- GRIT

- Posts

- 👉 Oracle, GameStop, and Adobe

👉 Oracle, GameStop, and Adobe

& Apple's New iPhone 17 Air

Welcome to your new week.

As a reminder, the Rate of Return by GRIT newsletter is broken up into two editions.

Every Monday morning we publish this edition of the newsletter — The Investing Week Ahead. This edition is entirely focused on ensuring you know exactly what’s taking place throughout the week — earnings reports, economic data, global affairs. You name it!

The Investing Week Ahead is completely free, so forward it to your friends.

On Sundays we publish the Week in Review. This edition of our newsletter is a detailed walkthrough of what actually happened in the markets between Monday and Sunday — and what I’m doing with my investment portfolio as I digest the news.

We actually offered yesterday’s Week in Review to our subscribers completely for free. We broke down Palo Alto Networks’, Target’s, and Walmart’s earnings results — as well as explained what Jerome Powell said in Jackson Hole.

Here’s a link to read it completely for free!

Together, The Investing Week Ahead and the Week in Review are the internet’s best summary of what took place in the markets and how to position your portfolio going forward.

Let’s jump in!

Key Earnings Announcements:

Adobe, Chewy, GameStop, Kroger, and Oracle highlight a softer week of earnings.

Monday (9/8): Casey’s

Tuesday (9/9): Cognyte, GameStop, Oracle

Wednesday (9/10): Chewy

Thursday (9/11): Adobe, Kroger

Friday (9/12): N/A

What We’re Watching:

Adobe (ADBE)

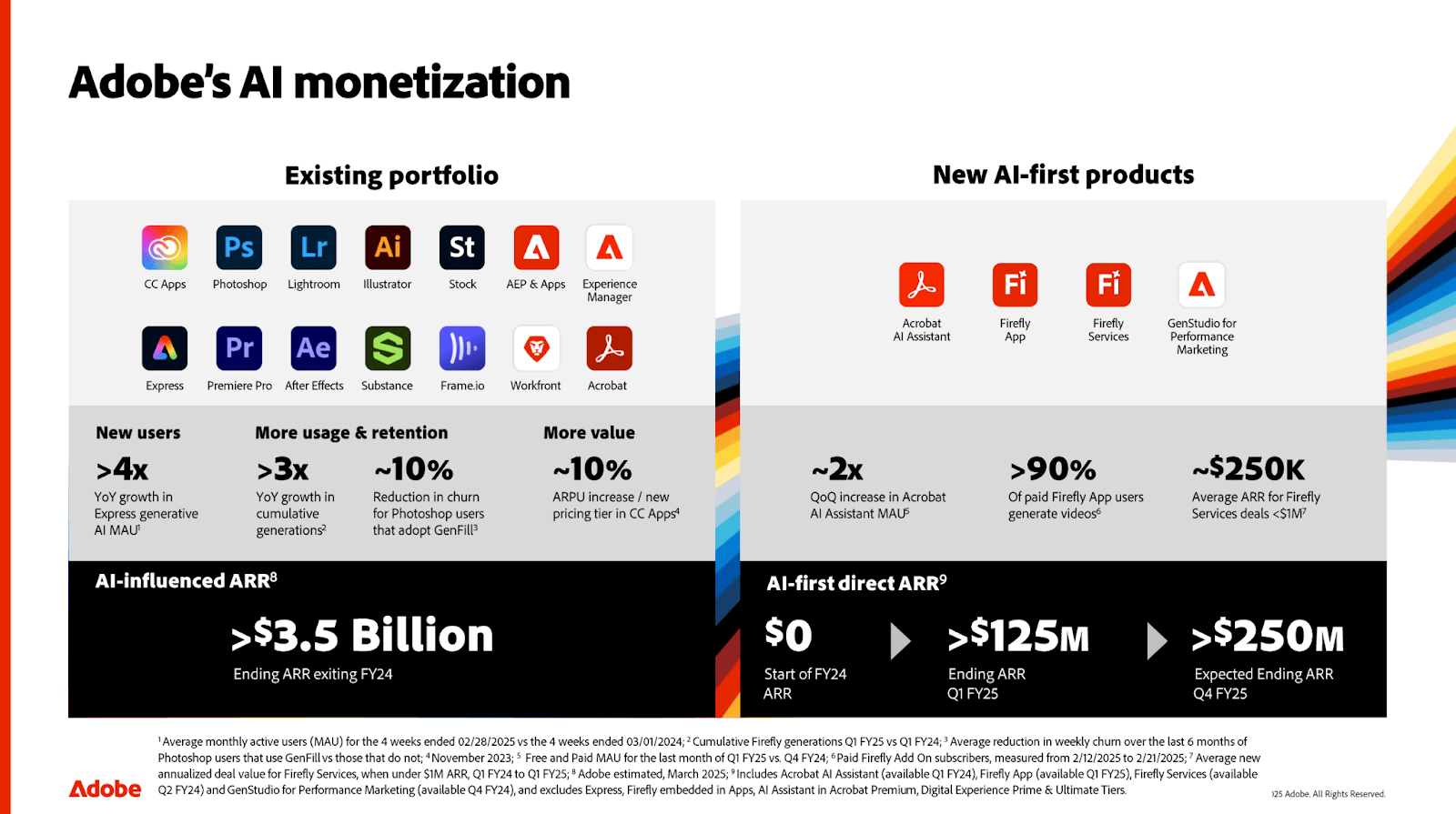

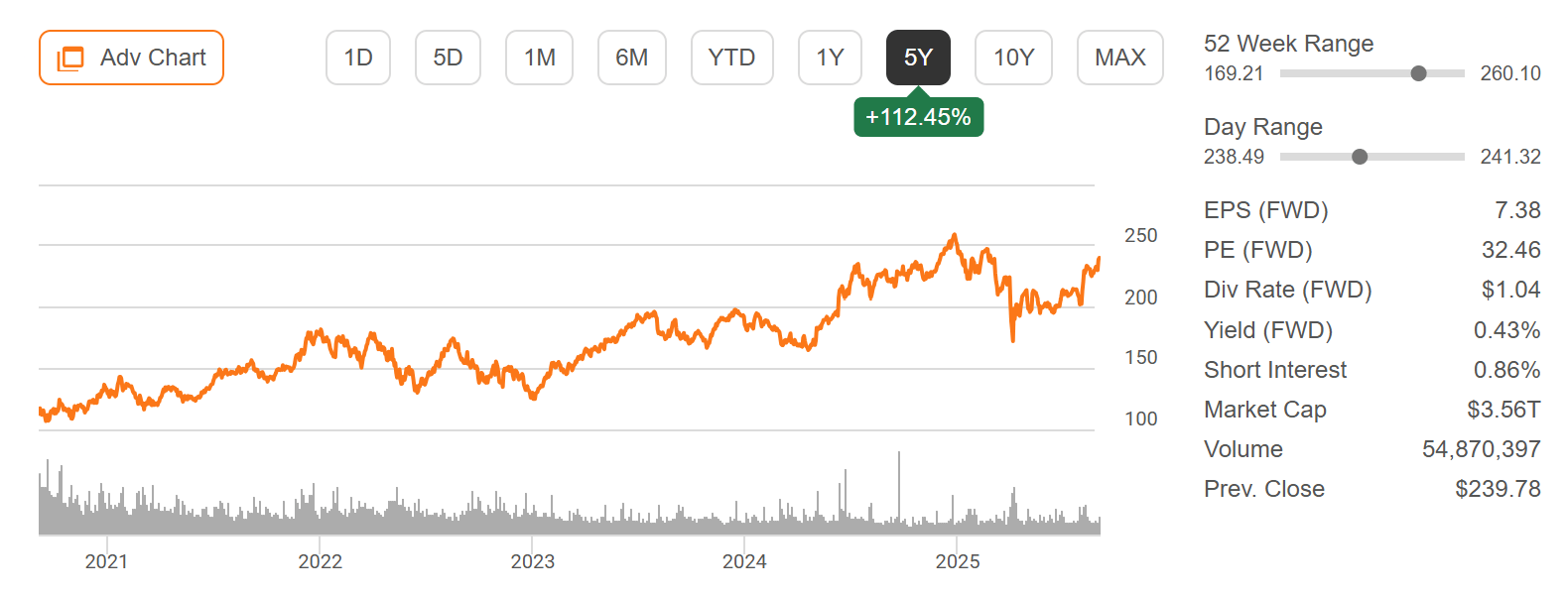

Adobe (-21.4% YTD) reports Q3 FY2025 earnings Thursday after the bell, stepping into the spotlight as Wall Street scrutinizes its AI-infused growth trajectory and long-term innovation edge.

This quarter, all eyes are on whether Adobe can sustain its AI-powered momentum — especially as generative products like Firefly and Acrobat AI Assistant now account for $3.5 billion in ARR, with CFO Dan Durn targeting a future where 100% of revenue is AI-influenced. Analysts will also be watching for updates on creative/media segment licensing trends and enterprise software strength.

I’ll be looking for commentary on AI ARR growth visibility (previously at $125M and expected to double within the year), as well as margin resilience, pricing power, and performance obligations as indicators of resilience.

“The creative opportunity is expanding across audiences with AI as an accelerant. … It is opening the content floodgates, tapping into everyone’s imagination…”

Adobe, Inc. (ADBE) Stock Performance, 5-Year Chart, Seeking Alpha

Oracle (ORCL)

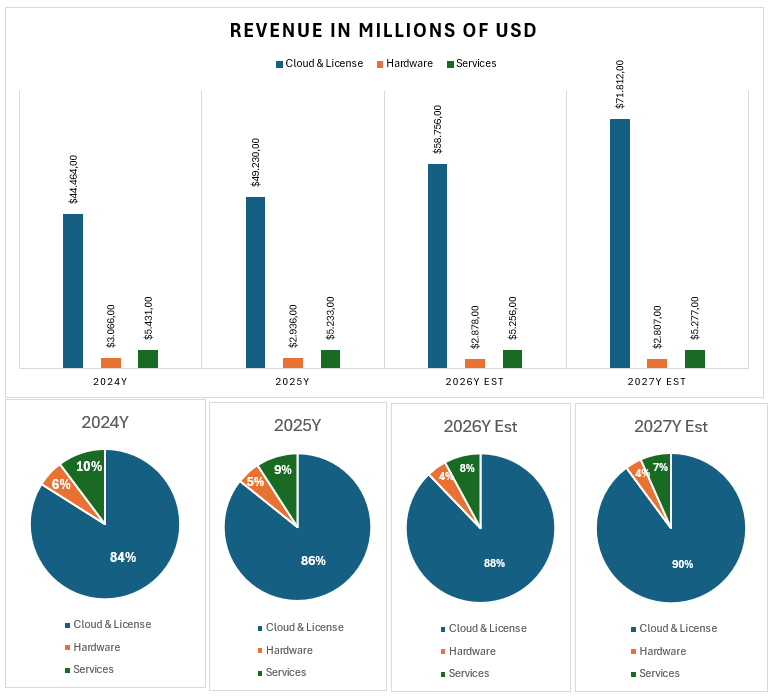

Oracle (+39.7% YTD) reports Q1 FY2026 earnings Tuesday after the bell, entering the spotlight as its AI-influenced cloud strategy continues to reshape investor sentiment.

This quarter, all eyes will be on whether Oracle can maintain its AI and cloud momentum — boosted by multi-year revenue guidance of $67 billion and a strong expansion trajectory (cloud growth projected to accelerate from +24% to over +40%). The upcoming earnings will test if this bullish trajectory is broad-based, with key attention on large cloud contract wins (a $30B+ opportunity in 2028 is already on the radar).

I’ll specifically be looking for updates on the newly struck Gemini access deal with Google, Oracle’s ambitious overseas infrastructure investments (like its $3B expansion in Germany and the Netherlands), and how capital expenditure ramp-ups are being balanced against upcoming AI-driven demand.

“My biggest worry is not lack of demand. My biggest worry is ensuring enough supply for expansion — not demand.”

Oracle Corporation (ORCL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Apple unveils new tech at its live event, Goldman Sachs’ Communacopia + Tech Conference, Klarna to price its IPO.

Apple ‘Awe Dropping’ Event

Apple will host its highly anticipated “Awe Dropping” event Tuesday in Cupertino, unveiling its thinnest-ever smartphone — the iPhone 17 Air — alongside new Apple Watch hardware.

Markets will be focused on how Apple positions the 17 Air as a premium upgrade cycle driver, especially as iPhone sales have softened in China and upgrade timelines lengthen globally. The new Apple Watch lineup is also expected to highlight health and fitness features — a category Apple continues to double down on for ecosystem stickiness.

I’ll be watching closely for commentary on AI integration into iOS and devices, given Apple’s Gemini licensing talks and push into on-device AI, as well as any updates on Services revenue growth — increasingly critical to Apple’s long-term story.

Apple, Inc. (APPL) Stock Performance, 5-Year Chart, Seeking Alpha

Goldman Sachs Communacopia + Tech Conference

The three-day Goldman Sachs Communacopia + Technology Conference kicks off next week at the Palace Hotel in San Francisco, showcasing a deepest-in-class lineup of enterprise tech innovators and infrastructure heavy hitters. Among executives slated to appear are:

Original list also includes: Uber, AMD, Snowflake, News Corp, Seagate, ASML, Autodesk, Rivian, Coinbase — all of which reflect the conference’s breadth across mobility, semis, cloud, and media.

With enterprise IT budgets under scrutiny, these sessions will offer signals on how the sector is adapting to AI, infrastructure demands, geopolitical risk, and technology consolidation.

Klarna IPO

Swedish fintech Klarna (KLAR) is set to begin trading this week, aiming to raise ~$1.27B at a valuation of up to $14B. That’s a steep drop from its $45B peak in 2021 but well above the $6.7B trough in 2022.

The listing highlights Klarna’s pivot beyond BNPL into broader financial services — with a U.S. debit card, mobile features, and potential banking license plans. Still, profitability remains a question after Q2 losses of $50–100M.

This IPO will be a key test of investor appetite for growth fintech, especially with the IPO market heating up. I’ll be watching to see if Klarna follows strong debuts like Circle and eToro — or faces a cooler reception.

Major Economic Events:

Focus is on the consumer, with CPI and University of Michigan's consumer sentiment survey.

Monday (9/8): Consumer Credit

Tuesday (9/9): NFIB Optimism Index

Wednesday (9/10): Core PPI, Producer Price Index, Wholesale Inventories

Thursday (9/11): Consumer Price Index, Core CPI, Initial Jobless Claims, Monthly U.S. Federal Budget

Friday (9/12): Consumer Sentiment (prelim)

What We’re Watching:

Consumer Price Index

Source: U.S. Bureau of Labor Statistics

US Core CPI rose +3.1% YoY in July, the steepest increase in five months, up from +2.9% in June and above expectations of +3.0%. On a monthly basis, core CPI climbed +0.3%, matching estimates and accelerating from +0.2% in June.

Shelter inflation eased slightly (+3.7% vs +3.8%), while other categories posted notable increases: medical care (+3.5%), household furnishings (+3.4%), motor vehicle insurance (+5.3%), and recreation (+2.4%).

Economists expect the following this week:

Core CPI (August, est.) — +0.2% MoM, +3.0% YoY

Headline CPI (August, est.) — +0.2% MoM, +2.8% YoY

Consumer Sentiment

US University of Michigan Consumer Sentiment dropped to 58.2 in August from 61.7 in July, revised down from the preliminary 58.6 and well below expectations of 62. The decline snapped a four-month rebound and reflected growing inflation concerns and sharply weaker buying conditions for durable goods, which fell to a one-year low.

Expectations for overall business conditions and the labor market outlook also deteriorated, though personal financial expectations held broadly steady. Year-ahead inflation expectations rose to 4.8% (+0.3pp), extending tariff-driven pressures seen earlier this year.

Economists expect the following this week:

University of Michigan Consumer Sentiment (Aug, final) — 58.2 actual vs 62.0 est.

Conference Board Consumer Confidence (Aug, est.) — 96.5

If you’re starting your investing journey or are interested in buying T-bills yielding 5% or more, consider visiting Public.com.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]