- GRIT

- Posts

- 👉 Your Super Bowl Sunday Update

👉 Your Super Bowl Sunday Update

Amazon, Oscar Health, Cloudflare

Happy Super Bowl Sunday, everyone.

Before we you get kick back for the big game — make sure that you’re signed up for the GRIT Money Summit! It’s free, and you should absolutely be there!

U.S. households’ stock allocation hit a record 49% in October, surpassing the 2000 dot-com peak. Since the Great Financial Crisis, stock exposure has doubled, making investing more accessible — but also more complex!

According to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%.

Join the GRIT Money Summit to learn head-on. Gain insights from experts, and empower yourself with the knowledge needed to navigate today’s fast-paced, ever-evolving markets, business and finance landscapes. Don’t be left behind — get equipped to invest with confidence!

Make sure you sign up using the links above!

Now let’s dive right in.

Attention all paid subscribers — our next Monthly Livestream will be tomorrow (February 10th) at 4pm ET.

Use this link to confirm your registration within a few seconds. As always, this livestream will be recorded and made available to you.

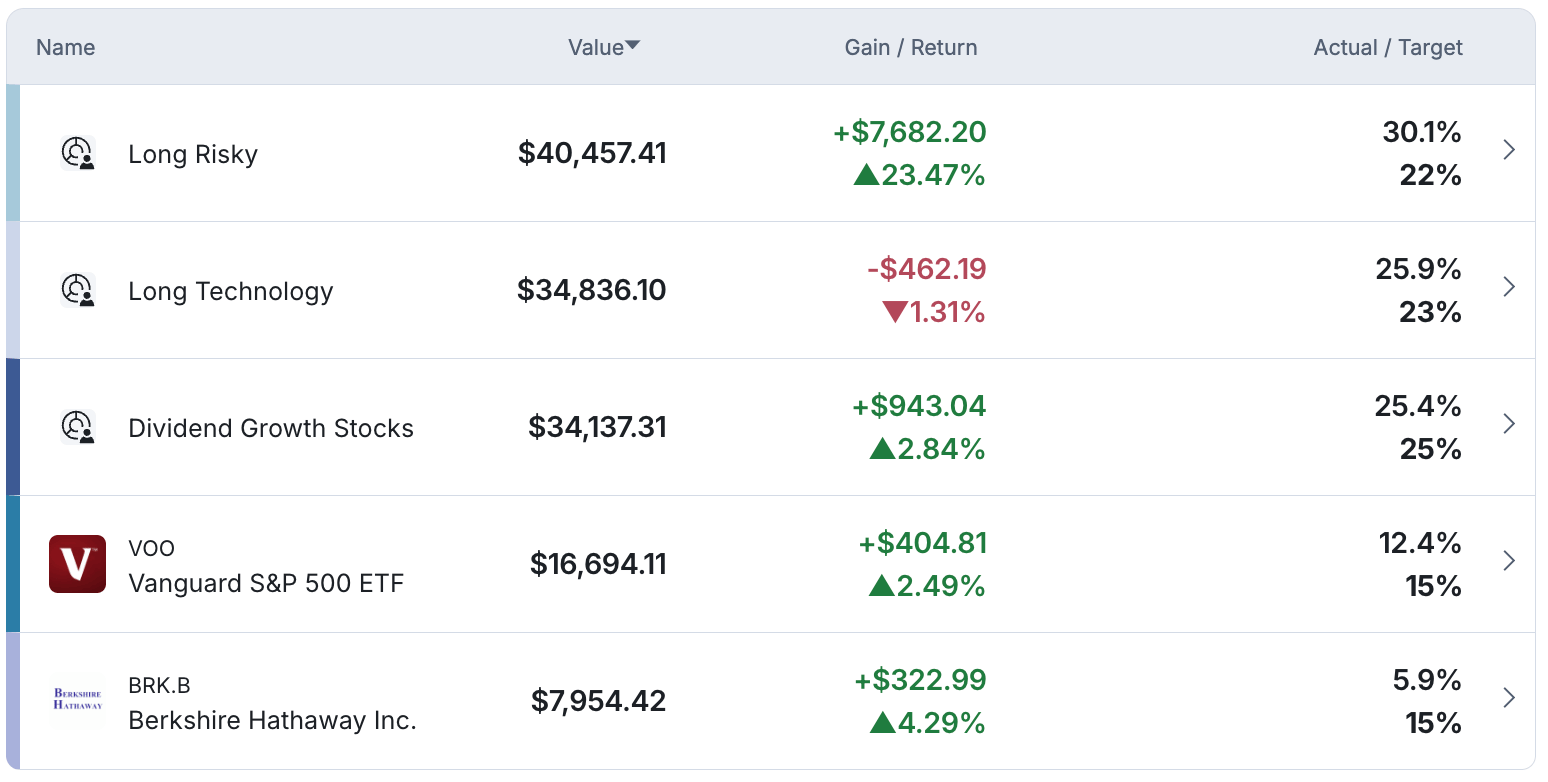

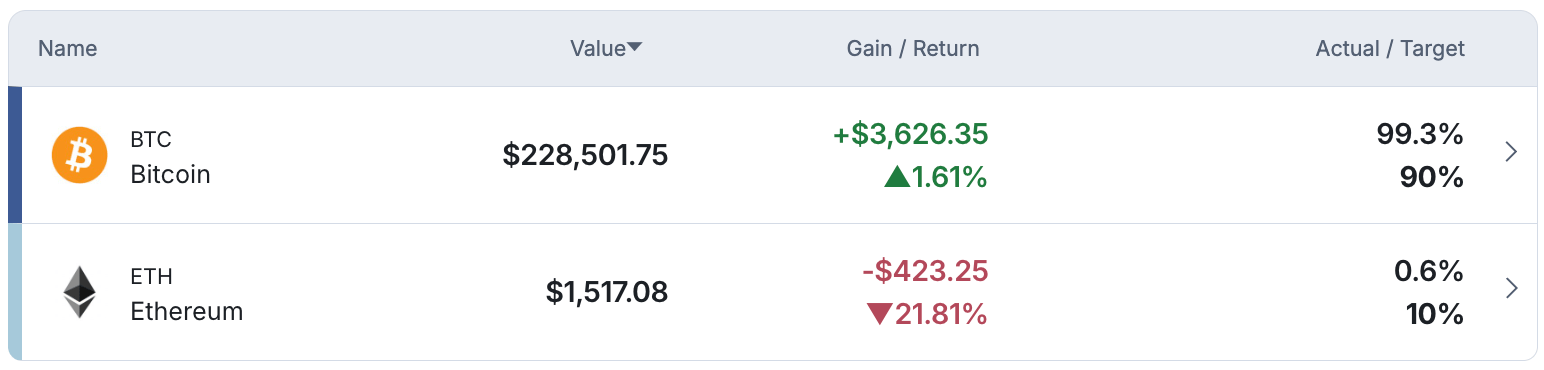

Portfolio Updates (YTD Performance):

No major updates on the portfolio to share for this week. With that being said, I plan to purchase more Uber after Bill Ackman disclosed his share in the company.

Additionally, I plan to buy the IAI ETF throughout the remainder of this month.

Week in Review —TLDR:

Amazon’s Retail business is more profitable than ever, Oscar Health is positioned for growth in 2025, Cloudflare signed more high-profile customers than ever before, the tariffs situation is beginning to heat up with China, insurance companies are skipping the Super Bowl, MicroStrategy decided to rebrand, the unemployment rate fell to 4%, and U.S. household borrowing continues to soar.

Key Earnings Announcements:

Amazon’s Retail business is more profitable than ever, Oscar Health is positioned for growth in 2025, and Cloudflare signed more high-profile customers than ever before.

Amazon (AMZN)

Key Metrics

Revenue: $188.0 billion, an increase of +11% YoY

Operating Income: $21.2 billion, an increase of +60% YoY

Profits: $20.0 billion, an increase of +88% YoY

Earnings Release Callout

“When we look back on this quarter several years from now, I suspect what we’ll most remember is the remarkable innovation delivered across all of our businesses, none more so than in AWS where we introduced our new Trainium2 AI chip, our own foundation models in Amazon Nova, a plethora of new models and features in Amazon Bedrock that give customers flexibility and cost savings, liberating transformations in Amazon Q to migrate from old platforms, and the next edition of Amazon SageMaker to pull data, analytics, and AI together more concertedly.”

My Takeaway

Despite stiffer-than-expected FX headwinds (-$700M), the company’s net sales during the quarter came in ahead of expectations at $188B driven by North America retail sales growing by +10% YoY and continued execution of AWS (+19% growth YoY).

AWS’ operating margins during the quarter came at 37%, in-line with Wall Street’s expectations. On the other hand, their Retail business segment’s operating margins came in well-ahead of Wall Street’s expectations (6.6% vs 4.7%) due to realizing cost-to-serve efficiencies throughout their fulfillment network — all while increasing delivery speed and selection.

The company guided for $105B to be spent on CapEx throughout 2025, the main reason their stock fell a few percentage points this week. This was $30B higher than Wall Street was expecting. The good news is this money is being spent on what Andy Jassy says is “probably the biggest technology shift and opportunity in business since the Internet.” AWS AI-specific revenue continues to grow dramatically, up +100% YoY.

