- GRIT

- Posts

- 👉 All Eye on CES 2025

👉 All Eye on CES 2025

Constellation Brands, Delta, Jefferies

Welcome to your new week.

In case you missed it — I posted my 2024 Portfolio Performance Review yesterday. Feel free to read it for free!

Consider upgrading your subscription to view my portfolio (+74.9% total return), my specific positions, and receive many other perks!

🚨 PROMO ALERT! 🚨

📚 The first 250 registrants for our GRIT MONEY SUMMIT (April 2025) will receive a FREE copy of Sahil Bloom's new book, "The 5 Types of Wealth."

Wealth isn’t just about money—there are 5 types of wealth:

💰 Financial

👥 Social

💪 Physical

🧠 Mental

⏳ Time

But beware — the blind chase of financial wealth can cost you the others!

📍Hear Sahil Bloom speak LIVE in Toronto (or stream online) this April!

Joining him are Genevieve Roch-Decter (GRIT Founder), Austin Hankwitz (GRIT Head Analyst), and other top speakers to help level up your investing game in 2025. 🚀

Spots for the in-person event are limited. Promo available exclusively for GRIT subscribers with U.S. or Canadian addresses.

Don’t miss out — let’s make 2025 your wealthiest year yet! 💥

NOTE: This promotion ends January 12, 2025, and is limited to U.S. and Canadian addresses.

Key Earnings Announcements:

Albertsons, Constellation Brands, Delta & Jefferies highlight the primary earnings reports this week.

Monday (1/6): Commercial Metals

Tuesday (1/7): AAR, RPM

Wednesday (1/8): Albertsons Companies, Jefferies

Thursday (1/9): Markets Closed to Honor Former President Jimmy Carter

Friday (1/10): Delta Air Lines, Constellation Brands, Tilray, Walgreens Boots Alliance

What We’re Watching:

Delta Air Lines (DAL)

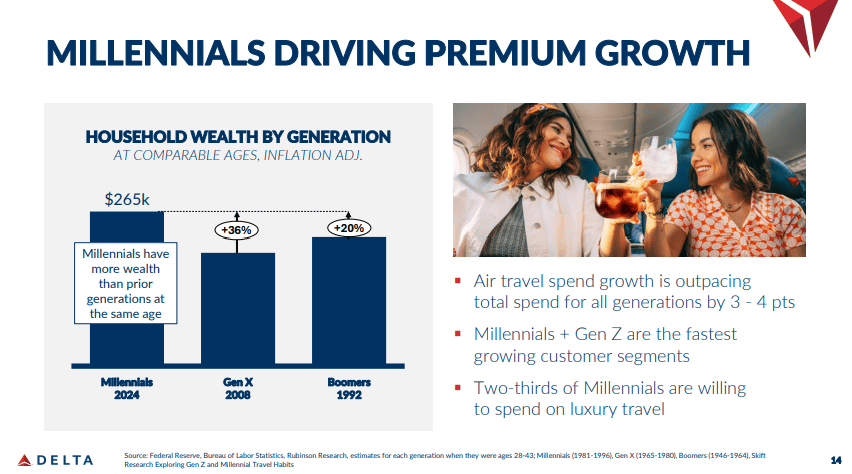

Delta Air Lines (+42% YoY) appears undervalued compared to peers, despite consistently outperforming United Airlines in revenue and demonstrating a strong post-pandemic recovery. While United’s revenue growth has been higher year-over-year, Delta’s profitability and operational efficiency stand out.

Challenges like rising fuel costs and a cybersecurity issues haven’t derailed performance, and Delta’s focus on modernizing its fleet and expanding premium services positions it for further growth. Financial strength is clear with a 40.7% Return on Equity, $15.68 billion in quarterly revenue, and a healthy balance sheet.

If you’ve read my work over the years, you know that I generally don’t have much interest in investing into airlines. However, Delta is up +42% over the past year and United is up +123% over the next year. I’m being forced to start paying closer attention to this sector, and I’m excited to report back on their earnings this week!

Delta Air Lines, Inc. (DAL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Consumer Electronics Show (CES), McValue Menu, Detroit Auto Show, and the TikTok Ban Hearing…

Consumer Electronics Show

The Consumer Electronics Show (CES) returns to Las Vegas from January 7–10, showcasing cutting-edge technology and bold breakthroughs. Global brands will debut their latest innovations, while industry leaders take the stage to discuss future trends.

Make no mistake, this is one of the biggest and most anticipated conferences of the entire year.

Notable keynote speakers include Delta Air Lines CEO Ed Bastian, Nvidia CEO Jensen Huang, Sirius XM CEO Jennifer Witz, X CEO Linda Yaccarino, Waymo Co-CEO Tekedra Mawakana, Accenture CEO Julie Sweet, and AMD CEO Lisa Su — highlighting the event’s influence across sectors.

Companies looking to make waves at CES include:

LG with new TV models

Qualcomm unveiling next-gen car technology

Gentex with connected car products

Himax Technologies showcasing eye-tracking tech

Abbott Labs introducing biowearables

SES AI revealing AI-powered robotics and drone cells.

In the auto sector, Toyota, Honda, and Faraday Future Intelligent are set to display prototype vehicles. Analysts are closely watching these companies for potential stock volatility tied to its announcements at the event.

“AI was everywhere at CES 2024, and while there were some cool examples of the fast-moving technology, there was also a lot of empty hype. At CES 2025, we'll be looking for clear evidence that AI is making a difference to any products it's embedded in and isn't just lending itself to a label on a box or another bullet point on a spec sheet.

At this year's show, we expect to hear plenty about "agentic AI," which will put smart assistants at the forefront of device interfaces. It's an idea that's been heavily hinted at by tech companies, and it's even the subject of experiments, in ways that suggest it could eventually kill off apps. It has yet to be executed in a way that makes us convinced it'll be the future.”

McDonald’s Unveils McValue Platform

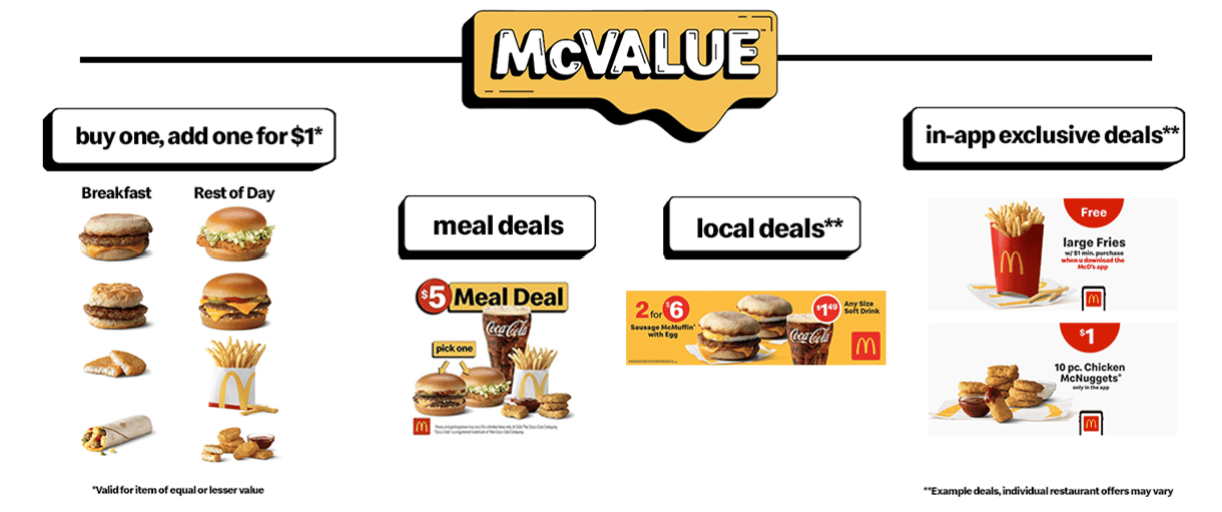

McDonald’s is rolling out its McValue platform nationwide, targeting budget-conscious diners. Key features include a $5 Meal Deal, exclusive in-app offers, local discounts, and a "Buy One, Add One for $1" deal covering breakfast, lunch, and dinner.

Expect this strategy to drive traffic and boost sales amid rising consumer focus on affordability.

McDonald’s Corp. (MCD) Stock Performance, 5-Year Chart, Seeking Alpha

McDonald’s is up just +0.8% over the past year, and investors are hoping that the McValue Menu can act as a catalyst.

Learn more about it here: McDonald’s Launching McValue Platform in US Restaurants in 2025

Media Day at Detroit Auto Show

The Detroit Auto Show runs Jan 10–20, with Media Day set for Friday, Jan 10. Industry giants like GM, Ford, Stellantis, Toyota, and Volkswagen are expected to share key updates.

Rivian will debut its R2 and R3X models, drawing attention to the EV market. Watch for announcements that could shape the auto sector’s outlook heading into 2025.

View more key information here: Detroit Auto Show

Supreme Court to Hear TikTok Case

Source: Sheldon Cooper/SOPA Images/LightRocket via Getty Images

The Supreme Court will hear arguments on the TikTok ban ahead of its scheduled enforcement on January 19 — just one day before President Trump is set to take office. Trump has urged the court to pause the ban, citing concerns over its impact.

Investor Jeffrey Yass, whose fund holds a 15% stake in TikTok’s parent company, made $96 million in donations to Republicans this election cycle — adding another layer of political intrigue to the case.

The outcome could set a major precedent for tech regulation and foreign-owned apps in the U.S.

“Trump, who on the campaign trail suggested in a social media post that he would “save TikTok,” is asking the court to suspend the divestment deadline and consider his preference for a “negotiated resolution" — given that as president, he will be responsible for national security.

Late on Friday, the Department of Justice asked the Supreme Court to reject Trump's request, saying no one was disputing that China “seeks to undermine U.S. interests by amassing sensitive data about Americans and engaging in covert and malign influence operations.””

Major Economic Events:

FOMC Minutes released & Michigan Consumer Sentiment take center stage in first full week of 2025.

Monday (1/6): Factory Orders, S&P Final U.S. Services PMI

Tuesday (1/7): ISM Services, Job Openings, Richmond Fed President Barkin Speaks, U.S. Trade Deficit

Wednesday (1/8): ADP Employment, Consumer Credit, Minutes of Fed’s December FOMC Meeting

Thursday (1/9): Initial Jobless Claims, Wholesale Inventories

Friday (1/10): Consumer Sentiment, U.S. Employment, U.S. Hourly Wages, U.S. Unemployment

What We’re Watching:

FOMC Minutes

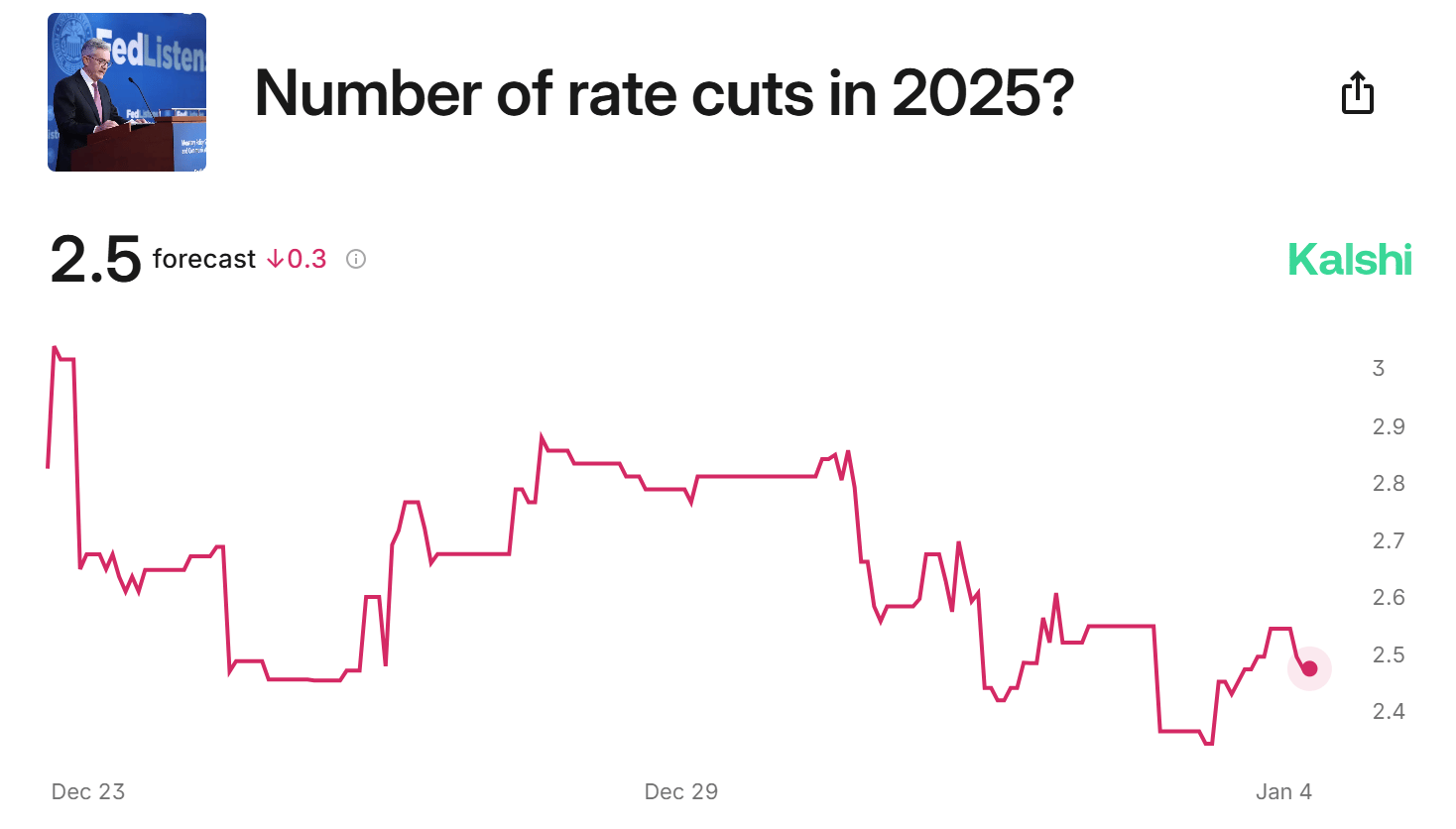

The Federal Reserve lowered the federal funds rate by 25bps in December, the third consecutive cut this year, bringing rates to 4.25%–4.5%, as expected.

Looking ahead, the dot plot now signals two rate cuts in 2025 — totaling 50bps — down from the 100bps projected last quarter. This reflects a much more cautious outlook on monetary easing due to a strong labor market and stickier-than-expected inflation.

View more here: Summary of Economic Projections, December 18, 2024

Michigan Consumer Sentiment

The University of Michigan’s consumer sentiment index rose to 74 in December, up from 71.8 in November — the highest level since April.

Expectations climbed to 73.3 from an initial 71.6, while current conditions dipped to 75.1 from 77.7. Inflation expectations eased slightly, falling to 2.8% for the year-ahead and 3.0% over five years.

"Buying conditions exhibited a particularly strong 32% improvement, primarily due to a surge in consumers expecting future price increases for large purchases. Broadly speaking, consumers believe that the economy has improved considerably as inflation has slowed, but they do not feel that they are thriving.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Cars.com

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply