- GRIT

- Posts

- 👉 Will the +27% Rally Continue?

👉 Will the +27% Rally Continue?

Alibaba, Disney, Shopify

Welcome to your new week, and Happy Veterans Day.

Today, the United States honors those who have served our country in the armed forces.

From myself and the entire Grit team, thank you to all of those that have committed so much of their lives to protecting our freedoms. We appreciate you!

As we navigate these exciting times in the market, consider upgrading to our premium subscription. It gives you access to my full portfolio, monthly livestreams, and more.

Now let’s dive into everything you should be aware of this week.

Key Earnings Announcements:

A wide variety of companies are reporting this week — Alibaba, Disney, Monday.com, On Holdings, Shopify and more.

Monday (11/11): Monday.com

Tuesday (11/12): Bitfarms, CAVA, Cronos Group, Hertz, Instacart, Marathon Digital, Novavax, On Holdings, Shopify, Soundhound

Wednesday (11/13): Bitcoin Depot, Cisco, Hut 8

Thursday (11/14): Applied Materials, Disney, Intuitive Machines, JD.com, Oklo

Friday (11/15): Alibaba, Spectrum Brands

What We’re Watching:

Disney (DIS)

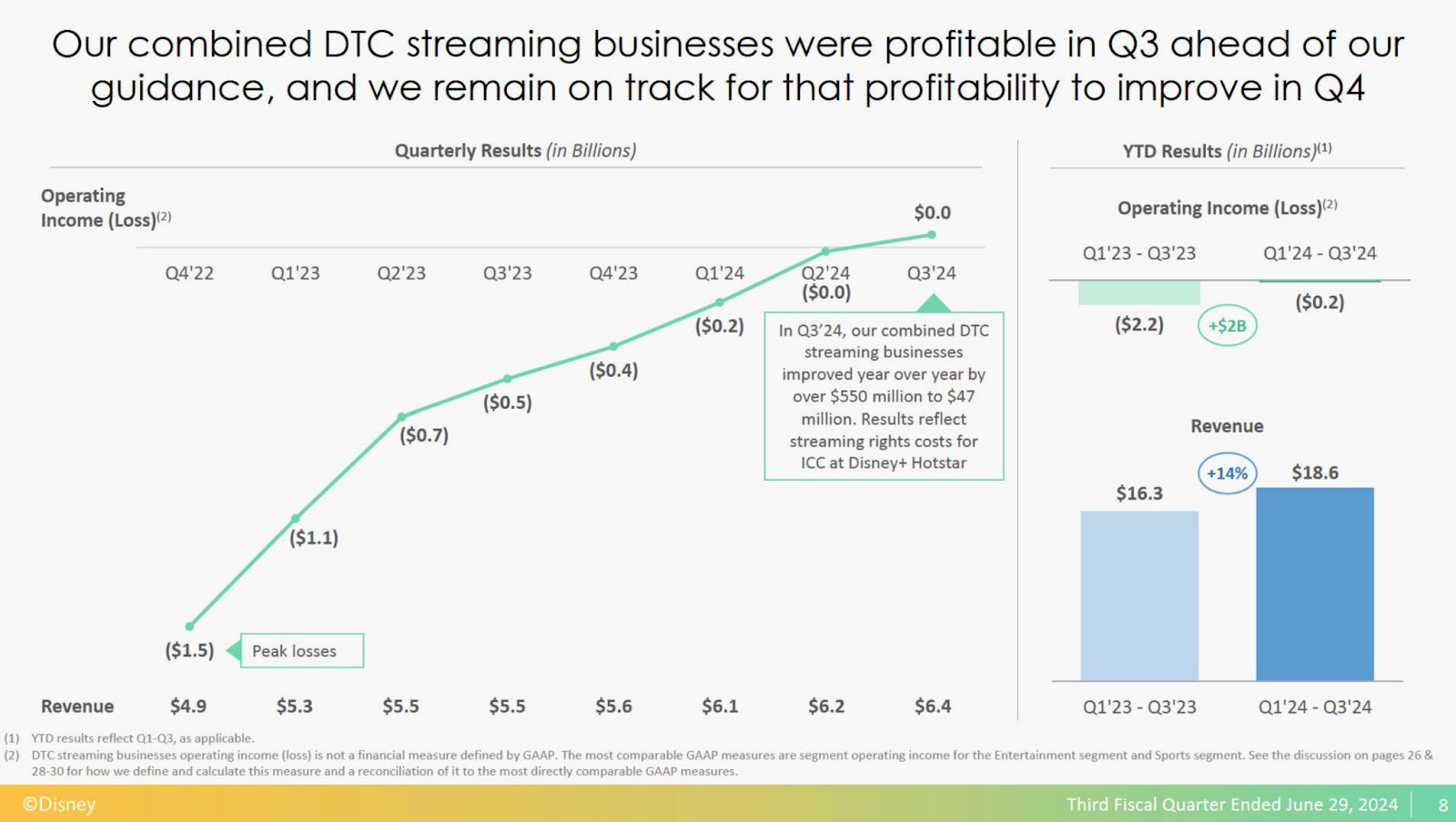

Disney (+10% YTD) is set to report Q4 results before the bell on Thursday, with investors watching closely for updates on its streaming and theme park businesses. Analysts expect a +35% profit boost, driven by a +6% revenue increase. Streaming profitability should continue to improve, benefiting from recent price hikes and Disney’s crackdown on password sharing.

However, the theme park segment faces challenges after underperforming last quarter.

Analysts are generally bullish — with Seeking Alpha recently upgrading the stock to a Strong Buy. Despite long-term underperformance (+9% over 10 years) compared to the S&P 500 (+187% over 10 years), some believe Disney’s content strategy is improving.

Investors are also on the lookout for a potential dividend increase, which could boost shareholder returns.

The Walt Disney Company (DIS) Stock Performance, 5-Year Chart, Seeking Alpha

Shopify (SHOP)

Source: Shopify Q2 Earnings Deck

Shopify (+12% YTD) is set to announce its Q3 earnings on Tuesday before the market opens. Over the past year, the company’s stock has climbed an impressive +37%, though gains in 2024 have slowed to around +10%. Seeking Alpha’s Quant Rating marks the stock with a Hold, while Wall Street analysts hold a more bullish outlook with a consensus Buy rating.

Shopify has been expanding — with over 450 new launches in two years — boosting the share of revenue generated from each transaction on its platform to record levels. Coupled with high margins, scalability, and strong free cash flow supported by ~$4 billion in net cash, Shopify remains well-positioned for continued growth, but investors should watch for volatility.

Shopify, Inc. (SHOP) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Coinbase has more institutional eyes on it than ever & there are numerous conferences this week: CNBC’s Delivering Alpha Conference, Fortune’s Global Forum, & Oppenheimer’s Generative AI Event.

Coinbase (COIN) is Leading the Way Post-Election

Shoutout to Charlie Bilello for compiling the following returns since the election (as of Sunday):

Coinbase: +40%

Tesla: +28%

Bitcoin: +15%

Banks: +8.9%

Small Caps: +6.2%

S&P 500: +3.7%

US Dollar: +1.5%

Long-Term Treasuries: -0.3%

International Stocks: -1.2%

Oil: -2.1%

Gold: -2.2%

China: -3.6%

Trump Media: -6%

Volatility: -27%

Why is Coinbase stock rising more than Bitcoin itself — and most major alt coins? Could it be because institutions are piling into Bitcoin via Coinbase?

We’ll be keeping an eye on these names / sectors over the coming days and weeks. Very exciting times to be in the investor class!

If you’re not and want a new brokerage — join Public today.

This is not a paid endorsement by Public, but we do receive an affiliate payout for new customers driven through the link above.

CNBC’s Delivering Alpha Investor Summit

The 14th CNBC Delivering Alpha Summit focuses on navigating uncertainty and uncovering opportunities for meaningful returns. Featuring CNBC’s top experts alongside influential voices in business and investing — this event will offer a dynamic mix of insights and discussions on the future of markets.

A few of the key speakers at the event: Ben Affleck, Gerry Cardinale (RedBird Capital), David Einhorn (Greenlight Capital), Nelson Peltz (Trian Partners), Anne Walsh (Guggenheim), Solita Marcelli (UBS), Saira Malik (Nuveen), and more.

Pretty much — it’s one celebrity, a lot of Chief Investment Officers, and all of CNBC’s largest contributors. This event typically leads to newsworthy takeaways.

Fortune Global Forum 2024

At the Fortune Global Forum, top CEOs and leaders from the Fortune Global 500 will come together to explore the disruptive forces reshaping industries. Examples include AI growth, geopolitical risks, and economic regulations.

Notable speakers include: Tom Brady, Brian Cornell (Target), Gita Gopinath (IMF), Boris Johnson, John Stankey (AT&T), Kate Brandt (Google), Chris Cocks (Hasbro), Alex Chriss (PayPal), Jim Fitterling (Dow), Lan Guan (Accenture), and more.

Oppenheimer Generative AI Event

On November 16 for Oppenheimer’s Generative AI event, where they explore the impact of AI on investing and showcase cutting-edge tools like Microsoft’s Soul Machines and Adobe Firefly. The overarching goal is to showcase how generative AI is transforming industries of all kinds.

The event will also feature a panel on investment opportunities in the Gen AI value chain, led by Oppenheimer’s top analysts.

The key takeaway will likely be the AI demos from Microsoft and Adobe. One of the taglines for the event is “Come interact with real robots and AI Avatars and be inspired by technological innovation!”

We’ll see if either company reveals something that we haven’t already seen.

Major Economic Events:

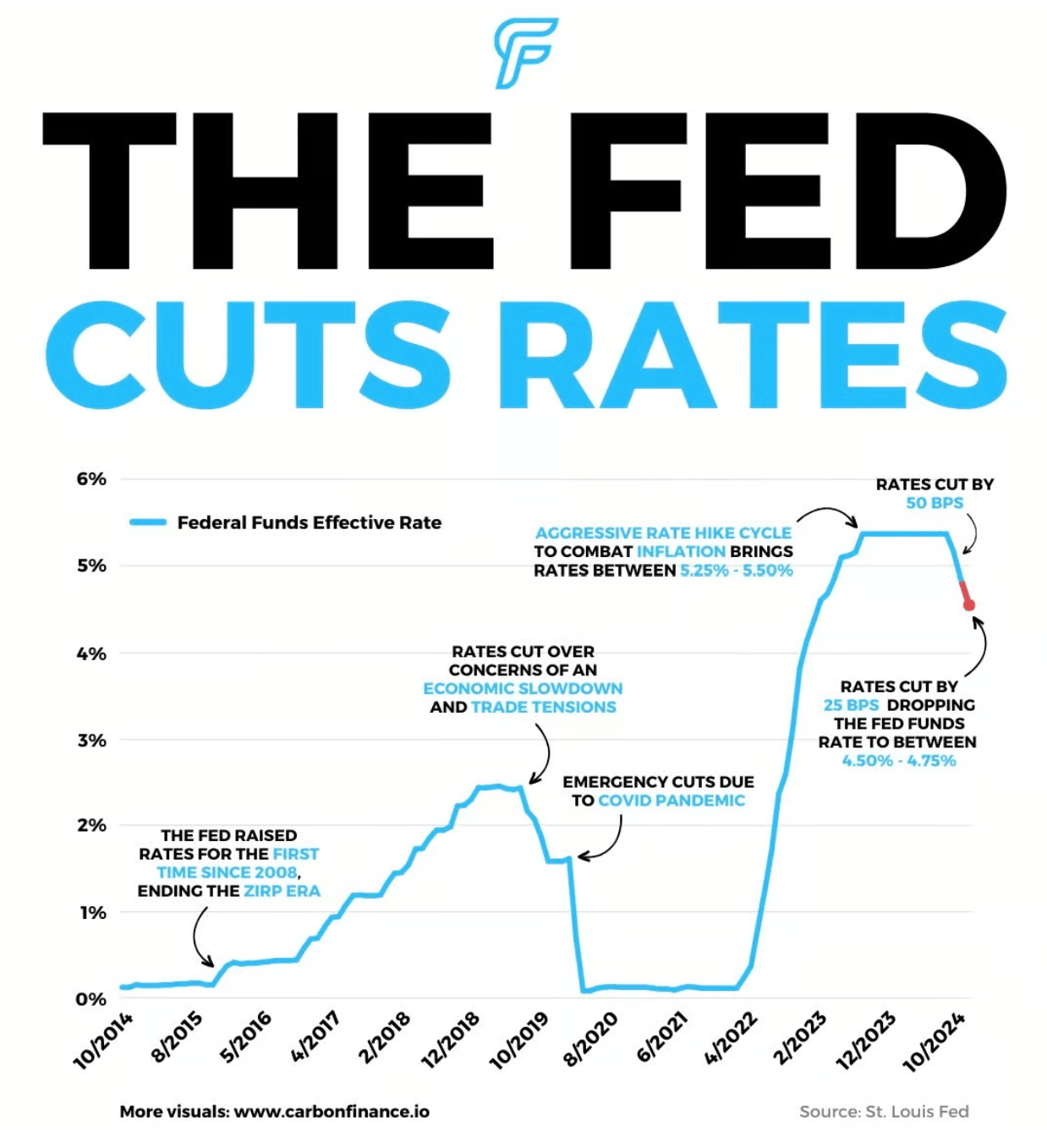

12 Fed Speakers and very important data related to retail, inflation, and shipments.

Monday (11/11): Veteran’s Day holiday, bond market closed

Tuesday (11/12): Fed Gov. Christopher Waller Speaks, NFIB Optimism Index, Philly President Harker Speaks, Richmond Fed President Barkin Speaks

Wednesday (11/14): Cass Freight Index, Consumer Price Index, Core CPI, Dallas Fed Pres Logan Speaks, KC Pres Schmid Speaks, Monthly U.S. Federal Budget, NY Fed Pres Williams Speaks, STL Fed Pres Musalem Speaks

Thursday (11/15): Core PPI, Fed Reserve Chair Powell Speaks, Initial Jobless Claims, Producer Price Index

Friday (11/16): Business Inventories, Capacity Utilization, Empire State Manufacturing Survey, Import Price Index Minus Fuel, Industrial Production, U.S. Retail Sales

What We’re Watching:

Consumer Price Index

The October Consumer Price Index (CPI) report is set to release on Wednesday. Economists predict a +2.6% annual increase in headline inflation, up from +2.4% in September, with a +0.2% MoM rise matching last month's growth.

Core CPI (excluding food and energy) is forecasted to rise +3.3% annually & have a +0.3% monthly gain.

"The good news is that the trend remains broadly disinflationary, but the bad news is that services inflation is still a problem… Inflation is dying, but not dead."

Retail Sales

Retail sales data for October — the last report before the holiday shopping season kicks off — will be released this Thursday.

Economists expect a +0.3% monthly increase, which would be slightly lower than +0.4% the month before.

“Barring a sharp downturn in the labor market, we expect consumer spending to continue growing moderately amid signs that frugal consumers are seeking cheaper options for the holiday season, and even mid- to high-income groups are under financial pressure.”

— Bloomberg Economics after last month’s retail sales data release

Cass Freight Index

The Cass Freight Index tracks North American freight activity, offering insights into market trends based on $38 billion in annual freight spend. It provides valuable data on shipping across various industries and is a key resource for understanding supply chain and economic conditions.

The Cass Freight Index shipments dropped -1.7% MoM in September, following a +1.0% gain in August. On a seasonally adjusted basis, shipments declined -2.6%. YoY, shipments were down -5.2% — worsening from August’s -1.9% drop.

More details can be found here.

“September data from Cass Information Systems showed “signs of price stabilization” even as volumes continued to reflect a soft demand environment.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Disney Experiences

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply