- GRIT

- Posts

- 👉 Salesforce, Broadcom, Lululemon

👉 Salesforce, Broadcom, Lululemon

& EV Tax Credit Deadline

Welcome to your new week.

As a reminder, the Rate of Return by GRIT newsletter is broken up into two editions.

Every Monday morning we publish this edition of the newsletter — The Investing Week Ahead. This edition is entirely focused on ensuring you know exactly what’s taking place throughout the week — earnings reports, economic data, global affairs. You name it!

The Investing Week Ahead is completely free, so forward it to your friends.

On Sundays we publish the Week in Review. This edition of our newsletter is a detailed walkthrough of what actually happened in the markets between Monday and Sunday — and what I’m doing with my investment portfolio as I digest the news.

We actually offered yesterday’s Week in Review to our subscribers completely for free. We broke down Palo Alto Networks’, Target’s, and Walmart’s earnings results — as well as explained what Jerome Powell said in Jackson Hole.

Here’s a link to read it completely for free!

Together, The Investing Week Ahead and the Week in Review are the internet’s best summary of what took place in the markets and how to position your portfolio going forward.

Let’s jump in!

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

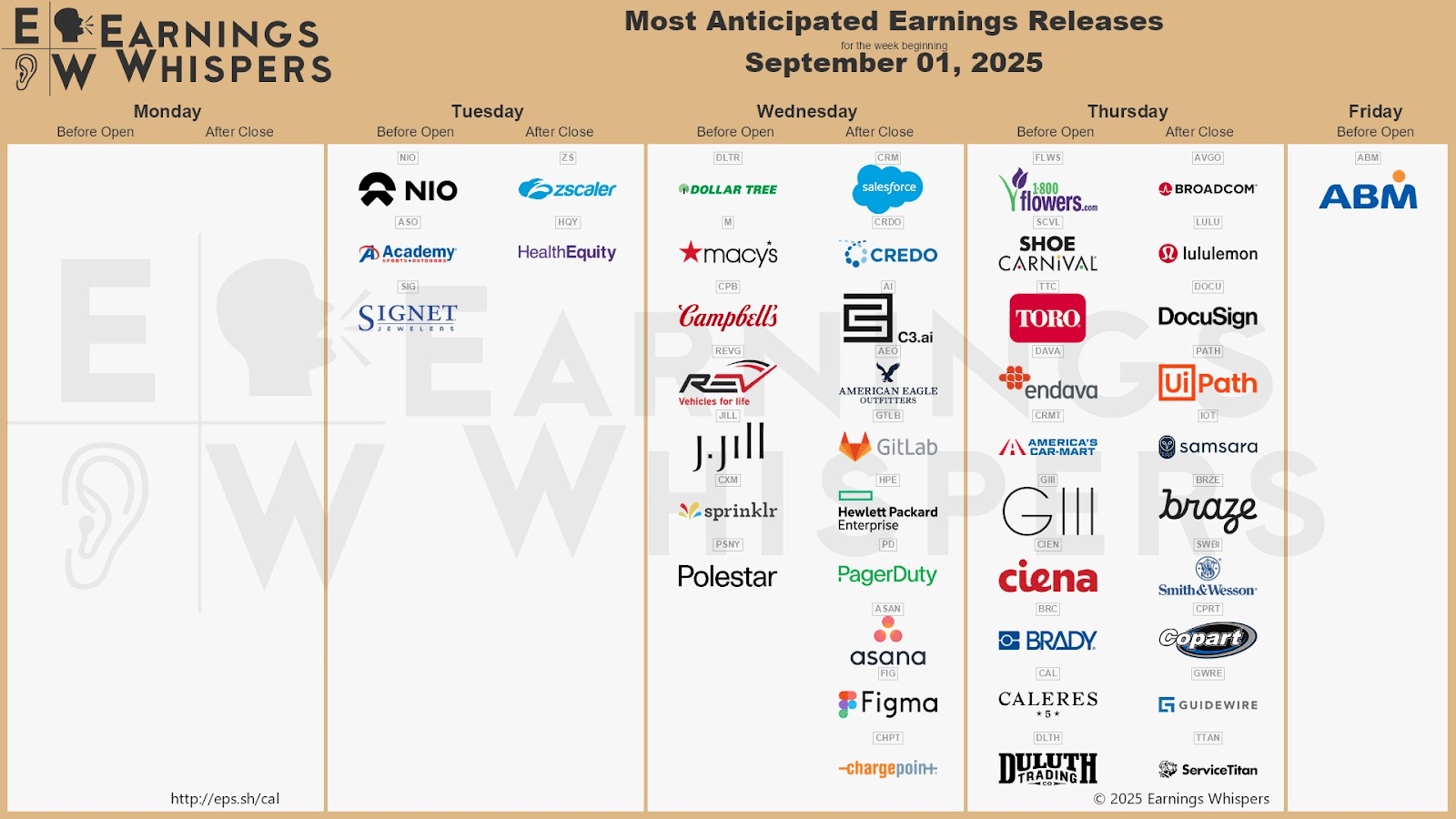

Key Earnings Announcements:

A short week calls for a mixed group of earnings led by Broadcom, Lululemon and Salesforce.

Monday (9/1): Labor Day

Tuesday (9/2): Nio, Zscaler

Wednesday (9/3): American Eagle, Asana, Campbell’s, Dollar Tree, Figma, GitLab, Hewlett Packard, Macy’s, Salesforce

Thursday (9/4): Broadcom, DocuSign, Lululemon, Toro

Friday (9/5): ABM

What We’re Watching:

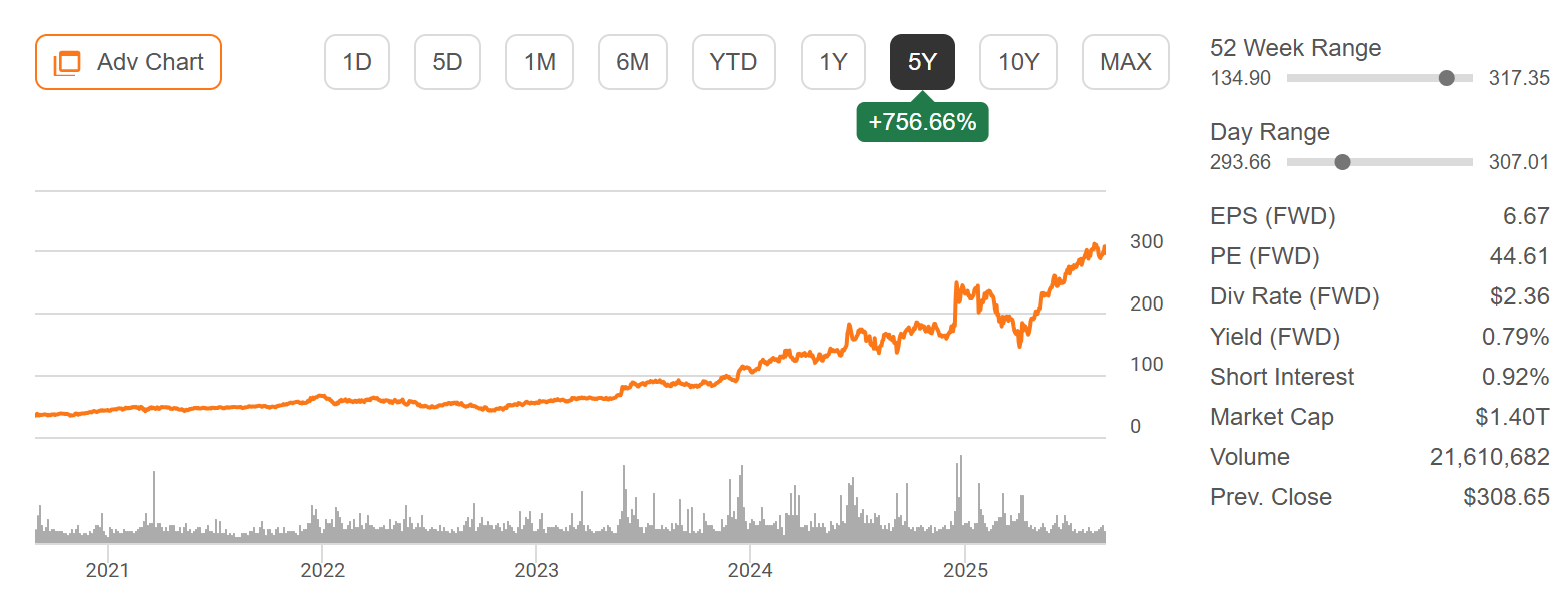

Broadcom (AVGO)

Source: Broadcom Earnings Deck

Broadcom reports Q3 fiscal earnings Thursday after the bell with heightened interest in their AI chip and infrastructure software. With their valuation fueled by hyperscaler demand and recent success integrating VMware, management this quarter is expected to deliver forward-looking guidance that will move the stock in a big way.

Investors will be focusing on whether Broadcom can sustain their AI semiconductor momentum — already up nearly 46% YoY in the prior quarter — and capitalize on infrastructure software market share gains. Analysts remain bullish, viewing the AI and enterprise software segments as core growth engines into FY2026.

I’ll be listening for updates on forward AI revenue trends, durability of hyperscaler demand, VMware subscription momentum, and how effectively Broadcom balances expensive AI infrastructure with continued debt repayment.

“Broadcom achieved record Q2 revenue on continued momentum in AI semiconductor solutions and VMware … We expect AI semiconductor revenue to accelerate to $5.1 billion in Q3, delivering ten consecutive quarters of growth.”

Broadcom, Inc. (AVGO) Stock Performance, 5-Year Chart, Seeking Alpha

Lululemon (LULU)

Source: Lulu Earnings Infographic

Lululemon reports Q2 FY2026 earnings Wednesday after the bell, with shares down -47% YTD as North American softness weighs on sentiment. Despite near-term margin pressures, the brand’s global resilience and long-term growth potential remain core to the bull case.

This cycle, focus will be on how effectively LULU executes its restructuring — balancing cost discipline with innovation — while leaning on international expansion to offset U.S. weakness, China and Europe being key bright spots.

Two things will be top of mind for me — 1) If management provides fresh commentary on social ROI, trend-driven product launches like Glow Up and Daydrift, and 2) How effectively LULU can balance its premium pricing power with tariff-related margin pressures.

A big swing factor is whether the company can maintain cultural relevance with Gen Z. Marketing spend (SG&A ~35% of sales) is being amplified by TikTok campaigns and social-driven virality, with LULU ranking highly on Social Blade for rapid digital engagement growth.

Just as millennials carried forward brand loyalty built in the early 2010s, Gen Z adoption now could lock in the next decade of premium positioning. Google Trends data also shows search interest continuing to peak around holidays, underscoring durable demand and brand desirability.

“In the U.S., consumers remain cautious right now, and they are being very intentional about their buying decisions.”

Lululemon Athletica, Inc. (LULU) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

EV credits, and Trump tariffs are headed to court + updates on India.

EV Tax Credit

Source: Yahoo Finance

Recent IRS guidance has offered a crucial lifeline to Tesla, GM, Ford, and other EV buyers awaiting delivery. As the $7,500 federal EV tax credit nears its September 30 expiration, the IRS clarified that purchasers who secure a written binding contract and make a payment before the deadline can still claim the credit — even if delivery occurs after September 30.

On this news — July EV sales surged roughly +26% MoM and nearly +20% YoY to 130,000 units, marking one of the strongest months on record. However, inventories are tightening quickly, with days-of-supply plunging nearly -50%. Manufacturers and dealers have ramped up steep discounts, leasing promos, and marketing pushes in a bid to clear inventory and lock in sales before the tax credit window closes.

Trump Tariffs in Court and India Responds

Source: AP News

A pivotal ruling from the U.S. Court of Appeals for the Federal Circuit has deemed most of President Trump’s broad tariffs — imposed under the International Emergency Economic Powers Act (IEEPA) — illegal, stating that Congress never intended to grant such sweeping authority to the executive branch. Although the tariffs technically remain in place, their enforcement has been stayed through mid-October to allow for potential Supreme Court review.

Treasury Secretary Scott Bessent expressed confidence that the Supreme Court will uphold these tariffs, but flagged a possible fallback — invoking Section 338 of the Smoot‑Hawley Tariff Act as an alternative legal basis.

In regards to tariffs — India has offered to cut its tariffs on U.S. goods to zero, an offer Trump called “too little, too late” after years of one-sided trade. This claim emerges amid mounting tensions triggered by Washington’s steep 50% levies on Indian imports — a punitive response to India’s continued purchases of Russian oil.

Major Economic Events:

ISM manufacturing PMI, ISM services PMI, and a much awaited jobs report highlights the week.

Monday (9/1): Labor Day

Tuesday (9/2): Construction Spending, ISM Manufacturing, S&P Final U.S. Manufacturing PMI

Wednesday (9/3): Auto Sales, Factory Orders, Job Openings, St. Louis Fed President Alberto Musalem Speaks, Fed Beige Book, Minneapolis Fed President Neel Kashkari Speaks

Thursday (9/4): ADP Employment, Chicago Fed President Austan Goolsbee Speaks, Fed Gov. Stephen Miran Senate Banking Hearing, Initial Jobless Claims, ISM Services, New York Fed President John Williams Speaks, S&P Final U.S. Services PMI, U.S. Productivity (Revision), U.S. Trade Deficit

Friday (9/5): Hourly Wages, Hourly Wages Year Over Year, U.S. Employment Report, U.S. Unemployment Rate

What We’re Watching:

ISM Manufacturing PMI

US ISM Manufacturing PMI fell to 48.0 in July from 49.0 in June, missing expectations of 49.5 and marking the fifth consecutive month of contraction — the weakest reading since October 2024. Supplier deliveries (45.7 vs 46.7) and employment (43.4 vs 45.0) dragged the index lower, with companies still focused on managing headcount rather than hiring.

On the positive side, production accelerated (51.4 vs 50.3), while declines in new orders (47.1 vs 46.4) and backlogs (46.8 vs 44.3) moderated. Price pressures also eased, with the prices index slipping to 64.8 from 69.7, suggesting some relief from cost increases.

Economists expect the following this week:

ISM Manufacturing PMI (July, actual) – 48.0 vs 49.5 est.

Check out the full report.

ISM Services PMI

US ISM Services PMI unexpectedly slipped to 50.1 in July from 50.8 in June, missing forecasts of 51.5 and signaling near-stagnation in the services sector. Seasonal and weather factors weighed on activity, while tariffs and commodity costs were frequently cited as headwinds.

Business activity (52.6 vs 54.2), new orders (50.3 vs 51.3), and inventories (51.8 vs 52.7) all slowed, while price pressures jumped to their highest level since October 2022 (69.9 vs 67.5). Employment fell deeper into contraction (46.4 vs 47.2), marking the fourth decline in five months. New exports (47.9 vs 51.1) and imports (45.9 vs 51.7) also slipped into contraction, underscoring tariff-related strain on global trade.

Economists expect the following this week:

ISM Services PMI (July, actual) – 50.1 vs 51.5 est.

Checkout the full report.

Jobs Report

US Jobs Report (Aug.) will be released Friday, September 5. Markets are bracing for disappointment following July’s weak labor print and steep downward revisions.

Nonfarm payrolls rose just +73K in July, while the unemployment rate held at 4.2%.

More concerning were the revisions: May was cut to +19K (from +144K) and June to +14K (from +147K), slashing a combined -258K jobs from prior reports. The BLS attributed the adjustments to additional employer data and seasonal recalculations, though the revisions sparked political fallout, including the dismissal of BLS Commissioner Erika McEntarfer.

Sector trends remain mixed.

Health care hiring continues to show resilience (+55K in July, well above the 12-month average +42K), while government payrolls contracted (-12K). Tariff pressures — particularly new levies on copper, steel, and aluminum — and an appeals court ruling questioning the legality of some Trump tariffs may weigh further on August hiring in mining, manufacturing, and related industries.

Economists expect the following this week:

Nonfarm Payrolls (Aug.) – +101K est.

Unemployment Rate – 4.2% est.

If you’re starting your investing journey or are interested in buying T-bills yielding 5% or more, consider visiting Public.com.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]