- GRIT

- Posts

- 👉 Major Earnings Reports Continue

👉 Major Earnings Reports Continue

Amazon, AMD, Google

Welcome to your new week.

The past week in the markets was one of the most volatile we’ve seen in many months. Let’s get you prepared for everything you can expect this go-round.

Between Google, Amazon, AMD, government shutdowns, IPOs, OpenAI drama, crypto investor heartache, and more — we’re here to break it all down!

Key Earnings Announcements:

Alphabet, Amazon, AMD, Palantir, and Uber highlight a very busy week of earnings.

Monday (2/2): Aptiv, IDEXX Laboratories, Palantir, Teradyne, Tyson Foods, Walt Disney

Tuesday (2/3): Advanced Micro Devices, Chipotle, Merck, PayPal, PepsiCo, Pfizer, Super Micro Computer

Wednesday (2/4): AbbVie, Alphabet, Arm Holdings, Boston Scientific, Eli Lilly, Novo Nordisk, Qualcomm, Uber

Thursday (2/5): Amazon, Bristol Myers Squibb, ConocoPhillips, Estee Lauder, Roblox, Shell

Friday (2/6): Biogen, Centene, Cboe Global Markets, Toyota Motor, Under Armour

What We’re Watching:

Alphabet (GOOGL)

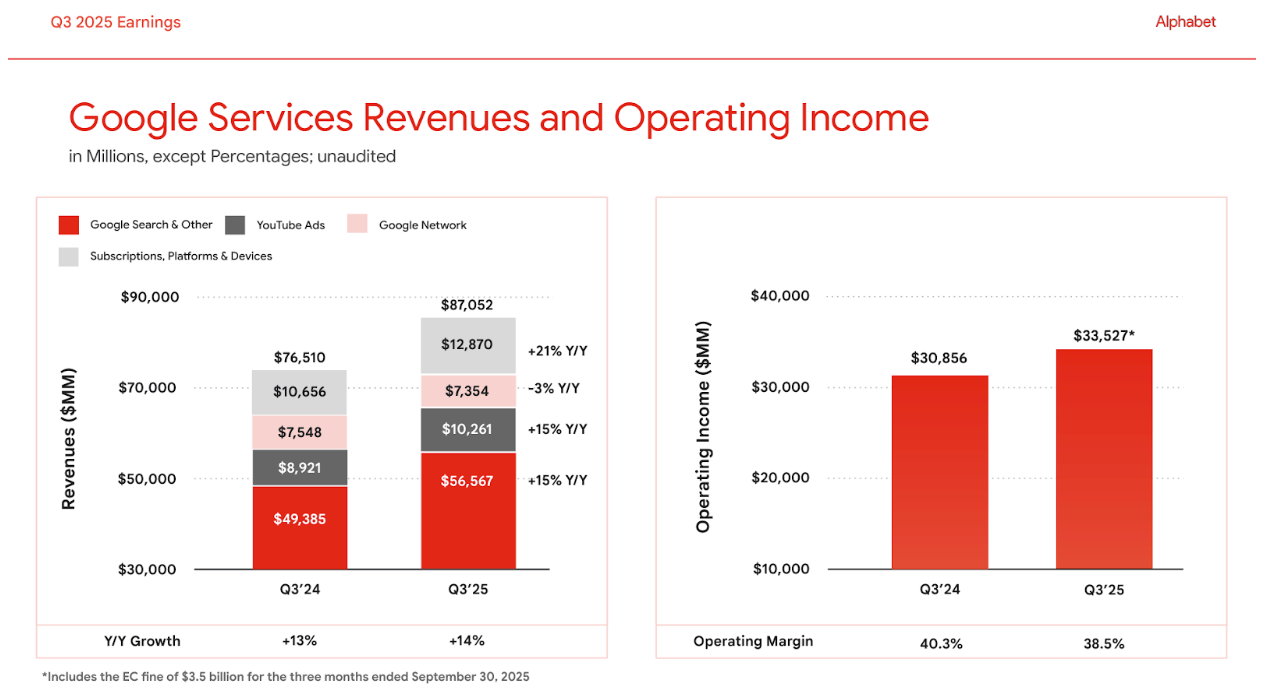

Source: Alphabet Q3 Earnings Deck

Alphabet (+8% YTD) reports Q4 FY2025 earnings this week, with investors focused on whether the company’s core ad business, cloud momentum, and AI initiatives can deliver durable growth and margin leverage in an increasingly competitive landscape.

Last quarter, Alphabet posted $96.4 billion in revenue (+14% YoY) and $2.31 in EPS (+22% YoY), above consensus, driven by strength in Search, YouTube, and a +32% jump in Google Cloud to roughly $13.6 billion. Despite heavy investment in AI infrastructure and products like Gemini, operating margin remained resilient at ~32%, underscoring the company’s ability to balance growth with profitability.

For this quarter, key items to watch include advertising demand trends, particularly international and YouTube monetization; Cloud growth and profitability trajectory; and early signals from AI product adoption and monetization across Search, Workspace, and developer offerings. Any updates on capex direction, competitive positioning versus Microsoft and Amazon in cloud, and strategic commentary around AI investments could be major catalysts.

“AI is positively impacting every part of the business, driving strong momentum.”

Alphabet, Inc. (GOOGL) Stock Performance, 5-Year Chart, Seeking Alpha

Amazon (AMZN)

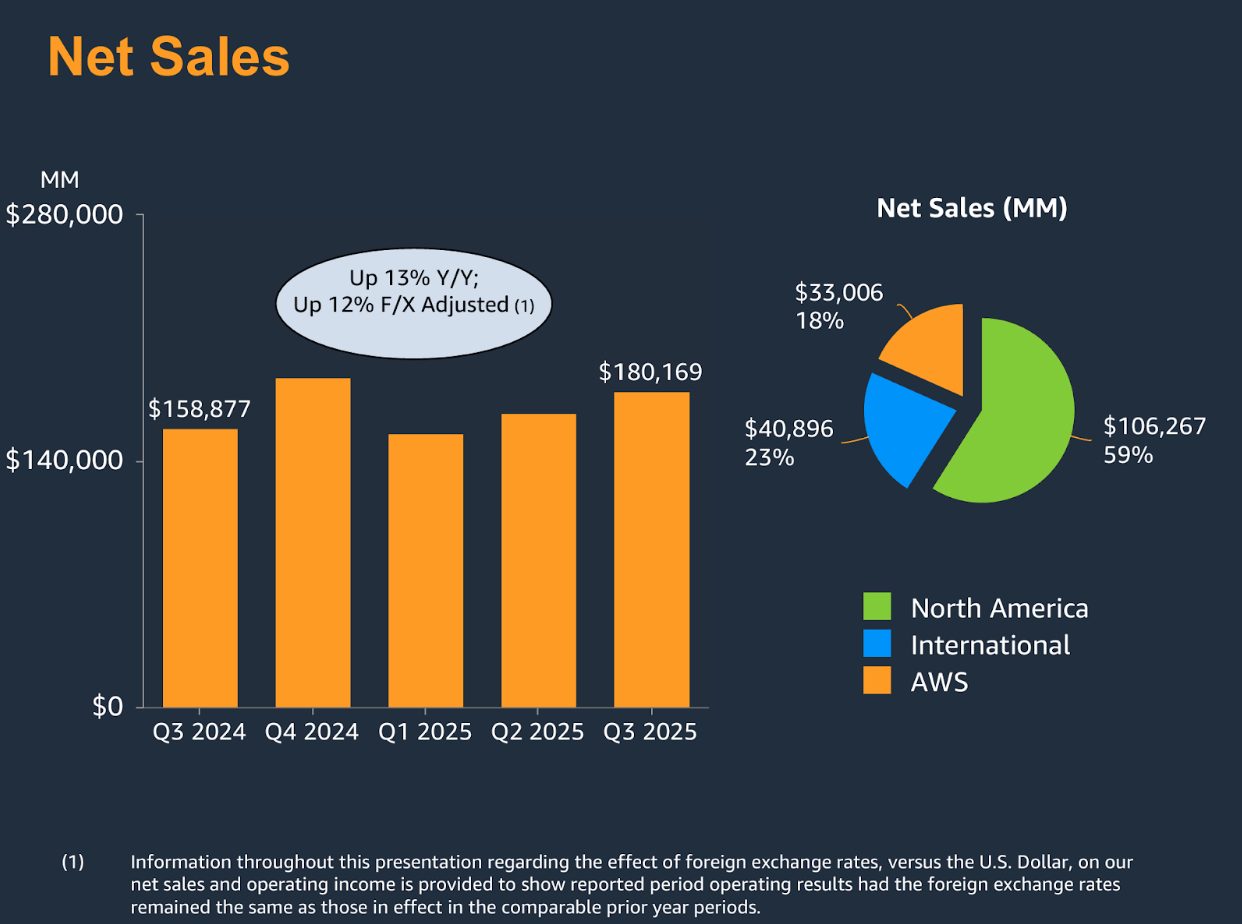

Source: Amazon Q3 Earnings Deck

Amazon (+4% YTD) reports Q4 FY2025 earnings Thursday after the close, with investors focused on whether accelerating AWS growth and AI-driven demand can offset ongoing margin pressure from fulfillment costs and heavy infrastructure spending. Amazon remains a bellwether for both consumer health and enterprise cloud investment, making this print especially consequential for broader market sentiment.

Last quarter, Amazon delivered $157.4 billion in revenue (+11% YoY) and $1.00 in EPS, beating expectations as AWS growth reaccelerated to +19% YoY and operating income expanded across both North America and International segments. Management highlighted rising demand for generative AI workloads, stronger advertising performance, and continued efficiency gains in fulfillment — though capex remained elevated as Amazon scaled data centers and logistics capacity.

Heading into this release, I’ll be watching whether AWS growth can push back above the 20% range, how quickly AI-related revenue translates into margin expansion, and whether retail profitability continues to improve amid stabilizing consumer demand. Commentary on 2026 capex, AI monetization (Bedrock, custom silicon), and advertising momentum will be key drivers for the stock’s next move.

“Customers are choosing AWS for generative AI because of our breadth of services, cost advantages, and pace of innovation.”

Amazon, Inc. (AMZN) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Numerous IPOs are coming, Nvidia’s relationship with OpenAI is being more closely analyzed, and more details on the sell-off in the crypto market.

IPO Rush

Source: REUTERS/Shannon Stapleton/File Photo

It’s a busy week for new listings, with several companies set to make their public-market debuts, testing investor appetite amid elevated volatility and selective risk-taking. Trading is expected to begin for VeraDermics, Once Upon a Farm, Eikon Therapeutics, Bob's Discount Furniture, Liftoff Mobile, and Forgent Power Solutions — spanning healthcare, consumer, and tech.

For markets, the mix of fresh IPOs will offer a timely read on risk appetite, valuation discipline, and demand for new equity issuance heading into the heart of earnings season.

“Seven IPOs raising at least $100 million are currently scheduled for the week ahead, in what could be one of the busiest weeks for sizable offerings since 2021. Notably, only one other week over the past four years has produced seven $100 million-plus IPOs, underscoring the renewed depth in issuance even as IPO investors remain selective. An eighth IPO (SGP) is tentatively scheduled for the month, and could also list this week.

The week ahead features emerging themes including a biotech rebound, a consumer comeback, and the first billion-dollar IPO of the year (Forgent Power Solutions). However, stay tuned on whether a possible US government shutdown impedes their listing plans.”

Nvidia–OpenAI Investment Narrative in Focus

Nvidia CEO Jensen Huang pushed back on reports that the company had committed to a $100B investment in OpenAI, clarifying that any participation would be non-binding and evaluated round by round. Huang emphasized that while Nvidia remains highly supportive of OpenAI’s mission and expects to invest “a great deal,” there was never a firm pledge at that scale.

The clarification follows reports suggesting internal debate at Nvidia around deal discipline and the optics of large AI partnerships, particularly as OpenAI is both a strategic partner and a major buyer of Nvidia’s chips. Similar concerns have surfaced around Nvidia’s growing financial ties with customers like CoreWeave, reinforcing investor scrutiny of “circular” AI funding structures.

For markets, the key watch this week is whether Nvidia provides more detail on the size, timing, and structure of any OpenAI investment — and how management frames capital allocation discipline as AI infrastructure spending continues to balloon across the ecosystem.

“We will invest a great deal of money… I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.”

Sell-Off in the Crypto Market

Crypto markets start the week under pressure after a sharp weekend selloff pushed Bitcoin below $75,000 for the first time since October 2024. The move triggered an estimated $2.5 billion in liquidations, as leverage was flushed across majors and altcoins.

Bitcoin briefly traded near $74,900, down more than 6% on the day and roughly 10% YTD, with selling pressure coming from both spot ETFs and miners. Adding to the tension, Bitcoin has surpassed a key psychological and market-structure level near $76,000 — the average purchase price of Michael Saylor’s Strategy holdings. The firm currently owns 712,647 BTC, acquired for roughly $54.2 billion at an average cost of $76,037 per coin.

This week, markets will be watching whether BTC can reclaim key technical levels, how ETF flows evolve after the drawdown, and whether broader macro catalysts – rates, the dollar, and equities – either stabilize crypto or extend the unwind.

“The levels right now are reading in pretty extreme disinterest.”

Major Economic Events:

The U.S. jobs report will be the main event of the week.

Monday (2/2): Auto Sales, ISM Manufacturing, S&P Flash U.S. Manufacturing PMI

Tuesday (2/3): ISM Services, Job Openings (JOLTS), S&P Final U.S. Services PMI

Wednesday (2/4): ADP Employment Report

Thursday (2/5): Atlanta Fed President Raphael Bostic Speaks, Initial Jobless Claims

Friday (2/6): Consumer Credit, Consumer Sentiment (Prelim), U.S. Employment Report, U.S. Hourly Wages, U.S. Hourly Wages Year Over Year, U.S. Unemployment Rate

What We’re Watching:

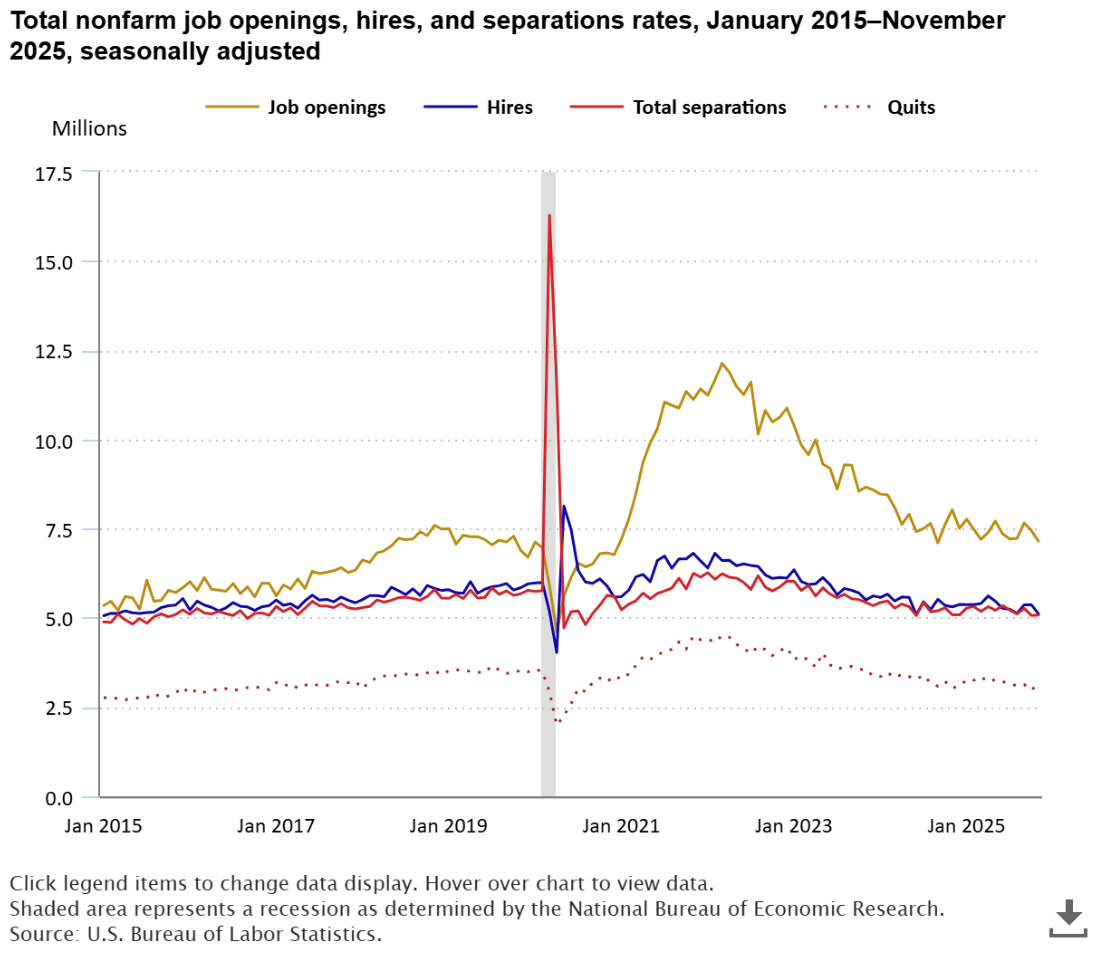

Job Openings

U.S. job openings fell sharply to 7.15 million in November, down 303,000 from October and well below expectations for 7.60 million. The reading marks the lowest level since September 2024.

Declines were concentrated in cyclical and consumer-facing sectors, with openings falling in accommodation & food services (-148K), transportation and warehousing (-108K), and wholesale trade (-63K). Construction was a notable outlier, posting a +90K increase. Regionally, job openings declined across all four major areas, led by the South and Midwest. Importantly, hires and separations held steady at 5.1 million, with quits and layoffs unchanged.

Economists expect the following this week:

Job Openings: 7.15M vs. 7.45M prior

Quits Rate: ~3.2M vs. 3.2M prior

“Job openings are falling back toward pre-pandemic norms – a sign the labor market is cooling through demand, not distress.”

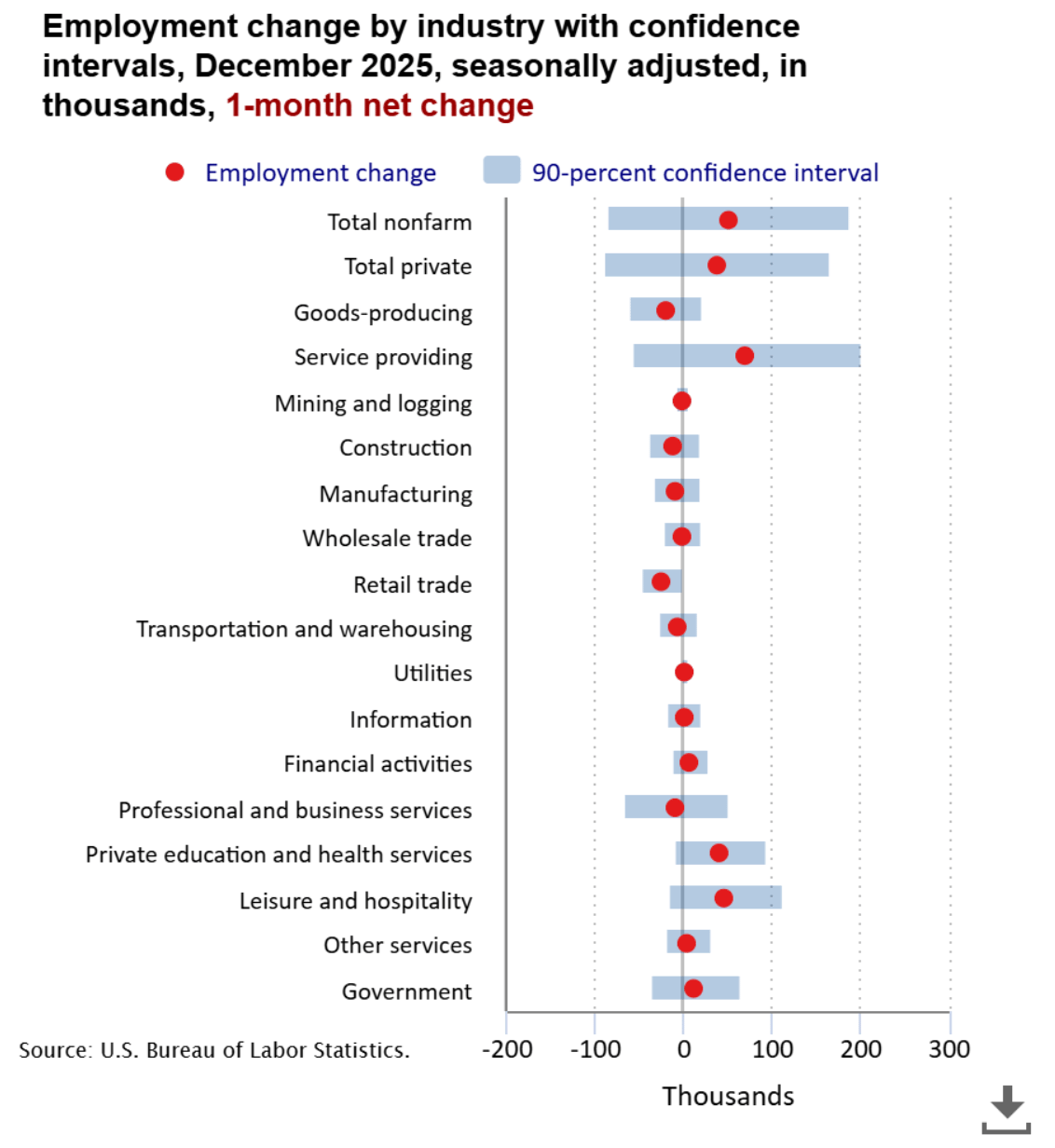

Non-Farm Payrolls

U.S. payroll growth cooled further in December, with the economy adding 50,000 jobs, below both November’s downwardly revised 56K and expectations for 60K.

Job gains remained concentrated in services, led by food services & drinking places (+27K), health care (+21K), and social assistance (+17K). Retail trade shed 25K jobs, while most other sectors – including construction, manufacturing, financial activities, and professional services – saw little to no change. Prior months were also revised lower, with October and November payrolls combined revised down by 76K.

For full-year 2025, payrolls rose by 584K, averaging just 49K per month, a sharp slowdown from the 2.0 million jobs added in 2024. The data points to a labor market that is losing steam without tipping into outright contraction.

Economists expect the following this week:

Nonfarm Payrolls: +50K vs. +56K prior

Average Monthly Job Growth (2025): ~49K vs. ~167K in 2024

“The labor market is no longer running hot –it’s cooling toward stall speed, which gives the Fed flexibility but little urgency.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

This content is sponsored by NEOS Investments. The creator is compensated by NEOS to discuss NEOS ETFs. This content is for informational purposes only, and is not personalized investment, tax, or legal advice, and does not constitute an offer to buy or sell any security. Investing involves risk, including possible loss of principal. Before investing, carefully review the NEOS ETFs prospectus at neosfunds.com.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: Goodshoot / Jupiterimages

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]