I continue to believe that Amazon, highlighted by both their robotics-enabled Retail business and AI-enabled AWS business segment, will be a long-term winner. I love this company. Holding shares.

Oscar Health (OSCR)

Key Metrics

Revenue: $2.4 billion, an increase of +69% YoY

Operating Loss: -$147.7 million, compared to -$145.5 million last year

Net Loss: -$153.3 million, compared to -$149.9 million last year

Earnings Release Callout

“Oscar reported positive full year 2024 results, capping the strongest year of financial performance in Company history. We reported both Adjusted EBITDA and net income profitability – two significant milestones. Our strong top and bottom line performance, all-time-high-membership, and consistent execution demonstrate our ability to deliver sustained profitable growth.”

My Takeaway

As you all know, I’ve become increasingly bullish on Oscar Health throughout the last few weeks — opening up an $8,500 position in the company at $14.50 / share. Oscar Health reported revenue and adj. EBITDA in-line with Wall Street’s expectations, however, their Medical Loss Ratio (MLR) came in higher-than-expected.

Total membership rose by +62% during the quarter to 1.7 million. Management provided their initial 2025 guidance, expecting revenue of $11.3B, MLR of 81%, and operating income of $250M. The new operating income guidance correlates to $400M of adjusted EBITDA, slightly below Wall Street’s expectations of $415M before earnings.

Management noted additional investment spend on AI initiatives to drive operational efficiencies and cost savings in 2026 and beyond. Their stock fell -15% after hours, but then rebounded well into the green the following day as investors digested the quarter. Today, their stock hovers around $15 / share.

I continue to believe Oscar Health will outgrow the market through continues share gains in newer expansion markets (NC, TX, GA) and is well positioned to withstand the potential Trump Administrative healthcare-specific headwinds in 2025 and 2026 such enhanced subsidies expire.

Oscar Health should deliver $11.3B in revenue in 2025, with $400M of that being realized as Adj. EBITDA — at a $3.3B in enterprise value is an 8X forward Adj. EBITDA multiple. Incredibly reasonable, especially when factoring in their expected revenue growth in 2027 and beyond. Long Oscar Health.

Cloudflare (NET)

Key Metrics

Revenue: $460.0 million, an increase of +27% YoY

Operating Loss: -$34.7 million, compared to -$42.8 million last year

Net Loss: -$12.8 million, compared to -$27.8 million last year

Earnings Release Callout

“We had a very strong end of 2024. We saw record growth in our largest customers, those that spend more than $1 million with Cloudflare per year—closing the year with 173. We added 55 of those customers in 2024, and more than half of these new additions came during the fourth quarter alone.

I'm proud of how our team continued to deliver ground-breaking innovation, especially in AI, and remained focused on delivering real ROI for customers. We drove the record results in the fourth quarter while ensuring we're well-positioned to capture the demand we see lined up in 2025 to reaccelerate Cloudflare's growth.”

My Takeaway

Cloudflare stock is up +25% this week after reporting better-than-expected earnings. Their total revenue grew by +27%, exceeding Wall Street’s expectations. The company achieved double-digit YoY increase in sales productivity for the 5th consecutive quarter. Total remaining performance obligations grew +35% to $1.7B, exactly in-line with Wall Street’s forecast.

Management noted during their earnings call “measurable improvement” in the macro environment this quarter — in particular, the company saw a notable uptick in close rates and improvement in sales cycles. The company continues to expand their sales organization and reiterated that the number of reps will increase meaningfully this year.

The recent run up of Cloudflare’s stock price YTD (+31%) has largely been driven by increasing positive sentiment around Cloudflare’s AI opportunity. With that being said, Wall Street isn’t expecting Cloudflare to deliver AI-specific revenue until 2026 at the earliest as Inference moves from core to the edge of the network.

Cloudflare discussed optimization techniques on its platform using DeepSeek as an analog and continues to believe they are well positioned in inference. It’s hard to say when that revenue will be realized, but it will be a game-changer for this company in the next 18-24 months at the latest.

I’ll continue to buy more shares of Cloudflare.

Investor Events / Global Affairs:

The tariffs situation is beginning to heat up with China, insurance companies are skipping the Super Bowl, and MicroStrategy decided to rebrand.

China to Begin Retaliatory Tariffs This Week

Source: Foreign Policy

China's retaliatory tariffs on U.S. goods, including a 15% tax on coal and liquefied natural gas and a 10% levy on crude oil, agricultural machinery, and large-engine cars, take effect on February 10 in response to new U.S. tariffs on all Chinese imports. Beijing also imposed export controls on 25 rare metals, crucial for electronics and military equipment, and launched an anti-monopoly probe into Google, while adding PVH, the owner of Calvin Klein and Tommy Hilfiger, to its "unreliable entity" list.

Hang Seng Index (HSI) Performance, 5 Year Chart, Seeking Alpha

Meanwhile, President Trump has threatened new tariffs on other countries, arguing they would create fairer trade conditions and help reduce the U.S. budget deficit, while also considering tariffs on European car imports. China has lodged a complaint with the World Trade Organization (WTO), calling U.S. tariffs "discriminatory and protectionist", but experts doubt the WTO can effectively rule on the matter. Despite expectations of a call between Trump and Chinese President Xi Jinping, Trump has stated he is in no hurry to negotiate. In a rare move, Trump temporarily suspended tariffs on small packages from China, allowing the U.S. Postal Service (USPS) to resume handling shipments after a brief halt.

“Any new tariffs will add to the confusion and chaos over global trade Trump has created since he entered office. Trump had originally planned to place 25% tariffs against Mexico and Canada on 1 February but ultimately halted both tariffs after negotiations with the country leaders. Those tariffs are now expected to go into effect 1 March.”

Insurance Companies Expected to Skip Super Bowl

Source: Bleeding Cool

No insurance companies will air ads during the 2025 Super Bowl, reflecting a broader trend of declining ad spending in the industry. State Farm pulled its ad due to ongoing wildfires in Los Angeles, but the decision aligns with reduced marketing budgets across major insurers. Rising underwriting costs have led to significant cuts in advertising, with Progressive down -30%, Geico down -34%, and Allstate down -31% in 2023, according to S&P Global Market Intelligence.

The Progressive Corporation (PGR) Stock Performance, 5-Year Chart, Seeking Alpha

The Allstate Corporation (ALL) Stock Performance, 5-Year Chart, Seeking Alpha

This marks a notable shift from previous years when brands like Jake from State Farm, Flo from Progressive, and the Geico Gecko were Super Bowl staples. The trend suggests insurers are prioritizing financial stability over high-profile ad placements.

“The absence of State Farm ads this Super Bowl underscores a critical industry shift towards prioritizing real-world impact over commercial gains, signaling a need for insurers to adapt their marketing to current realities.”

MicroStrategy (MSTR) Rebrands to Strategy

MicroStrategy has rebranded as Strategy, emphasizing its focus on Bitcoin and artificial intelligence. The new identity includes a stylized "B" logo and an orange color scheme, symbolizing its role as the largest Bitcoin Treasury Company.

As part of the shift, the company launched new websites for its AI-powered business intelligence software and merchandise. Strategy recently expanded its Bitcoin holdings to 471,107 BTC, funded in part by a $563.4 million preferred stock offering.

“Strategy is one of the most powerful and positive words in the human language. It represents a simplification of our company name to its most important, strategic core.”

Major Economic Events:

The unemployment rate fell to 4% and U.S. household borrowing continues to soar.

Jobs Report & Unemployment Rate

The U.S. labor market remained strong in January, with the unemployment rate unexpectedly dropping to 4% — its lowest level since May 2024. The economy added +143,000 jobs, below the +170,000 forecast, but revisions to previous months showed 100,000 more jobs than initially reported. Wages grew +4.1% year-over-year, surpassing expectations and signaling ongoing inflation pressures.

The labor force participation rate ticked up slightly to 62.6%, indicating continued engagement in the job market. Strong payroll revisions and wage growth reduce the likelihood of Fed rate cuts in the near term, with markets now pricing a 67% chance of no change through May. While layoffs remain low, hiring has slowed, making it tougher for job seekers despite a resilient labor market.

“It’s notable that January’s payroll print is so tepid — and despite the revisions to past data, we think both the establishment and household survey are now overstating the level of employment. We maintain our baseline that the Fed will cut rates by 75 bps this year.”

"It's a low-hiring environment… So if you have a job, it's all good. But if you have to find a job, the job-finding rate, the hiring rates have come down."

Consumer Credit

US consumer borrowing surged by a record +$40.8 billion in December, driven by a sharp rise in credit card balances and non-revolving loans. Revolving debt, including credit cards, increased by +$22.9 billion, reversing the prior month’s decline, while non-revolving credit rose by +$18 billion, the most in two years. Auto sales contributed to the spike, hitting their fastest pace since May 2021.

Despite strong hiring, high interest rates and persistent inflation are straining household finances, with the average credit card interest rate at 22.8%. More Americans are carrying over credit card debt, with minimum payments at record highs and delinquency rates rising. Fed officials expect a slower pace of rate cuts this year after lowering rates by one percentage point in 2024.

“Overall, while headlines warn of a credit implosion, evidence from both banking practices and bond markets points to a stable credit environment — at least for now.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: David Paul Morris, Bloomberg

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply