- GRIT

- Posts

- 👉 On Running Triples Profits

👉 On Running Triples Profits

Crowdstrike, On Running, Broadcom

Together with Betterment

Happy Sunday.

Let’s dig into things!

Turn out the lights on traditional savings accounts. With Betterment’s high-yield cash account, your money is earning nearly 11x the national average**.

Register for the (free) GRIT Money Summit!

U.S. households’ stock allocation hit a record 49% in October, surpassing the 2000 dot-com peak. Since the Great Financial Crisis, stock exposure has doubled, making investing more accessible — but also more complex!

According to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%.

Join the GRIT Money Summit to learn head-on. Gain insights from experts, and empower yourself with the knowledge needed to navigate today’s fast-paced, ever-evolving markets, business and finance landscapes. Don’t be left behind — get equipped to invest with confidence!

Make sure you sign up using the links above!

Now let’s dive right in.

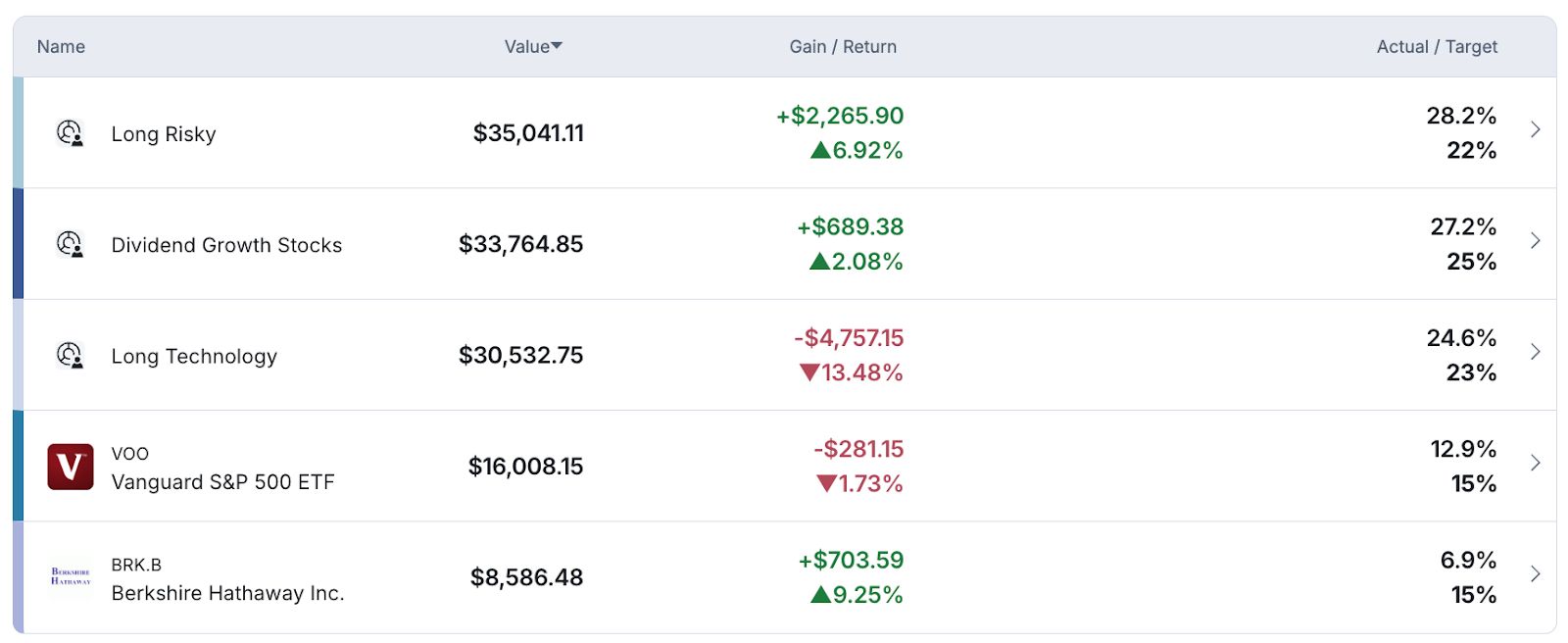

Portfolio Updates (YTD Performance):

There are likely only two outcomes for both the stock market and Bitcoin at the moment:

The stock market (both the S&P 500 and the Nasdaq-100) finds support around the 200-day moving average which causes us to bounce and rally higher (potentially back to all-time highs) throughout the coming months before we experience a larger contraction / reversion to the mean in 2026 induced by recessionary fears and other macro-economic factors at play.

The stock market finds temporary support around the 200-day moving average (both the S&P 500 and the Nasdaq-100) which causes us to bounce and make a “lower high” before trending lower as mass layoffs, recession risks, and tariffs cause continued volatility.

Whichever way you slice it, the playbook has changed.

I’ve always been the type of investor to believe “the trend is your friend.”

The Fed is expected to raise rates? Well, don’t fight the Fed and let’s all go lower together, pick up shares at generational prices and ride the wave. AI is going to cause new efficiencies and profits? Let’s invest and ride the wave.

This recent 2.5 year long bull market, which was seemingly catalyzed by OpenAI releasing ChatGPT during November of 2022, has been one for the ages. Not only were countless companies oversold as we turned the corner, but they were able to leverage AI to produce record profits — therefore their stock prices experienced immense multiple expansion.

Now as we test long-standing moving averages and reflect upon Wall Street’s forward EPS expectations — things don’t feel as bullish. I’m not ready to say the bull market is over, but I do believe we should position ourselves in a more defensive posture.

Specifically for my portfolio, this means I’ll be taking advantage of what I hope in the coming weeks and months turns into a “relief bounce” — giving me the chance to take profits on some of my biggest winners across the entire portfolio.

Year-to-date performance

My goal is NOT to completely exit entire stock positions, but instead to begin to realize the tens of thousands in profits I have across some of the riskiest positions in my portfolio.

The goal is to then reallocate this money into a handful of places:

QQQH — the NEOS Nasdaq-100 Hedged Equity Income ETF. This ETF holds all underlying constituents of the Nasdaq-100 (which means I’m invested if we experience a rally back to new all time highs this Summer) while simultaneously implementing a put-option strategy to hedge against downside risk. Year-to-date this ETF is down -1.5% compared to QQQ being down -4.0%. No brainer.

KTEC — it’s obvious Chinese tech stocks are experiencing their own bull run. I plan to participate via this ETF.

SCHD — I already have this ETF in my portfolio, but I plan to beef it up a bit as dividend growth stocks tend to be more resilient during times of volatility. For example, the ETF is up +4% YTD.

Precious Metals like Gold and Silver via GLD and SLV.

Let me be clear — I’m not bearish, I’m just not exactly bullish.

The last time we experienced a bear market I was able to “sell the strength” at the turn of the calendar year heading into 2022. I plan to do something similar this go around. With that being said, I will continue to be a net-buyer of assets. The only difference here is the assets I’m buying are much more resilient during times of volatility when compared to the high-octane growth stocks I currently own.

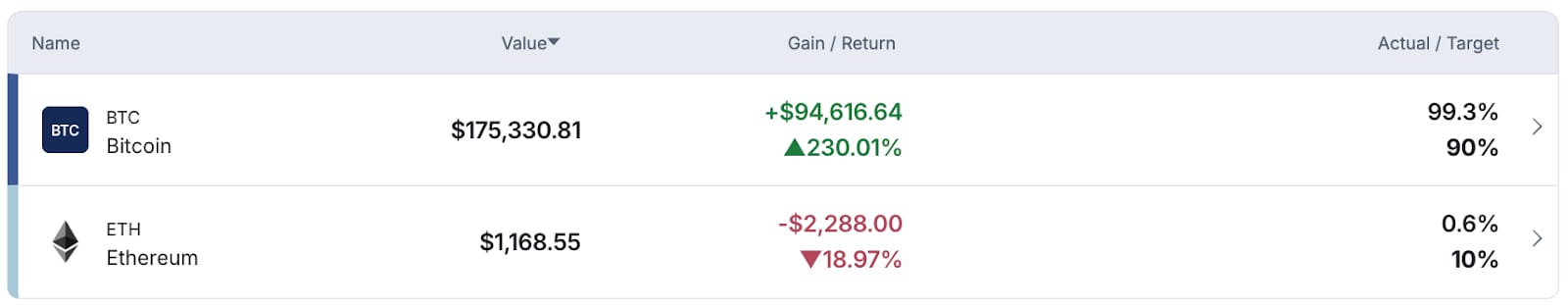

As for Bitcoin, I’ve begun to exit this position.

Don’t freak out! I’ve only sold 10% of my Bitcoin position around the $88-90K range leading up to the Friday Crypto Summit at the White House. After watching this video from Ben Cowen, it’s clear to me there’s two outcomes for Bitcoin — similar to that as I shared above.

We could retest the $72-74K levels (similar to retests we experienced in prior cycles) and then go to all-time highs, or we drop into the $60K range (proving the cycle top is in) and we experience a relief bounce back to the $80-90K range before confirming a “lower high” and entering another crypto winter.

I’m not sure what’s going to happen. I’m ready to start realizing some of these Bitcoin profits no matter the outcome. My goal is to have 80-90% of this position entirely exited in the coming months as close to $90-120K as possible.

All-time performance

With that being said, I have a hunch the price of Ethereum and other alt coins are more closely tied with the Fed’s balance sheet (quantitative easing) than some previous market cycle calendar. For that reason, I’m treating my Ethereum position completely separate from how I’m treating Bitcoin. Nothing has been sold yet and I don’t plan to for a while. Stay tuned for updates there as the Fed likely begins QE in the coming weeks / months.

Week in Review —TLDR:

Crowdstrike’s new accounting caused confusion, Broadcom added ByteDance to their list of hyperscale customers, and On Holdings tripled their profits.

The White House hosted its highly-anticipated Crypto Summit, retailers are reducing their growth expectations for 2025, the S&P 500 is seeing some new additions (including DoorDash and Williams-Sonoma), the BLS Jobs Report came in close to expectations, Jerome Powell essentially guaranteed that there won’t be a rate cut in March, and the ADP Employment Report shocked economists with a near -50% miss.

Key Earnings Announcements:

Crowdstrike’s new accounting caused confusion, Broadcom added ByteDance to their list of hyperscale customers, and On Holdings tripled their profits.

CrowdStrike (CRWD)

Key Metrics

Revenue: $1.1 billion, an increase of +25% YoY

Operating Loss: -$85.3 million, compared to $29.7 million last year

Net Loss: -$92.7 million, compared to $54.9 million last year

Earnings Release Callout

“Delivering $224 million of net new ARR, which brings our ending ARR to $4.24 billion, places us firmly on the flight path to our $10 billion ending ARR goal. We are seeing strong momentum in our Next-Gen SIEM, Cloud Security, and Identity Protection businesses, surpassing $1.3 billion in combined ending ARR.

With 97% gross retention and accounts adopting Falcon Flex adding over $1 billion of in-quarter deal value, customers are increasingly consolidating on the Falcon platform as their AI-native SOC for today and tomorrow.”

My Takeaway

Shares of Crowdstrike fell -6% after their earnings report due to near-term free cash flow uncertainty and a worse-than-expected operating income guide. Let’s dig into the details.

ARR grew +23% YoY, in-line with Wall Street’s expectations. Management noted their products and services are used by over 74,000 organizations with their customer count growing +30% YoY. During Q4 itself, Crowdstrike closed 20 deals worth more than $10M, 350+ deals worth more than $1M, and 2,300+ deals worth more than $100K. Additionally, management noted their MSSP product, which services small to medium sized businesses, will contribute 15% of net new business in 2025.

Alternatively, the company’s operating income guidance was a head scratcher. Management guided to a 20.2% margin at the midpoint, materially lower than Wall Street’s 21.2% consensus. The reason this is a head scratcher, specifically, stems from their updated accounting — which excludes payroll taxes for employee stock-based compensation. This is a new accounting method for them in 2025 that will add about +1% to their operating margin. So not only are they getting a “free” 1% benefit from this accounting change, but it’s also 1% lower than Wall Street expected. Cancel out this weird accounting benefit and you’re guiding to net 2% lower than expected, which on $5B in revenue is a $100M swing in operating income.

Crowdstrike remains a company that I’m buying no matter what uncertainty awaits. The company is obviously going to achieve their $10B in ARR goal in the coming years, their FCF is going to eclipse $2B sooner than we might think, and they clearly are a market leader operating in a massive secular growth trend. I’ll buy any weakness that might come this stock’s way. Bullish.

Broadcom (AVGO)

Key Metrics

Revenue: $14.9 billion, an increase of +25% YoY

Operating Income: $6.3 billion, an increase of +200% YoY

Profits: $5.5 billion, an increase of +332% YoY

Earnings Release Callout

“Broadcom’s record quarterly revenue and adj. EBITDA were driven by both AI semiconductor solutions and infrastructure software. AI revenue grew +77% YoY to $4.1 billion and infrastructure software revenue grew +47% YoY to $6.7 billion.

We expect continued strength in AI semiconductor revenue of $4.4 billion next quarter, as hyperscale partners continue to invest in AI XPUs and connectivity solutions for AI data centers.”

My Takeaway

Broadcom shares rallied +13% after reporting their quarterly earnings driven by strong AI upside paired with long-term visibility into new engagements.

The company delivered +10% sequential and +77% annual growth in its AI-specific revenue, reaching $4.1 billion during the quarter — well above Broadcom’s original target of $3.8 billion. With expected growth in their AI business, I continue to believe the company is extremely well position to capitalize on what I expect to be improving industry fundamentals over the immediate term and to benefit over the long-term as AI adoption continues.

ByteDance is their newest hyperscale customer (alongside Google and Meta) looking to deploy a million XPU clusters. According to management “Just these three customers’ multi-year engagements represent an estimated $60-90B across both our networking and XPU businesses.”

The company also continued to see strong results from its Infrastructure Software business, which was led by its VMWare division, that has now passed its one-year mark since the acquisition closure. This business segment grew by +15% sequentially and +47% annually.

AI is here to stay, and Broadcom is leading the charge. I plan to continue to let this position compound and grow overtime. Bullish.

On Holdings (ONON) — in CHF

Key Metrics

Revenue: $2.3 billion, an increase of +29% YoY

Operating Income: $211.6 million, an increase of +17% YoY

Profits: $242.3 million, an increase of +205% YoY

Earnings Release Callout

“We close this remarkable year with immense pride in all that we’ve accomplished. Exceeding CHF 2.3 billion in net sales and reaching a cash position close to CHF 1 billion are not just milestones but testaments to On’s continued strong momentum, all made possible through the incredible work of our team.

All of the achievements and unique moments in 2024 gave us an increased amount of energy for 2025. We are excited to launch a firework of new products and deliver an even more premium experience at every touchpoint to our fans.”

My Takeaway

This company has been the definition of a “home run,” haha.

2024 was a banner year for On Holdings, as they finished it with quarterly results that reflected a +40% increase in organic sales compared to only +30% growth guided to at the beginning of the year. Moreover, their organic sales growth was almost all volume-driven, with no price effect and at best a small contribution to mix.

The company reported a 16.7% adj. EBITDA margin, up +1.3% YoY. Moreover, their full year 2024 profits came in at CHF 242 million, tripling their 2023 profits.

The most exciting part of all of this is Wall Street has a hunch the company is going to grow their annual revenue to over CHF 10 billion over the coming 10 years. This idea stems from the company’s ability to diversify geographically from the US on products and distribution, as well as sales growth being fueled by a continual reinvestment back into innovation. The company leads the sector in Capital Expenditures (reinvest back into the business).

This company is certainly here to stay, and I’ll continue to let this name compound and grow within my portfolio. Bullish.

Investor Events / Global Affairs:

The White House hosted its highly-anticipated Crypto Summit, retailers are reducing their growth expectations for 2025, and the S&P 500 is seeing some new additions (including DoorDash and Williams-Sonoma.

White House Crypto Summit Recap

Source: USA Today / Fox LA

President Donald Trump has officially endorsed stablecoins and signed an executive order establishing a US Bitcoin Reserve funded by seized crypto assets. The Treasury and Commerce departments will create “budget-neutral strategies” to expand this reserve without additional taxpayer costs. During the White House meeting with crypto leaders, Treasury Secretary Scott Bessent emphasized stablecoins' role in maintaining the US dollar’s dominance.

Crypto figures like Brian Armstrong, Michael Saylor, and the Winklevoss twins attended the gathering. It was also extremely cool to see Sergey Nazarov — Co-Founder of Chainlink — speak directly to the President in front of the media. The U.S. government currently holds an estimated $17.5 billion in Bitcoin, with efforts underway to audit its total digital asset holdings. Trump's administration has also supported the pausing of multiple SEC investigations into the industry.

We encourage you to read the official Fact Sheet from the White House regarding all of this — don’t just trust headlines! Regardless of brutal price action since the Inauguration and relatively boring soundbites coming from the event… it’s unbelievable how bullish all of this has been for the long-term health of the crypto industry.

“With the reserve, the goal is long-term preservation. With the stockpile, the goal is responsible stewardship.”

Retailers Temper Expectations for 2025

U.S. Retail Sales Monthly Change, 1-Year Chart, Trading Economics

Major retailers — including Abercrombie & Fitch, Target, and Walmart — are lowering their sales expectations for 2025 as American consumers cut back on spending.

Consumer confidence dropped sharply last month, fueled by inflation concerns and new tariffs imposed by President Trump on Mexico, Canada, and China. These tariffs, which include a 25% tax on Mexican & Canadian imports and a 20% levy on Chinese goods, have sparked fears of rising prices and economic uncertainty. Abercrombie & Fitch projected only +3-5% sales growth for 2025, significantly lower than last year’s 16%, causing its stock to plummet.

Abercrombie & Fitch (ANF) Stock Performance, 5-Year Chart, Seeking Alpha

Target also warned of profit pressures from tariffs, with its CEO cautioning that food prices — especially for Mexican imports like avocados — could rise soon. Walmart, despite a strong 2024, now anticipates lower-than-expected earnings and sales growth, adding to Wall Street’s concerns. Specialty retailers like Gap, American Eagle, and Guess have also seen significant stock declines, reflecting broader market uncertainty.

“Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.”

S&P 500 Rebalancing

Source: CNBC

The S&P 500 is undergoing its quarterly reshuffling, with four new stocks being added to the index. DoorDash, TKO Group Holdings, Williams-Sonoma, and Expand Energy will be the newest companies to join the S&P 500 ranks. Meanwhile, BorgWarner, Teleflex, Celanese, and FMC Corp are being removed due to their declining market caps, with all four now valued at $6 billion or less.

The departing stocks will move to the S&P Small-Cap 600, while the new entrants come from the S&P MidCap 400. Additionally, Palantir, Intuitive Surgical, and ServiceNow will join the S&P 100, replacing Kraft-Heinz, Dow Inc., and Ford. These changes, effective March 24, aim to ensure the indexes accurately represent market capitalization shifts.

DoorDash (DASH) Stock Performance, All-Time Chart, Seeking Alpha

Williams-Sonoma Stock Performance, 5-Year Chart, Seeking Alpha

Make sure you read the full breakdown in the table above! There’s a reason why stocks pop on the news of being added to major indices — because it can lead to substantial inflows!

Major Economic Events:

The BLS Jobs Report came in close to expectations, Jerome Powell essentially guaranteed that there won’t be a rate cut in March, and the ADP Employment Report shocked economists with a near -50% miss.

Jobs Report + Unemployment Rate

While the U.S. added +151,000 jobs in February, the unemployment rate rose to +4.1% — signaling a softening labor market. More people are permanently out of work, and federal government payrolls declined, while part-time employment for economic reasons increased. President Trump’s policies, including tariff hikes and government spending cuts, are expected to further pressure job creation and potentially raise unemployment.

The report also showed a rise in multiple jobholders, with nearly 8.9 million Americans now working more than one job. Wage growth remained steady at +0.3% month-over-month — while labor force participation dropped to a two-year low. Economists predict the Federal Reserve may cut interest rates by 75 basis points this year as the labor market weakens.

“The near-term path of policy is cloudy, and so the economy’s path is cloudy, too. If the government stays the course on big tariff hikes and spending cuts, those policies would continue to weigh on job creation in the next few months, likely pushing the unemployment rate higher still.”

Jerome Powell Speech

After Powell’s speech, odds of no rate cut in the March Fed Meeting moved to a 97% chance. Source: CME FedWatch Tool

Federal Reserve Chairman Jerome Powell stated that the Fed will wait for more clarity on President Trump’s policy changes before adjusting interest rates.

He emphasized that the White House's moves on trade, immigration, fiscal policy, and regulation create significant uncertainty for the economy. Powell reassured that the Fed is not in a hurry and will carefully assess the economic impact before making decisions. His comments contrast with market expectations — which anticipate three rate cuts by the end of the year due to economic uncertainty.

Powell acknowledged that inflation remains above the Fed’s +2% target and that recent sentiment surveys show concerns about rising prices. He maintained that the U.S. economy is in a strong position with a solid labor market, though tariff policies could impact inflation. While some Fed officials suggest holding rates steady for now — Powell reiterated that policy is flexible and will adjust as needed.

“Policy is not on a preset course. Our current policy stance is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate…

The path to sustainably returning inflation to our target has been bumpy, and we expect that to continue.”

ADP Employment Report

The ADP National Employment Report showed that +77,000 private jobs were added in February, the lowest since July and below the expected +141,000. Goods-producing jobs increased by +42,000, while service-providing jobs added +36,000. The Professional and Business Services sector saw the highest growth with +27,000 jobs, while Trade, Transportation, and Utilities lost -33,000.

Regionally, the East North Central region had the largest job gain of 45,000, whereas the South Atlantic region lost -26,000 jobs. Large companies with 500+ employees added +37,000 jobs, while small businesses with 1-19 employees lost -17,000.

The report highlights continued volatility in the labor market, with hiring trends returning to pre-pandemic levels.

"Policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month. Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead."

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source:

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply