- GRIT

- Posts

- 👉 Meta's "Tech of the Future"

👉 Meta's "Tech of the Future"

Consumer Confidence, Costco, Micron

Welcome to your new week.

A couple of quick reminders for you:

1) I have a free webinar with CNBC-regular Katie Stockton tomorrow (Tuesday) at 1pm ET. It will also be recorded for those that can’t make it live. Click here to sign up!

2) There’s only ONE WEEK LEFT for 75% off an annual subscription. Click here to check out the deal!

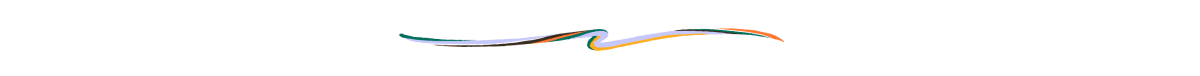

Key Earnings Announcements:

Costco and Micron are in focus.

Monday (9/23): AAR, Red Cat

Tuesday (9/24): Autozone, KB Home, Progress

Wednesday (9/25): Cintas, Concentrix, HB Fuller, Jeffries, Micron

Thursday (9/26): Accenture, Blackberry, Carmax, Costco, Vail Resorts

Friday (9/27): N/A

What We’re Watching:

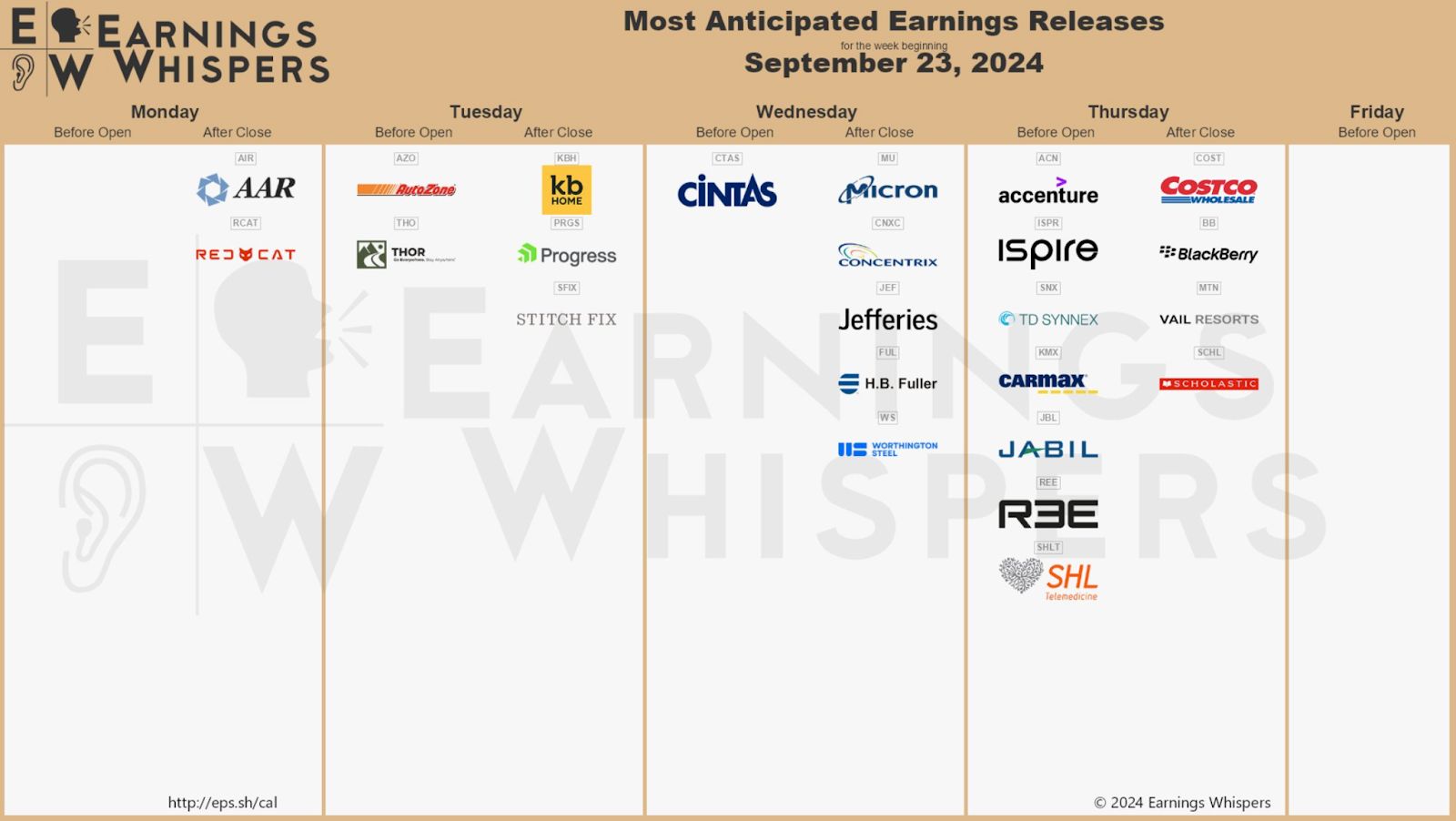

1) Costco (COST)

Source: Costco Investor Relations

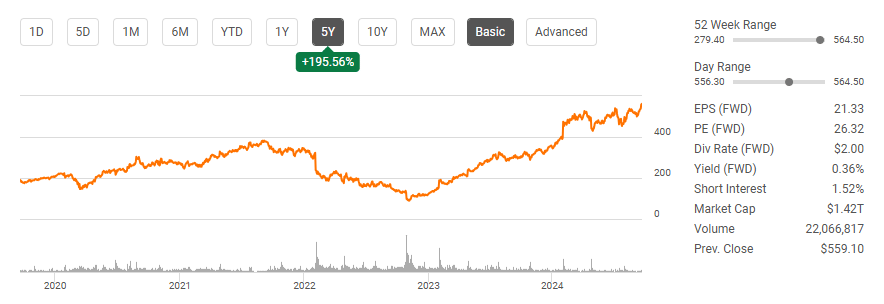

Costco’s last quarterly report in May featured a beat on earnings and revenue estimates. The company reported net sales of $58.52B (compared to estimates of $58.08B) and adjusted EPS of $3.78 (compared to estimates of $3.70).

"We're definitely winning in consumables, as we see the food business and dining away from home has softened up a bit," said CEO Ron Vachris, who stepped into the role in January.

The story behind Costco is quite simple… this is an EXPENSIVE stock. The P/E ratio of Nvidia (NVDA) currently sits around 54X — it’s 56X for Costco. Costco bulls are begging for a big beat, otherwise this stock market monster might be set for a bit of a pullback.

Costco Wholesale (COST) Stock Performance, 5-Year Chart, Seeking Alpha

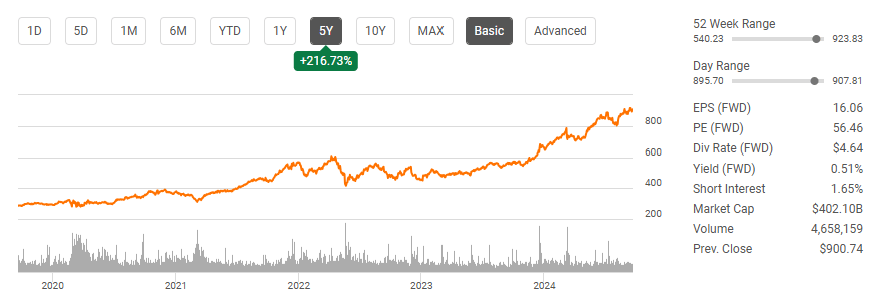

2) Micron (MU)

Source: Micron Investor Relations

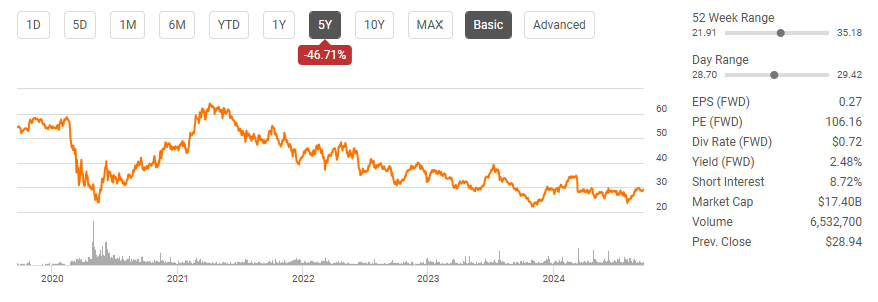

Micron’s last earnings report in June featured a beat on earnings and revenue estimates. The company reported revenue of $6.81B (beating by +$136M) and EPS of $0.62 (beating by +$0.09).

Since hitting all-time highs three months ago, Micron has dropped -41% — mostly due to sub-par guidance that was shared during that earnings report.

"We are very optimistic because after Nvidia, Micron has a bigger exposure to AI growth than perhaps any other semiconductor company," said Micron Chief Business Officer Sumit Sadana.

Citi estimates that roughly 80% of investors are bearish on Micron stock, while analysts are starting to chime in that this could be an undervalued way to get exposure to AI. Micron joins Costco as the two main stocks that have analysts begging for guidance upgrades this week.

Micron Technology (MU) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs

Meta hosts the biggest event of the week, and Southwest Airlines seems ready to break some sort of big news.

Meta Connect Event

Source: Meta Platforms

Meta Connect 2024 promises exciting announcements, especially with the anticipated unveiling of a more affordable Quest VR headset, potentially named "Quest 3S." Expect updates on mixed reality hardware, including new versions of the Ray-Ban Meta smart glasses and possibly a glimpse of the rumored "Orion" AR glasses. The conference will also highlight Meta's AI initiatives, showcasing the latest from the Llama language model and generative AI tools for developers.

Mark Zuckerberg will lead the keynote, focusing on the future of VR, AR, and Horizon Worlds. Live streams will be available on Meta’s Connect site and Horizon Worlds.

Meta Platforms (META) Stock Performance, 5-Year Chart, Seeking Alpha

“Meta—like all its Big Tech brethren—has fully pivoted to generative AI and large language models to fuel the next phase of its growth. Meta’s AI features are bleeding into nearly all of its apps and services, and there is probably much more on this front coming during Connect.”

Southwest Airlines (LUV) Warns Employees Ahead of Investor Day

Southwest Airlines is experiencing one of the biggest shakeups in its 53-year history. Source: The Dallas Morning News

This Thursday, Southwest Airlines will be hosting its Investor Day… and it’s not without drama.

Southwest Airlines is preparing for significant changes aimed at restoring profitability, warning employees of difficult decisions ahead. While city closures are not planned, adjustments to the airline’s flight network and schedule are expected, with details set to be released on September 25.

These moves come as Southwest faces pressure from activist investor Elliott Investment Management to revamp its business model, including adding more premium services. The airline has already begun initiatives like targeting younger consumers through revamped advertising and new distribution channels such as Google Flights and Kayak.

“We’re trying to get more out of what we already have, but getting our costs under control is not going to be enough, because we’re not going to do this on the back of employees or customers. Therefore, it has to be on the revenue side that we make the traction to get our profitability and equation balanced.”

Major Economic Events

GDP and Core PCE are in focus. Consumer confidence reports also shouldn’t be ignored.

The next version of The Conference Board’s Consumer Confidence Index will be released this week. Economists expect a reading of 102.8.

Monday (9/23): Atlanta Fed President Bostic Speaks, Chicago Fed President Goolsbee Speaks, Minneapolis Fed President Kashkari Speaks, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

Tuesday (9/24): Consumer Confidence, Federal Reserve Governor Bowman Speaks, S&P Case-Shiller Home Price Index (20 cities)

Wednesday (9/25): Federal Reserve Governor Kugler Speaks, New Home Sales

Thursday (9/26): Durable-Goods Orders, Federal Reserve Chair Powell Gives Opening Remarks, Fed Reserve Vice Chair for Supervision Barr Speaks, Fed Governor Kugler & Boston Fed President Collins Speak Together, GDP (2nd Revision), Initial Jobless Claims, Pending Home Sales

Friday (9/27): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Consumer Sentiment (final), Core PCE, PCE, Personal Income, Personal Spending

What We’re Watching:

1) GDP

U.S. GDP Growth Rate, 5-Year Chart, Trading Economics

Last month’s GDP reading (Q2 first revision) landed at +3.0% growth. This week’s release will be the second revision for Q2 — which is expected to come in at +2.9% growth.

If this number comes in any higher than +2.9%… the market could rally with optimism. GDP underperformance over the coming quarters and years was a key talking point of the Fed’s meeting last week.

I expect the market to pay very close attention to this release.

Danielle DiMartino Booth of QI Research says a soft-landing scenario for the U.S. economy is unlikely and the Fed cut interest rates more than expected because it expects negative revisions to the GDP print. She believes the market is in for a “rude awakening.”

View her thoughts here and form your own opinion! I highly recommend you tune in!

2) Core PCE

U.S. Core PCE Price Index Annual Change, 5-Year Chart, Trading Economics

The most recent reading of Core PCE — which is the Fed’s preferred inflation gauge — revealed that core personal consumption expenditure prices increased +0.2% in July and +2.6% from a year ago.

The 12-month figure was slightly lower than the +2.7% estimate.

Economists are expecting another +0.2% monthly increase this week, and the estimate for the yearly increase is set at +2.7% again.

“The American economy is poised to grow at or above the long-term 1.8% rate as the Fed begins its rate-cutting campaign, which should put a floor under growth and hiring… This data supports risk taking by the commercial sector as rates come down and by investors, who are now looking at a sustained increase in the economic expansion.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Meta Connect Website

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply