- GRIT

- Posts

- 👉 Robinhood's First-Ever Investor Day

👉 Robinhood's First-Ever Investor Day

Lululemon, Salesforce, SentinelOne

Welcome to your new week, and Happy December.

Let’s dive in!

Key Earnings Announcements:

Tuesday is the biggest day of earnings this week with a mix of retail & tech.

Monday (12/2): Zscaler

Tuesday (12/3): Box, Couchbase, Core & Main, Salesforce

Wednesday (12/4): American Eagle, Campbell’s, Chargepoint, Chewy, Cracker Barrel, Dollar Tree, SentinelOne

Thursday (12/5): BMO Harris, Caleres, Dollar General, DocuSign, Hewlett Packard Enterprises, Kroger, Lululemon, TD Bank, UiPath, Ulta Beauty

Friday (12/6): BRP, Genesco

What We’re Watching:

Salesforce (CRM)

Source: Salesforce Investor Relations

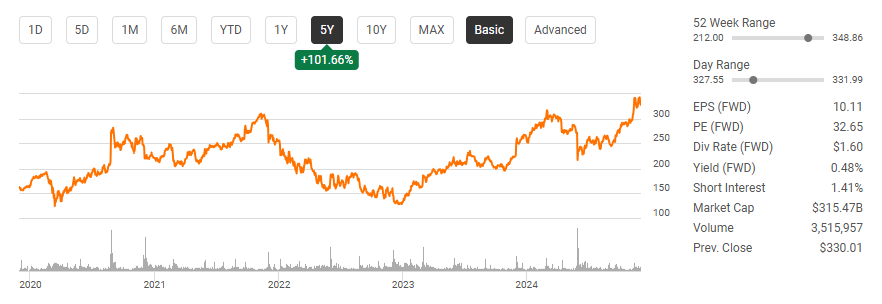

Salesforce (+25% YTD) will report FQ3 earnings after the market closes on Tuesday — with analysts expecting a +16% profit increase and +7% revenue growth.

The focus remains on Agentforce, credited with heavily contributing to a +32% surge in Salesforce’s stock since September. Its role in strengthening renewal of Salesforce business and AI monetization are expected to be continued talking points in this week’s report.

Analysts highlight Agentforce’s multi-billion-dollar growth potential — leveraging AI to enhance customer experiences by tackling tasks beyond routine automation.

Salesforce has also partnered with Google and Nvidia to elevate its capabilities. Investors will closely monitor updates on AI-driven innovations like Data Cloud, as well as Salesforce's ability to balance growth with expanding profitability.

Salesforce, Inc (CRM) Stock Performance, 5-Year Chart, Seeking Alpha

SentinelOne (S)

SentinelOne’s OneCon Conference Presentation

SentinelOne (+2% YTD) reports earnings after close on Thursday this week. Its Singularity platform will be taking center stage.

Singularity’s ability to provide real-time threat detection without deep system integration has positioned the company to gain market share, especially as businesses diversify cybersecurity providers in the wake of global IT outages.

Recent growth highlights include a +33% revenue increase and the launch of Purple AI — signaling SentinelOne's focus on continued, rapid innovation. Despite competition from established players like CrowdStrike, SentinelOne’s strong balance sheet ($1.1 billion in cash and no debt) offers financial flexibility for strategic moves.

However, the company remains unprofitable and investors need clear signs of profitability to sustain its +60% upside potential by 2025.

SentinelOne, Inc. (S) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

The biggest event of the year for Amazon Web Services (AWS), Robinhood’s first-ever Investor Day, and the highly-anticipated OPEC+ meeting.

AWS re:Invent Conference

The AWS re:Invent conference kicks off this week in Las Vegas, running from Dec. 1 to Dec. 6. A keynote from AWS CEO Matt Garman on Tuesday will highlight key themes, including generative AI, cloud operations, and emerging technologies.

You can read more here as announcements from the event are released.

Amazon, Inc. (AMZN) Stock Performance, 5-Year Chart, Seeking Alpha

“This premier cloud computing event brings together the global cloud computing community for a week of keynotes, technical sessions, product launches, and networking opportunities”

Robinhood’s First Investor Day

Source: Robinhood / Assembled

Robinhood will host its first-ever Investor Day on Wednesday, December 4th.

Robinhood’s stock has surged over +196% YTD, driven by strong growth in trading fees and its innovative subscription model. Robinhood Gold now boasts over 2.2 million subscribers.

The recent acquisition of TradePMR positions Robinhood for growth in investment advisory and retirement assets — further solidifying its goal to have a long-standing presence in the personal finance journey of Gen Z and Millennial investors.

Robinhood, Inc. (HOOD) Stock Performance, 1-Year Chart, Seeking Alpha

“Robinhood has announced its first Investor Day, scheduled for December 4, 2024 in New York City. The event will be live streamed, with options for both institutional and retail investors and analysts to attend in person. During the event, Robinhood plans to share its long-term vision for the next decade and beyond, focusing on how this vision can drive customer and shareholder value.”

OPEC+ Meeting

Source: REUTERS / Lisa Leutner / File Photo

OPEC+ has postponed its policy meeting to Dec. 5, with discussions focusing on delaying a planned January 2025 output hike amid weaker global demand and rising non-OPEC production.

Key topics include the UAE’s 300,000 bpd production increase, part of a phased plan to unwind cuts through 2025. With Brent crude prices hovering in the $70-$80 range, the group's next steps will be closely watched.

“Oil futures rose on Monday, with upbeat manufacturing data from China lifting prospects for energy demand after a cease-fire between Israel and Iran-backed Hezbollah led to a drop in prices for the month of November.

Weakness on Friday came after the Organization of the Petroleum Exporting Countries and its allies — known together as OPEC+ — delayed until Thursday a meeting that had been set for Sunday.”

Major Economic Events:

The next Jobs Report has our full attention.

Monday (12/2): Construction Spending, ISM Manufacturing, S&P Final U.S. Manufacturing PMI

Tuesday (12/3): Auto Sales, Job Openings

Wednesday (12/4): ADP Employment, Factory Orders, Fed Beige Book, ISM Services, S&P Final U.S. Services PMI, St. Louis Fed President Musalem Speaks

Thursday (12/5): Initial Jobless Claims, U.S. Trade Deficit

Friday (12/6): Chicago Fed President Goolsbee Speaks, Consumer Credit, Consumer Sentiment (prelim), Non-Farm Payrolls, U.S. Hourly Wages, U.S. Employment Report, U.S. Unemployment Rate

What We’re Watching:

U.S. Jobs Report

Source: U.S. Bureau of Labor Statistics.

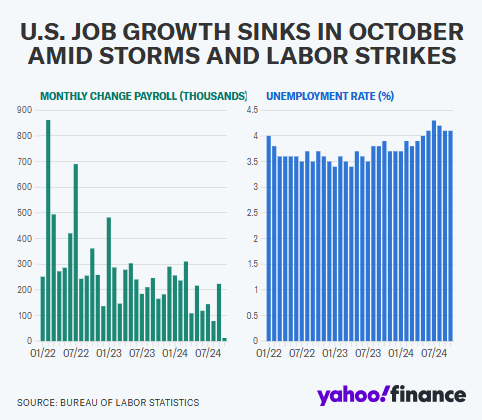

In October 2024, the U.S. economy added +12,000 jobs — SIGNIFICANTLY below the +113,000 forecasted and marking the weakest growth since December 2020.

This slowdown was attributed to strikes, notably at Boeing, and disruptions from hurricanes. However, the Bureau of Labor Statistics couldn't quantify the exact impact. The unemployment rate remained steady at 4.1% in the last reading.

This figure was also well below the average monthly gain of +194,000 over the past year — indicating a notable deceleration in job creation.

The unemployment rate is expected to hold steady at 4.1% and the median forecast for nonfarm payrolls has rocketed to +200,000 jobs.

If both of those projections are surpassed in a positive way — then a Santa Claus rally could receive quite the boost.

ISM Services PMI

Source: Institute of Supply Management (ISM)

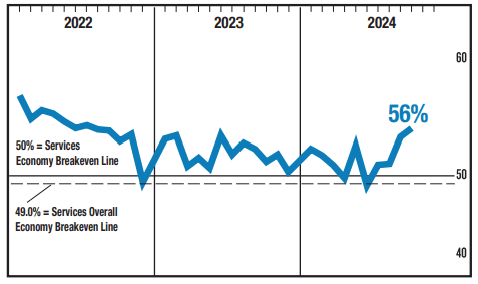

The Services PMI® rose to 56% in October, up from 54.9% in September — marking its highest level since July 2022.

This indicates continued expansion in the services sector, as readings above 50% signal growth. Historically, this level corresponds to a +2.3% annualized increase in real GDP, highlighting the sector's strong contribution to overall economic momentum.

The full report can be read here.

Source: ISM Services PMI Report

The ISM Services reading this week is expected to come in at 57%.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Canadian Association of Radiologists (CAR)

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply