- GRIT

- Posts

- 👉 The First Big Earnings Reports of 2026

👉 The First Big Earnings Reports of 2026

Delta, JPMorgan, Taiwan Semi

Welcome to your new week.

And just like that… we’re back in the thick of it. Earnings reports are picking back up, Trump news is constant, major conferences are dominating headlines, and everyone awaits the next moves by the Fed.

Read on for everything you should be watching this week.

CLICK HERE to sign up for today’s livestream! It will take place today — Monday, January 12th — at 5pm ET.

If you can’t make it, you’ll still be able to access the recording.

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Key Earnings Announcements:

As usual — big banks kick off the next set of earnings reports. Here we go!

Monday (1/12): N/A

Tuesday (1/13): Bank of New York Melon, Delta, JPMorgan Chase

Wednesday (1/14): Bank of America, Citi Bank, Wells Fargo

Thursday (1/15): BlackRock, Goldman Sachs, J.B. Hunt, Morgan Stanley, Taiwan Semi

Friday (1/16): PNC, Regions, State Street

What We’re Watching:

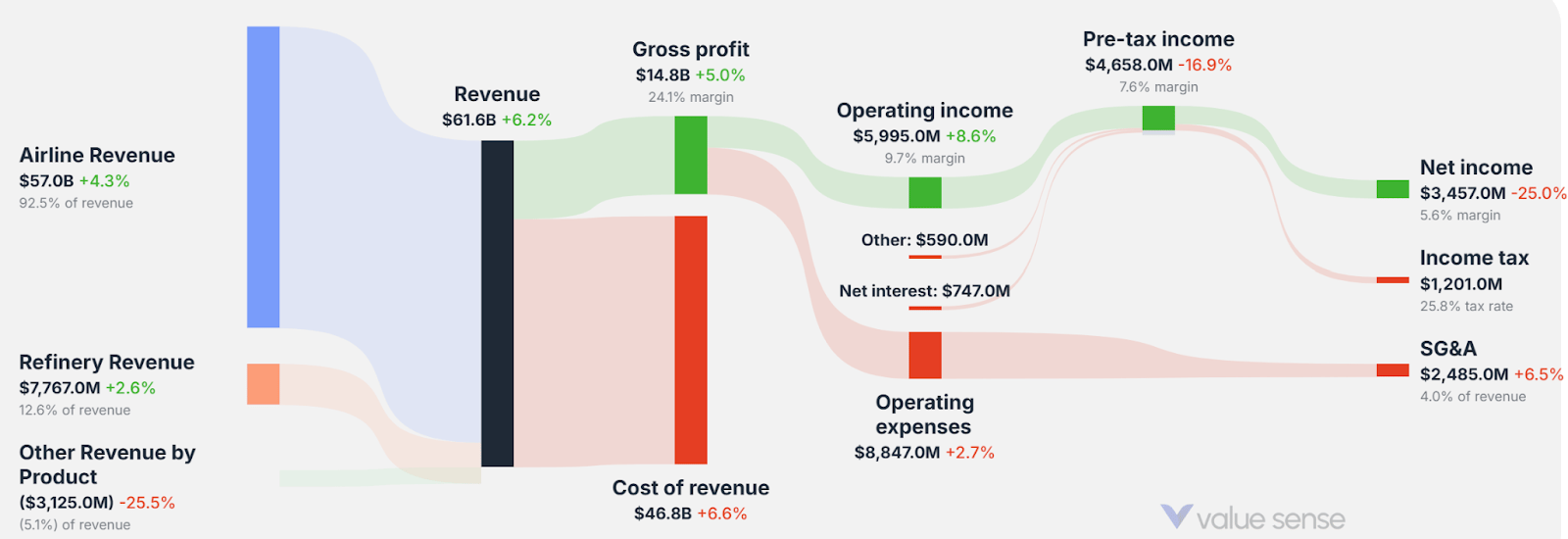

Delta Air Lines (DAL)

Delta Air Lines (+8% 1-Year) reports Q4 FY2025 earnings Thursday before the open, with investors focused on whether strong travel demand and premium cabin growth can continue to offset rising costs and a more price-sensitive consumer. Delta remains the highest-margin major U.S. carrier, but fuel prices, labor costs, and corporate travel trends are key variables heading into 2026.

Last quarter, Delta delivered $15.5 billion in revenue (+6% YoY) and $2.04 in adjusted EPS, beating expectations as international travel, premium seating, and loyalty revenue remained strong. Operating margin held above 13%, supported by pricing power in premium cabins and continued strength in credit-card and loyalty partnerships.

For this quarter, I’ll be focused on whether yield strength is holding across premium and international routes, how fuel and labor costs are tracking, and whether management adjusts capacity or margin guidance for 2026. Updates on loyalty revenue and corporate-travel trends will also be key drivers for sentiment.

“Demand for premium and international travel continues to outperform, giving us confidence in our long-term margin profile.”

Delta Air Lines, Inc. (DAL) Stock Performance, 5-Year Chart, Seeking Alpha

JPMorgan Chase (JPM)

JPMorgan Chase (+37.2% 1-Year) reports Q4 FY2025 earnings Friday before the open, with investors focused on whether the largest U.S. bank can sustain profit growth as net interest income peaks and consumer credit conditions begin to soften. JPM remains the bellwether for U.S. financials, but rising delinquencies, regulatory uncertainty, and shifting rate expectations are becoming more important swing factors for 2026.

Last quarter, JPM posted $42.3 billion in revenue (+8% YoY) and $4.33 in adjusted EPS (+18% YoY), beating expectations as investment banking rebounded and trading activity picked up. Net interest income remained strong, though management flagged that deposit betas are rising and loan growth is slowing, particularly in commercial real estate and credit cards.

Heading into this print, I’ll be watching trends in net interest income, credit-card charge-offs, and commercial loan growth, as well as updates on capital returns and regulatory capital requirements. Commentary on consumer health, deposit competition, and how the bank is positioning for a lower-rate environment will be key for the stock.

“We’re seeing a normalization of credit while the economy continues to show resilience.”

JPMorgan Chase & Co. (JPM) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

The largest consumer conference returns to the spotlight in Orlando, markets react to Trump’s call for a 10% credit card rate cap, and the JPMorgan Healthcare Conference kicks off in San Francisco.

ICR Conference

Source: icrconference.com

ICR Conference — one of the most important events on the retail calendar — kicks off this week in Orlando, Florida. Major companies are expected to provide holiday sales updates, margin commentary, and fresh full-year guidance. The conference often drives post-holiday revisions to earnings forecasts and sets the tone for how Wall Street views consumer demand heading into the new year.

Notable participants include Walmart (WMT), Urban Outfitters (URBN), Shake Shack (SHAK), Movado (MOV), Yeti (YETI), and more.

“The super bowl of consumer conferences.”

JPMorgan Healthcare Conference Kicks Off in San Francisco

The four-day JPMorgan Healthcare Conference begins this week, bringing together the world’s largest pharmaceutical, biotech, and medical-device companies with institutional investors. Heavyweights including Johnson & Johnson, Novartis, AstraZeneca, Bristol-Myers Squibb, and Kodiak Sciences will present on pipelines, clinical data, M&A priorities, and 2026 growth outlooks.

This year’s event carries added weight after a volatile year for biotech and a surge in dealmaking expectations, with investors watching closely for signals on drug pricing, capital allocation, and late-stage trial readouts.

A key moment will be the keynote from FDA Commissioner Marty Makary, who is expected to outline the agency’s priorities around accelerated approvals, AI-driven drug development, and safety and efficacy standards – guidance that could shape regulatory risk and valuation across the sector for the year ahead.

“The conference often sets the tone for the year ahead, and will offer an early pulse on what the health-care industry could look like in 2026. Executives from companies large and small are expected to roll out key business and drug pipeline updates, announce splashy M&A deals and offer their read on industry sentiment more than a year into Trump 2.0.”

