- GRIT

- Posts

- 👉 The Market Expects Peace Soon

👉 The Market Expects Peace Soon

Accenture, Darden Restaurants, Tesla Robotaxi

Together with TaxQuotes

Welcome to your new week.

This Friday marks the official start of Summer 2025. We don’t have a crystal ball — but it seems like it’s going to be an insane summer in the markets.

Let’s dive right in to the Investing Week Ahead.

Before you read on — we highly encourage that you schedule a call with TaxQuotes below. They are real people and we’ve enjoyed starting a new partnership with them. If you are stressed about taxes in any way, shape, or form — chat with TaxQuotes!

Putting off dealing with unfiled or unpaid taxes? Don’t let penalties and interest pile up — TaxQuotes can help you get back on track.

Whether you haven’t filed in years or owe more than you can manage, we offer honest, affordable help from the comfort of your home.

Here’s what you’ll get:

📱Free phone consultation

📝Personalized tax investigation report

👫One-on-one guidance through every step of your resolution

Regain control of your finances — it all starts with a free appointment.

👉 Schedule yours here

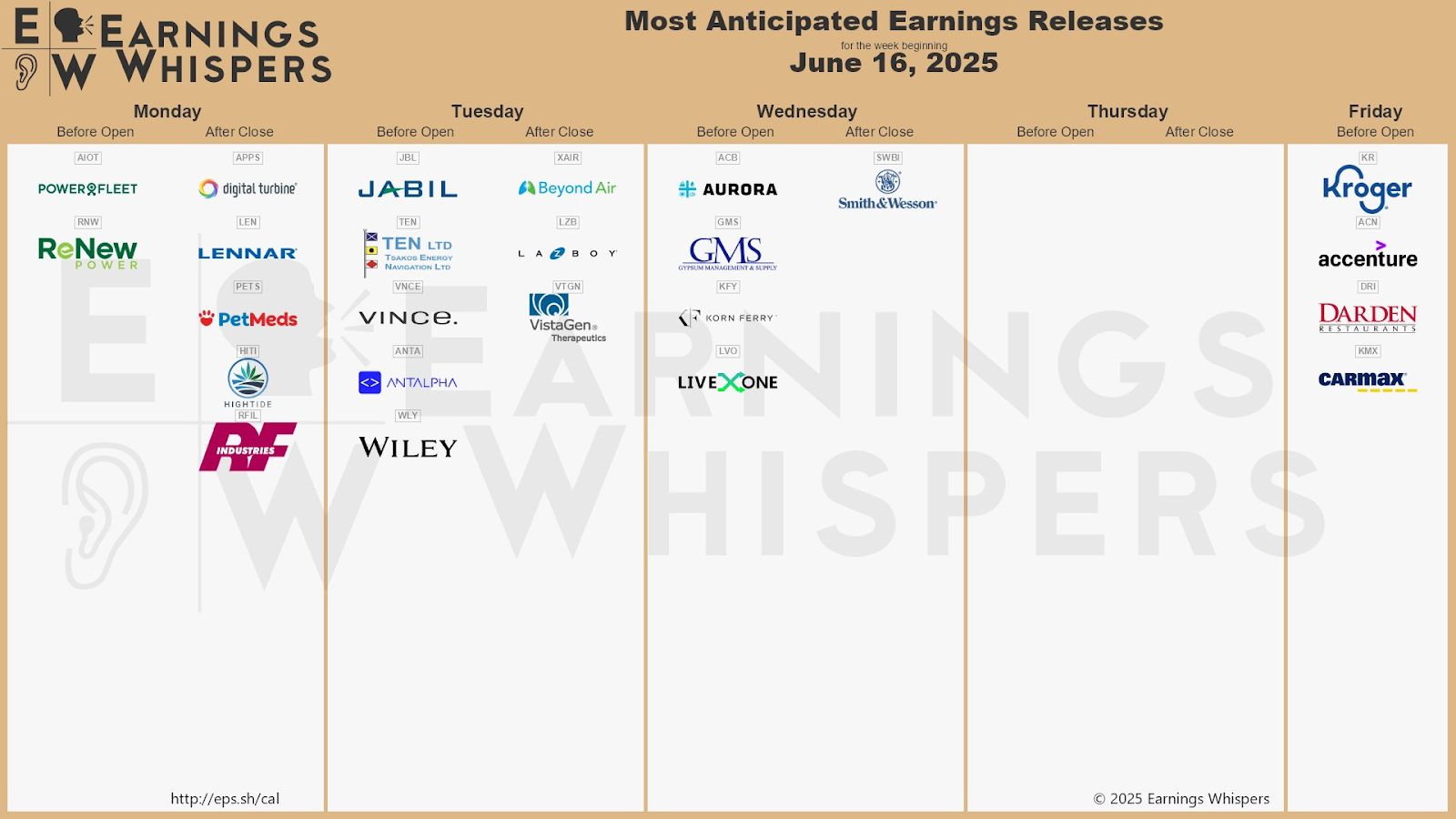

Key Earnings Announcements:

Very small week of earnings — Accenture, Darden Restaurants, Jabil and Kroger headline.

Monday (6/16): Digital Turbine, Lennar, PetMeds, PowerFleet, ReNew Power, SAIC

Tuesday (6/17): Beyond Air, Couchbase, Jabil, La-Z-Boy, Ten Ltd, VistaGen

Wednesday (6/18): Aurora Cannabis, GMS, Korn Ferry, LiveOne, Smith & Wesson

Thursday (6/19): None Scheduled (Juneteenth Holiday)

Friday (6/20): Accenture, CarMax, Darden Restaurants, Kroger

What We’re Watching:

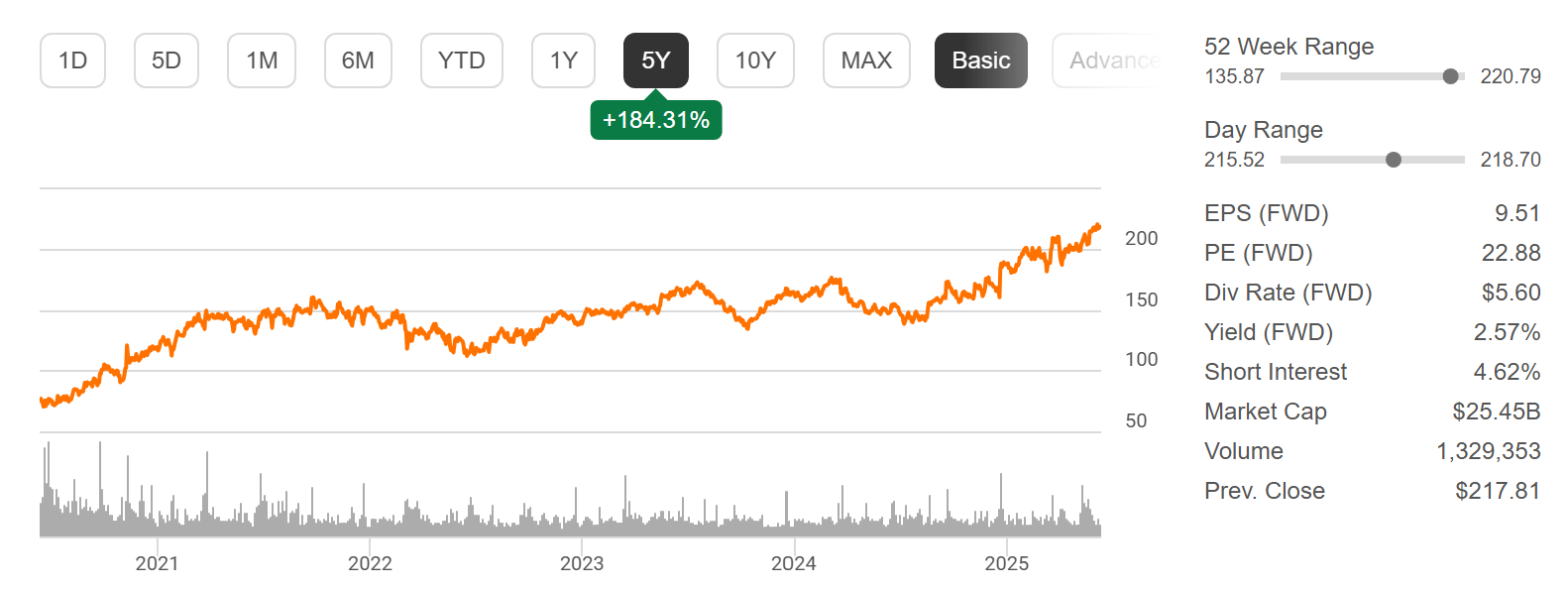

Accenture (ACN)

Source: Q2 FY25 Performance Presentation

Accenture reports earnings Thursday before the bell, with its stock down -11.4% YTD. Investor focus will be on momentum in new bookings, particularly in generative AI services, where Accenture has made sizable investments. But ongoing margin compression, macro headwinds, and uncertainty in federal contracts have kept sentiment muted.

Key metrics to watch include consulting vs. outsourcing mix, headcount trends, and updated FY guidance amid rising competitive intensity.

“We continue to scale AI responsibly and rapidly — but with a clear eye on driving productivity and business value for our clients.”

Accenture plc (ACN) Stock Performance, 5-Year Chart, Seeking Alpha

Darden Restaurants (DRI)

Source: Darden Restaurants Investor Relations

Darden Restaurants reports earnings Friday before the bell. Shares are up +45% over the past year due to strong casual-dining trends and resilient traffic at core brands like Olive Garden and LongHorn Steakhouse.

Last quarter, total sales grew +6.2% to $3.16B — with LongHorn delivering a standout +7.5% same-restaurant-sales gain while Darden raised its full-year outlook

Investors will be watching for continued momentum in middle-income segments, margin stability amidst wage & tariff pressures, and updates on expansion plans. Darden is on track to open 50–55 new locations this year. Commentary on fine-dining versus casual demand, value positioning, and cost control will be key metrics to assess as the consumer spending environment remains uncertain.

Darden Restaurants, Inc. (DRI) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Israel / Iran tensions escalate, the Paris Air Show comes at an interesting time, and Tesla’s Robotaxi could be officially launching as soon as Sunday.

Israel / Iran Exchange Escalates

Iron Dome Defense System via Leo Correa / AP

Tensions spiked dramatically this week after Israel struck over 80 sites across Iran — including Tehran and strategic fuel infrastructure — prompting Iran to launch more than 200 missiles and drones (killing at least 13 people in Israel). The tensions are being viewed as Israel’s most extensive strike campaign yet, including targeted attacks on energy and nuclear facilities.

Global oil prices surged over +7% amid fears of supply disruptions, while equities faltered and safe-haven assets rallied. If hostilities intensify or Iran targets shipping routes, oil prices could spike further — adding new inflation risks just as the Fed looks to stay on hold.

Israeli officials have reportedly called on the United States to join the war more directly. There are also reports that “Tehran is ready to abandon enrichment but needs a face-saving exit.” Keep in mind — we don’t know if either of those headlines are 100% accurate. Situations like these are filled with constant confusion and conflicting headlines — leading to volatility.

Let’s hope this conflict can be resolved soon to save as many lives as possible. The global affairs leadership of President Trump is being tested to its fullest extent this week.

Our take? This will not turn into a full-blown war, and will be relatively short-lived. That doesn’t mean full resolutions will take place, but we don’t believe that missiles are going to continue flying for weeks on end. It seems like the market agrees with us right now.

“Iran maintains that its nuclear program is peaceful, and the U.S. and others have assessed that Tehran has not pursued a nuclear weapon since 2003. But the head of the International Atomic Energy Agency has repeatedly warned that the country has enough enriched uranium to make several nuclear bombs if it chooses to do so.”

Paris Air Show

Source: GE Aerospace X

The Paris Air Show kicks off this week, offering a key stage for aerospace giants like Boeing, Airbus, GE Aerospace, and Honeywell to unveil next-gen tech, lock in major aircraft orders, and shift investor sentiment. With defense spending rising and commercial demand rebounding, the event could set the tone for the second half of 2025 across the aviation and aerospace sectors.

Source: GE Aerospace X

Over the past week — President Trump has signed an executive order on drones, flying cars, and supersonics + a London-bound Boeing 787 crashed in India, killing 270+ people. Oh — and the political unrest of the Middle East has reached this event as well. The French government blocked the displays of two major Israeli defense companies just before the conference started.

Aircraft updates of all kinds have been dominating the headlines, and we’d expect some exciting news to come out of the Paris Air Show.

“As our industry prepares to start the Paris Air Show, [Boeing Commercial Airplanes CEO Stephanie Pope] and I have both canceled plans to attend so we can be with our team, and focus on our customer and the investigation”

Tesla (TSLA) Robotaxi Launch Coming Soon?

Tesla could launch its long-awaited robotaxi service in Austin as early as June 22, according to a recent social media post from CEO Elon Musk. The rollout would mark a pivotal moment in Tesla’s push to dominate autonomous mobility — an area Musk has called the company’s “most important” long-term initiative. Analysts say Tesla’s full-stack AI approach and vehicle production scale give it an edge in the robotaxi race, with Goldman Sachs noting its potential to lead the market in self-driving tech.

Robotaxis and humanoid robots are keeping me LONG on TSLA — and I will be indefinitely. I’ll be sure to keep you posted if that ever changes.

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

"We are being super paranoid about safety, so the date could shift."

“It is a very precise machine. It was driving really well on Austin streets, but more aggressively than I would have chosen. If somebody changes their direction walking or biking, that could pose a problem. It’s critical that police and emergency personnel know how to talk to these vehicles—using consistent hand signals and gestures. Waymo already does this. Tesla and others should, too.”

Major Economic Events:

The FOMC interest rate decision and retail sales are the spotlight.

Monday (6/16): Empire State Manufacturing Survey

Tuesday (6/17): Business Inventories, Capacity Utilization, Home Builder Confidence Index, Import Price Index, Import Price Index Minus Fuel, Industrial Production, Retail Sales, Retail Sales Minus Autos

Wednesday (6/18): Building Permits, FOMC Interest-Rate Decision, Fed Chair Powell Press Conference, Housing Starts, Initial Jobless Claims

Thursday (6/19): None Scheduled (Juneteenth Holiday)

Friday (6/20): Philadelphia Fed Manufacturing Survey, U.S. Leading Economic Indicators

What We’re Watching:

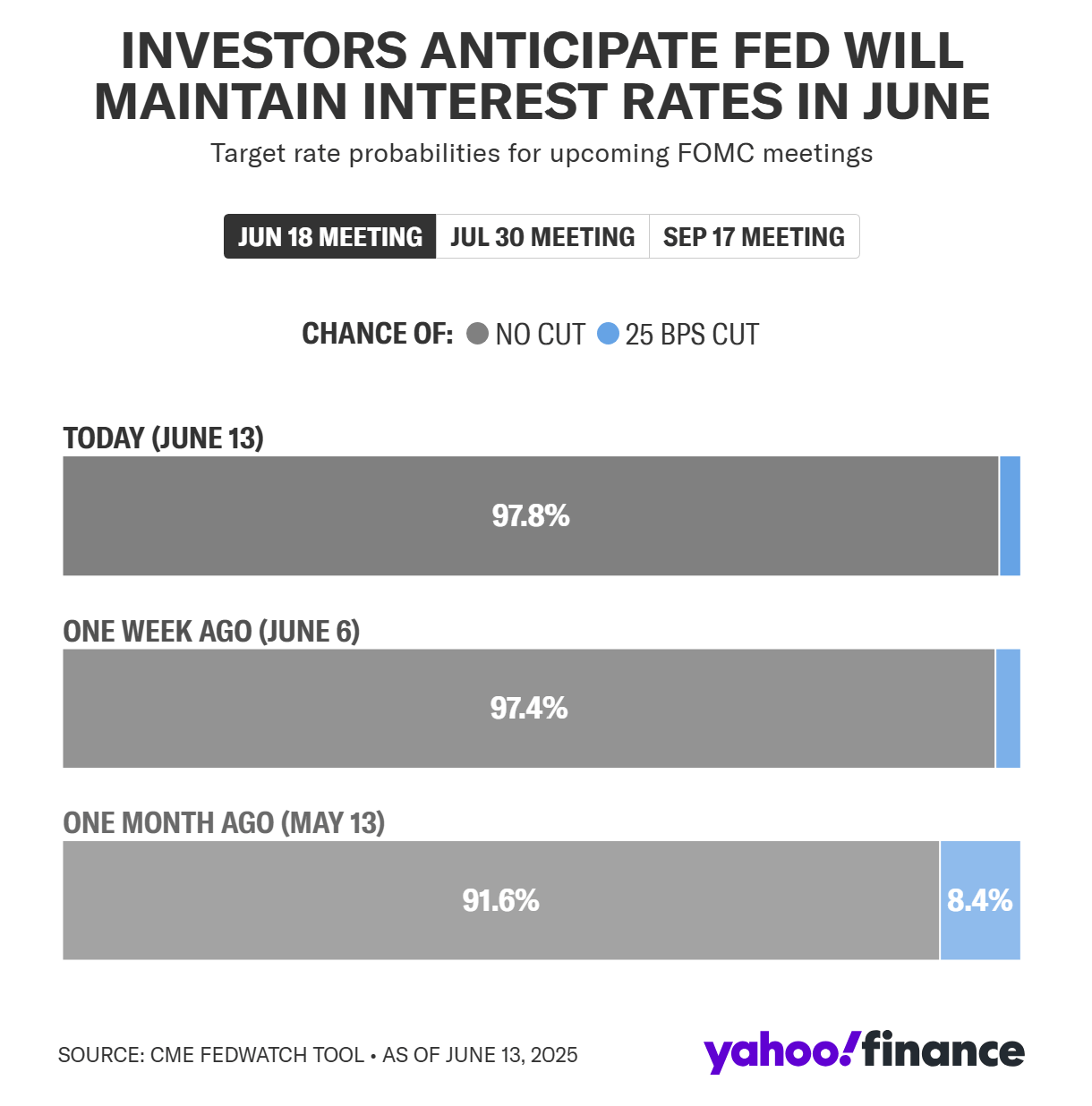

FOMC Interest-Rate Decision

The Fed is widely expected to hold rates steady this week, as officials balance solid labor market data with signs of cooling inflation and rising tariff-related uncertainty. Despite President Trump’s public push for a full percentage point rate cut, markets don’t anticipate any action when the FOMC meeting concludes Wednesday. Instead, all eyes will be on Chair Powell’s press conference for updated economic forecasts and clues on timing for potential cuts later this year.

Current Fed Funds Rate: 4.25%–4.50%

Market expectations: No rate change in June or July (according to the CME FedWatch Tool)

“Our decisions will continue to be guided by the data—retail sales, inflation, and employment all play a role in shaping the path ahead.”

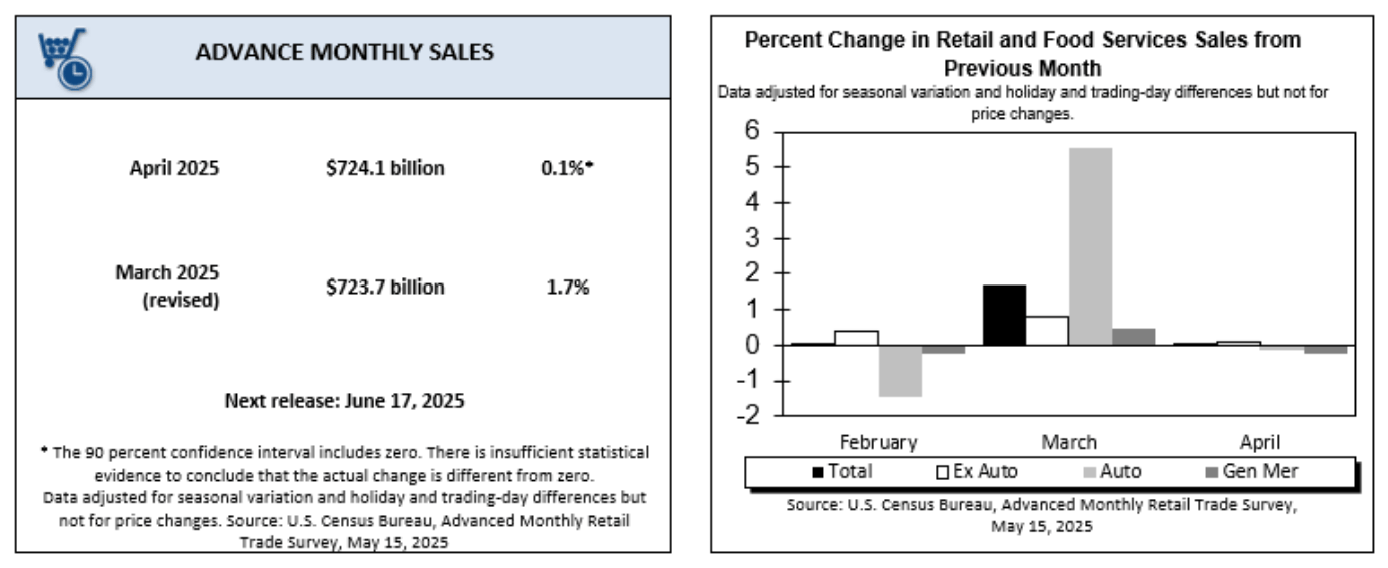

Retail Sales

U.S. retail sales rose just +0.1% in April, a sharp slowdown from March’s upwardly revised +1.7% gain, as consumers pulled back after a wave of tariff announcements early in the month. Categories like dining (+1.2%) and home improvement (+0.8%) led gains, while discretionary segments such as sporting goods (-2.5%) and apparel (-0.4%) declined. Core retail sale — the GDP component — fell -0.2%, suggesting consumer strength may be softening under inflation and policy uncertainty.

Economists expect the following this week:

Retail Sales — +0.2% month-over-month

Retail Sales ex-Auto — +0.3% month-over-month

“Despite declines in confidence caused by the economic uncertainty that has come with tariffs, consumer fundamentals remain intact. Consumers maintain their ability to spend and have strong reasons to spend now before tariffs can drive up prices or cause shortages on store shelves.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: NBC News

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]