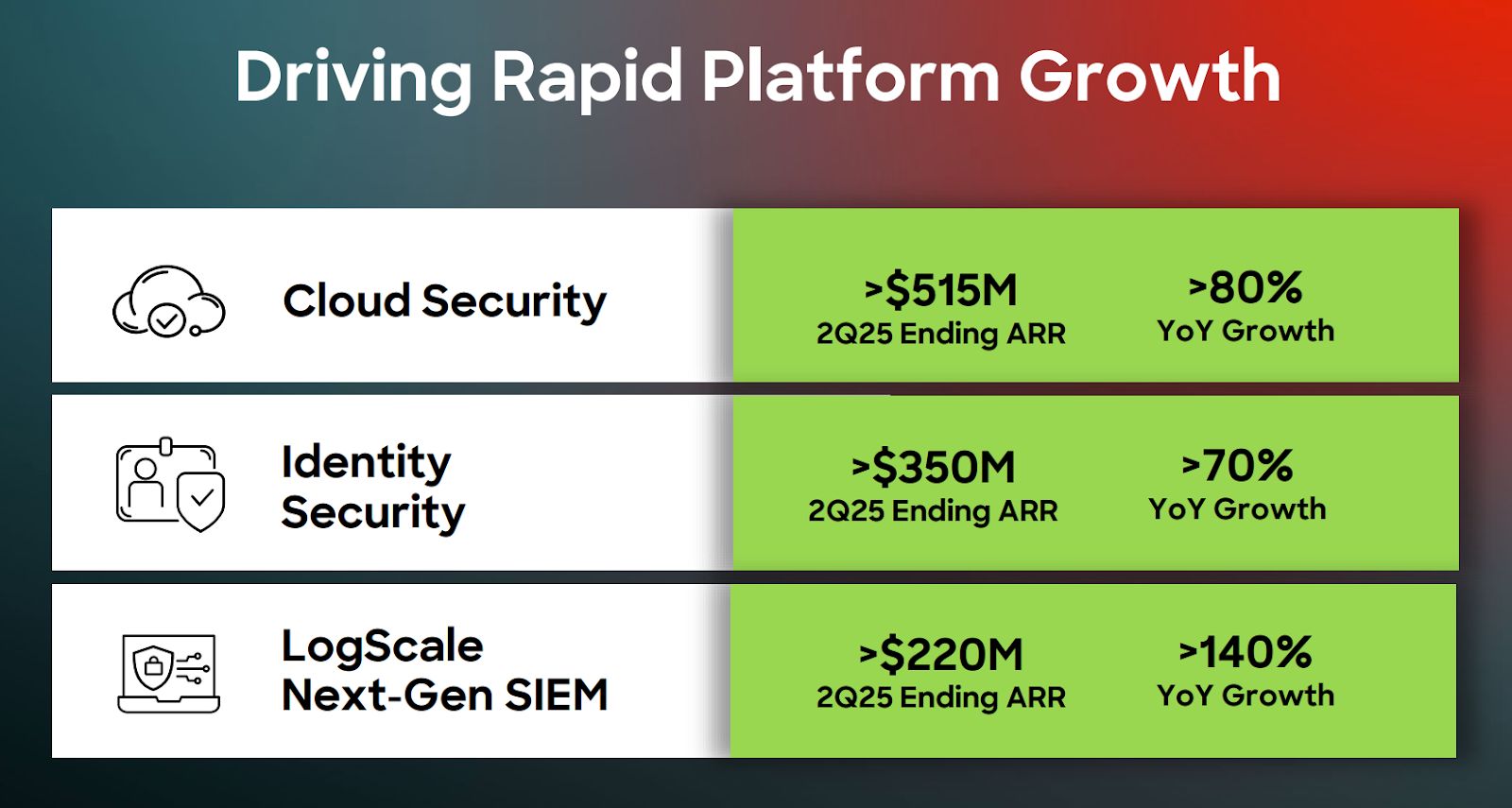

Dell (+88% YTD) is positioned to capitalize on continued AI market growth as it reports Q3 earnings Tuesday after market close. The company expects revenue of $24B-$25B, aligning with consensus of $24.6B. Management's conservative guidance highlights potential for outperformance, particularly as Dell gains traction in AI server markets and benefits from healthier Nvidia GPU supply and Tier 2 service provider demand.