Markets React to Trump’s Call for a 10% Credit Card Rate Cap

President Trump’s call for a one-year 10% cap on credit-card interest rates starting Jan. 20, 2026 has injected a new policy variable into consumer finance and bank earnings. While the proposal has no formal regulatory backing yet and would likely require congressional action, expect markets to be weighing the implications for lending profitability, consumer behavior, and credit availability.

On top of that, major U.S. banks will report December credit-card metrics this week, offering a real-time snapshot of how stressed the consumer already is before any policy intervention:

American Express, Bank of America, Citigroup, Capital One, Discover, JPMorgan, and Synchrony will all update investors on net charge-offs and delinquency rates.

These reports will be closely watched as:

Delinquencies are rising across subprime and near-prime borrowers

Revolving balances remain near record highs

Funding costs for banks stay elevated

“It's unclear if the president will attempt to enforce his proposed 10% cap through some kind of executive action, or if his goal is to pressure credit card issuers to slash their rates voluntarily.”

Major Economic Events:

Fed speak whirlwind, CPI, PPI, and retail sales highlight this week

Monday (1/12): Fed Speakers (Barkin, Bostic, Williams)

Tuesday (1/13): CPI, Core CPI, CPI Year-over-Year, Core CPI Year-over-Year, NFIB Optimism Index, New Home Sales, U.S. Budget Deficit

Wednesday (1/14): Retail Sales, Retail Sales ex-Autos, PPI, Core PPI, Business Inventories, Existing Home Sales, Fed Beige Book

Thursday (1/15): Initial Jobless Claims, Import Prices, Empire State Manufacturing, Philly Fed Manufacturing

Friday (1/16): Industrial Production, Capacity Utilization

What We’re Watching:

Consumer Price Index

U.S. inflation cooled meaningfully in December, with headline CPI falling to 2.7% YoY, the lowest reading since July and well below expectations for 3.1%. While energy prices remained elevated — led by fuel oil and natural gas — price pressures eased across several core categories, including apparel and new vehicles.

More importantly for the Federal Reserve, core inflation declined to 2.6% YoY, its lowest level since March 2021, beating expectations and signaling broad-based disinflation across the economy. Shelter inflation slowed to 3.0%, while medical care, furnishings, and used vehicles showed moderate increases.

Due to the 43-day government shutdown, October CPI was not collected and November monthly data was not released, but the BLS said prices rose just 0.2% over the two-month period from September through November, reinforcing the cooling trend.

Economists expect the following this week:

• Headline CPI (YoY): 2.7% vs. 3.0% prior

• Core CPI (YoY): 2.6% vs. 3.0% prior

• CPI (MoM): ~+0.2%

“The absence of clean readings on inflation, as well as signs the US labor market is stabilizing after a run of weak payrolls figures, help explain why Federal Reserve officials are expected to hold the line on interest rates in the near-term.”

Producer Price Index

U.S. producer prices rose 0.3% MoM in September, rebounding from August’s unexpected 0.1% decline and landing in line with expectations. The increase was driven almost entirely by higher food and energy costs, with factory-gate food prices jumping 1.1% and energy prices rising 3.5%, led by gains in natural gas liquids and ethanol.

Goods inflation accelerated to 0.9%, its fastest pace in over a year, while services prices remained flat, holding on to the prior month’s decline – a sign that upstream inflation remains concentrated in commodities rather than broad-based pricing power. On an annual basis, PPI held steady at 2.7%, indicating that underlying producer-level inflation has not reaccelerated despite the monthly spike.

The report reinforces the idea that inflation risks are being driven more by volatile energy and food inputs than by demand-driven pricing.

Economists expect the following this week:

• Headline PPI (MoM): +0.3% vs. -0.1% prior

• Headline PPI (YoY): 2.7% vs. 2.7% prior

• Core PPI (MoM): ~0.0%

“With multiple domestic and international reports on the horizon, investors will be assessing whether underlying inflation continues to ease, how consumers and businesses are responding, and what central banks’ next moves might be.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: CoinGeek

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]