- GRIT

- Posts

- 👉 More Tariff Updates

👉 More Tariff Updates

Amazon, Google, Palantir

Welcome to your new week.

Of course — it’s a very ugly one at the moment.

We’ve included additional color below, as the situation is very fluid!

First — be sure to sign up for the GRIT Money Summit!

U.S. households’ stock allocation hit a record 49% in October, surpassing the 2000 dot-com peak. Since the Great Financial Crisis, stock exposure has doubled, making investing more accessible — but also more complex!

According to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%.

Join the GRIT Money Summit to tackle these challenges head-on. Gain insights from experts, and empower yourself with the knowledge needed to navigate today’s fast-paced, ever-evolving markets, business and finance landscapes. Don’t be left behind — get equipped to invest with confidence!

Make sure you sign up using the links above!

Now let’s dive right in.

Key Earnings Announcements:

Around 20% of the S&P 500 report earnings this week — including Amazon and Google.

Monday (2/3): NXP, Palantir, Tyson

Tuesday (2/4): Alphabet, AMD, Amgen, Apollo, Chipotle, Enphase, Estēe Lauder, Ferrari, PayPal, Pepsico, Pfizer, Snap, Spotify

Wednesday (2/5): Arm, Boston Scientific, Disney, Ford, Novo Nordisk, Qualcomm, Toyota, Uber

Thursday (2/6): Affirm, Amazon, Cloudflare, ConocoPhillips, Eli Lilly, Fortinet, Peloton, Pinterest, Yum Brands

Friday (2/7): Canopy Growth, CBOE, Newell Brands

What We’re Watching:

Alphabet (GOOGL)

Source: Investors' Edge

Google is set to report Q4 earnings on February 4, with analysts projecting $97 billion in revenue (+14% YoY) and $30.8 billion in operating profit (+24% YoY). Favorable ad spending trends and strong AI-driven cloud growth suggest Google could exceed expectations. Google Cloud has consistently gained market share — Q3 revenue surging 35% YoY to $11.4 billion and operating income improving to $1.9 billion. Analysts expect this momentum to continue — forecasting $12.2 billion in Q4 cloud revenue.

Key areas to watch include AI advancements, ad revenue momentum, cloud expansion, and willow updates (quantum computing) — these will determine whether Google can sustain its growth trajectory in an increasingly competitive market.

Alphabet Inc. (GOOG) Stock Performance, 5-Year Chart, Seeking Alpha

Palantir (PLTR)

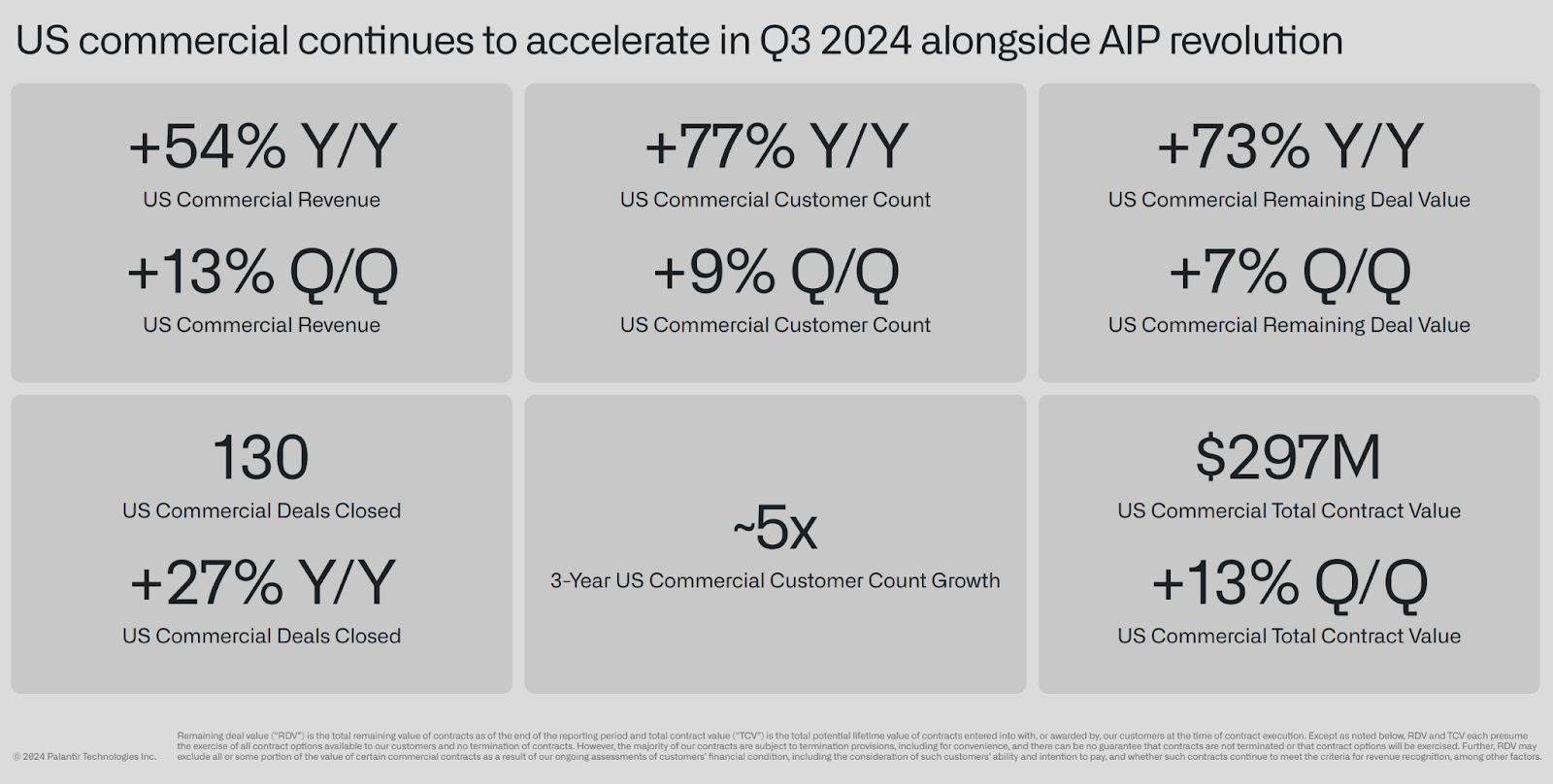

Source: Palantir Q3 ‘24 Earnings Deck

Palantir reports earnings Monday with expectations of strong EPS and revenue growth. Palantir is in a unique position as concerns over DeepSeek, an open-source AI breakthrough, are misplaced — rather than a threat, it accelerates AI innovation and strengthens Palantir’s leadership in deployment, security, and enterprise integration. As AI models become commoditized, the real value lies in operationalizing them, an area where Palantir excels.

We are entering software AI’s ‘moment’ and Palantir will have the ability to benefit from being at the forefront of this new technology. The democratization of AI will allow Palantir to integrate advanced models into mission-critical applications for government and enterprise clients. As investors, we’ll watch for updates on AIP (Artificial Intelligence Platform) adoption and how open-source advancements enhance Palantir’s AI offerings. As demand for scalable, secure AI solutions grows, Palantir remains well-positioned to capitalize on the evolving AI landscape.

We’re going to find out this week if PLTR is truly as overvalued in the public markets as it looks.

Palantir Technologies Inc. (PLTR) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

More context on tariffs, an important OPEC+ meeting, and a couple new IPOs.

More Tariff Context

As mentioned as the top of this newsletter — we provided commentary yesterday about why Canada and Mexico must make a deal with President Trump. We all have the right to an opinion about how these tariffs have been implemented, but the reality is that neither Canada’s, nor Mexico’s economy will be able to withstand such economic impact.

This section of today’s newsletter is intended to be more visual for you all. We’re not going to pretend that we are tariff experts, and most of you likely aren’t either. Providing as much context as possible is our key goal!

Additionally — we’d encourage you to actually read the executive order from the White House. It’s linked here, and it consistently repeats that this is a health crisis.

Of course, this is the largest point of contention for Canadians. According to NPR, In 2024, only about 43 pounds of fentanyl was seized at America's northern border. That compares with roughly 21,100 pounds seized at the southern border. So this obviously begs the question of what Canada specifically needs to change to have the tariffs lessened or removed.

If you’re an American reader and you’re most interested in what exports could be impacted the most — it’s looking like cars and crude petroleum could see price hikes in the short-term.

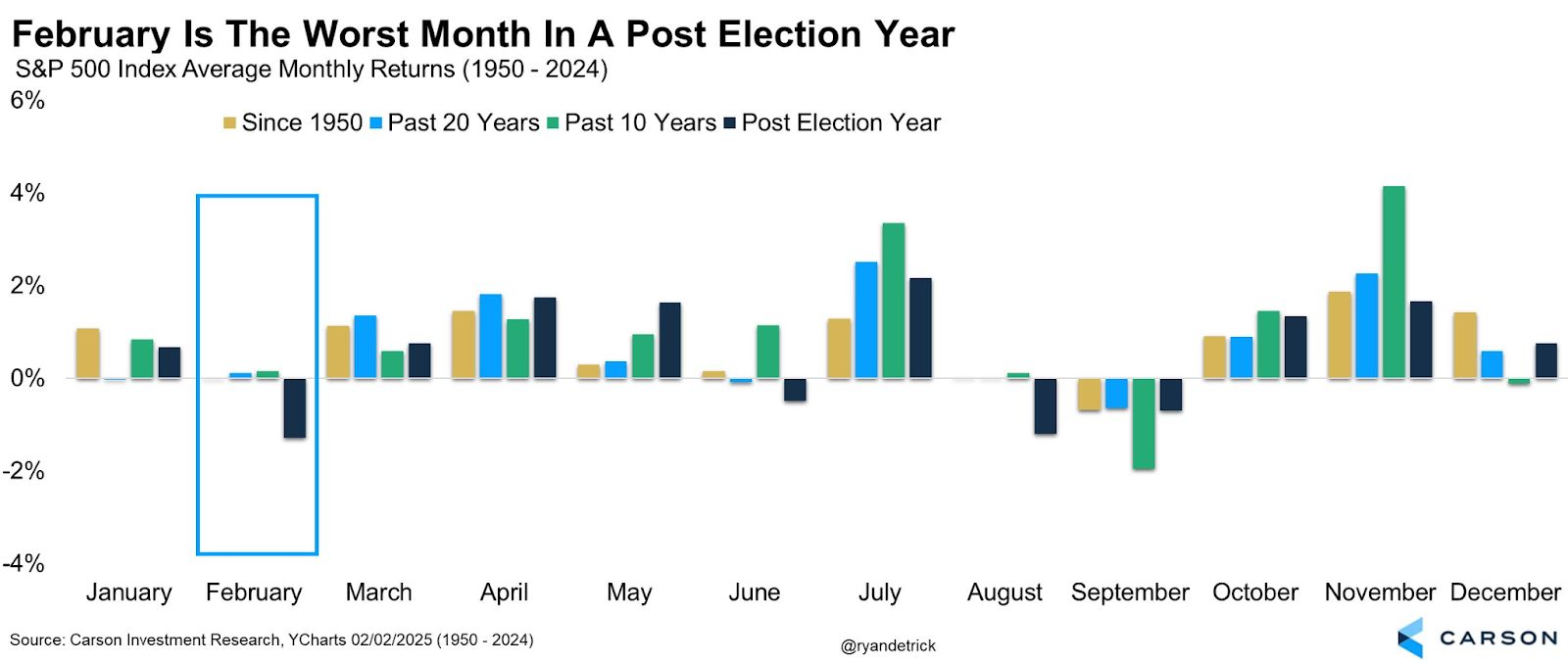

Interestingly, February is historically the worst month of the year for the S&P 500 in post-election years. On average — February is brutal, March is better, and April / May are great in post-election years.

This of course can’t be used to predict the future, but this supports what we’ve been saying for months now. Change brings uncertainty (the market hates uncertainty) — so the market becomes volatile. It makes sense for the first full month of a new presidency to be filled with changes and uncertainty.

To show a little context into why these tariff increases are so dramatic — please see above. In recent years, the United States has had among the lowest tariff rates in the developed world. Trump views this as foolish and believes the most powerful country in the world should be able to exercise strength through trade positioning.

You’ve likely seen the currency fluctuations for both the Mexican Peso and the Canadian Dollar. We’ll continue to monitor the impacts these tariffs will have on foreign currencies as more updates are received.

And lastly, here’s an interesting perspective from Joseph Wang, CIO of Monetary Macro:

“Trump's 25% tariffs look less like a negotiating tool and more like the first step in realizing his long articulated economic vision. Tariffs encourage businesses to make in America, and could raise $1t over 10 years. The markets still misunderstand him.”

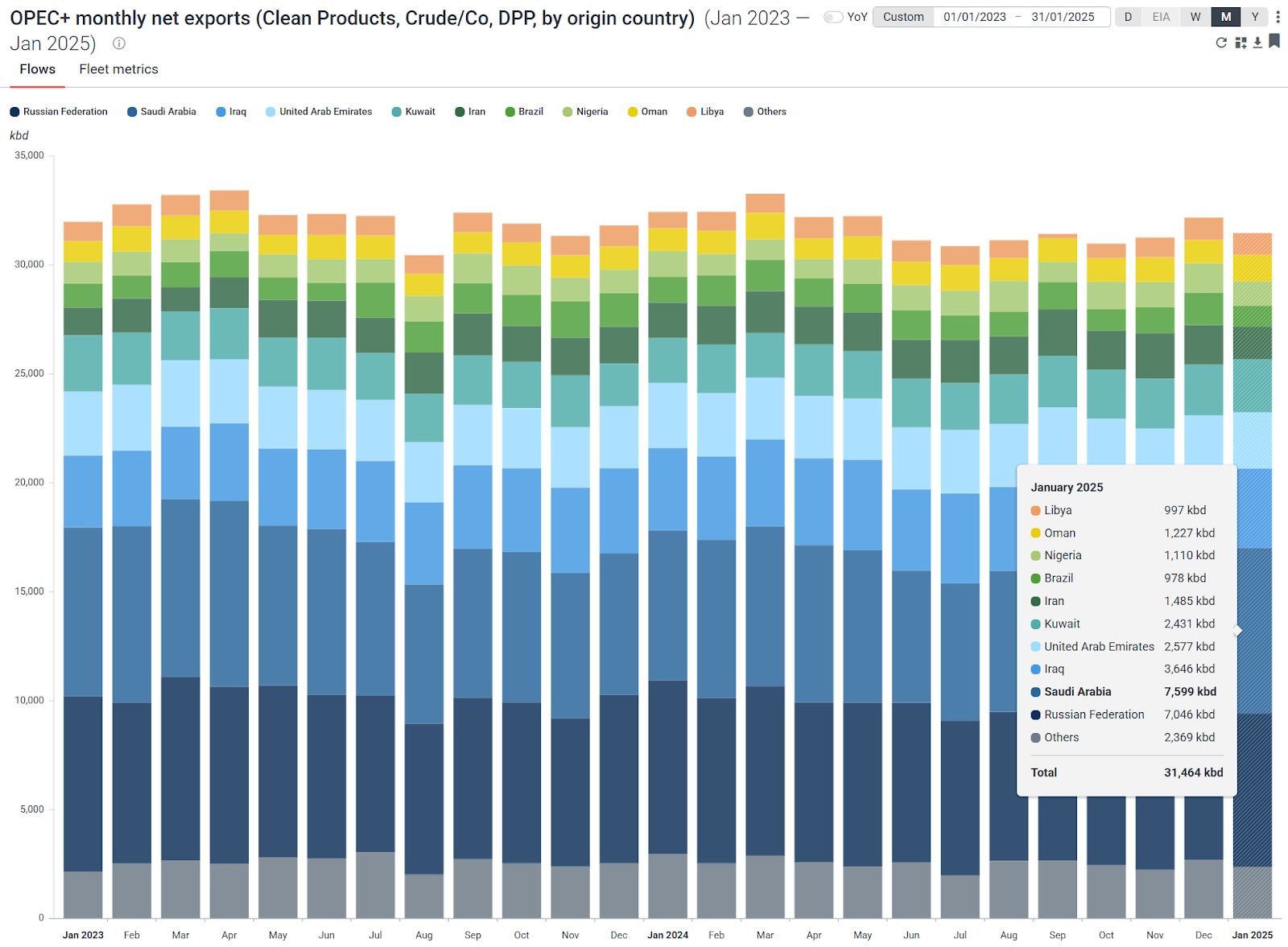

OPEC+ Meeting

OPEC+ ministers will meet this week to discuss market conditions and production policies, with energy traders closely watching for signals on future output adjustments. Brent crude is hovering around $76.29/barrel, while U.S.

WTI sits at $73.83/barrel, reflecting ongoing supply-demand dynamics. We’ll watch volatility this week as tariffs and trade discussions are in focus. Considering one of Trump’s primary goals is U.S. energy independence — it will be interesting to see what OPEC+ leaders may have to say.

"We think the intention remains to stay the course. We do suspect there will be a delicate diplomatic dance to ensure that the organization and various member states are not on the receiving end of retaliatory ire.”

“OPEC+ is facing a new challenge with President Trump’s tariffs. [The group] is likely to act cautiously, balancing its efforts to stabilize prices while also dealing with geopolitical tensions.”

New IPOs Coming

RedCloud (RCT) will debut after pricing its IPO — aiming to raise $55 million at a $352 million market cap. The consumer goods platform operator enters the market with growing investor interest in e-commerce infrastructure.

Titan America (TTAM) is set to begin trading some time in the near future — targeting a $100 million raise. As a major cement and concrete manufacturer, its IPO will be closely watched amid ongoing infrastructure and construction demand.

While the week has started with a lot of market uncertainty, it’s nice to see another one of our predictions for this year continuing to come true — MORE INITIAL PUBLIC OFFERINGS.

As always, we rarely ever want to buy stocks right as they are listed. However, we’re looking forward to reviewing the first few quarterly performance reports for these companies and many more this year.

Major Economic Events:

It’s a busy week on the economic front with job openings, employment reports and ISM manufacturing data.

Monday (2/3): ATL Fed President Raphael Bostic Speaks, Auto Sales, Construction Spending, ISM Manufacturing, S&P final U.S. Manufacturing PMI

Tuesday (2/4): ATL Fed President Raphael Bostic Speaks, Factory Orders, Fed Reserve Vice Chairman Philip Jefferson Speaks, Job Openings, San Francisco Fed President Daly Speaks

Wednesday (2/5): ADP Employment, Chicago Fed President Goolsbee Speaks, Fed Governor Michelle Bowman Speaks, Fed Vice Chairman Philip Jefferson Speaks, ISM Services, Richmond Fed President Tom Barkin Speaks, S&P Final U.S. Services PMI, U.S. Trade Deficit

Thursday (2/6): Dallas Fed President Lorie Logan Speaks, Initial Jobless Claims, Fed Governor Christopher Waller Speaks, U.S. Productivity

Friday (2/7): Consumer Credit, Consumer Sentiment (Prelim), Fed Governor Michelle Bowman Speaks, U.S. Hourly Wages, U.S. Unemployment Rate, U.S. Employment Report, Wholesale Inventories

What We’re Watching:

ISM Manufacturing

The ISM Manufacturing PMI rose to 49.3 in December – its highest level since March and above expectations of 48.4. New orders hit 52.5 — the strongest level in 11 months — and showing a potential bottoming in manufacturing output.