Last quarter, Dell’s Infrastructure Solutions Group posted +38% YoY growth, driven by an +80% surge in Server & Networking sales.

Amid SMCI's struggles, Dell is primed to expand market share in AI servers, supported by partnerships like Nvidia's Blackwell launch and AI-focused offerings like the PowerEdge.

Dell Technologies (DELL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Holiday shopping has officially arrived, a new robotaxi IPO, and 2025 year-end forecasts reveal expectations to the upside.

Holiday Shopping Data

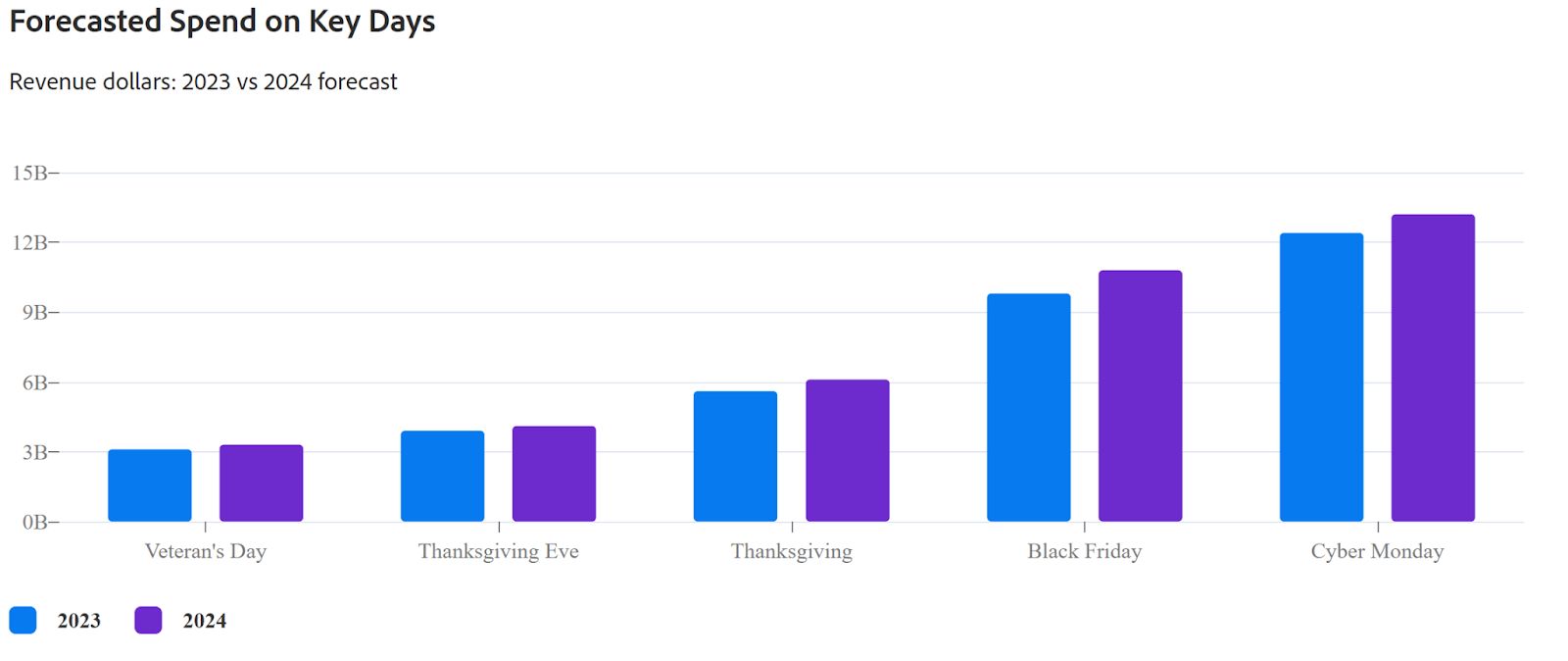

Source: Adobe Holiday Shopping Report

The holiday shopping season officially kicks off on Black Friday — with early data expected to provide insights into spending trends. U.S. holiday shoppers are projected to spend $296.5 billion online, accounting for 30.1% of total holiday sales and a +3% increase from 2023. Notably, 92% of Americans plan to shop this holiday season — though only 17% expect to spend more, while 30% anticipate cutting back.

Source: Adobe Holiday Shopping Report

Online shopping remains strong, with 57% of consumers planning to purchase gifts digitally, though this is slightly down YoY. Buy Now Pay Later services are also gaining traction, with $18.5 billion expected in spending.

Interestingly, 45% of shoppers began their holiday purchases as early as October, reflecting a shift toward earlier buying habits.

You can dive into some really cool data linked here from Adobe & Capital One!

Robotaxi IPO Around $4.6B Valuation

Pony.ai, a leading autonomous driving company based in Guangzhou, plans to price its IPO and begin trading this week. The company aims to raise up to $260 million by offering 20 million American Depositary Shares (ADS) priced between $11 and $13 — targeting a valuation of approximately $4.6 billion.

Founded in 2016, Pony.ai has focused on developing advanced autonomous driving technology — with over 20 million miles of road testing under its belt.

Operating across three segments — Robotaxi, Robotruck, and Personally Owned Vehicles (POV) — the company provides self-driving solutions for both personal transportation and commercial logistics. This IPO offers investors a chance to gain exposure to a key player in the rapidly growing autonomous vehicle industry.

Are we going to be participating in this IPO? Probably not.

However, it’s GREAT to see private equity activity / acquisitions / IPOs all continuing to tick upward. Keep in mind, IPOs have pretty much been an afterthought for most of the last 18-24 months.

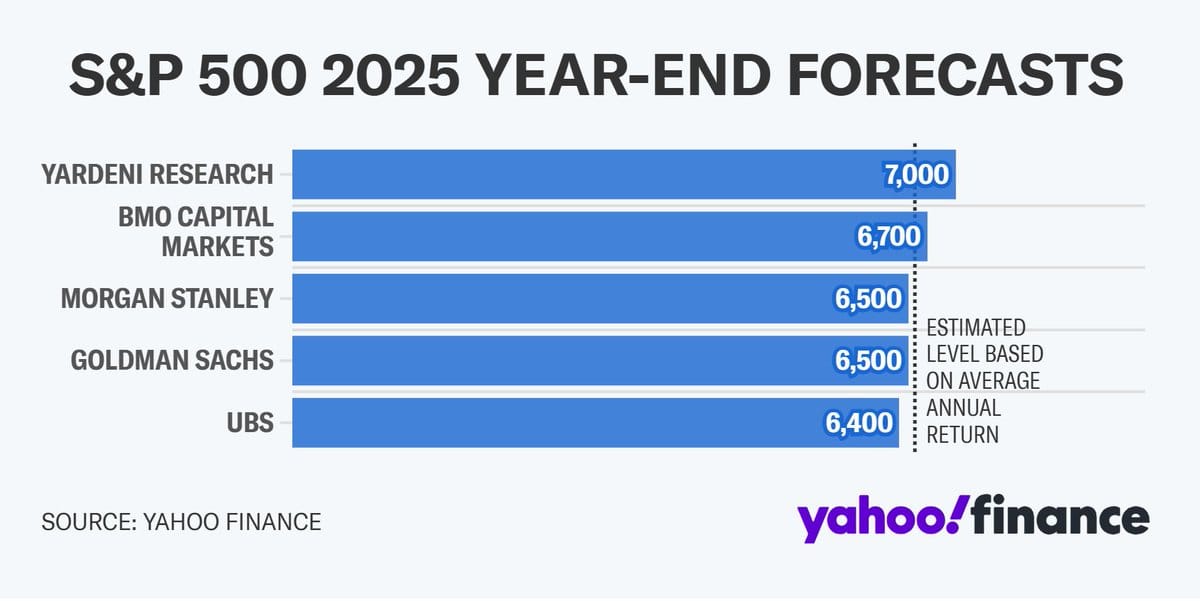

2025 Year-End Forecasts

Morgan Stanley has raised its 2025 year-end target for the S&P 500 to a range of 6,500-6,700, up from 6,200-6,400. This bullish forecast suggests a +12% gain from current levels, driven by expectations of a strong U.S. economy and earnings growth under President-elect Donald Trump’s policies, which aim to reduce regulatory costs.

Well’s Fargo also joined other major wall street firms raising its target to 6,500.

“Earnings growth should find extra support from reduced regulation [under Trump’s second presidency]. A corporate tax cut remains a possibility, although the timing and amount remain uncertain…

Our forecast and target changes reflect improving conditions in the U.S. economy and likely policy changes from the incoming administration in Washington. Beyond a stronger pace of growth than we previously expected, we believe some additional inflation is likely by year-end 2025.”

Major Economic Events:

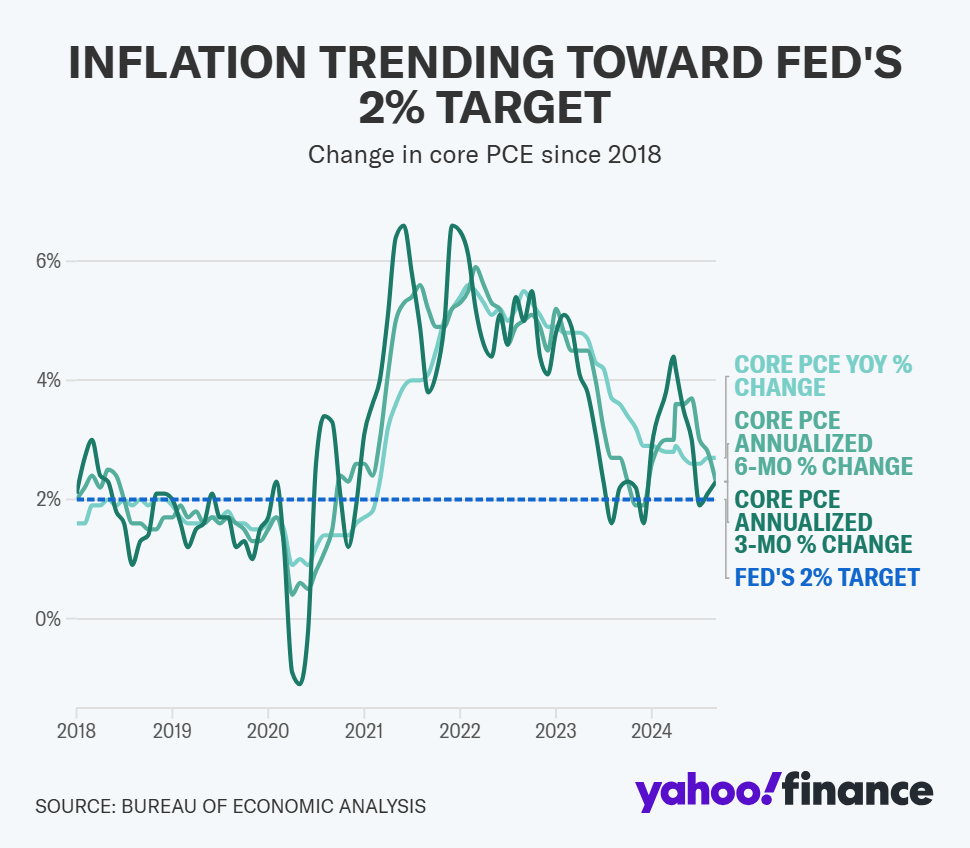

November’s FOMC meeting minutes & the Fed's preferred inflation gauge are in focus.

Monday (11/25): N/A

Tuesday (11/26): Consumer Confidence, FOMC Nov Meeting Minutes, New Home Sales, S&P Case Shiller Home Price Index

Wednesday (11/27): Advanced Retail Inventories, Advanced US Trade Balance in Goods, Chicago Business Barometer, Core PCE, Durable Goods Orders, GDP, Initial Jobless Claims, PCE, Pending Home Sales, Personal Income, Personal Spending

Thursday (11/28): HAPPY THANKSGIVING

Friday (11/29): N/A

What We’re Watching:

FOMC Minutes

The CME FedWatch Tool still has another Fed rate cut before the end of the year as a “coin flip” scenario.

On Tuesday — the FOMC Meeting Minutes will be revealed from the Fed’s November meeting.

During that meeting, Fed Chair Jerome Powell emphasized that strong U.S. economic growth allows for a cautious approach to potential rate cuts — with no immediate changes needed to their approach. He highlighted a resilient labor market and progress toward the Fed's 2% inflation target, despite slight increases in recent inflation data.

Powell reaffirmed the Fed's commitment to patience as the economy stabilizes. We’ll be interested to see if the Fed’s Meeting Minutes will review uniformity or division within the group’s decision making.

“So you’re right. As I mentioned, and as you mentioned, the latest economic data have been strong, and that’s, of course, a great thing and highly welcome. But, of course, our mandate is maximum for employment and price stability, and we think that even with today’s cut, policy is still restrictive. We understand it’s not possible to say precisely how restrictive, but we feel that it is still restrictive…

And if you look at our goal variables, the labor market has cooled a great deal from its overheated state of two years ago and is now essentially in balance. It is continuing to cool, albeit at a—at a modest rate, and we don’t need further cooling, we don’t think, to achieve our inflation mandate. So that’s the labor market.”

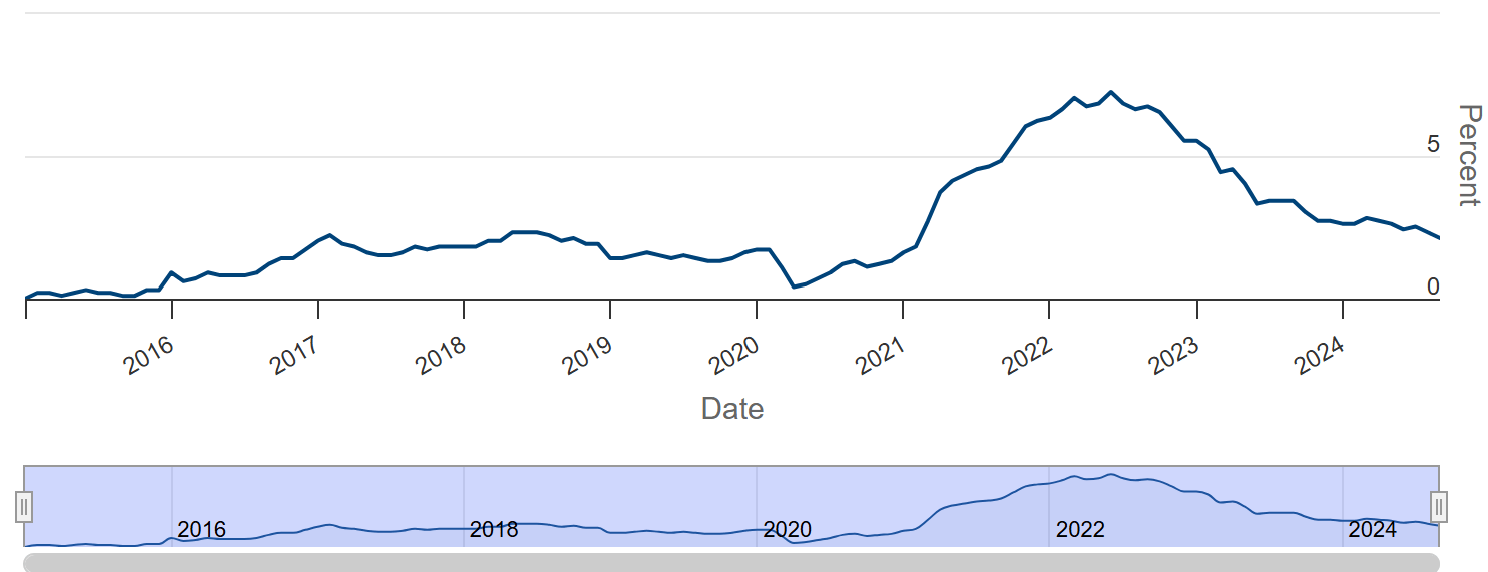

PCE Index

PCE Price Index via FederalReserve.gov

The PCE Price Index increased +0.2% MoM in September 2024 — matching expectations and accelerating slightly from August’s +0.1% rise. Service prices led the increase, up +0.3%, while goods prices dipped by -0.1%.

The Core PCE index, which excludes food and energy, rose +0.3% — the largest monthly gain in five months — highlighting ongoing pressure in underlying inflation metrics.

"Even though Thursday’s core PCE moved only slightly higher, we believe this is the first in a series of months and quarters where we see an increase in inflation. Investors should be prepared for a re-acceleration of inflation in late 2024 and early 2025… We believe the Fed is still poised to cut interest rates in November by 25 basis points, but we believe the Fed will pause any rate cuts in December amid fears about a re-acceleration of inflation."

Savvy Investors Know Where to Get Their News—Do You?

Here’s the truth: there is no magic formula when it comes to building wealth.

Much of the mainstream financial media is designed to drive traffic, not good decision-making. Whether it’s disingenuous headlines or relentless scare tactics used to generate clicks, modern business news was not built to serve individual investors.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable insights that go beyond the headlines.

And the best part? It’s completely free. Join 1M+ readers and subscribe today.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Fox Business / Getty Images

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply