- GRIT

- Posts

- 👉 Trump's "Investment Announcement" Coming Today

👉 Trump's "Investment Announcement" Coming Today

Broadcom, CrowdStrike, Target

Together with Betterment

Welcome to your new week.

The last seven days in the market have been some of the craziest we’ve seen in years. Is Trump about make it even crazier over the next couple of days?

Read on for your full breakdown.

Turn out the lights on traditional savings accounts. With Betterment’s high-yield cash account, your money is earning nearly 11x the national average**.

Key Earnings Announcements:

Abercrombie & Fitch, Broadcom, CrowdStrike, Target, and more.

Monday (3/3): AST SpaceMobile, Hut 8, Nuscale, Okta, Plug, Sunnova

Tuesday (3/4): Autozone, Best Buy, CrowdStrike, EVgo, Nordstrom, ON Holding AG, Target

Wednesday (3/5): Abercrombie & Fitch, Marvell, MongoDB, OppFi, Rigetti, Victoria’s Secret

Thursday (3/6): BigBear.AI, Broadcom, Costco, Hewlett Packard Enterprise, JD.com, Kroger, Macy’s, Samsara

Friday (3/7): N/A

What We’re Watching:

CrowdStrike (CRWD)

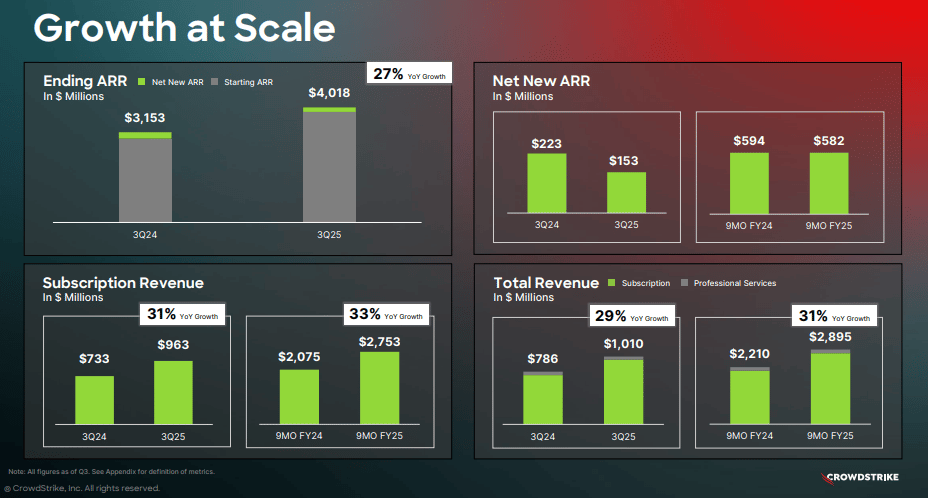

Source: CrowdStrick Q3 FY25 Earnings Deck

CrowdStrike’s Q4 earnings land Tuesday, with expected revenue of $1.03B — a +22% YoY leap powered by its Falcon platform’s AI edge. The cybersecurity titan’s $4B+ ARR milestone could finally be hit this quarter, but there are whispers of July’s IT outage fallout causing a dent in net new ARR. Shares currently sit at $389.

The cloud security boom keeps CrowdStrike’s stock trending higher. With a knack for beating EPS consistently since Q1 of 2023, this report could be just what the stock needs to move higher.

CrowdStrike Holdings, Inc. (CRWD) Stock Performance, 5-Year Chart, Seeking Alpha

Target (TGT)

Source: Target Q3 24 Earnings Infographic

Target (TGT) reports Q4 earnings Tuesday, with profit expected to drop -28% and revenue expected to come in slightly lower — trailing Walmart’s mixed Q4. Wall Street is expecting $25.2B in sales and is eager to gain more clarity about a cautious consumer after Walmart’s weak guidance.

Holiday sales rose +2.8%, fueled by record Black Friday & Cyber Monday sales and a +9% digital surge. Despite a -9% YTD stock drop, Wall Street remains bullish — with all eyes on whether Target can boost confidence in the retail sector or if it will signal retail weakness ahead.

Target Corp. (TGT) Stock Performance, 5-Year Chart, Seeking Alpha

"Consumers tell us their budgets remain stretched and they're shopping carefully as they work to overcome the cumulative impact of multiple years of price inflation."

Investor Events / Global Affairs:

The Ukraine drama continues, the largest and most influential event for the mobile technology industry, and Trump’s big surprises.

Important Ukraine Updates

Source: AP Photo/Evgeniy Maloletka

EU leaders will hold an emergency summit on March 6 to discuss Ukraine and European security, as shifting U.S. policy under Trump raises uncertainty. Ahead of the meeting, EU officials will visit Kyiv on the third anniversary of Russia’s invasion, signaling continued support. With defense spending in focus — some defense stocks could see movement as markets gauge Europe’s next steps.

Ukrainian President Volodymyr Zelensky has also reaffirmed his willingness to sign a US-Ukraine minerals deal despite a tense meeting with former President Donald Trump that ended without an agreement.

He emphasized Ukraine’s need for security guarantees and criticized the handling of discussions, stating that the fallout only benefited Russian President Vladimir Putin. US Treasury Secretary Scott Bessent suggested that an economic deal could not proceed without a peace agreement, implying that Zelensky’s approach disrupted the intended sequencing of negotiations.

At a European summit, Zelensky supported stronger European military commitments but acknowledged that some form of US involvement, such as air defense and intelligence, remained crucial. Amid criticism from some US politicians, including Senator Lindsey Graham, Zelensky dismissed calls for his resignation and reiterated that Ukraine’s ultimate goal remains NATO membership.

Over the last few days — a Ukraine deal has become one of the ‘potential positive catalysts’ that the market has been craving. Let’s see what comes next… and if the mineral rights deal is actually signed.

Mobile World Congress (MWC) Barcelona

Mobile World Congress (MWC) is widely considered the largest and most influential event for the mobile technology industry. It kicks off this week, bringing together global tech, mobile, and connectivity leaders for four days of product launches, AI advancements, and 5G innovation.

Expect major announcements from smartphone makers, telecom giants, and AI firms as the industry showcases what’s next in mobile tech and connectivity.

Check it out here.

Notable exhibitors include: Accenture, Alibaba, Dell Technologies, Ericsson, Meta Platforms, Palo Alto Networks, PwC, and more.

The Week of Tariffs + Unexpected Announcements

Source: Brandon Bell / Getty Images

The U.S. is set to impose new tariffs on Canada and Mexico, with President Trump determining the exact levels (currently 25%). This move could disrupt trade flows, impact key industries, and add to inflation pressures — and they are set to officially begin on Tuesday.

Markets will be watching for retaliatory measures and how businesses adjust to rising costs and supply chain shifts.

Markets are also watching a few announcements by President Trump…

Trump says that “tomorrow night will be big.” This is talking about Tuesday evening — when he will be giving his first joint address to Congress.

The White House has announced that there will be an “investment announcement” today (Monday) at 1:30pm ET.

Get ready for more VOLATILITY!

Major Economic Events:

Key data from the manufacturing sector and updates on the labor market.

The New York Fed has released GDP expectations that are completely different from the Atlanta Fed’s negative expectations…

Monday (3/3): Auto Sales, Construction Spending, ISM Manufacturing, St. Louis Fed Pres Musalem Speaks, S&P Final U.S. Manufacturing PMI

Tuesday (3/4): New York Fed Pres Williams Speaks, Richmond Fed Pres Barkin Speaks

Wednesday (3/5): ADP Employment, Factory Orders, Fed Beige Book, ISM Services, S&P Final U.S. Services PMI

Thursday (3/6): Atlanta Fed Pres Bostic Speaks, Fed Gov C. Waller Speaks, Initial Jobless Claims, U.S. Productivity Final, U.S. Trade Deficit

Friday (3/7): Consumer Credit, Fed Chair J. Powell Speaks, Fed Gov Kugler Speaks, Fed Gov M. Bowman Speaks, New York Fed Pres Williams Speaks, U.S. Hourly Wages, U.S. Unemployment Rate, U.S. Jobs Report

What We’re Watching:

ISM Manufacturing PMI

The ISM Manufacturing PMI jumped to 50.9 in January, marking the first expansion in over two years. New orders (55.1) surged, while production (52.5) and employment (50.3) rebounded, signaling improving demand.

However, price pressures rose (54.9), and inventories continued to shrink (45.9). With the factory sector finally back in growth mode, markets will watch if momentum holds — or if inflation concerns resurface.

Economists are forecasting a reading of 50.6 for February — which would keep the sector in expansion territory.

"The Prices Index indicated increasing prices for the fourth consecutive month, likely reflecting the agreement and deployment of prices by buyers for 2025. Mill materials (steel, aluminum and copper), food elements and natural gas registered increases, offset by plastic resins and diesel fuel moving down in price."

Jobs Report

Wall Street expects +160K new jobs in this month’s jobs report, with the unemployment rate slightly rising to 4.1%. With labor market momentum fading, the Fed’s next move — and market reaction — will hinge on whether this is just cooling or a deeper slowdown.

There’s also been a lot of attention on Treasury Secretary Scott Bessent’s commentary lately. He claims that the U.S. economy is more fragile under the surface than economic metrics suggest and he’s focused on "re-privatizing" growth by cutting government spending and regulation.

We’ll see if more cracks appear in the economy this week.

"The previous administration's over-reliance on excessive government spending and overbearing regulation left us with an economy that may have exhibited some reasonable metrics but ultimately was brittle underneath, and heading for an unstable equilibrium.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: CrowdStrike

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply