- GRIT

- Posts

- 👉 Netflix & Tesla Kick Off Major Earnings

👉 Netflix & Tesla Kick Off Major Earnings

Coca-Cola, Capital One, Intel

Together with Tenzing Memo

Welcome to your new week.

The “seasonality bug” decided to bite the market a bit late this year — with October exhibiting plenty of struggles. As we approach the end of October — and the final two months of the year — let’s stay prepared!

The government shutdown ending + a deal between Trump & China + another rate cut + quality earnings reports could equal some SERIOUS upside!

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Let’s dive in!

This is what a new customer recently said about Tenzing MEMO, a software tool designed to get investment professionals up to speed fast on new companies and situations:

“I did deep dives on four stocks and found data points that made me want to make additional purchases tomorrow. These are companies I have followed for years, but by working around some key items, I found a lot more color, detail, and conviction.

The chat box is super powerful; it's like having a senior analyst on staff who never forgets anything. I love the follow-up questions and tasks it suggests.

Very impressive. I don't say this lightly - I’ve been researching stocks for a quarter of a century.”

Accelerate your research and discovery today with a no-commitment free trial.

Key Earnings Announcements:

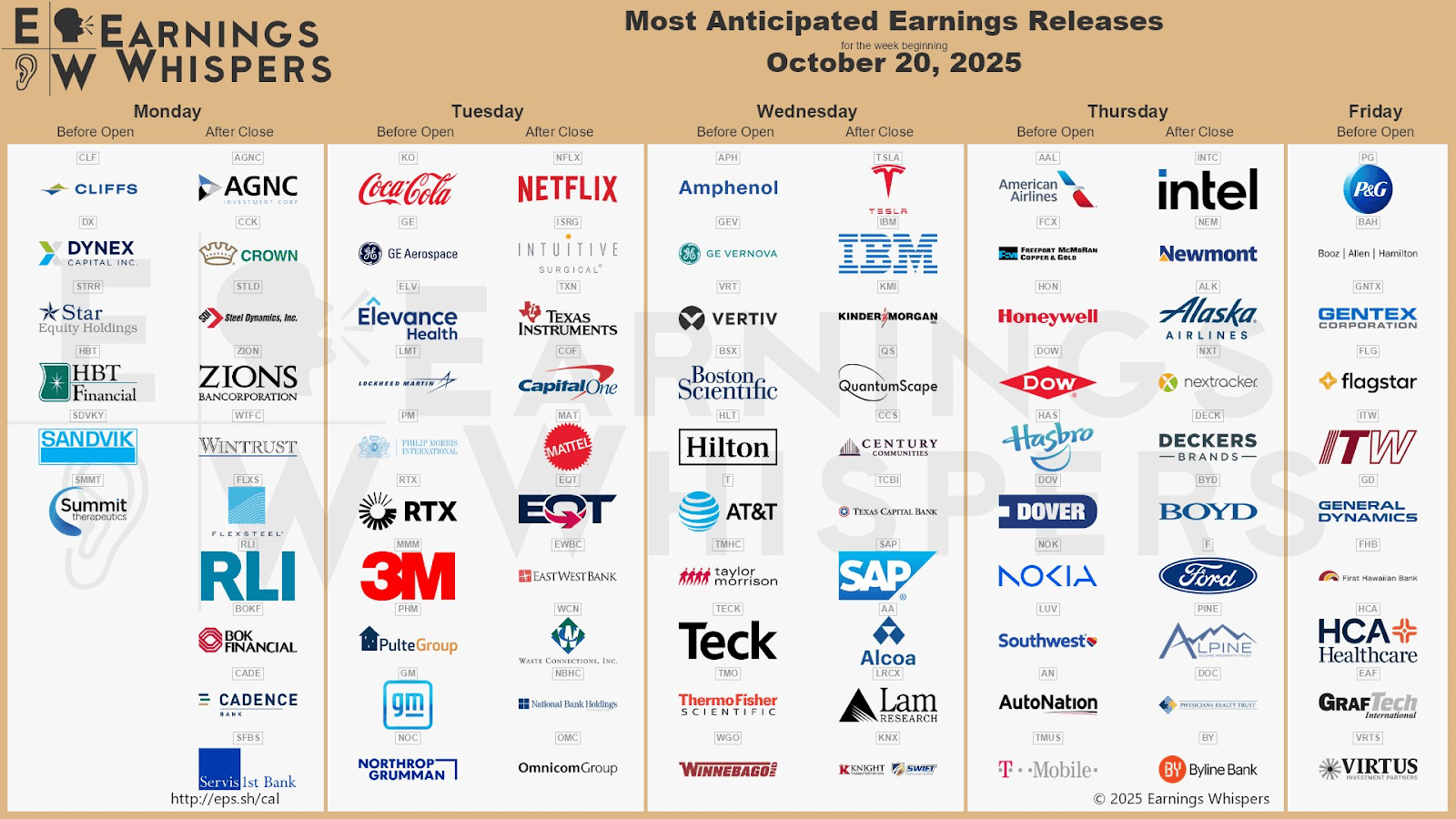

Intel, Netflix, and Tesla take center stage as Q3 earnings ramp up.

Monday (10/20): Cadence Bank, Cliffs, RLI, Sandvik, Summit Therapeutics, Wintrust

Tuesday (10/21): 3M, Capital One, Coca-Cola, Elevance Health, GE Aerospace, Intuitive Surgical, Lockheed Martin, Netflix, Philip Morris International, PulteGroup, RTX, Texas Instruments

Wednesday (10/22): Alcoa, AT&T, Boston Scientific, GE Vernova, Hilton, IBM, Lam Research, SAP, Taylor Morrison, Tesla, Thermo Fisher Scientific

Thursday (10/23): Alaska Airlines, American Airlines, AutoNation, Deckers Brands, Dover, Dow, Ford, Freeport-McMoRan, Hasbro, Honeywell, Intel, Nokia, Southwest Airlines, T-Mobile, General Dynamics

Friday (10/24): Booz Allen Hamilton, Flagstar, General Dynamics, Gentex, GrafTech, HCA Healthcare, ITW (Illinois Tool Works), Procter & Gamble

What We’re Watching:

Netflix (NFLX)

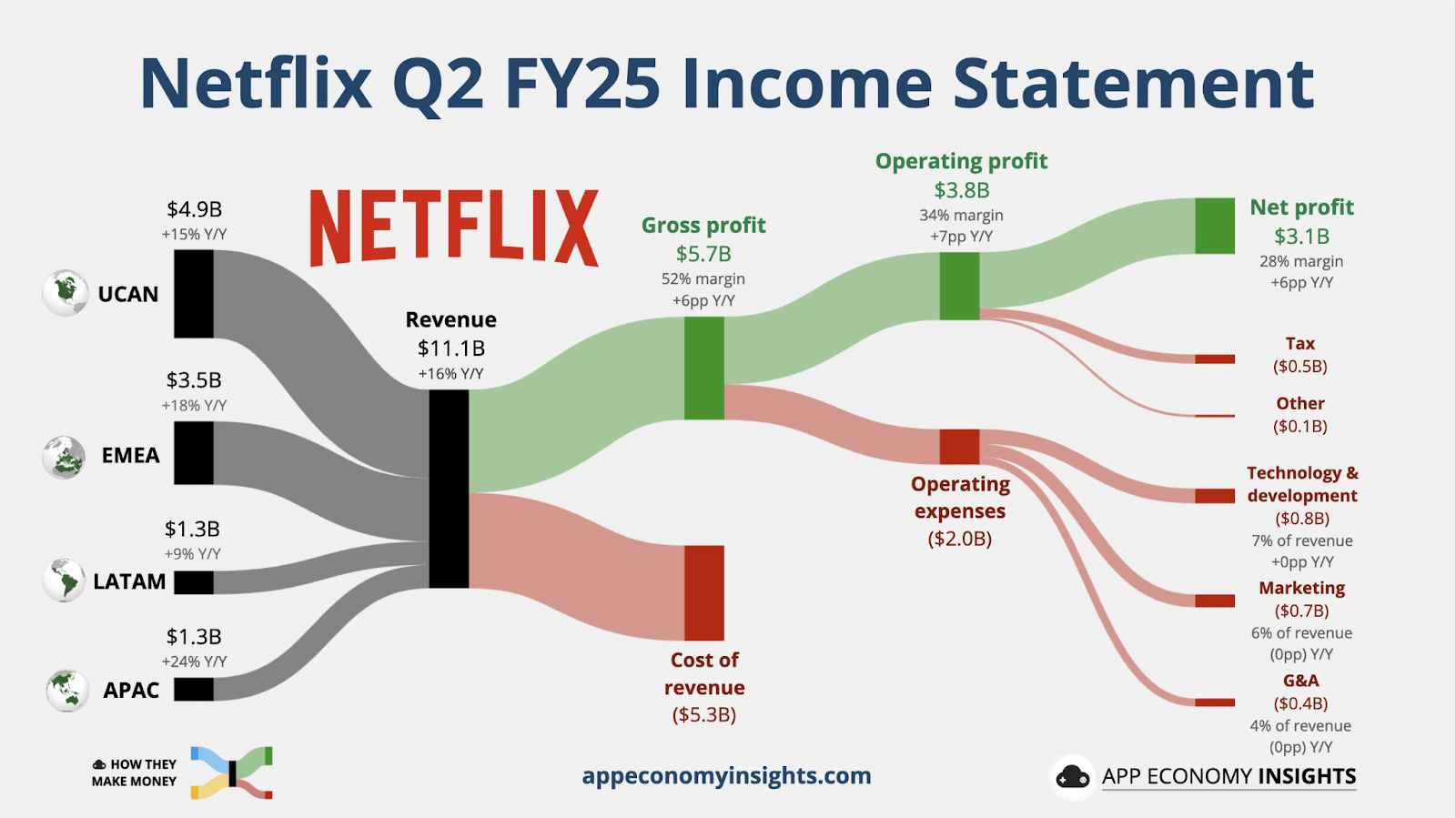

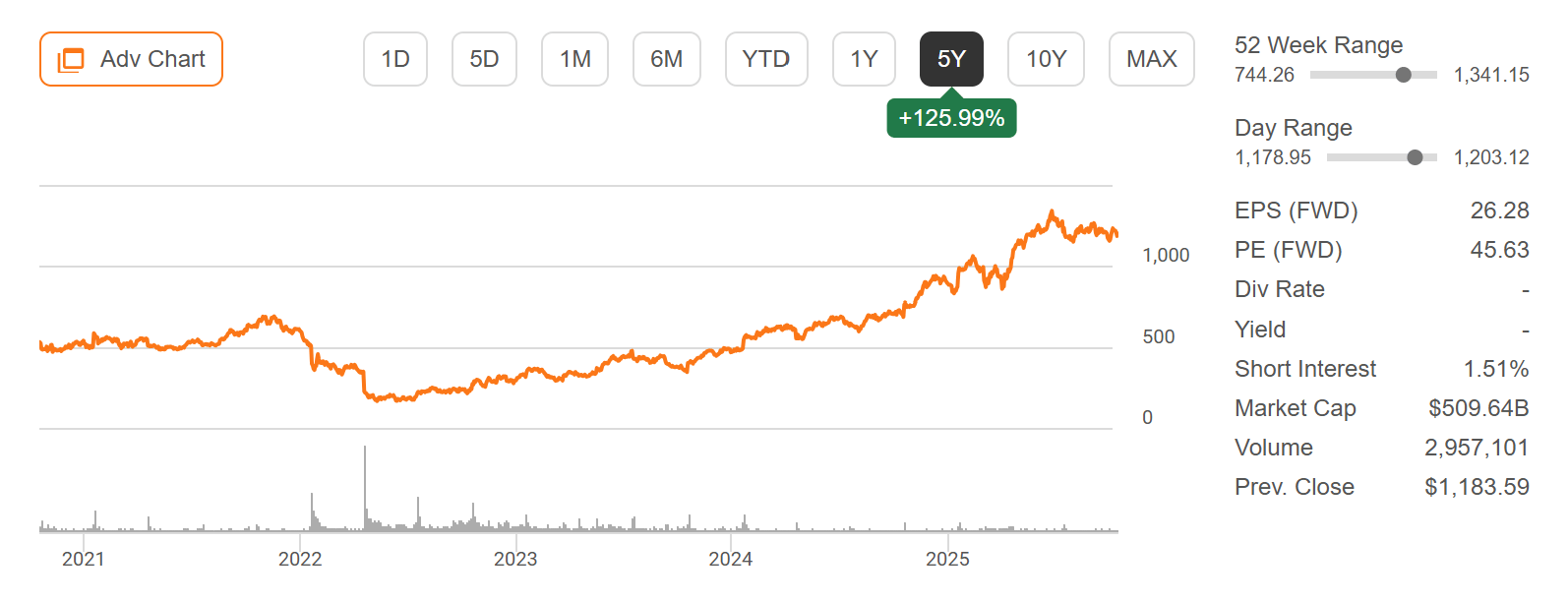

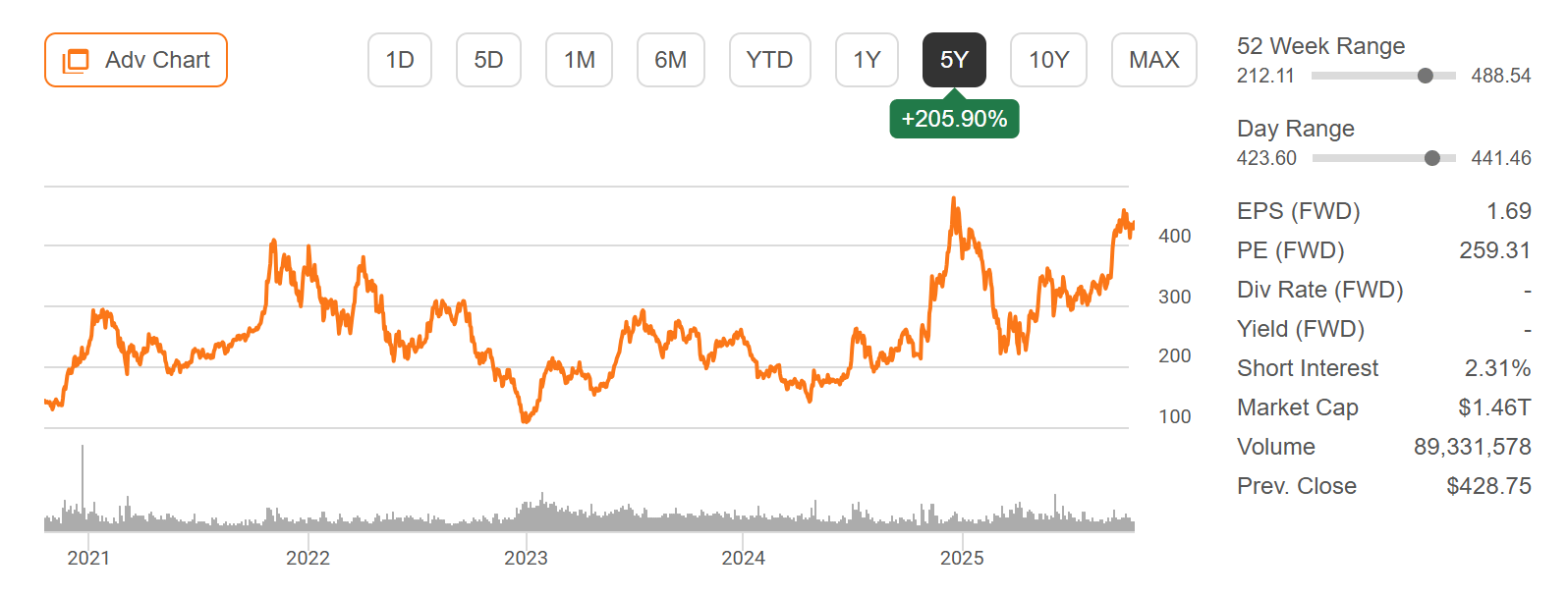

Netflix (+35% YTD) reports Q3 FY2025 earnings Tuesday, October 21 after the close, as investors assess whether the streaming leader’s latest content and ad-monetization strategies can fuel sustained growth in a competitive landscape.

Coming off Q2 where Netflix posted $11.1 billion in revenue (+16% YoY) and $7.2 in EPS, both exceeding expectations, the company also raised its full-year revenue guidance to $44.8-45.2 billion, citing healthier member growth, a weaker dollar and an accelerating ad business.

In the Q3 release, I’ll be watching how Netflix navigates three key themes: the pace and quality of new member additions beyond major hit-titles, the scale and trajectory of the ad-supported tier (including interactive formats), and margin leverage amid heavy content investing and global expansion. The tone around 2026 content spend, live-event roll-out (e.g., sports) and potential capital return will also be critical for valuation.

“Our focus is on sustainable growth – scaling our ads business and paid sharing while continuing to deliver must-watch stories from around the world.”

Netflix, Inc. (NFLX) Stock Performance, 5-Year Chart, Seeking Alpha

Tesla (TSLA)

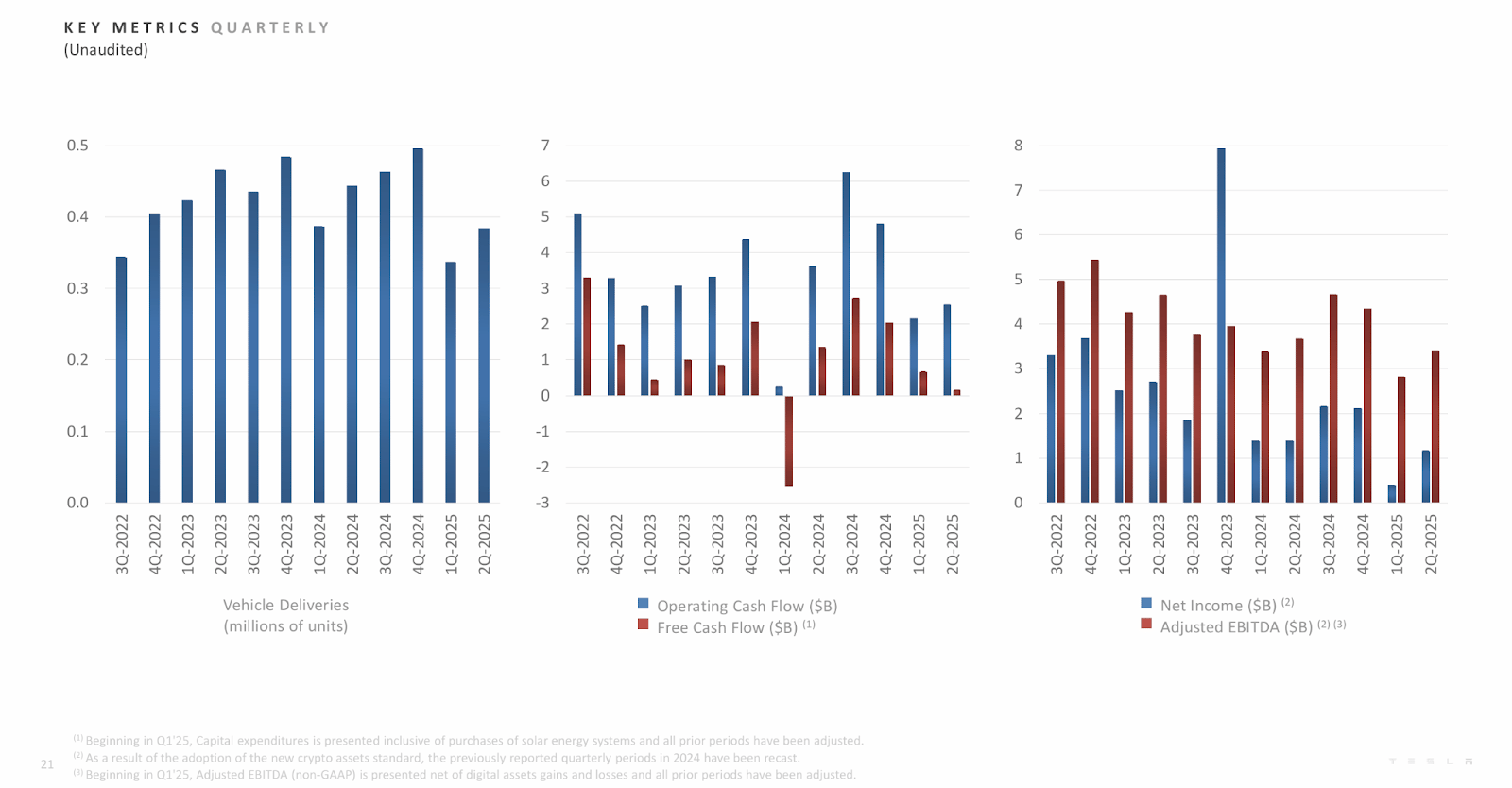

Source: Tesla Earnings Deck

Tesla (+9% YTD) reports Q3 FY2025 earnings Wednesday after the close, with investors watching whether the company’s record deliveries can translate into stronger margins amid pricing pressure and a more competitive EV landscape. Tesla remains at the center of the electric vehicle transition – but softening global demand, rising costs, and heavy investment in next-gen projects like robotaxis and AI infrastructure have raised questions about near-term profitability.

