- GRIT

- Posts

- 👉 Walmart (+19% YTD) Faces Next Test

👉 Walmart (+19% YTD) Faces Next Test

AI Fears, Beef Shortage, DoorDash

Welcome to your new (and shortened) week in the markets.

Nvidia earnings will take place NEXT week — but there’s still plenty of critical earnings reports between now and then. Let’s see how investors respond after puzzling time in the markets over the last few trading sessions.

Read on to see what deserves your attention.

Key Earnings Announcements:

Carvana, Doordash, Figma, and Walmart are in the spotlight this week.

Monday (2/16): Presidents Day

Tuesday (2/17): Cadence Design Systems, Devon Energy, Leidos, Medtronic, Palo Alto Networks, Toll Brothers

Wednesday (2/18): Analog Devices, Carvana, DoorDash, eBay, Figma, Garmin, Kinross Gold, Moody’s, SolarEdge, Verisk

Thursday (2/19): Akamai, Deere, Klarna, Live Nation, Walmart, Wayfair

Friday (2/20): AngloGold Ashanti, Hudbay Minerals, Lamar Advertising, PPL, Western Union

What We’re Watching:

DoorDash (DASH)

DoorDash (-29% YTD) reports Q4 FY2025 earnings this week, with investors focused on whether the delivery platform can sustain revenue acceleration and improve profitability as competition and cost pressures persist. DoorDash has carved out a leading position in on-demand delivery, but questions remain about long-term unit economics and how it drives incremental growth beyond core food delivery.

Last quarter, DoorDash delivered $2.87 billion in revenue (+15% YoY) and $0.28 in adjusted EPS, topping expectations as stronger order frequency and marketplace economics helped offset elevated incentives and delivery costs. Marketplace take rate stabilized, and growth in Convenience and Grocery categories showed early promise, though margins remained pressured by promotions and driver pay mix.

This quarter, I’ll be watching order frequency, take rate trends, and margin leverage, particularly in the face of ongoing investment in faster delivery and loyalty initiatives. Commentary on cost discipline, international expansion (if any), and guidance for 2026 marketplace profitability — especially versus rival rivals — will be key for trader sentiment.

“We continue to expand the breadth of our marketplace while intensifying focus on efficiency and long-term profitability.”

DoorDash Inc. (DASH) Stock Performance, 5-Year Chart, Seeking Alpha

Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, this card could easily be worth $100s in cash back every year. And — even better — you could get approved extremely fast. If approved, you’ll receive an insanely valuable welcome bonus deposited straight into your Amazon account, ready to use immediately.

You also don’t have to jump through any hoops to get this bonus. No extra work or special spending requirements. Get approved, and it’s yours.

This might be one of the most powerful cash back cards available, especially considering how much most people spend on Amazon each month. It gives you the chance to earn cash back on the purchases you’re already making, turning your routine shopping into something that actually pays you back.

If you shop at Amazon or Whole Foods, this card could help you earn meaningful cash back on every purchase you make. But this offer won’t last forever — and if you’re an Amazon Prime member, this card is as close to a no-brainer as it gets.

Amazon Prime members: See what you could get, no strings attached

Walmart (WMT)

Source: Walmart Earnings Deck

Walmart (+20% YTD) reports Q4 FY2025 earnings this week, with investors focused on whether the retail giant can sustain traffic, leverage pricing power, and expand margins as consumers continue to navigate inflationary pressures. Walmart remains a key barometer for U.S. consumer health, given its broad footprint and mix of staple and discretionary categories.

Last quarter, Walmart delivered $161.5 billion in revenue (+7% YoY) and $1.51 in adjusted EPS (+10% YoY), topping expectations as food and consumables remained resilient and price investments helped hold share. U.S. comp sales grew mid-single digits, while international operations and e-commerce continued to contribute meaningfully to the topline.

Heading into this print, I’ll be watching same-store sales trends, the sustainability of price/mix gains, and how gross margin is navigating cost pressures and promotional activity. Commentary around holiday performance, inventory positioning, and forward guidance — particularly in the face of rising wage and freight costs — will be key for market reaction.

“Our everyday low prices and broad assortment are critical advantages as consumers remain value-conscious.”

Walmart, Inc. (WMT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Beef prices are still surging and AI fears in the market continue this week.

Beef Prices Surge as Cattle Shortage Deepens

Beef prices are rising far faster than the broader grocery basket, with the beef and veal category up +15% YoY and uncooked ground beef hitting a fresh record. By contrast, chicken prices are up just +1.1% and milk is little changed – highlighting how concentrated the pressure has become.

The core issue is supply. The U.S. cattle herd has shrunk to its smallest size since the early 1950s, pressured by years of drought, elevated feed and equipment costs, and higher interest rates. Ranchers have opted to sell cattle earlier rather than retain them to rebuild herds, prolonging the contraction cycle. Even if expansion begins now, meaningful supply relief wouldn’t hit grocery shelves until 2028 at the earliest, according to industry analysts.

The Trump administration has moved to increase Argentine beef import quotas and pledged to boost competition in meat processing, but imports primarily affect ground beef and won’t quickly solve the broader herd shortage. Meanwhile, a halt on live cattle imports from Mexico due to parasite concerns adds another layer of supply tightness.

For markets, the takeaway is twofold: protein inflation remains sticky even as broader grocery prices stabilize, and agricultural cycles may keep food-price volatility elevated longer than many expect.

“The entirety of the beef and cattle market is a wreck. To put it simply, there are no cattle left in America. That may sound like hyperbole, but the numbers are historically tight.”

AI Fears Continue to Keep Market Volatile

U.S. equities remain near flat on the year, but beneath the surface, volatility has picked up meaningfully. Artificial intelligence disruption fears have triggered sharp swings across software, insurance, wealth management, and transportation stocks, creating increasingly extreme “AI winners vs. losers” moves.

At the same time, leadership is quietly rotating. While technology – still roughly one-third of the S&P 500 – has slipped more than 4% year-to-date, sectors like energy, materials, industrials, and consumer staples have each gained 10% or more. Small caps have also outperformed, signaling a potential broadening of market participation beyond mega-cap tech.

Investors will be watching whether this rotation proves durable or if tech weakness begins to weigh more heavily on the broader indices.

“AI winner and loser moves are becoming increasingly extreme – at some point, the weakness can start to outweigh the strength.”

Major Economic Events:

Durable goods orders, GDP growth rate, and Core PCE are the highlights of the week.

Monday (2/16): Presidents Day

Tuesday (2/17): Empire State manufacturing survey, Home builder confidence index

Wednesday (2/18): Building permits (Dec), Building permits (Nov), Capacity utilization, Durable-goods orders (delayed report), Durable-goods minus transportation, Housing starts (Dec delayed), Housing starts (Nov delayed), Industrial production, Minutes of Fed’s January FOMC meeting

Thursday (2/19): Advanced retail inventories, Advanced U.S. trade balance in goods, Advanced wholesale inventories, Initial jobless claims, Leading economic index, Minneapolis Fed President Neel Kashkari speaks, Philadelphia Fed manufacturing survey, U.S. trade deficit

Friday (2/20): Consumer sentiment (prelim), Core PCE (year over year), Core PCE index, GDP (Q4), New home sales (Dec delayed), New home sales (Nov delayed), PCE (year over year), PCE index, Personal income, Personal spending, S&P flash U.S. manufacturing PMI, S&P flash U.S. services PMI

What We’re Watching:

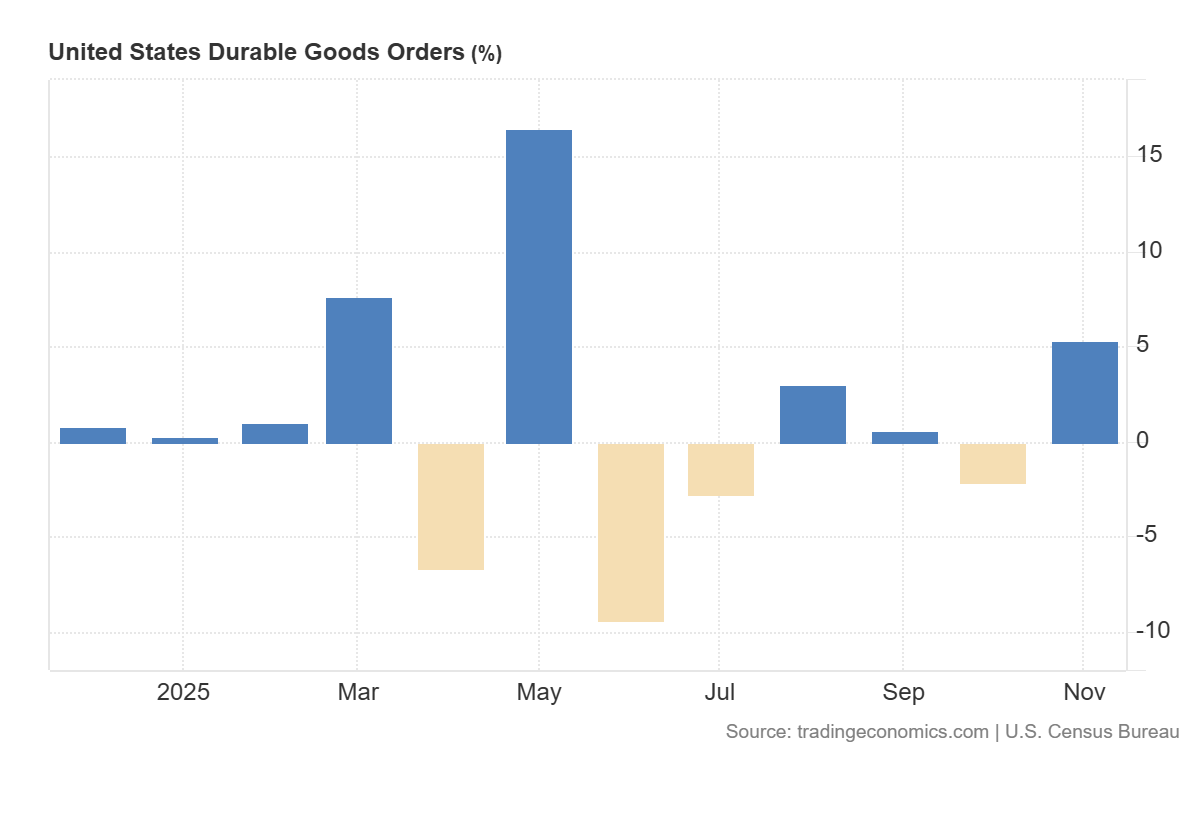

Durable Goods Orders

New orders for U.S.-manufactured durable goods jumped 5.3% MoM in November, rebounding sharply from October’s revised 2.1% decline and beating expectations for a 3.7% increase. The headline gain was driven primarily by transportation equipment, which surged 14.7% following a prior drop, as civilian aircraft bookings spiked nearly 98%.

Outside of transportation, momentum was more modest but still constructive. Orders excluding transportation rose 0.5%, while core capital goods orders – non-defense capital goods excluding aircraft, a key proxy for business investment – climbed 0.7% after a 0.3% gain in October. Orders also improved across fabricated metals, machinery, electrical equipment, and electronics.

The report suggests underlying business spending remains steady, though the headline strength was heavily influenced by large aircraft orders – a historically volatile component.

Economists expect the following this week:

Durable Goods Orders (MoM): +5.3% vs. -2.1% prior

Core Capital Goods Orders: +0.7% vs. +0.3% prior

“While uncertainty is far from eliminated, executives appear to have reached the point where they have enough information to move forward. The robust core capital goods orders and shipments figures for the second half of last year suggest that momentum in business investment has been building heading into 2026.”

GDP Growth Rate

The U.S. economy expanded at an annualized 4.4% in Q3, slightly above the prior 4.3% estimate and marking the fastest growth since Q3 2023. The upward revision reflected stronger exports and a smaller drag from inventories, reinforcing the view that economic momentum remained solid heading into year-end.

Growth was driven by firm consumer spending (+3.5%), a sharp rebound in exports (+9.6%), and renewed government outlays (+2.2%). Imports declined another 4.4%, helping boost net trade. Meanwhile, the inventory drag eased significantly, subtracting just 0.12 percentage points from growth versus a hefty 3.44-point drag in Q2

On the softer side, fixed investment slowed sharply to +0.8% from +4.4% in Q2, signaling some cooling in business spending even as overall growth remained strong.

Economists expect the following this week:

Q3 GDP (Final): +4.4% vs. +4.3% prior estimate

Consumer Spending: +3.5% vs. +2.5% in Q2

“A key trend is evident: the 10-year moving average of GDP growth fell below the historical average in 2007 and has remained there, signaling a significant deceleration in U.S. economic expansion since the Great Recession. Current growth exceeds both the long-term series average and the 10-year moving average, indicating a faster pace of growth than experienced historically.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

This content is sponsored by NEOS Investments. The creator is compensated by NEOS to discuss NEOS ETFs. This content is for informational purposes only, and is not personalized investment, tax, or legal advice, and does not constitute an offer to buy or sell any security. Investing involves risk, including possible loss of principal. Before investing, carefully review the NEOS ETFs prospectus at neosfunds.com.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Image Source: Jason Ivester/The Associated Press

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]