- GRIT

- Posts

- 👉 Trade News Coming SOON

👉 Trade News Coming SOON

Apple Conference, GitLab, Oracle

Welcome to your new week.

One of the biggest weeks of the year for inflation data, US / China trade talks in London, Apple’s WWDC event, and much more are on the schedule this week.

Our next livestream is TODAY (Monday) at 4pm ET. To sign up — click here!

Throughout the summer — I’ll be sharing weekly portfolio updates, breaking down all of the most important earnings reports, and much more. We’d love to have you as a premium subscriber to receive all the analysis + portfolio access!

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Key Earnings Announcements:

A much quieter week of earnings — headlined by Adobe, Oracle, GameStop, Gitlab, and RH.

Monday (6/9): Casey’s, Skillsoft

Tuesday (6/10): Academy Sports, Core & Main, GameStop, Gitlab

Wednesday (6/11): Chewy, Oracle, Victoria’s Secret

Thursday (6/12): Adobe, Lovesac, RH

Friday (6/13): N/A

What We’re Watching:

GitLab (GTLB)

Source: Github Earnings Deck

GitLab reports earnings Tuesday after the bell. Shares are down -13.5% YTD, buoyed by strong demand for its AI-powered DevSecOps platform. Last quarter, ARR grew steadily, with retention above 125% and enterprise adoption on the rise.

This earnings cycle, investors will focus on how GitLab continues scaling AI features like Duo Chat and transparency tools, whether new government contracts gain traction, and if operating margins expand as the company pushes toward profitability. I’ll also be tuning in for guidance on FY2026 growth and CapEx plans tied to AI infrastructure.

“By 2027, the number of platform engineering teams using AI to augment every phase of the SDLC will have increased from 5% to 40%.”

“By 2027, 75% of organizations will have switched from multiple point solutions to DevOps platforms to streamline application delivery, up from 25% in 2023.”

Gitlab Inc. (GTLB) Stock Performance, All-Time Chart, Seeking Alpha

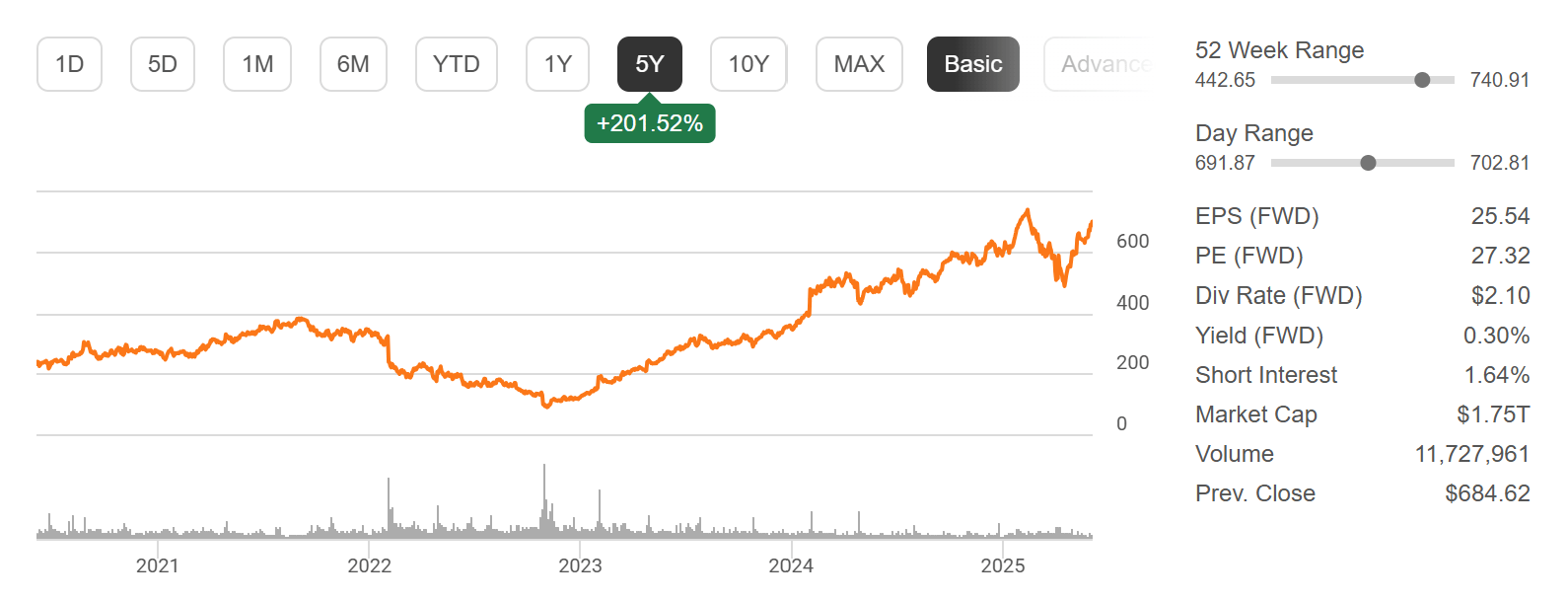

Oracle (ORCL)

Oracle reports earnings Wednesday after the bell and shares are up +40% over the past 12 months. In Q3, Oracle delivered $14.1B in total revenue (+6% YoY) and a record $130B in Remaining Performance Obligations — a sign of robust future deals.

Analysts expect continued strength in cloud infrastructure, especially Oracle Cloud Infrastructure (OCI), which clocked +49% YoY growth in Infrastructure-as-a-Service (IaaS) last quarter. All eyes will be on updates related to the $40B “Stargate” Oracle–NVIDIA deal — including 400K GB200 chips earmarked for OpenAI’s U.S. data center — and whether AI partnerships / data-center expansion will further accelerate revenue and margins.

I’ll be listening for management’s Q4 guidance on revenue, free cash flow, and CapEx plans tied to AI buildout — plus any insight on Apollo 2029 long-term targets. Oracle’s earnings could set the tone for AI infrastructure stocks heading into the summer.

Oracle Corp. (ORCL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Apple’s flagship event, Meta might make a $10B+ AI investment, and it’s officially game day for US / China trade negotiations.

Apple (AAPL) to Host Worldwide Developers Conference (WWDC)

Source: Tom's Guide / Shutterstock

Apple’s WWDC starts Monday in Cupertino, spotlighting software innovation across its ecosystem under the “AI Next” wave. Expect a refreshed, cross-platform UI dubbed “Solarium,” with iOS 26, macOS 26 (Tahoe), iPadOS 26, watchOS 26, tvOS 26, and visionOS 26 featuring visionOS-inspired translucent elements and unified design.

AI is expected to be a central theme — with enhancements like live translation, a smart health coach, battery tools, and greater developer access to Apple Intelligence. There’s also expected to be exciting AirPods updates and a new gaming app.

Apple, Inc. (AAPL) Stock Performance, 5-Year Chart, Seeking Alpha

“The new plan for developers is expected to be one of the highlights of the developers conference, better known as WWDC. But the biggest announcement will likely be overhauled versions of the iPhone, iPad and Mac operating systems, part of a project dubbed Solarium. The idea is to make the interfaces more unified and cohesive. The new approach will be largely reminiscent of visionOS, the operating system on the Vision Pro headset.”

Meta Platforms (META) in Talks with Scale AI for $10B+ Investment

Meta is reportedly in advanced talks to invest over $10B into Scale AI — a move that would mark one of the largest private funding rounds in history. The deal would represent Meta’s biggest external AI bet to date, signaling a shift from in-house model development toward deeper partnerships. Scale, a key player in defense and enterprise AI, already collaborates with Meta on “Defense Llama” and serves clients like Microsoft and OpenAI.

Meta Platforms, Inc. (META) Stock Performance, 5-Year Chart, Seeking Alpha

“Scale, co-founded in 2016 by CEO Alexandr Wang, has been growing quickly: The startup generated revenue of $870 million last year and expects sales to more than double to $2 billion in 2025… Scale plays a key role in making AI data available for companies. Because AI is only as good as the data that goes into it, Scale uses scads of contract workers to tidy up and tag images, text and other data that can then be used for AI training.”

U.S. / China Trade Talks

Treasury Secretary Scott Bessent with Chinese Vice Premier He Lifeng in Geneva last month. Sources: Martial Trezzini / AFP - Getty Images / NBC News

Senior US and China officials are meeting in London to resume trade talks aimed at easing tensions between the two countries, following a steep 34.5% drop in Chinese exports to the U.S. in May. The talks come just weeks after both nations agreed to suspend most tariffs — though recent accusations of violations have reignited uncertainty.

The U.K. is hosting the discussions but is not directly involved. President Trump and President Xi recently held a 90-minute phone call, which Trump described as productive — resulting in China agreeing to resume exports of rare earth minerals to the US. Monday's meeting, focused on clarification of the trade deal, will include top economic officials from both sides, including U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng.

Kevin Hassett, Trump’s National Economic Council Director, has said that the meeting will likely be short — but yield results. He shared that the US expects export controls to be eased and rare earths to be released in volume… and he’s “absolutely expecting progress” from these talks.

The expectations are getting higher and higher going into this meeting. We’ll see what happens very soon!

“There’s absolutely no other way of describing all of this, and this is about how data flows. It’s about information. It’s about AI. It’s about tech. It’s about defense too. China’s rapidly expanding its munitions production at the moment. So it’s about how these two economies actually compete and survive in a digital world where nobody really knows what the power of the nation state is.”

“There could be some resolution on specific issues, like a rare earths, for instance, China already announced that they will give some permits to foreign firms applying for imports. Now, those kind of a temporary solution, we might see some of that come out. But I doubt we will have a complete solution coming from this dialog in the U.K.”

Major Economic Events:

With a limited earnings slate this week — both inflation for consumers and inflation for producers will be in the brightest of spotlights.

Source: WSJ

Monday (6/9): Wholesale Inventories

Tuesday (6/10): NFIB Optimism Index

Wednesday (6/11): Consumer Price Index, Core CPI, Core CPI Year-Over-Year, CPI Year-Over-Year, Monthly U.S. Federal Budget

Thursday (6/12): Core PPI, Core PPI Year Over Year, Initial Jobless Claims, Producer Price Index, PPI Year Over Year

Friday (6/13): Consumer Sentiment (Prelim)

What We’re Watching:

Consumer Price Index

U.S. consumer inflation eased in April, with headline CPI rising +2.3% YoY — the lowest since February 2021 and below expectations. Falling gas and food prices helped offset sticky shelter costs, which accounted for over half of the monthly +0.2% CPI gain. Core inflation held steady at +2.8% YoY, suggesting the Fed’s 2% target remains elusive even as energy deflation deepens and consumer demand softens.

Economists expect the following this week:

CPI — +0.2% month-over-month and +2.5% year-over-year

Core CPI — +0.3% month-over-month & +2.9% year-over-year

“We expect a soft print for May’s CPI, with deflation in discretionary services more than offsetting firmer goods inflation. As the recent beige book flagged, some firms are passing through tariffs costs. We see partial pass-through in categories like furniture, apparel, and auto parts. But airfares are falling sharply, and hotels and recreational services are downshifting too.”

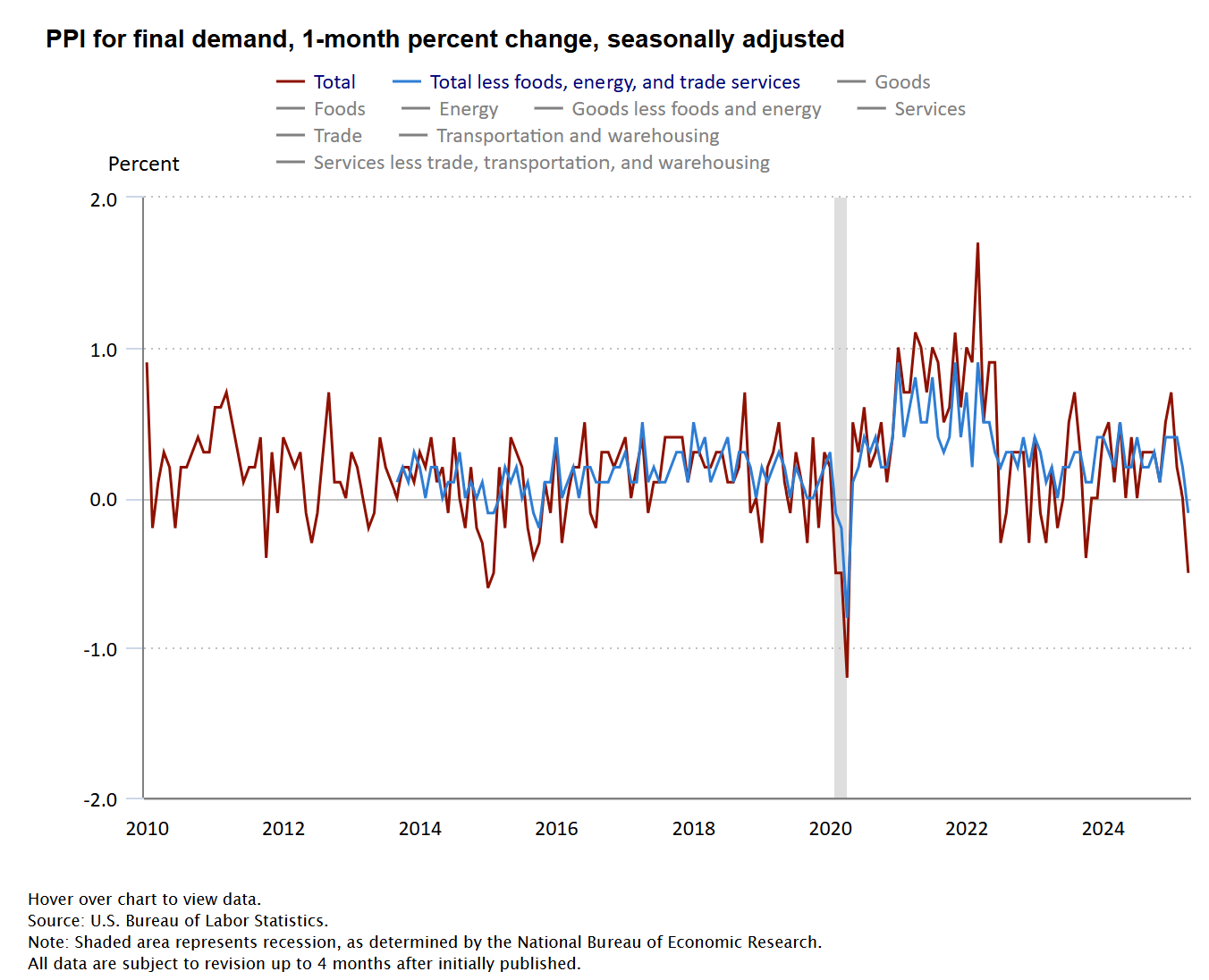

Producer Price Index

Producer prices fell -0.5% in April – the steepest drop since April 2020 and a surprise decline vs. +0.2% expected. The drop was driven by a historic -0.7% plunge in service costs, as businesses appeared to absorb more margin pressure amid rising tariffs. Annual PPI eased to 2.4%, adding to signs of disinflation across the supply chain.

Economists expect the following this week:

PPI — +0.2% month-over-month and +2.6% year-over-year

Core PPI — +0.3% month-over-month and +3.0% year-over-year

“For now, distributors are not passing on all these extra costs to consumers… It will take more time to assess whether a sustained squeeze on margins is occurring.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Apple

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]