In Q2, Tesla energy storage deployments surged and software revenue continued to expand, automotive gross margin slipped to 17.3%, its lowest level in nearly four years, reflecting lower average selling prices and higher input costs. The company also reiterated progress on FSD v13, with Elon Musk calling it a “major leap” toward autonomy.

Heading into this quarter, I’ll be watching how Tesla balances its volume growth strategy with margin recovery, particularly in China and Europe where price competition has intensified. Key areas include updates on AI-training capacity, Optimus humanoid development, and the Robotaxi timeline, which Musk has suggested could see a prototype event by year-end.

“After record deliveries, margins –not momentum – will decide how the market reacts.”

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

The government shutdown carries on, major speakers at the Ted AI Conference, and Samsung’s live broadcasted open media event.

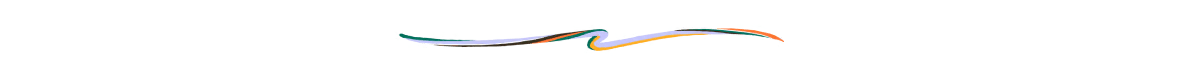

Government Shutdown

Source: Kalshi

The U.S. entered a partial federal government shutdown on October 1 as Congress failed to pass appropriations for fiscal year 2026. With no funding deal in sight, the economic and market implications are mounting: the White House Council of Economic Advisers estimates the cost to the economy is up to $15 billion per week, with potential growth drag of ~0.1-0.2% of GDP per week of shutdown.

Key consequences include delayed or suspended releases of economic data, which could hamper Federal Reserve decision‐making, and a rise in political risk as the shutdown enters its third week and spirals into layoffs, social-program disruptions, and credit-rating pressure. Markets had long viewed shutdowns as manageable, but this one carries deeper systemic risks across governance, regulator functions, and financial markets.

“If a shutdown lasts at least several weeks, the impacts become material – delays to data, markets flying blind, and sharper pressure on growth and credit.”

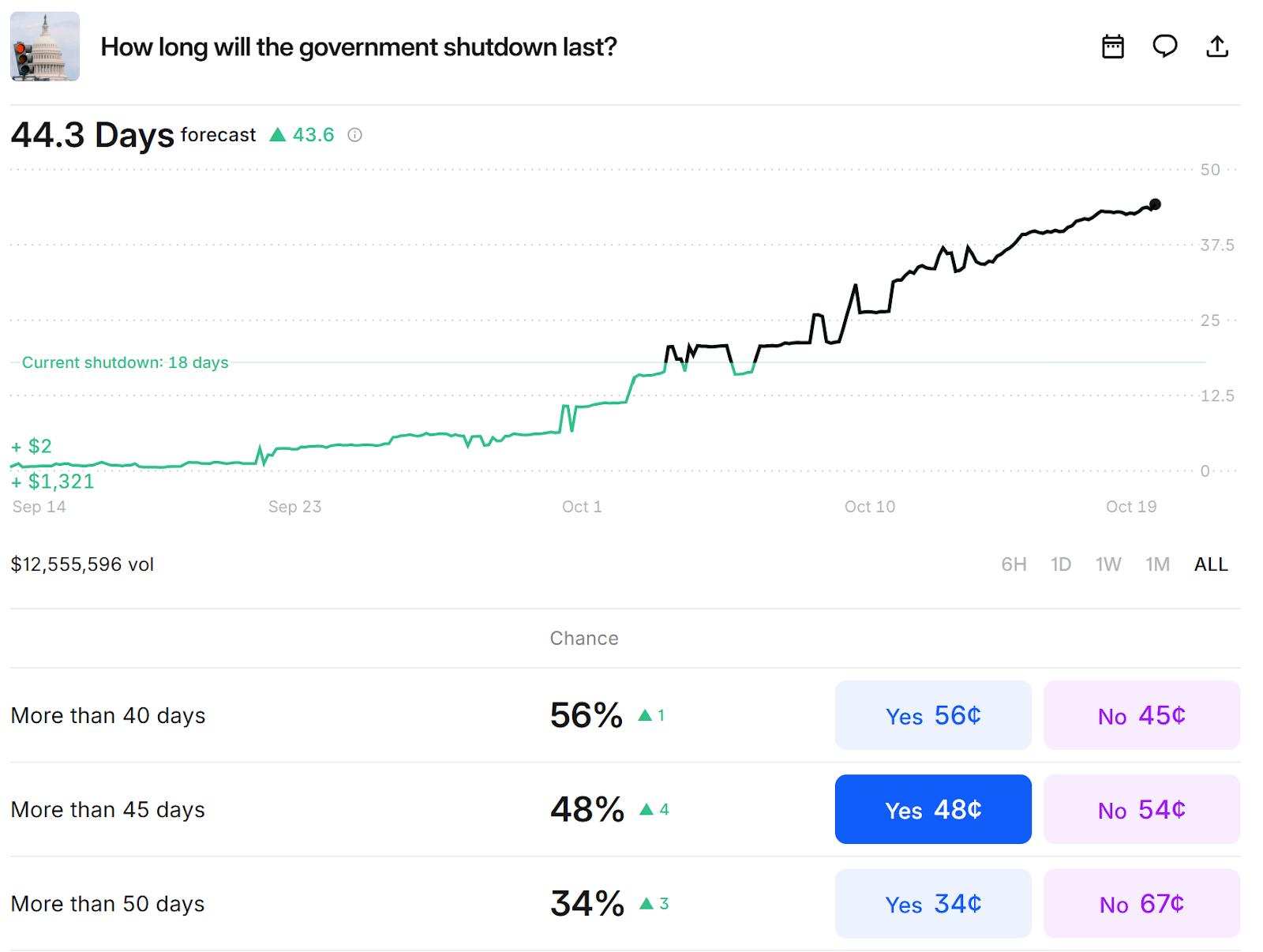

TED AI Conference

The TED AI Conference (Oct. 21–22, San Francisco) will gather global innovators across technology, science, and the arts to explore AI’s impact on society and business. Among the featured speakers is Robinhood CEO Vlad Tenev, alongside executives from Oracle, Hewlett Packard Enterprise, and eBay.

The event, newly focused on applied AI, is expected to highlight advances in responsible innovation, infrastructure, and generative applications shaping finance, enterprise tech, and consumer platforms. Investors will be watching for AI adoption updates and partnership announcements from participating firms as the conversation shifts from model development to real-world deployment and monetization.

“TEDAI brings together the visionaries defining how artificial intelligence can—and must – benefit society.”

Samsung Open Media Event

Samsung Electronics will host its Worldwide Open media event on October 21 at 10 p.m. ET, where it’s expected to reveal its long-anticipated XR headset, codenamed Project Moohan. The device marks Samsung’s entrance into AI-native extended reality (XR) — blending immersive hardware, spatial computing, and embedded AI.

At the center of this launch is Android XR, a new platform co-developed with Google and Qualcomm, optimized for real-time intelligence and designed to scale across devices.

“This is where the true potential of XR comes alive – unlocking a new dimension of possibilities.”

Major Economic Events:

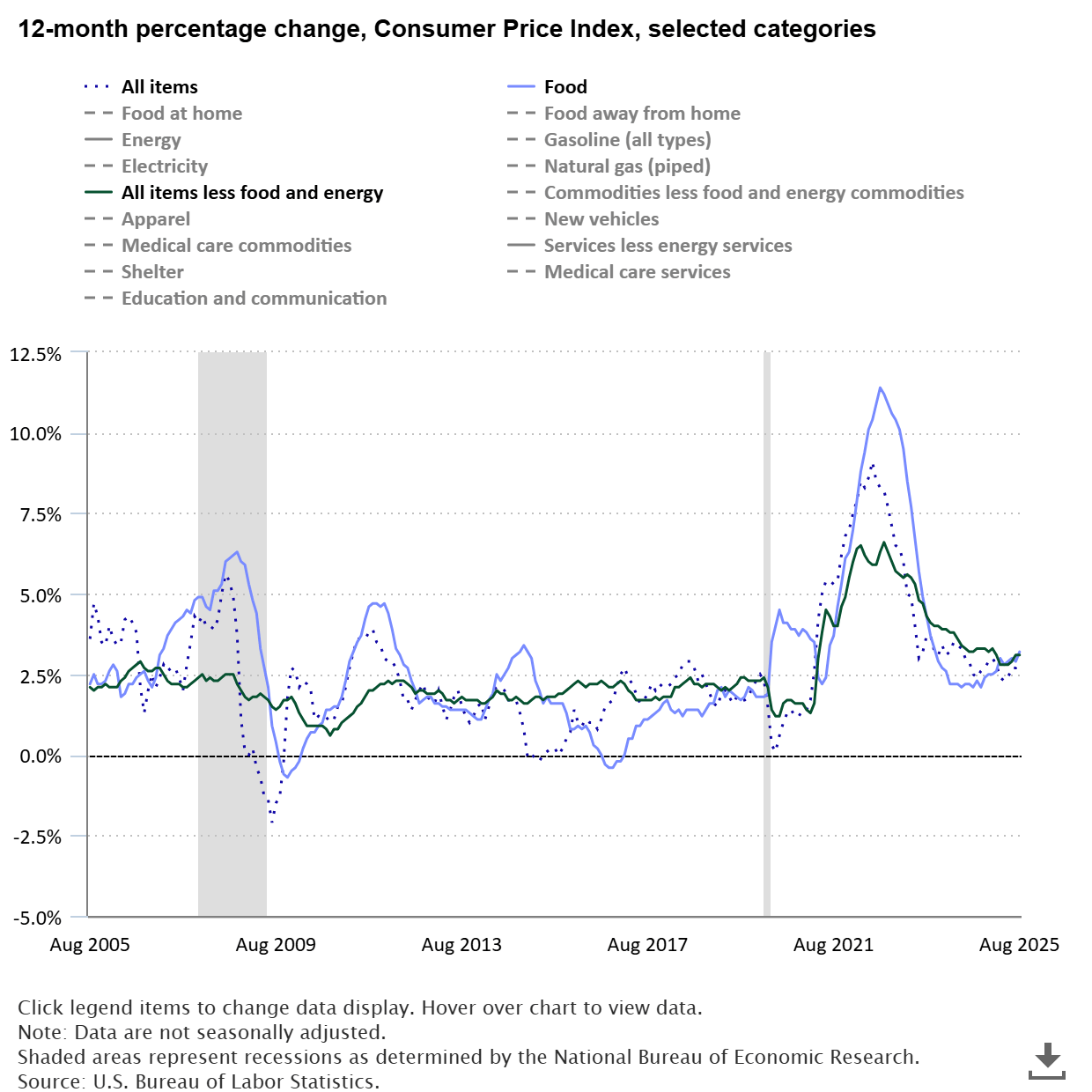

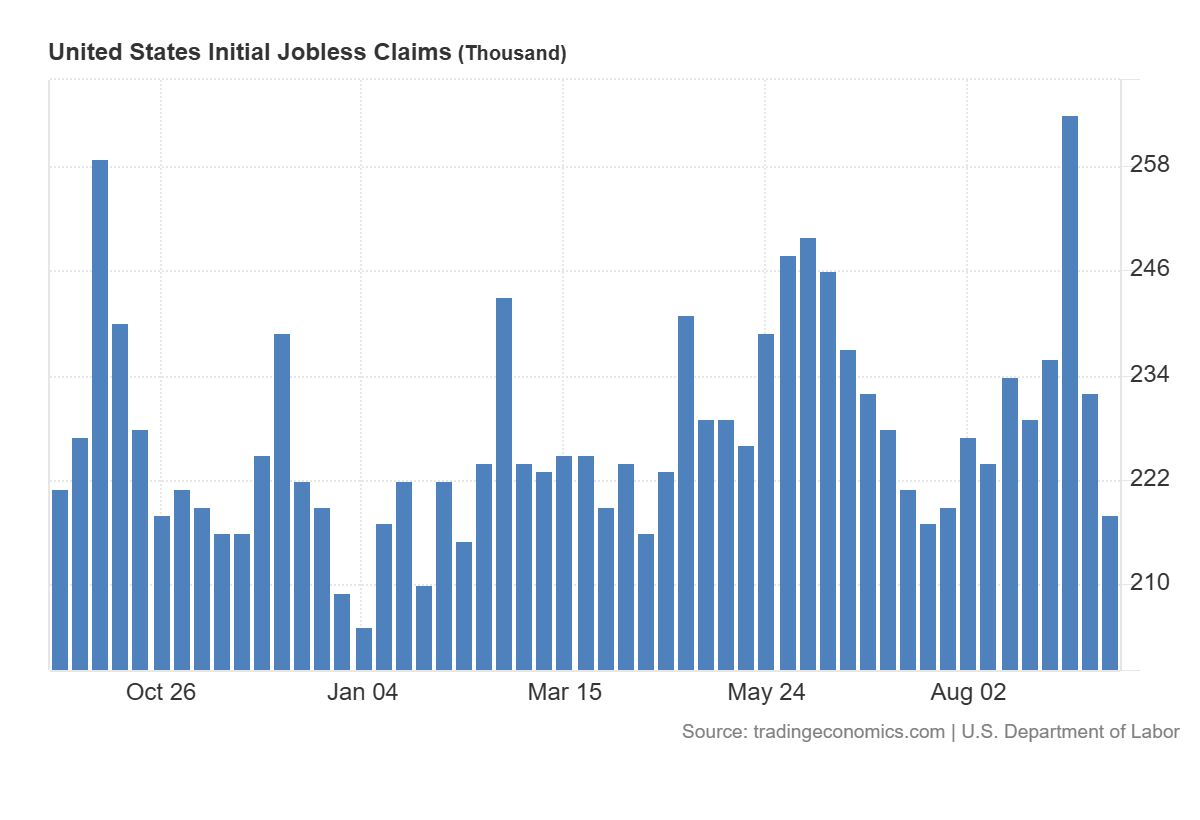

The Consumer Price Index (CPI) and initial jobless claims are in focus — but these of course can be delayed / impacted due to the government shutdown.

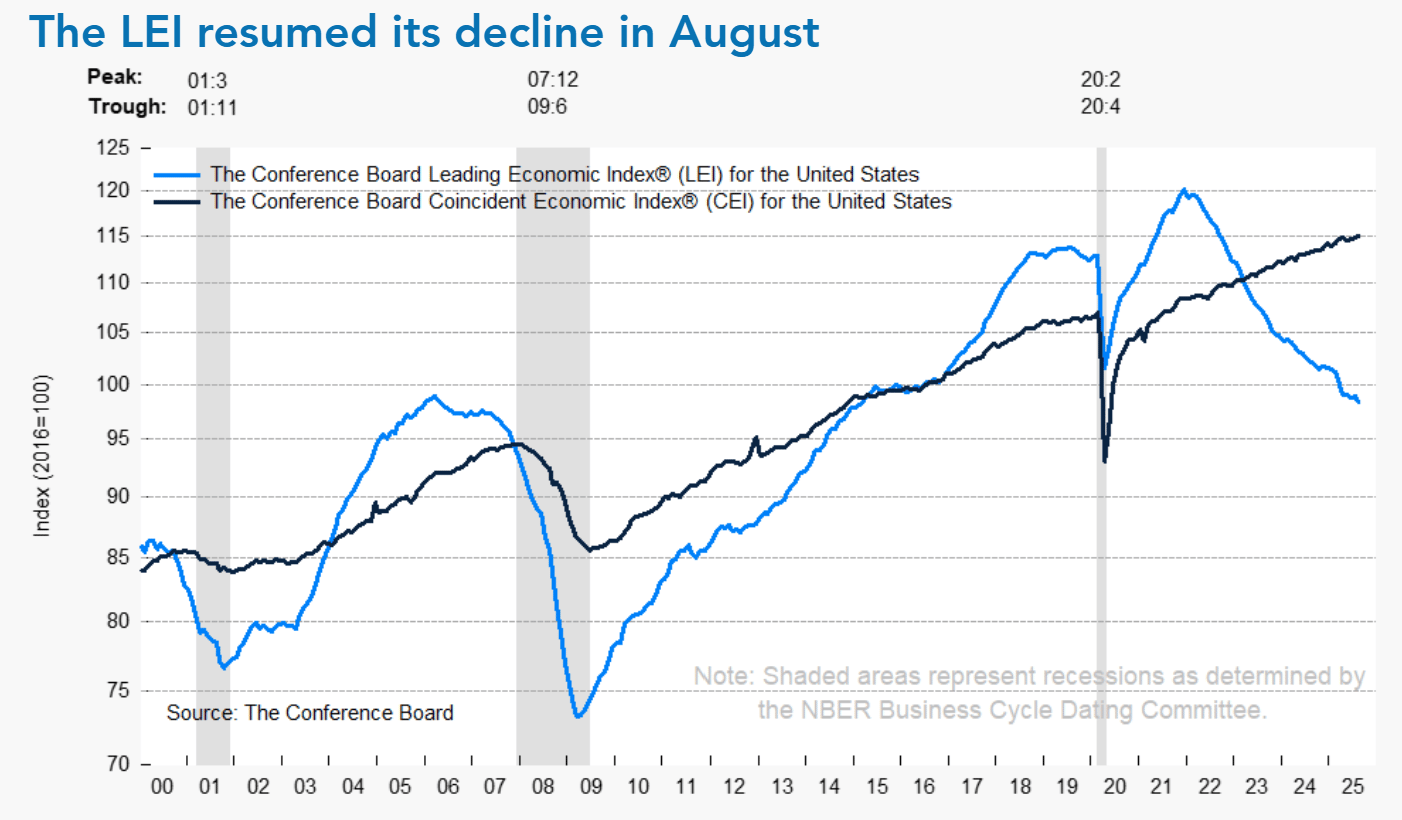

Monday (10/20): U.S. Leading Economic Indicators

Tuesday (10/21): Fed Governor Christopher Waller Opening Remarks

Wednesday (10/22): Fed Governor Michael Barr Speaks

Thursday (10/23): Existing Home Sales, Fed Governor Michael Barr Speaks, Fed Vice Chair for Supervision Michelle Bowman Testifies, Initial Jobless Claims

Friday (10/24): Consumer Price Index (CPI), Core CPI, Core CPI Year Over Year, CPI Year Over Year, Consumer Sentiment (Final), New Home Sales, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

What We’re Watching:

Consumer Price Index

The Consumer Price Index rose +0.4% MoM in August, the largest increase since January and above expectations for +0.3%, reflecting pressure from housing and energy costs.

On an annual basis, headline inflation accelerated to +2.9% YoY — the highest since January — after holding steady at 2.7% in June and July. Food prices picked up (+3.2% vs. +2.9%), used cars and trucks climbed (+6.0% vs. +4.8%), and new vehicle prices edged higher (+0.7% vs. +0.4%). Energy costs also rose for the first time in seven months (+0.2% vs. -1.6%), as declines in gasoline and fuel oil prices eased.

Shelter costs, the largest CPI component, rose +0.4% MoM, accounting for more than half of the monthly gain. Core CPI — which excludes food and energy — held steady at +3.1% YoY, matching February’s high, while the monthly core rate rose +0.3%, in line with forecasts.

Economists expect the following this week:

Headline CPI (MoM): +0.4% vs. +0.3% expected

Headline CPI (YoY): +2.9% vs. +2.7% prior

Core CPI (MoM): +0.3% vs. +0.3% prior

Core CPI (YoY): +3.1% vs. +3.1% prior

“Inflation’s reacceleration in August likely reflects temporary energy and shelter pressures rather than a sustained uptrend – but it complicates the Fed’s path toward rate cuts, at least in the near term.”

Initial Jobless Claims

Initial jobless claims fell by -14,000 to 218,000 in the third week of September, surprising economists who expected a rebound to 235,000. The drop marks the lowest level in two months and suggests that labor market conditions remain resilient despite signs of broader economic slowdown.

Continuing claims also eased, dipping to 1.93 million, the lowest since late May — signaling that laid-off workers are still finding new jobs relatively quickly. The data pushed back against fears of an accelerating labor-market deterioration that had surfaced after a series of weaker payroll and employment reports earlier this month.

Claims filed by federal employees rose modestly (+63 to 635), with government hiring in focus amid reports of agency workforce adjustments and the potential risk of a federal shutdown.

Economists expect the following this week:

Initial Jobless Claims: 218K vs. 232K prior

Continuing Claims: 1.93M vs. 1.96M prior

“The decline in jobless claims suggests that the labor market is cooling, but not cracking. For the Fed, it reinforces the view that a soft landing remains achievable even as inflation stays elevated.”

Tenzing Memo Disclaimer: Tenzing MEMO is available for professional use only. A valid work email is required for this offer. Approved users receive a 3-week free trial to evaluate companies of their choosing with no commitment or credit card required.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Image Source: ABC News / Samuel Corum / Getty Images

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]