Production expanded to 50.3 for the first time in six months, though input prices rising to 52.5 keep inflation concerns in focus.

"The manufacturing recession might be over, and we think the ISM manufacturing index is likely to break above 50 in January.”

Job Openings & Unemployment Rate

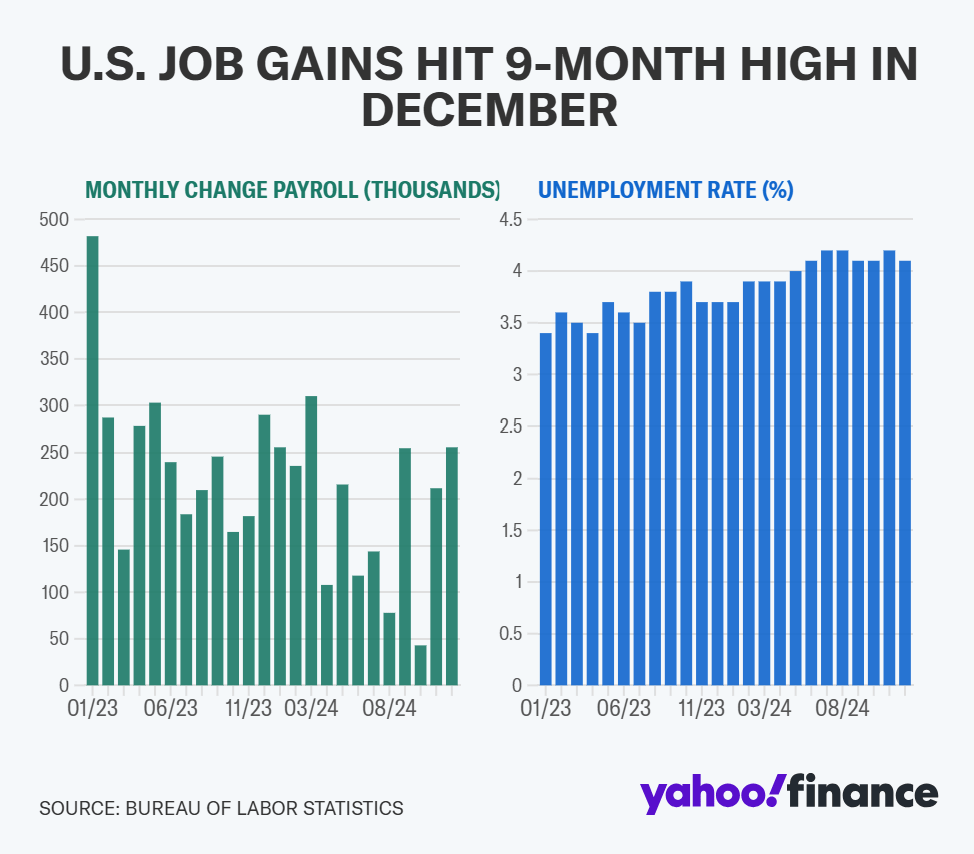

The January jobs report (Friday) is expected to show 150,000 new jobs added, a slowdown from December’s 256,000 gain. The unemployment rate is projected to hold steady at 4.1%, signaling a moderating labor market.

Investors will watch for signs of wage growth and labor force participation shifts, which could influence Fed policy moving forward just about as much as anything else.

“December’s jobs report was solid across the board. While we expected the strong showing in the establishment survey, the significant employment gains in the household survey – including a drop in the unemployment rate — surprised us. We take that as an encouraging sign that the job market may be stabilizing after it deteriorated steadily over the second half of 2024.”

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Brandon Wade

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply