- GRIT

- Posts

- 👉 THANKFUL for a Rate Cut Soon?

👉 THANKFUL for a Rate Cut Soon?

Alibaba, Dell, Zoom

Happy Thanksgiving!

We’re very grateful to have you as a reader of Grit Capital’s Rate of Return Newsletter. Read on for everything you need to know as we begin this shortened week in the markets.

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

As a heads-up, there will not be a Week in Review post next Sunday due to the holiday.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Key Earnings Announcements:

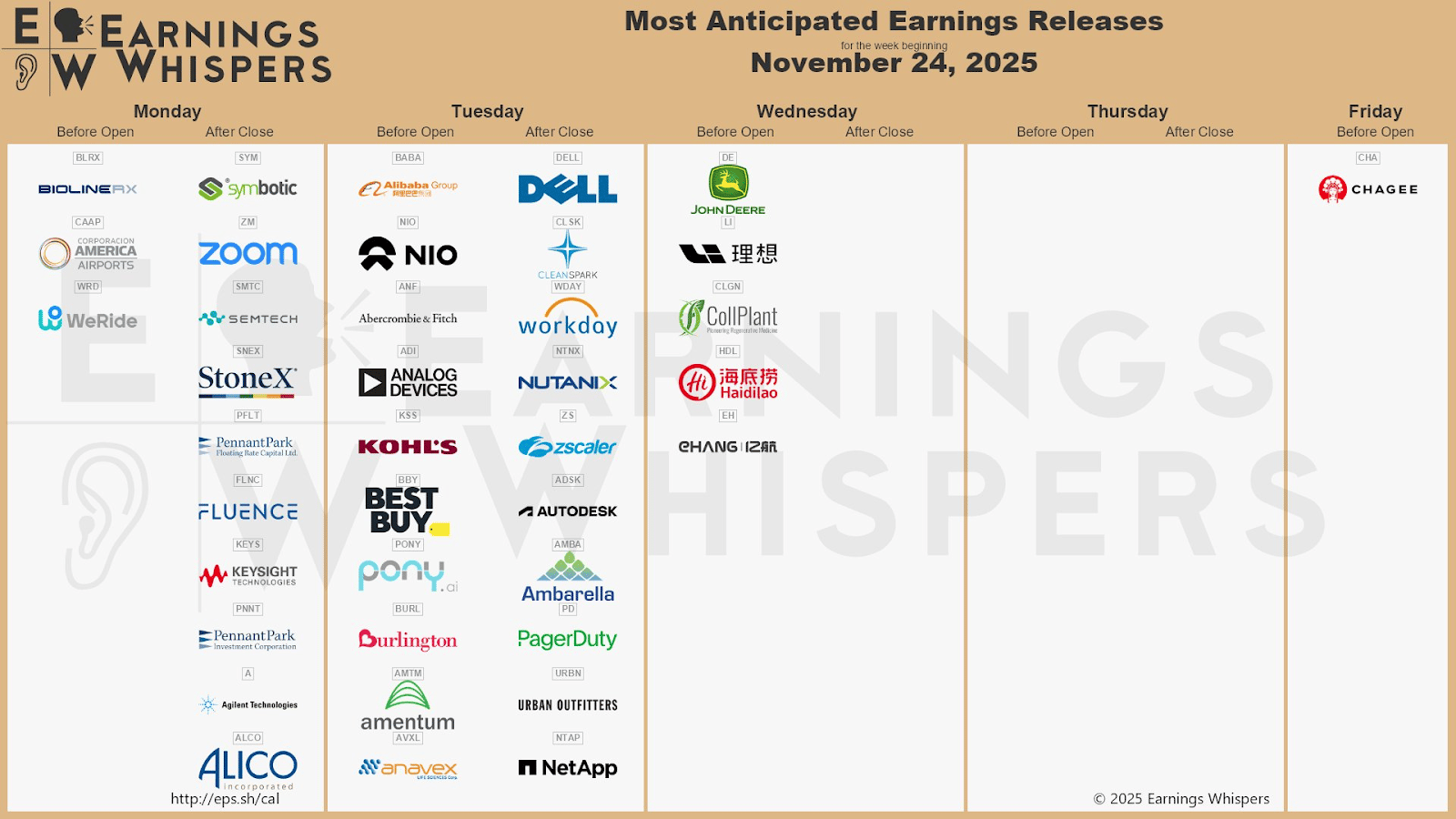

Earnings are winding down during this shortened trading week for Thanksgiving.

Monday (11/24): America Airports, BiolineRx, Jinko Solar, PennantPark Floating Rate Capital, PennantPark Investment Corporation, Semtech, StoneX, Symbotic, WeRide, Zoom

Tuesday (11/25): Alibaba, Ambarella, Analog Devices, Anavex, Amentum, Burlington, CleanSpark, Kohl's, NIO, Nutanix, PagerDuty, Pony.ai, Urban Outfitters, Verizon, Visa, Workday, Zscaler

Wednesday (11/26): EHang, Haidilao, John Deere, NetApp, StoneCo

Thursday (11/27): Markets Closed for Thanksgiving Holiday

Friday (11/28): N/A – U.S. Stock Market closes at 1:00 PM

What We’re Watching:

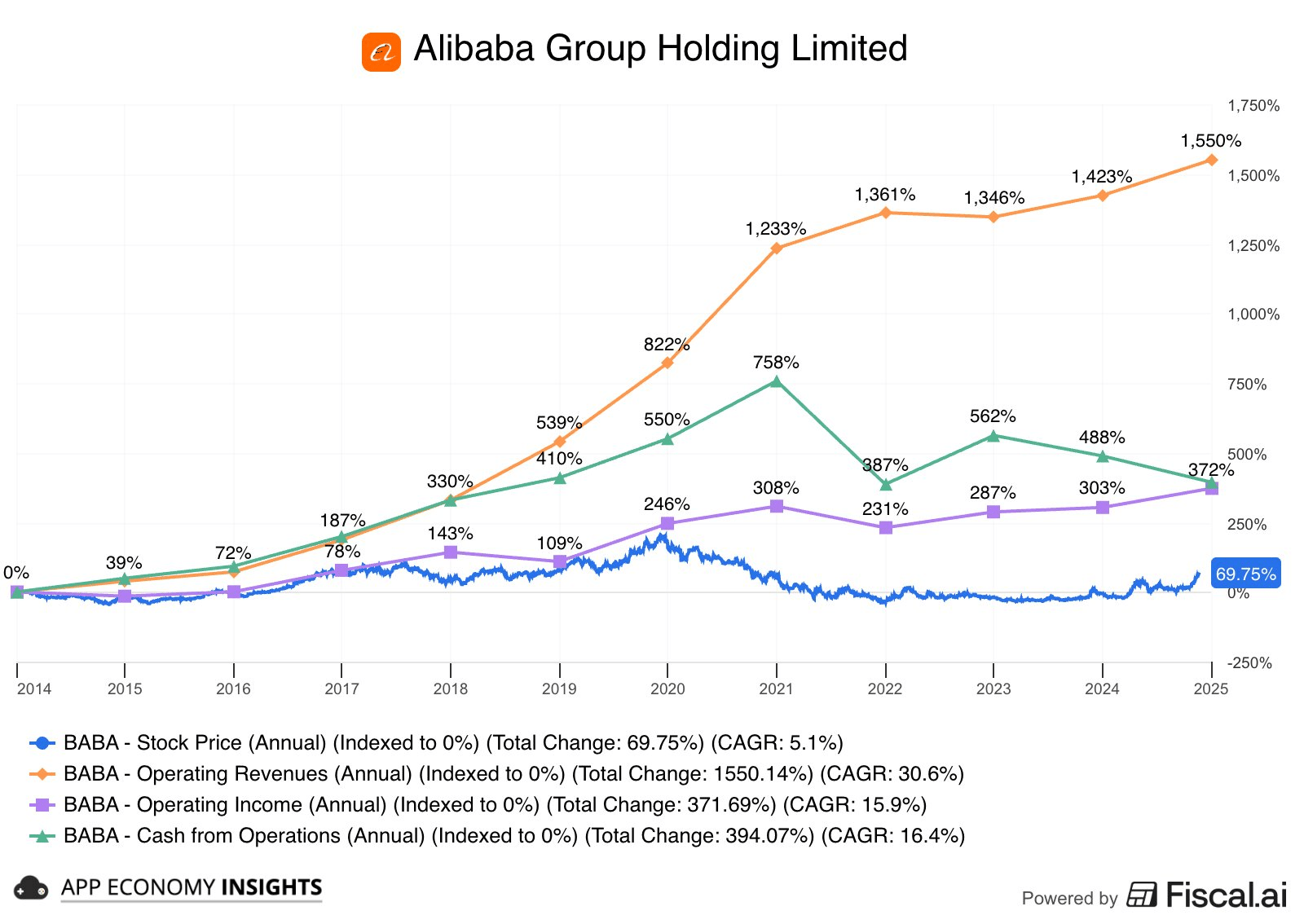

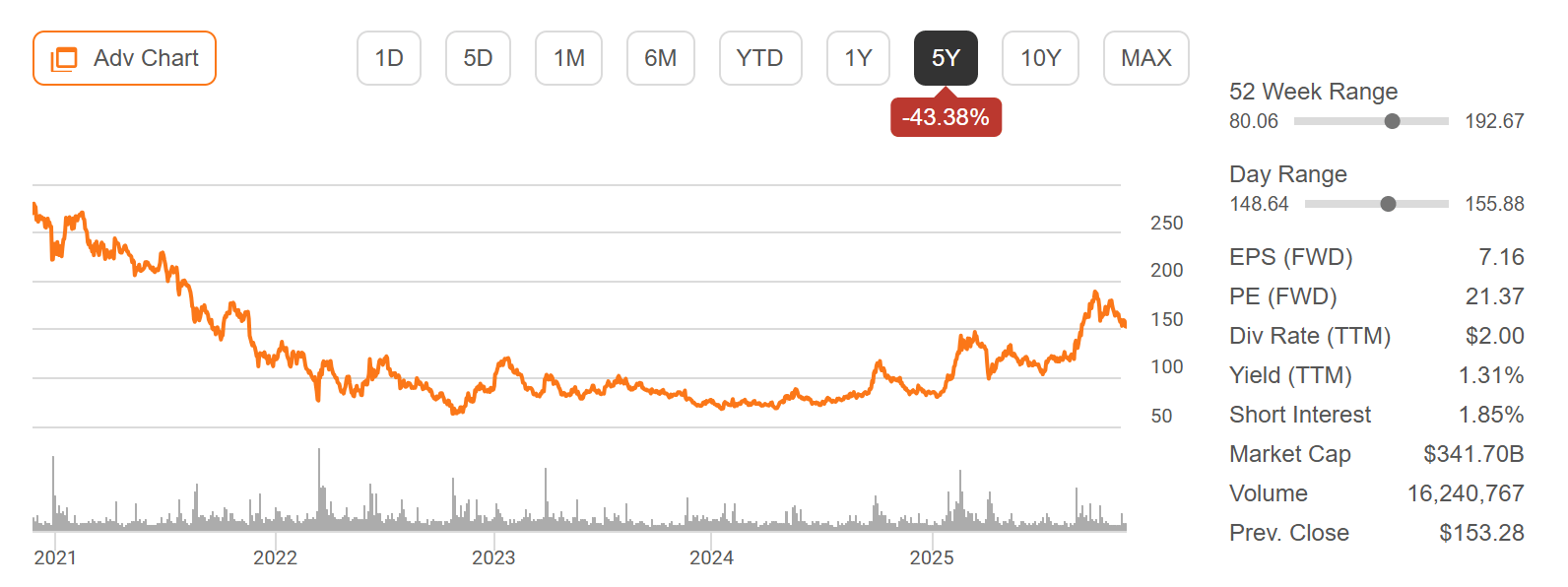

Alibaba (BABA)

Alibaba Group (+80% YTD) reports Q3 FY2025 earnings Thursday before the open, with investors focused on whether China’s largest e-commerce and cloud platform can reaccelerate growth amid a fragile domestic economy and ongoing restructuring across its business units. Alibaba remains a barometer for Chinese consumer demand – but macro softness, intense competition, and regulatory pressure have kept expectations muted.

Last quarter, Alibaba posted RMB 241.2 billion in revenue (+8% YoY) and RMB 15.1 in adjusted EPS (+12% YoY), with strength in Taobao & Tmall Group and improving profitability in its Cloud Intelligence segment. Cloud revenue grew +12%, supported by enterprise AI adoption, while International Commerce (+19%) continued to scale on the back of AliExpress Choice and Lazada.

For this quarter, I’ll be watching GMV trends across Taobao/Tmall, cloud growth tied to China’s AI rollout, and the pace of cost optimization under the company’s simplified six-business-group structure. Management’s commentary on consumer sentiment, competitive intensity, and capital return plans will also be critical for investor sentiment.

“We are simplifying our organization and focusing on our core businesses so we can return Alibaba to sustainable, high-quality growth.”

Alibaba Group Holding Limited (BABA) Stock Performance, 5-Year Chart, Seeking Alpha

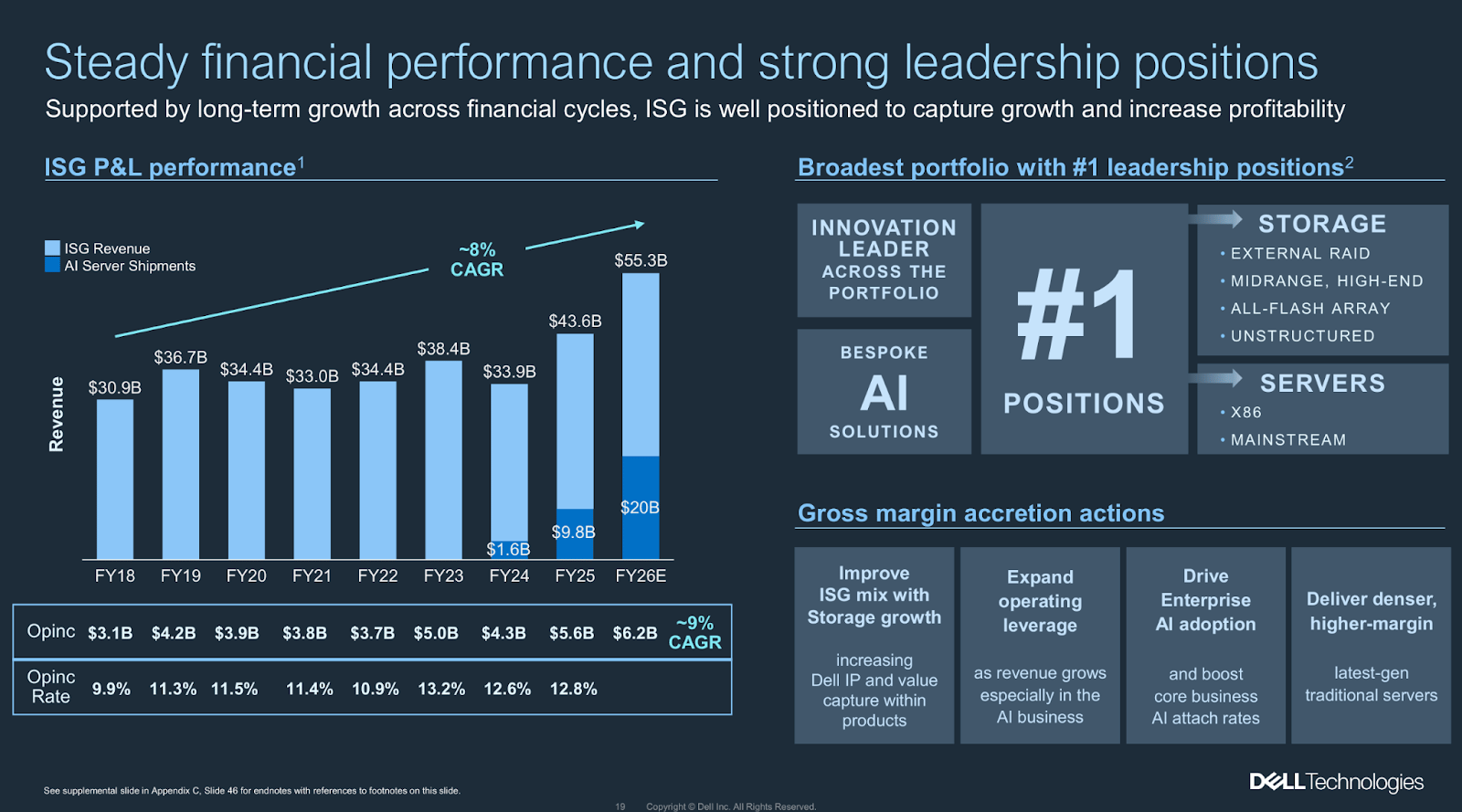

Dell (DELL)

Dell Technologies (+6% YTD) reports Q3 FY2025 earnings Thursday after the close, with investors focused on whether the company can maintain momentum in AI-driven server and storage demand while stabilizing softer PC shipments. Dell has become one of the biggest hardware beneficiaries of the AI buildout, but questions remain around margins and how quickly new AI-optimized servers convert to revenue.

Last quarter, Dell delivered $23.5 billion in revenue (+7% YoY) and $1.89 in adjusted EPS (+12% YoY), beating expectations as AI-server orders surged more than 100% YoY and backlog expanded sharply. Infrastructure Solutions Group revenue climbed +15%, while Client Solutions (PCs) showed early signs of recovery but remained choppy due to weak commercial demand.

For Q3, I’ll be watching the AI server backlog and conversion rate, margin trends in Infrastructure Solutions, and whether PC demand stabilizes into year-end. Commentary on supply constraints, pricing, and the pace of enterprise AI adoption will be key for the next leg of the stock.

“AI servers continue to drive exceptional demand – and we’re only in the early innings of modernization.”

Dell Technologies, Inc. (DELL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

AI bond surge pressures credit & tech markets, Michael Burry teases new disclosure, and markets reprice December rate-cut odds.

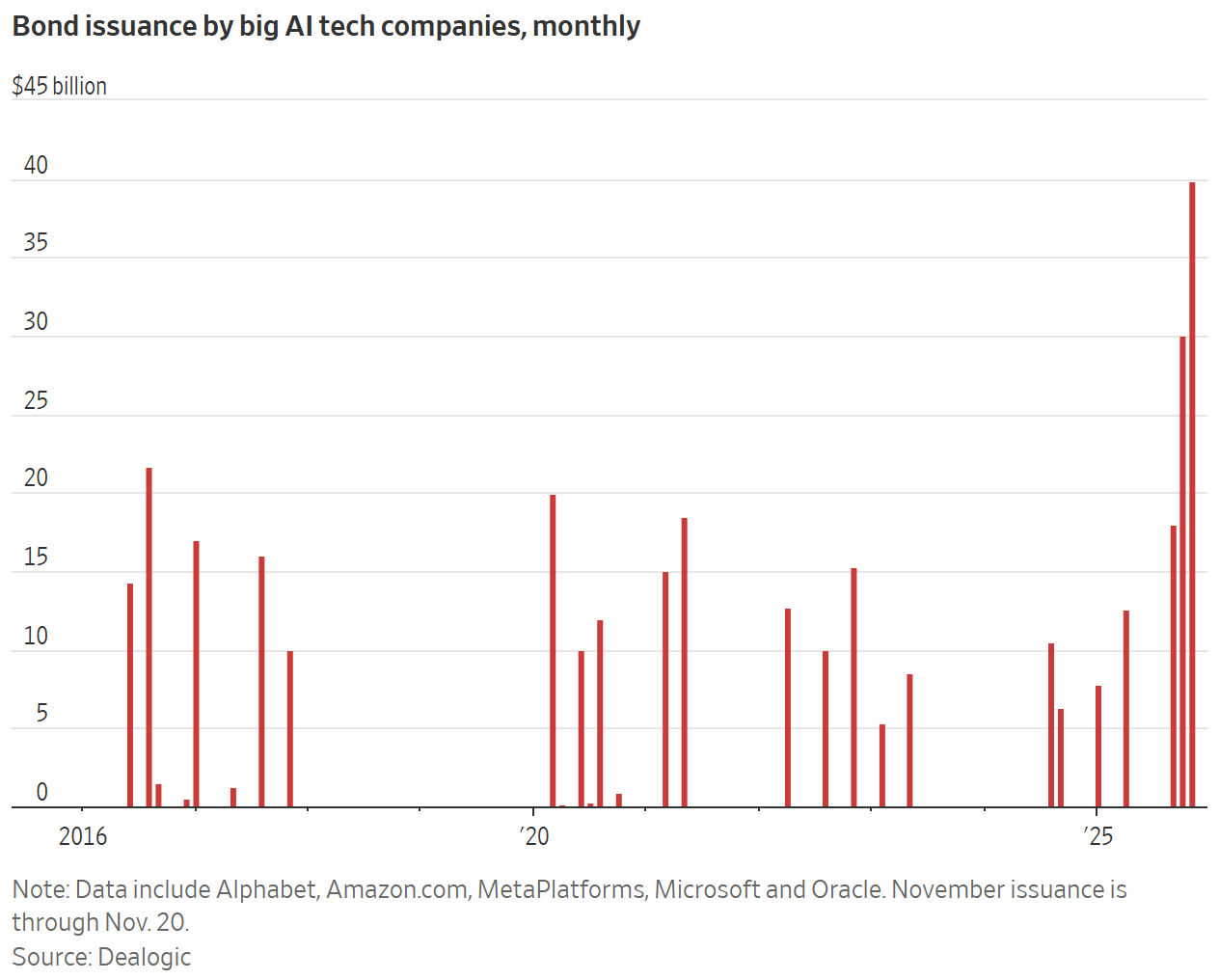

AI Bond Surge Pressures Credit & Tech Markets

Wall Street is absorbing a flood of new debt from AI-heavy tech companies, creating unexpected strain across credit markets. Since early September, Amazon, Alphabet, Meta, and Oracle have issued nearly $90B in investment-grade bonds – more than the previous 40 months combined. AI data-center developers like TeraWulf and Cipher Mining have added another $7B in high-yield issuance.

The surge has pushed borrowing costs higher, driven newly issued bonds lower in secondary trading, and increased credit-default-swap pricing as investors reassess leverage tied to massive AI spending. Equity markets are feeling the pressure too, with the Nasdaq down ~3% this month, as weakness in AI credit spills over into tech stocks.

While cash-rich giants like Amazon and Alphabet are better positioned, Meta and Oracle may need to rely more heavily on debt to fund ambitious AI buildouts – raising questions about balance-sheet durability and long-term returns on these investments.

“The markets are very interconnected now. It will be hard for the credit markets to do well if AI stocks are selling off – and vice versa.”

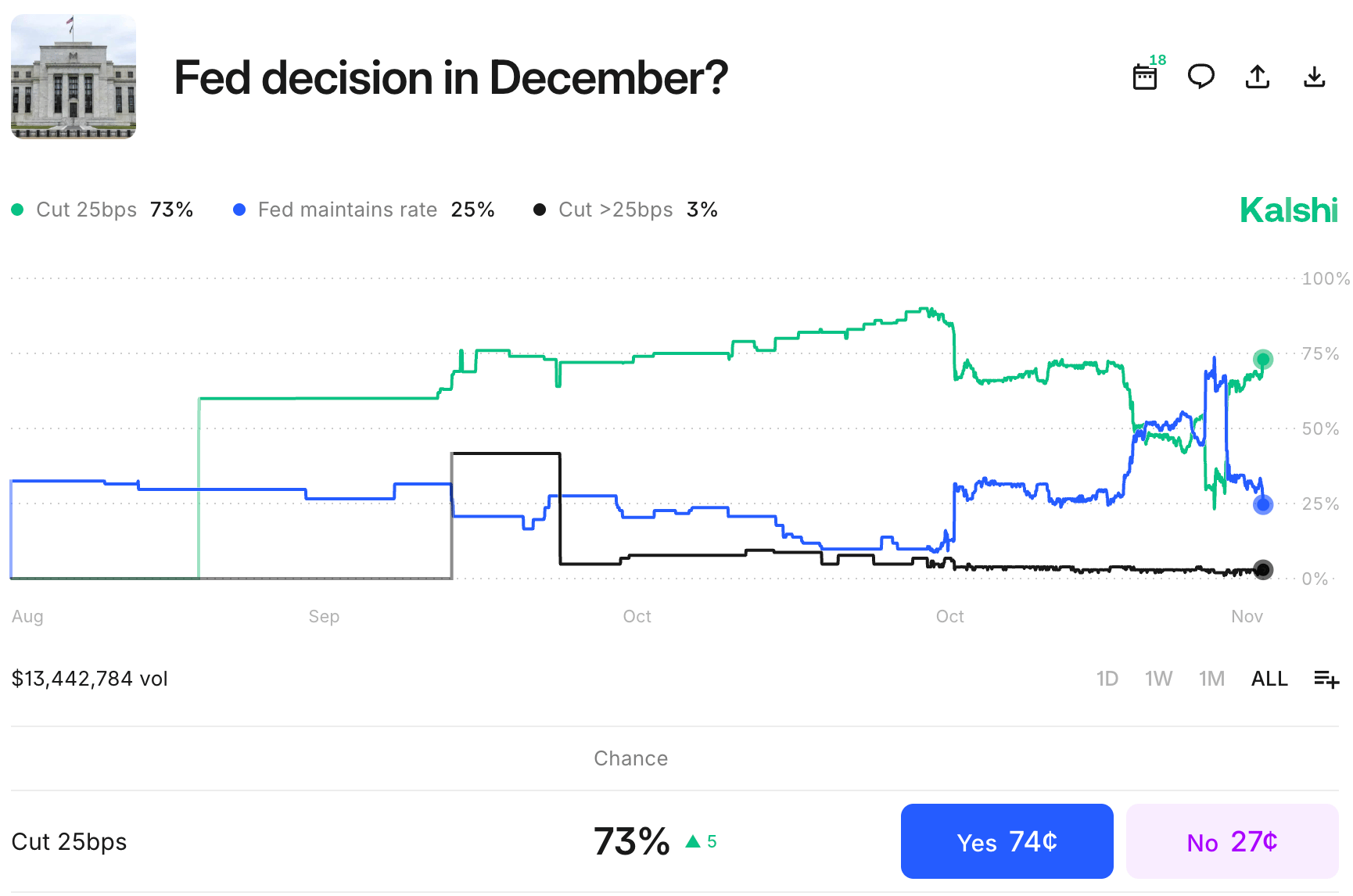

Markets Reprice December Rate-Cut Odds

Rate-cut expectations flipped sharply this week, with markets now assigning meaningfully higher odds to a 25bps cut at the December FOMC meeting — a major reversal from just days ago when a hold was overwhelmingly expected.

The shift came as a widely circulated post on X claimed that several senior banking executives had contacted Fed Chair Jerome Powell to express “grave concerns” about global financial risks tied to Japan’s monetary trajectory and urged the Fed to move sooner on easing. While unconfirmed, the timing aligned closely with the sudden repricing in Fed funds futures.

If the market continues to price in a December cut, it could accelerate a risk-asset rebound sooner than expected. A rate cut also complicates prior expectations of a possible retest of the major indices’ 200-day moving averages — a scenario that looked more likely before this shift in policy odds.

“A larger-than-usual number of US data releases have been bunched together due to the government shutdown. Furthermore, the December Fed meeting remains pivotal, with markets split between a cut and a hold. That pricing is likely to shift decisively, potentially even on the day of the meeting. All told, that makes for elevated market anxiety deep into the festive season.”

Major Economic Events:

The Producer Price Index (PPI) and retail sales headline the short week.

Monday (11/24): N/A

Tuesday (11/25): Business Inventories (Delayed Report), Consumer Confidence, Core PPI, Core PPI Year Over Year, Pending Home Sales, PPI Year Over Year, Producer Price Index (Delayed Report), S&P Case-Shiller Home Price Index (20 Cities), U.S. Retail Sales (Delayed Report), U.S. Retail Sales Minus Autos

Wednesday (11/26): Durable Goods Minus Transportation (Delayed Report), Durable Goods Orders (Delayed Report), Initial Jobless Claims

Thursday (11/27): None Scheduled – Thanksgiving Holiday

Friday (11/28): Chicago Business Barometer (PMI)

What We’re Watching:

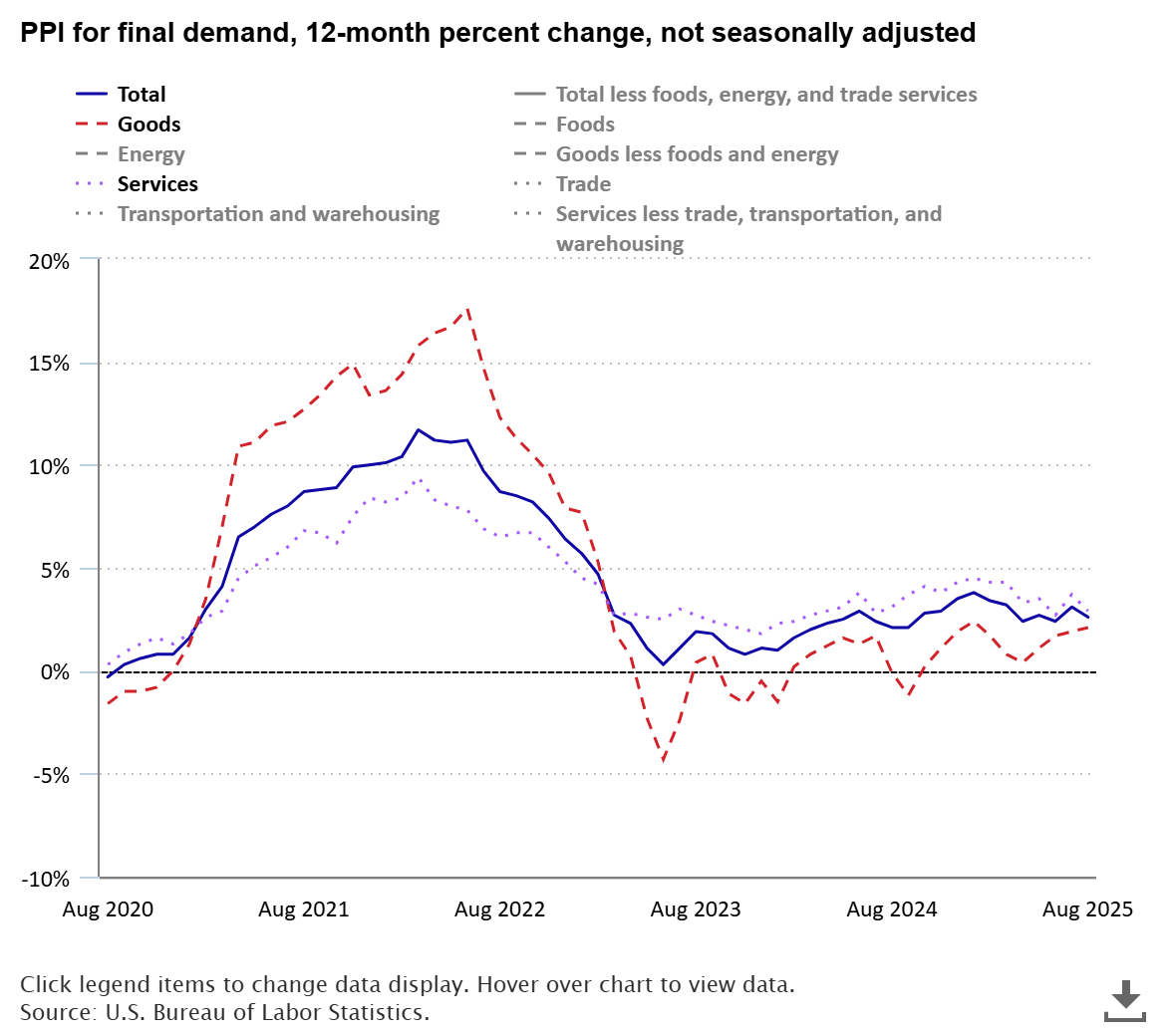

Producer Price Index

U.S. producer prices fell 0.1% in August, a sharp downside surprise versus expectations for a +0.3% increase and marking the first decline in four months. The drop was driven by a 0.2% fall in services prices, the biggest slide since April, led by a 3.9% drop in machinery and vehicle wholesaling margins. Several other service categories – including commercial equipment, chemicals, furniture, food retailing, and data processing – also weakened.

Goods prices edged +0.1% higher, supported by a 2.3% jump in tobacco products and increases in beef, poultry, printed circuit assemblies, and electric power.

Year-over-year, headline PPI slowed to +2.6% (down from 3.1% prior), while core PPI also declined 0.1% MoM, pulling the annual core rate down to 2.8%, underscoring easing upstream inflation pressures.

Economists expect the following this week:

Headline PPI (MoM): -0.1% vs. +0.3% expected

Core PPI (MoM): -0.1% vs. +0.3% expected

Headline PPI (YoY): +2.6% vs. +3.1% prior

“Producer inflation is losing momentum, signaling that pipeline price pressures are softening even before they reach consumers.”

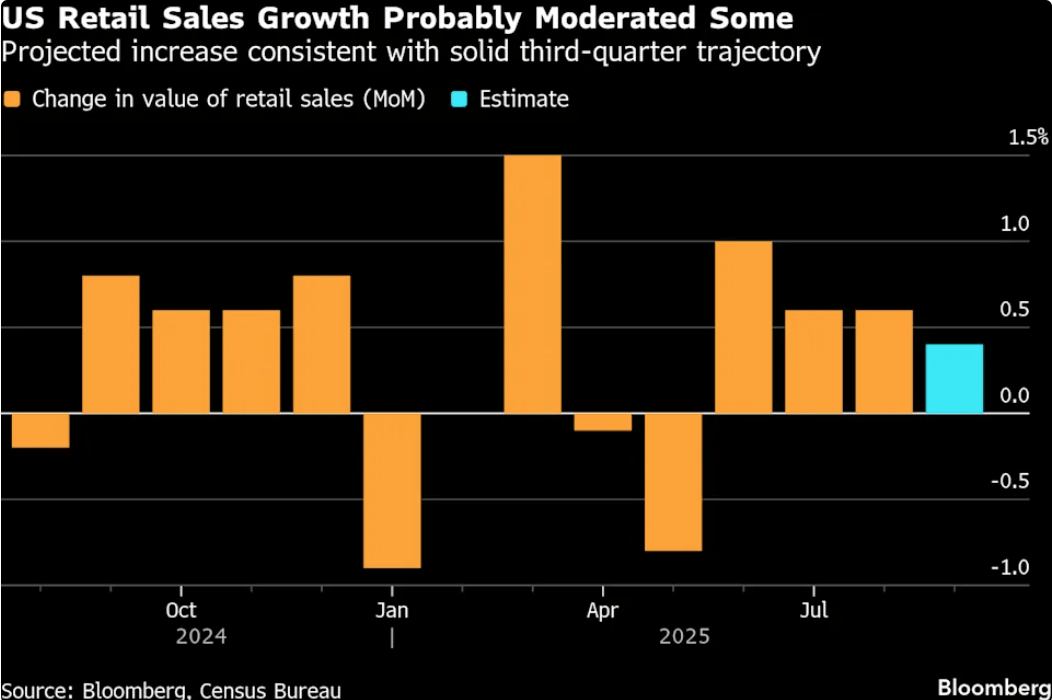

Retail Sales

U.S. retail sales rose 0.6% MoM in August, matching July’s upwardly revised gain and handily beating expectations for a 0.2% increase. The report shows consumers are still spending despite higher prices and weaker sentiment, with strength concentrated in categories tied to online shopping, discretionary goods, and dining.

Non-store retailers led the month (+2.0%), followed by clothing (+1.0%), sporting goods & hobbies (+0.8%), restaurants & bars (+0.7%), and gasoline stations (+0.5%). Auto sales also firmed (+0.5%). Weakness showed up in miscellaneous stores (-1.1%), furniture (-0.3%), and general merchandise (-0.1%).

Core retail sales – the category used in GDP calculations, excluding autos, gas, food services, and building materials – jumped 0.7%, beating expectations and marking a second straight month of strong underlying demand.

Economists expect the following this week:

Headline Retail Sales (MoM): +0.6% vs. +0.2% expected

Core Retail Sales (MoM): +0.7% vs. +0.4% expected

“Consumer spending isn’t booming, but it’s proving far more resilient than many feared heading into the second half of the year.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: AI Image from TradingView

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]